Taxing Human Waste Won't Get Chicago's Pension Fund Out of Deep Doo-Doo

Residents of the city will pay $57 annually as part of a rescue plan that hinges on several questionable assumptions.

Residents of Chicago already pay for water and sewer services—like anyone else does.

Starting next year, though, they'll be paying an extra 30 percent for the privilege of having indoor plumbing.

Draining those dollars out of resident's wallets isn't a response to a sudden increase in the price of water and won't pay for upgrades to the city's sewers. In fact, not a single dollar of revenue from the new tax will be spent on any aspect of Chicago's public infrastructure.

What it will do—maybe—is shore up a municipal employee pension system that's woefully underfunded and in danger of going bankrupt within the next few years. Right now, the Municipal Employees' Annuity and Benefit Fund of Chicago has only enough assets to cover 32 cents of every dollar owed to retirees and current employees. Since the Illinois Supreme Court ruled in March that retirement benefits are sacrosanct and cannot be reduced, Chicago is left with only one option: find a way to pay for promises that probably never should have been made in the first place.

Mayor Rahm Emanuel pushed the tax through the city council with the promise that it would, within 50 years, close the pension plan's deficit. It's going to cost the average Chicago household about $53 in 2017, but will increase over the next four years.

"Chicago's pension funds are now off the road to bankruptcy and on the path to solvency," Emanuel declared last week after the city council approved the new tax.

Before getting into how the money will be spent and whether it will do what Emanuel says, you have to understand how the city got into this mess in the first place.

The short answer: lots of bad decisions made over many years.

The longer answer requires a bit of math, but I've tried to simplify things as much as possible.

Chicago finds itself here because the city has failed to adequately fund the cost of its municipal pension plan. Going back to at least 2006, Chicago has never come close to fully funding its annual pension obligation—in most years, it hasn't even put in half of what would be required to keep the fund stable.

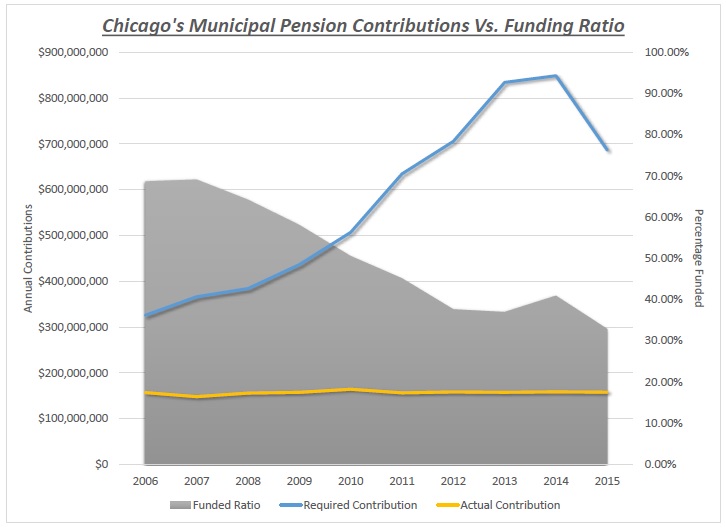

Here's what that looks like. The blue line on the chart below is called the ADT—that's the amount of money the actuaries say the city should be putting into the fund each year. It's based on a lot of different factors, including investment performance, benefits due to retirees and benefits promised to current employees who will one day retire and have to be paid.

If anything, the blue line represents the bare minimum that a city should be paying into the pension fund each year to keep up with its long-term obligations. It's the mortgage bill.

The yellow line represents how much money Chicago has actually put into the pension fund each year. As you can see, the gap is huge.

The big grey wall in the background represents the level to which the pension system is funded. A system funded at 100 percent has all the money necessary to pay for the retirement benefits promised to all current employees and living beneficiaries. Chicago isn't even close to being able to do that.

It's not hard to see the relationship between the contributions and the funding level. There are other factors that affect the funding level—like investment returns—so it's not exactly that straightforward, but there's no doubt that failing to meet your annual obligations results in larger future obligations and a retirement system that is less well funded than it ought to be.

