How Much Are You Paying in State & Local Taxes?

New York, Connecticut, New Jersey top dismal list; Alaska, South Dakota, Wyoming have lowest burdens.

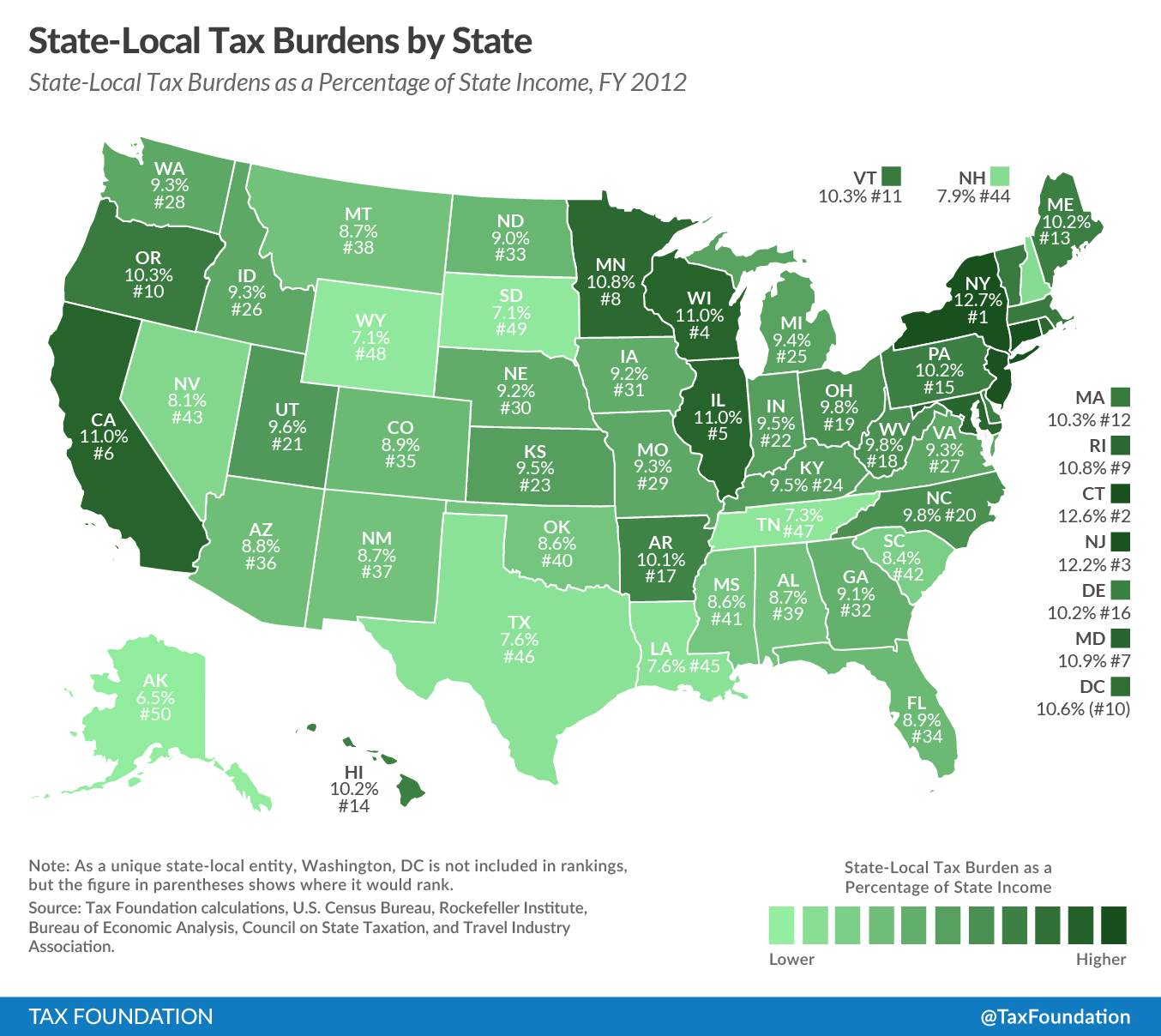

The fine folks at the Tax Foundation have jut released their latest compilation of combined state and local tax burdens (due to lags in gathering data, figures are based on 2012 rates). Some highlights:

9.9 percent of personal income went to state and local tax payments. This is down from 10.1 percent fiscal year 2011. Average income increased at a faster rate than tax collections, driving down state-local tax burdens on average.

