Surprise: Donald Trump & Hillary Clinton Pledge To Hike Historically High Spending Levels

Only Libertarian Gary Johnson promises to balance budget while reducing outlays.

In a presidential campaign that has mostly been about rhetoric, vitriol, and sweeping statements (No more Mexicans! Much More Social Security!), it's easy to lose sight of what is arguably the single-most important act of any chief executive: The amount of spending he or she pledges to enact.

Such spending, especially when it is paid for with borrowed dollars (as it always is), is easy to sell to voters because they feel as if they're getting something for pennies on the dollar. In fact, between 2009 and 2013, the federal government borrowed 33 cents of each dollar they spent. Who wouldn't buy $1 worth of stuff for just 67 cents? It's future citizens—hello, millennials!—who will pick up the tab, in the form of reduced services, much-higher taxes, "monetizing the debt" (inflation), or some combination of the three.

Here's the worst part: Both market-friendly and left-leaning economists agree that persistently high and increasing levels of national debt correlate strongly with sharply diminished economic growth. In a 2012 paper on "debt overhangs," Carmen Reinhart, Vincent Reinhart, and Kenneth Rogoff found that periods where debt-to-GDP rations exceeded 90 percent for five or more years correlated with economic growth averaged 2.3 percent rather than 3.5 percent for more than 20 years. Left-wing economists at the University of Massachusettsf found that growth in debt-overhang periods came in a hair lower, averaging 2.2 percent for decades after. You compound 2 percent growth versus 3 percent growth for a quarter-century and you are looking at a phenomenally lower increase in living standards.

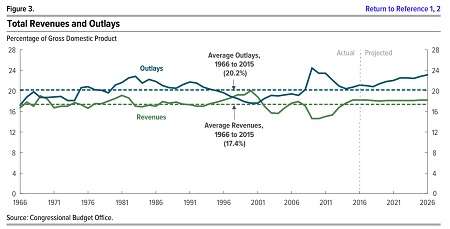

Which brings us to Donald Trump's and Hillary Clinton's plans for spending. A new report by the Committee for a Responsible Federal Budget finds that "Clinton would increase spending by $1.45 trillion over ten years, from 22.1 to 22.7 percent of GDP." Under Trump, spending would increase "from 22.1 to 22.5 percent of GDP." Think about that: We are already spending historically sums of tax dollars as a percentage of GDP and both major-party candidates have signed on to increase it even further. This is the spending ratchet effect at work, and it's not pretty. Clinton includes tax hikes that would raise revenues from a current level of 18.1 percent to 18.6 percent. Trump's tax plan would massively decrease revenues to just 13.6 percent of GDP.

Relative to current law, it would require $2.9 trillion to stabilize the debt as a share of GDP and $7.8 trillion to balance the budget after ten years. A responsible fiscal plan would aim to achieve a target somewhere between these two goals.

Both plans would thus increase the national debt, which currently stands at over $19 trillion (that figure includes debt held by the public and intra-government debt). Under Clinton's plan, according to the CFRB calculations, the United States would need to get to 4.1 percent annual economic growth to balance the budget. With Trump, economic growth would need to be 9 percent. Realistic projections of economic growth come in around 2.1 percent for the forseeable future.

Which is simply one more way of underscoring that neither of these candidates is acceptable. Trump's slap-dash plan is laughable on its face, but that shouldn't let Clinton off the hook, either. She represents a party that is talking loudly about increasing Social Security and other entitlements that are already spending far more money each year than they generate in dedicated revenues. As a number of high-profile conservatives and Republicans abandon even the pretense of supporting Donald Trump and work "to make sure he loses" (see George Will, for instance), Clinton's rotten budget scenario deserves even more scorn for its worse-than-head-in-the-sand projections.

Only one presidential candidate to date has actually said that he will balance the budget as his top priority: the Libertarian candidate Gary Johnson, whose web page asserts:

Governor Johnson has pledged that his first major act as President will be to submit to Congress a truly balanced budget. No gimmicks, no imaginary cuts in the distant future. Real reductions to bring spending into line with revenues, without tax increases. No line in the budget will be immune from scrutiny and reduction. And he pledges to veto any legislation that will result in deficit spending, forcing Congress to override his veto in order to spend money we don't have.

This sort of stance seems almost quaint in the 21st century, when the national debt doubled under George W. Bush and then again under Barack Obama. Quaint, maybe, but also more necessary than ever, especially for future generations that will be paying for the party thrown on their dime before most of them were even born. Given the longstanding mismatch between spending and revenue levels, this is hardly an easy sell. As the Congressional Budget Office (CBO) notes, average outlays between 1966 and 2015 averaged 20.2 percent of GDP while average revenues averaged just 17.4 percent. CBO estimates that under current tax law and ecomomic projections, revenues might increase to as much as 18.2 percent of GDP while spending might bump up to over 23 percent.

Those of us closer to the grave than the maternity ward should also ask ourselves: What exactly do we have to show for the massive splurge in credit-card-funded spending over the past 15 years of Bush/Republican/Obama/Democratic runaway spending? Ruinous wars in foreign countries, deeply suppressed economic growth, infrastructure that is rarely top-notch if not falling apart, and on and on. Unlike lost weekends in New Orleans or Vegas or wherever, we don't even have fond-if-hazy memories of good times. All we (should) have is regret and shame that we're doing our best to screw the future for the single-largest generation of Americans and the poor saps who come after them.

For one way to reduce annual deficits in a programmatic and plausible way, read "The 19 Percent Solution: How to balance the budget without increasing taxes."

Show Comments (222)