Government Spending Spree Drives Global Debt to $100 Trillion

However bad your spending habits may be, chances are it's better than that of the average national government. The political class around the world has been running the credit cards up with such glee, you have to wonder how officials plan to pay the loans back (that's rhetorical—of course they don't plan to pay them back). Riding a tide of government borrowing, global debt markets rose to $100 trillion in mid 2013 from a mere $70 trillion in 2007. Wait. $100 trillion? Yup.

According to the Bank for International Settlements, which basically acts as a bank for central banks:

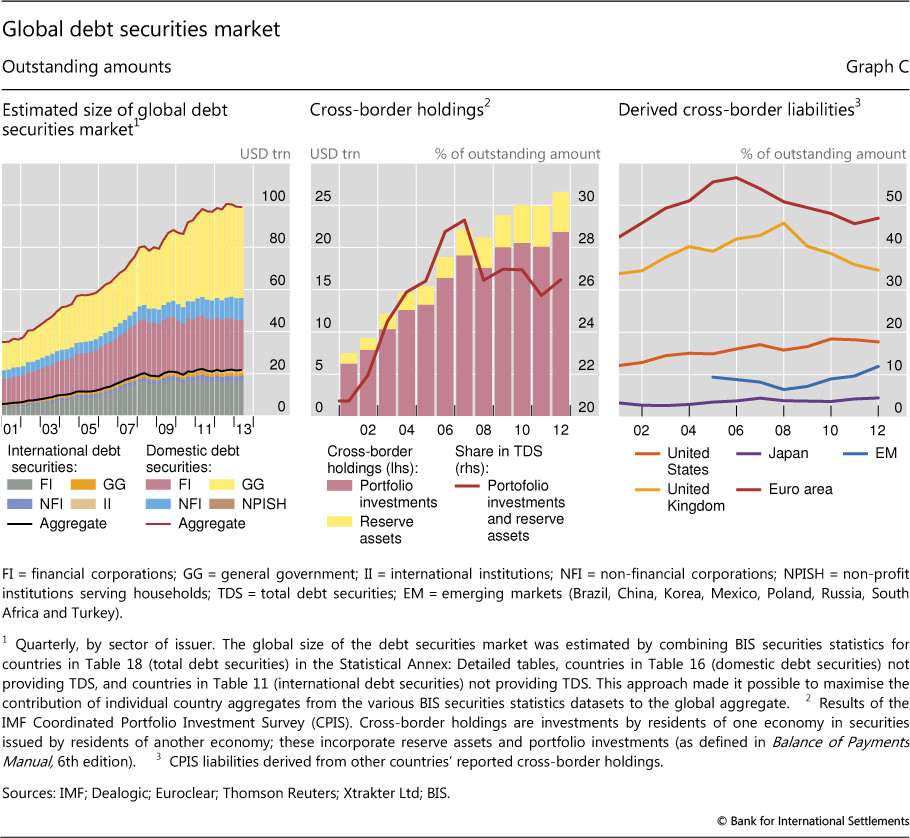

Global debt markets have grown to an estimated $100 trillion (in amounts outstanding) in mid-2013 (Graph C, left-hand panel), up from $70 trillion in mid-2007. Growth has been uneven across the main market segments. Active issuance by governments and non-financial corporations has lifted the share of domestically issued bonds, whereas more restrained activity by financial institutions has held back international issuance (Graph C, left-hand panel).

Not surprisingly, given the significant expansion in government spending in recent years, governments (including central, state and local governments) have been the largest debt issuers (Graph C, left-hand panel).

Graph C is below, and it shows that global debt is soaring and poised to achieve orbit.

The United States government's official national debt is currently $17.5 trillion. Peter Suderman recently pointed out that the proposed White House budget would leave us with a debt that's $8.3 trillion higher than it is now over the next decade.

So the next time somebody starts talking about "austerity," you can explain just how austere the past few years have been for poor, strapped governments.

Show Comments (57)