New Yorkers faced the highest burden, with 12.7% of income in the state going to state and local taxes. Connecticut (12.6%) and New Jersey (12.2%) followed closely behind. On the other end of the spectrum, Alaska (6.5%), South Dakota (7.1%) and Wyoming (7.1%) had the lowest burdens.

On average, taxpayers pay the most taxes to their own state and local governments. In 2012, 78 percent of taxes collected were paid within the state of residence, up from 73 percent in 2011.

State and local taxes are felt by folks who live far, far away too:

Taxpayers pay state and local taxes to their own state of residence, but also pay taxes to other state and local governments. For instance, when a family takes a vacation to Disney World, it pays a variety of taxes to Florida. The family might encounter taxes on hotel rooms, rental cars, food, and many other things. They pay taxes in Florida, but the actual burden of the tax resides back in their home state.

The Tax Foundation notes that combined tax burdens are relatively bunched across the country, with the highest burden being New York's 12.7 percent of personal income and the lowest being Alaska's 6.5 percent.

Back in 2005, I pondered a similar dataset (a "U.S. economic freedom index") and noted that places that cost less to live (including tax burdens) typically had much less going on and that in fact many people willingly pay a premium to live where they think the action is. "Live free and die of boredom" is how I phrased it, drawing on my experiences living in various far-flung spots across this greatest country ever. I think that's still true but also incomplete. How can states with shrinking populations and relatively high tax burdens make it easier for businesses, jobs, and people to move their way? It's likely impossible that Alaska or South Dakota could lure me to live there via any incentives (including a zero tax rate). At the same time, do taxes factor into decisions about living in western New Jersey versus eastern Pennsylvania? Certainly to many.

Here's a question worth considering: Would we see more competition for residents among states based on tax rates if we eliminated the deduction for state and local taxes from our federal income tax? As it stands, you can deduct payments for those things, making New York's tax bite a little less bloody. When you look at the two coasts, you see state and local tax rates that are very close to one another. Perhaps that reflects similar desires for similar levels of public services. Or maybe it reflects a sense that folks living in those areas can't escape similar tax rates without moving far, far away. I'd like to see more "fiscal federalism," where states offer radically different levels of services and charge radically different levels of taxes.

As Veronique de Rugy has pointed out, though, it would take more than killing deductions for state-and-local taxes to make that a reality. "Washington has taken over more and more state functions," she says, "largely through grants to state and local governments, also called grants-in-aid…. [Between 1960 and 2010], total grant outlays increased from $285 billion in fiscal year 2000 to a whopping $493 billion in fiscal year 2010—a 73 percent increase. Grants also account for a bigger share of federal spending: 18 percent in 2009, compared to 7.6 percent in 1960."

De Rugy also points out that tax burdens alone won't make someone (or some business) move to one place or another. Much, much more goes into such decisions. But lowering costs and making it easier for folks to get by certainly can help and especially in an era of cash-strapped governments at all levels, states and municipalities should be figuring out how to reduce their size and spending.

A few years back, Reason spoke with Erica Greider, the Texas Monthly staffer whose book Big, Hot, Cheap, and Right, which explored that issue by comparing California and Texas and the different levels of services offered and taxes charged.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

It's not enough! We need to make sure people are paying their FAIR SHARE!!11!!!!

/Feel the Bern

If I had a million dollar salary and lived in my current town in a house with proportionate value to my own, I would pay by rough calculation 55.8% of my gross income in taxes before sales taxes come into play.

Free-market capitalist paradise, yo.

I'm very happy to know that Florida will never have a state income tax. It's in the state constitution, which means nothing can change it but a 60% public vote, which even in Florida will never happen.

It's one of the few good things about living here.

