U.S. Steel Stock Has Dropped 57 Percent Since Trump's Tariffs Were Announced

Another sign that the tariffs aren't working. The same thing happened when Bush imposed steel tariffs in 2002.

President Donald Trump's steel tariffs were intended to prop up domestic steelmakers by raising the price of imported steel. American steelmakers were strong advocates for the tariffs and exercised significant influence over their implementation.

How's all that working out?

US Steel closed at a 17-month low, down 57% since the Tariff announcement back on March 1st. $X pic.twitter.com/GJXSEVnkmg

— Charlie Bilello (@charliebilello) December 11, 2018

As Charlie Bilello, director of research for New York-based Pension Partners, pointed out on Twitter this week, U.S. Steel's stock price has collapsed by more than 50 percent since early March, when Trump announced plans to place new taxes on imported steel. Since the tariffs were officially implemented on June 1, U.S. Steel has seen its stock price fall from $37 to less than $21 at noon on Wednesday. The current price represents a 17-month low.

Stock prices are affected by a wide variety of factors, of course, and trade policy is only one of those. Still, the dramatic fall of U.S. Steel's value in the eyes of investors raises questions about the benefits of Trump's attempt to boost American steelmakers at the expense of America's steel-consuming industries, which are forced to pay higher prices due to tariffs.

In other words, if Trump is going to justify believes it is necessary to force automakers like Ford to pay $1 billion annually in tariff-related costs in order to benefit American steelmakers, shouldn't the benefits of that policy outweigh the costs?

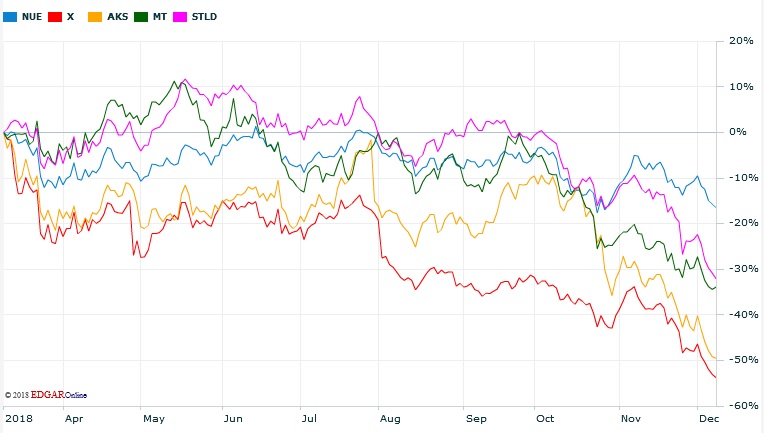

U.S. Steel is hardly alone in seeing its stock price slide despite help from the federal government. Here's the stock prices of five major American steel producers since March 8 of this year.

"Of the 13 stocks in the S&P 1500 steel sub index, all but one are down year to date by an average of nearly 25 percent," Barron's notes this week, adding that the real problem facing all these companies is that "steel is very much a global market. The U.S. is 'short' steel. Even with domestic mills running at about 80% of capacity the U.S. needs to import about 30 million tons of steel."

Tariffs can't really do much to address that. Sure, artificially inflating the price of foreign steel will shift some demand towards the already-more-expensive American-made stuff, but it doesn't do anything to increase the supply of domestic steel. Despite Trump's repeated assertions (which have now earned him a "bottomless Pinocchio" from The Washington Post's fact-checkers), there are not seven or eight new steel plants being built across the country. There's not even one—unless you count U.S. Steel making some upgrades to its main facility in Gary, Indiana, but that's hardly what Trump claimed the tariffs would accomplish.

In short, American steel-consuming companies are still importing steel—they have to, because there's simply not enough made in America to meet domestic demand. But now those steel-consuming industries have to pay higher taxes to the federal government for the privilege of importing it.

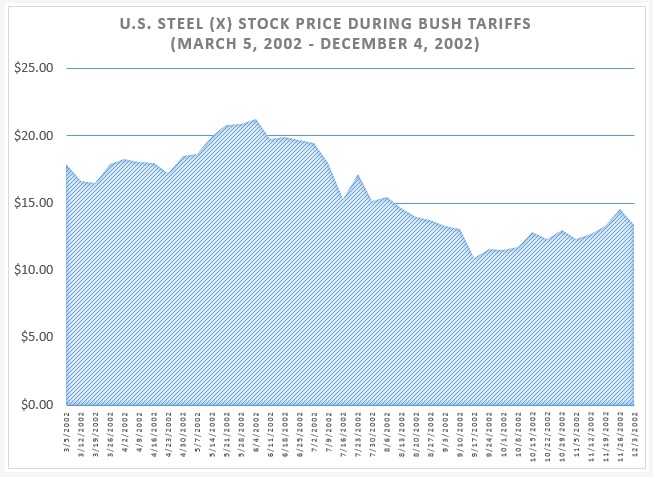

This shouldn't really be a surprise, either. Here's how the stock price of U.S. Steel reacted during similar protective tariffs imposed by President George W. Bush in 2002:

The drop-off is not as dramatic as what we have seen this year, but it trends in the same direction and follows the same general shape: an initial boost followed by a long decline. Nine months after they were imposed, Bush repealed those steel tariffs in the face of political and economic pressure. Trump is facing some of the same, but seems more determined to stay the course.

In the meantime, if American steelmakers are the "winners" of the trade war, it's only because other American industries are losing worse.

Show Comments (35)