The Financial Crisis of 1837

Trying to understand one of America's great economic downturns

The Many Panics of 1837: People, Politics, and the Creation of a Transatlantic Financial Crisis, by Jessica M. Lepler, Cambridge University Press, 337 pages, $29.95

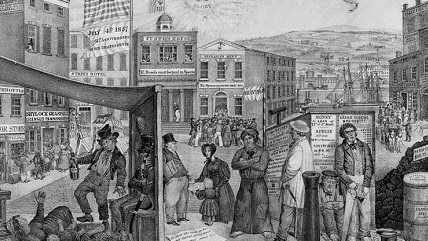

In May 1837, a major financial crisis engulfed America's approximately 800 banks, with all but six ceasing to redeem their banknotes and deposits for specie (gold or silver coins). This was followed by a short but sharp depression, constituting only the second manifestation of the modern business cycle in the country's history up to that point.

The panic had been preceded by President Andrew Jackson's famous "Bank War," in which the Second Bank of the United States lost its exclusive charter from the national government. It was followed by vociferous political disputes about the monetary system, and by a prolonged price deflation that began in 1839 and didn't end until 1844.

Historians and economists continue to explore the panic's causes and consequences, a question made all the more relevant by the financial crisis of 2007-08. Now the University of New Hampshire historian Jessica M. Lepler has entered the fray with The Many Panics of 1837: People, Politics, and the Creation of a Transatlantic Financial Crisis, based on her award-winning Brandeis doctoral dissertation. Lepler's book is a social and business micro-history confined to the events leading up to and culminating in the bank suspension. She thus joins the ranks of those cultural historians who over the last decade or so have tried to illuminate topics usually addressed by economists. The result is a work of great detail and mixed quality.

The best feature of The Many Panics of 1837 is the author's prodigious research. Focusing primarily on events in three locations-London, New Orleans, and New York-Lepler combs through such primary sources as Bank of England archives, contemporary newspapers, personal correspondence, sermons, and assorted forgotten books that offered advice on household economy. She exudes familiarity with a vast secondary literature as well, and the footnotes refer to several titles from libertarian authors, among them Lawrence White's Free Banking in Britain, Murray Rothbard's The Panic of 1819, and Richard Timberlake's The Origins of Central Banking in the United States.

Lepler construes the term "panic" in its literal sense to mean an increasing uncertainty and fear, particularly among businessmen, brokers, and bankers. She convincingly argues that not one but multiple panics, arising in each of the three major commercial centers covered, preceded the American bank suspension. Once the suspension took place, it actually had a calming effect on both sides of the Atlantic, she maintains.

These panics were fueled in part by imperfect and delayed communication in an interconnected international market that relied heavily on credit, notably bills of exchange. The failures of major commercial houses in all three cities became the trigger that set off the suspension of specie payments. The Many Panics of 1837 thus reinforces the contention that the subsequent economic downturn was driven as much by events in the United Kingdom as in the United States.

Many historians and economists, by contrast, still place primary blame for the Panic of 1837 on the policies of President Jackson. According to this view, the Second Bank of the U.S. acted as a nascent central bank in restraining the monetary expansion of state banks. As Jackson eliminated the Second Bank's privileges, he unleashed an inflationary boom. Then his Specie Circular of 1836, requiring that payments for public land be made in gold or silver, abruptly cut the boom short and initiated the downturn.

But in the 1960s, George Macesich, Richard Timberlake, Peter Temin, and other economic historians, employing more sophisticated quantitative techniques, began examining the determinants of the domestic money stock. They discovered that the primary factor causing monetary fluctuations during this period was international specie flows, orchestrated largely by the Bank of England. If anything, the Second Bank had encouraged greater use of bank-issued notes and deposits as money rather than keeping a check on state banks. It was therefore the Bank of England, faced with declining reserves, that precipitated the panic by raising its discount rate in 1836.

The deflation that started three years later, after the initial economic recovery of 1838, had a different cause. By this time, specie was again flowing into the United States. A string of outright bank failures (which are more serious than temporary suspensions) drove up both the reserve ratios of the surviving banks and the specie holdings of the general public, causing a collapse of the money stock as large as during the Great Depression from 1929 to 1933 (although the resulting economic distress was nowhere near as severe).