More and more people from NY/NJ/CT are migrating to Florida, so don't be so sure.

The amusing thing is they want to get away from the suck only to propose.. "you would totally like implementing what we did back there!"

You see this with MA people relocating to NH.

If it was so great, stay the F in MA.

Does this phenomenon exist when dealing with national borders or just state ones?

Last thing we need is a bunch of Canadian immigrants showing up and bringing their monarch-loving, socialist ways to our country.

Same thing here in Nevada with folks moving in from California. I'm one of the exceptions, I guess, in that I moved here in part *because* of the state's politics.

Picture of naked lady to illustrate an article on taxes. Gotta say, Hit and Run knows its audience.

Well, Texas is 46th and isn't a far-flung nothing-goin'-on state (if you accept that premise), nor is Tennessee really at 47th.

Oh Jesus, you based that on living in fucking Huntsville. How does living in the rural area of a large state give you a view of the whole state?

"Live free and die of boredom" is how I phrased it, drawing on my experiences living in various far-flung spots across this greatest country ever.

Being bored just means you lack the intelligence and energy to find or create something interesting to do. I've lived in small towns and cities in West Texas, medium sized and big cities in the Midwest and East Coast. You know what? I've never been bored (other than at work) for more than afternoon. Maybe a whole weekend once or twice.

As someone who has lived most of his life in flyover country, few things grind my gears more than coastal elitists who think that the only way to live life is in a huge, filthy, corrupt hive.

I go up to summit County to avoid the people. I'm entertained the entire time. Guns. Dirt bikes. My old Toyota. Skiing. What could be better?

This study is cool and all, but it doesn't show that in a place like New York there are "hotspots" of sorts. For instance, property taxes in Lake Placid are not what they are in Nesconsett where some homes are taxed annually more than the original mortgage on the home. Wanna know why there are so many New Yorkers in Florida?

CO is 35th? My taxes are absurd. Man, fuck New York and California. And Florida, but for other reasons.

It's not bad I suppose

When I lived on.Long Island I was subject to 167 taxing entites

Of course, thanks to all the liberals moving to Texas, that philosophy won't last long.

My relatives on Long Island pay over a grand in property taxes PER month! Granted they live in a gated community, but their house isn't even that big (1 story, 2 bed 2 bath, no backyard other than shared area with neighbors, other houses built on top of and next to it condo style). After their home owners association dues and mortgage, they spend roughly 80% of the US yearly median income on their housing. These people aren't even that rich! Obviously what the middle class needs is higher taxes and more (poor quality) free shit that isn't necessarily in demand.

I should also add that their community has only a volunteer fire department and the public schools are so shitty they have to shell out 8 grand sending their daughter to private school to get her a basic education. How the fuck can people really believe government is competent enough to run anything without insane levels of waste?

I should also add that their community has only a volunteer fire department and the public schools are so shitty they have to shell out 8 grand sending their daughter to private school to get her a basic education. How the fuck can people really believe government is competent enough to run anything without insane levels of waste?

Who the hell thought this graphic would best be illustrated in increments of one color? Hmmmm?

Considering the quality of services one receives,or doesn't, in Pennsylvania, to damned much.

Kind of a silly metric- total state tax intake, divided into total state income doesn't really translate to anything on an individual basis.

I look at how much of a check I would have to write, if there was no withholding, as a measure of taxation and the fact that most government services are provided on a local level - police, fire, EMS, municipal infrastructure - while the largest remittance goes to the government entity that provides the least of these - FEDGOV - shows we have evolved to a point where our whole system of taxation is completely upside-down.

How much could be saved if we sent the most money, directly, to the local government instead of it having to be filtered down from higher ones, through the various levels it must go through to end up there?

If by "not much going on" you mean that these places generally don't have the horrific problems of progressive states, you're right. People like it that way. They generally go hunting, hiking, fishing, ATV, build homes, ride horses, etc.

string bean

he he he

Tax is a complex thing if we are not well aware about it. Many people take help from lawyers to help them with their tax issues. There are various reference sites can be checked to find about tax details. One need to keep himself updated about tax.

You mean they drive the zambonis?