How Much Are You Paying in State & Local Taxes?

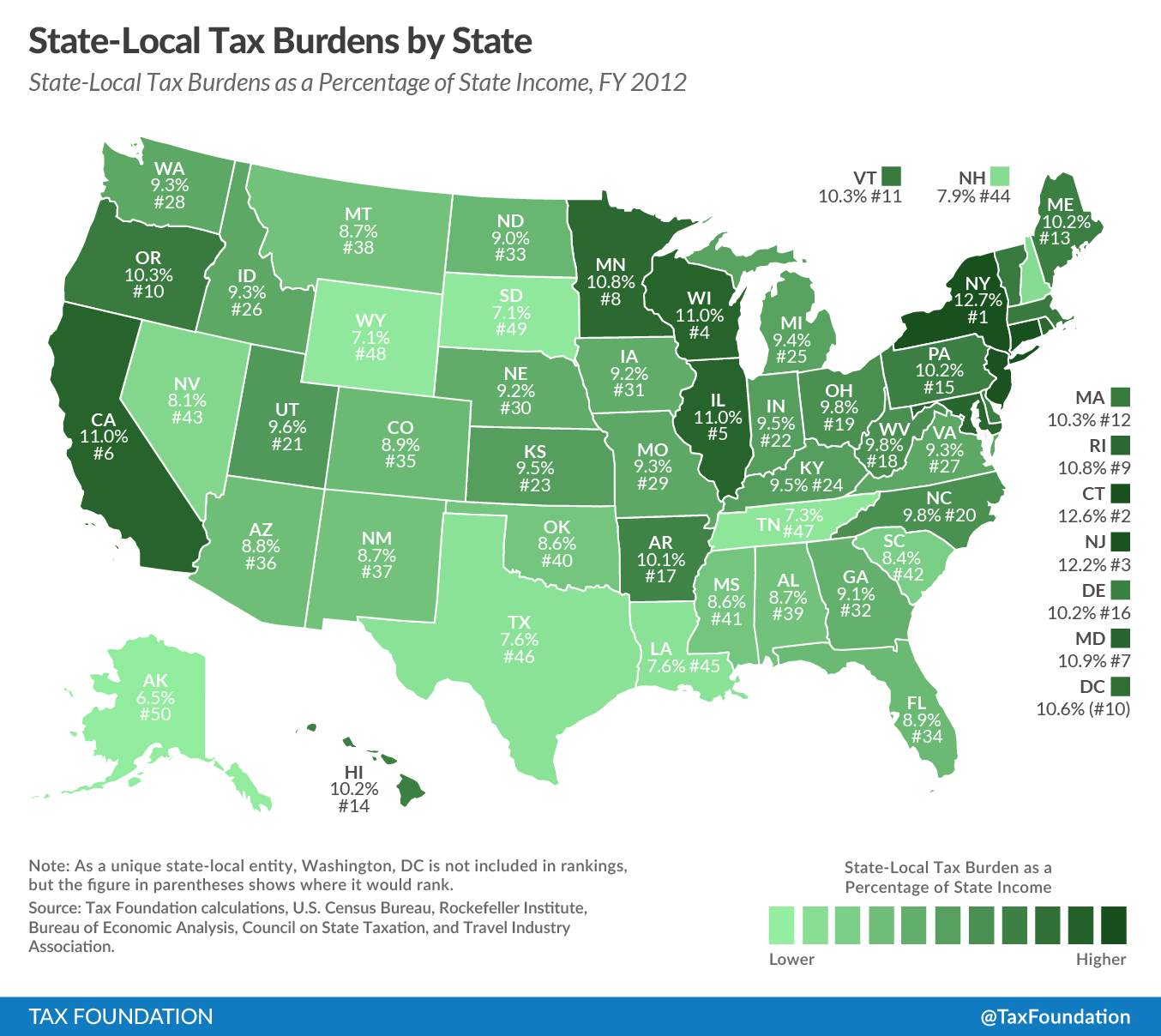

New York, Connecticut, New Jersey top dismal list; Alaska, South Dakota, Wyoming have lowest burdens.

The fine folks at the Tax Foundation have jut released their latest compilation of combined state and local tax burdens (due to lags in gathering data, figures are based on 2012 rates). Some highlights:

9.9 percent of personal income went to state and local tax payments. This is down from 10.1 percent fiscal year 2011. Average income increased at a faster rate than tax collections, driving down state-local tax burdens on average.

New Yorkers faced the highest burden, with 12.7% of income in the state going to state and local taxes. Connecticut (12.6%) and New Jersey (12.2%) followed closely behind. On the other end of the spectrum, Alaska (6.5%), South Dakota (7.1%) and Wyoming (7.1%) had the lowest burdens.

On average, taxpayers pay the most taxes to their own state and local governments. In 2012, 78 percent of taxes collected were paid within the state of residence, up from 73 percent in 2011.

State and local taxes are felt by folks who live far, far away too:

Taxpayers pay state and local taxes to their own state of residence, but also pay taxes to other state and local governments. For instance, when a family takes a vacation to Disney World, it pays a variety of taxes to Florida. The family might encounter taxes on hotel rooms, rental cars, food, and many other things. They pay taxes in Florida, but the actual burden of the tax resides back in their home state.

The Tax Foundation notes that combined tax burdens are relatively bunched across the country, with the highest burden being New York's 12.7 percent of personal income and the lowest being Alaska's 6.5 percent.

Back in 2005, I pondered a similar dataset (a "U.S. economic freedom index") and noted that places that cost less to live (including tax burdens) typically had much less going on and that in fact many people willingly pay a premium to live where they think the action is. "Live free and die of boredom" is how I phrased it, drawing on my experiences living in various far-flung spots across this greatest country ever. I think that's still true but also incomplete. How can states with shrinking populations and relatively high tax burdens make it easier for businesses, jobs, and people to move their way? It's likely impossible that Alaska or South Dakota could lure me to live there via any incentives (including a zero tax rate). At the same time, do taxes factor into decisions about living in western New Jersey versus eastern Pennsylvania? Certainly to many.

Here's a question worth considering: Would we see more competition for residents among states based on tax rates if we eliminated the deduction for state and local taxes from our federal income tax? As it stands, you can deduct payments for those things, making New York's tax bite a little less bloody. When you look at the two coasts, you see state and local tax rates that are very close to one another. Perhaps that reflects similar desires for similar levels of public services. Or maybe it reflects a sense that folks living in those areas can't escape similar tax rates without moving far, far away. I'd like to see more "fiscal federalism," where states offer radically different levels of services and charge radically different levels of taxes.

As Veronique de Rugy has pointed out, though, it would take more than killing deductions for state-and-local taxes to make that a reality. "Washington has taken over more and more state functions," she says, "largely through grants to state and local governments, also called grants-in-aid…. [Between 1960 and 2010], total grant outlays increased from $285 billion in fiscal year 2000 to a whopping $493 billion in fiscal year 2010—a 73 percent increase. Grants also account for a bigger share of federal spending: 18 percent in 2009, compared to 7.6 percent in 1960."

De Rugy also points out that tax burdens alone won't make someone (or some business) move to one place or another. Much, much more goes into such decisions. But lowering costs and making it easier for folks to get by certainly can help and especially in an era of cash-strapped governments at all levels, states and municipalities should be figuring out how to reduce their size and spending.

A few years back, Reason spoke with Erica Greider, the Texas Monthly staffer whose book Big, Hot, Cheap, and Right, which explored that issue by comparing California and Texas and the different levels of services offered and taxes charged.

Show Comments (29)