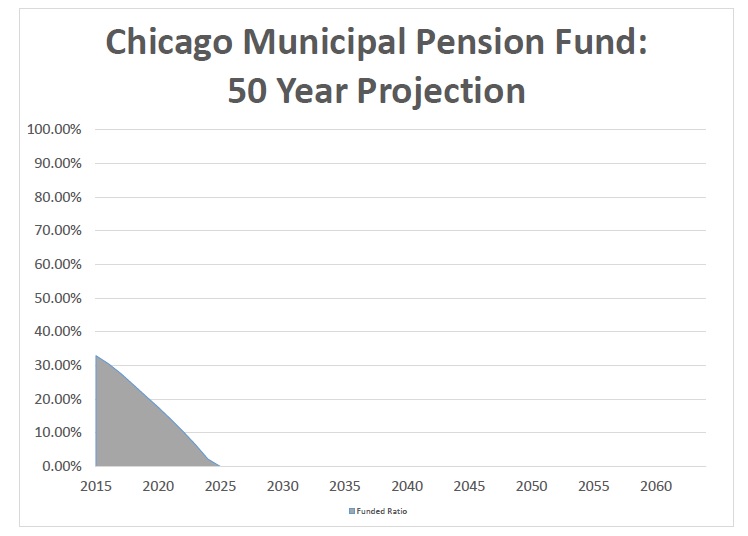

If you enjoy gallows humor, you might get a laugh out of the MEABF's 50-year projection. This is something the fund is required by law to produce each year, but last year it was actually more of a nine-year projection because the fund is on pace to be completely out of money by 2025. (If you want to see this spelled out in black and white, it's on page 48 of the fund's 2015 annual report.)

As you can see, the system isn't going to pull out of this funding nosedive anytime soon—and the ground is getting close.

City officials say the new tax on water and sewer service will refill the pension fund to 90 percent within 50 years. Instead of running out of money in the mid-2020s, the extra revenue will keep the retirement plan running for future generations. Whether that's worth $53 per year to you probably depends on whether you're someone who is only paying the tax or someone who is both paying the tax and getting a pension from the city (or hoping to get a pension from the city in the future).

Either way, it's important to note the many ways in which that claim is based on questionable assumptions.

None of those assumption are bigger than the 7.5 percent annual rate of return—known in pension parlance as the "discount rate"—that's baked into the system. The influx of new tax revenue will only get the pension plan back to 90 percent funded if the plan earns at least 7.5 percent every year for the next 50 years, says Jesse Hathaway, a research fellow at the Heartland Institute who has been tracking Chicago's pension problems.

When the returns are short of expectations, even a good year can turn bad.

During 2015, the fund realized a 6.8 percent return on investment. That's not bad—actually, it's pretty good in a year when the S&P 500 Index dropped by about 2 percent and more than 70 percent of investors lost money—but because of the unrealistic expectations, the fund actually finished the year $30 million deeper in the red.

Over the past 10 years, the Chicago municipal pension system has earned an average return of 4.6 percent. That's nothing to sneeze at, of course, but it's also not good enough to meet the expectations that form the basis of all the system's long-term projections. Achieving 7.5 percent isn't impossible—the fund returned 11 percent in 2013 and 9.3 percent in 2014, for example—but growing at that rate for half of a century seems like a bit of a stretch.

"If they get anything short of that 7.5 percent rate, they're not going to hit their numbers. If that happens, they're going to have to go back to the taxpayers and say 'we need more money,'" Hathaway said in an interview this week with Reason.

That's not the only rosy assumption built into Chicago's projections for the new tax.

Remember the first chart—the one with the lines showing how much money the city's accountants said should be contributed over the past decade versus how much the city's elected officials actually paid?

The reason for that gap is almost entirely political. Elected officials don't score points for adequately funding a pension system because every dollar spent on pensions is a dollar that can't be spent on higher profile things like schools, cops or tax breaks for Donald Trump. There's no ribbon-cuttings and no giant checks, no press conferences and no photo ops.

On the flip side, there's no political pain from underfunding pensions. Even now, when the pension system is less than a decade from running out of money, it's a problem that can be pushed off to next year or after the next election. Try taking a few million dollars out of the school budget or the police budget to fund the pension system and see how quickly the political consequences set in. In this environment, politicans do what comes naturally and take the path of least resistance. Unfortunately, they've run out of road to kick the can down.

Getting back to being 90 percent funded would require 50 years' of discipline on the part of Chicago's budget-makers. Do they have what it takes? History suggests they probably don't.

In the most optimistic scenario—one in which city officials overcome the political incentives to shortchange the pension funds, somehow find a way to pay for everything else while making those massive annual contributions and manage to avoid a serious economic recession for the next five decades—Chicago residents are looking at the prospect of paying this extra water and sewer tax until today's high schoolers are getting ready to retire.

Withdraw any of those rosy assumptions and the tax will do little more than postpone the inevitable collapse.

Show Comments (53)