Lepler hardly delves into this period. But she does touch on President Martin Van Buren's proposal for an Independent Treasury, first inspired by the Panic of 1837 and ultimately instituted as a result of these monetary dislocations. Bringing about what was then touted as a "divorce of bank and government"-an explicit invocation of Jefferson's separation of church and State-this reform constituted the first and only time in all of the country's history that the financial system was completely and totally deregulated at the national level. Its full implementation in 1846 also ended the political convulsions over monetary issues, despite the fact that financial deregulation had not extended to the state level.

Unfortunately, Lepler couples her valuable contributions to the literature with some noticeable flaws. Despite her familiarity with several sophisticated economic analyses, she seems to have never mastered the fundamental principles available in more basic economic texts. She states, for example, that banks and brokers attempted to resell bills of exchange for "more than the bill's face value." Perhaps she is using the term "face value" in an idiosyncratic or anachronistic way. More likely, she doesn't understand that bills invariably sold at a discount below face value until maturity. The discount is what varied, usually declining as maturity approached.

This misunderstanding probably contributes to Lepler's scant attention to changes in interest rates when she discusses credit relationships. She instead places most of her emphasis on trust and confidence. Although she does stress how ubiquitous credit was in 19th-century commerce, Lepler never fully grasps its vital role in the allocation of savings. And in her extensive examination of the part that information played in the development and spread of panic, she could have profited from Friedrich Hayek's insight into the role of markets in revealing information. Lepler even believes that economists are oblivious to the obvious, well-known fact that aggregates such as Gross Domestic Product result from "a nearly infinite number of individual choices." These and other lapses lead her to a thinly disguised disdain for economics as a discipline.

The book exhibits some historical lacunae as well. It is undoubtedly a bit churlish to complain that such a well-researched account overlooks some important works. Nonetheless, I was surprised to discover Lepler's reliance on the popular, superficial biography of Van Buren written by Clinton speechwriter Ted Widmer. She never cites Major Wilson's The Presidency of Martin Van Buren, the best book by far not only on Van Buren's presidency but also on the Independent Treasury. If she had consulted it, she would have a deeper understanding of the Jacksonian hard-money program and would have realized that the Independent Treasury was far more profound than a mere alternative to government deposits in those state banks that had suspended. Susan Hoffman's Politics and Banking: Ideas, Public Policy, and the Creation of Financial Institutions would have similarly given her a better perspective on the ideological contours of these monetary debates. Such works might have saved her from her bizarre characterization of the system of state banks-individually chartered by state legislatures, prohibited from interstate branching, and otherwise highly regulated and often subsidized-as a form of laissez faire.

Other flaws arise from Lepler's effort to over-differentiate her product, a vice endemic in academia. Considering The Many Panics of 1837 as more a replacement for earlier studies than a supplement to them, she presumptuously declares that "for political or economic purposes, the panic in 1837 had vanished" from historical accounts until her "rediscovery of the history of panic itself." This is like dismissing a general military history of the Civil War that recounts campaigns, battles, and strategy for not being exclusively devoted to the anecdotal experiences of individual soldiers.

Indeed, Lepler tends to elevate the perceptions of people at the time, which she has documented so well, into reliable and definitive causal explanations of these complex phenomena. One cannot help but be reminded of the fable of the blind men and elephant, except that Lepler has actually seen the entire elephant and still, minutely familiar with one of its legs, adamantly insists that the animal is really a pillar.

While denying that the many panics of 1837 in any way constitute a single event, Lepler does an outstanding job of showing how they are intimately tied together. But while dismissing political interpretations of the panic she simultaneously asserts one of her own: that Jackson's Bank War aroused the anxiety in England that triggered the unraveling of credit relationships. Jackson's actions may have played some minor role, as previous writers have suggested, but it was far from a sole or dominant consideration for Bank of England policies.

While praising the decentralized system of state-chartered banks for their ability to "channel capital into local investments," Lepler nonetheless denounces them because "no single authority determined the policies of political economy." Her overarching conclusion thereby becomes that "the crisis provided a testing ground for different systems of political economy," with the alleged regulatory "protectionism" of the Bank of England outperforming American free trade.

This characterization is off the mark for both countries. Not only does it overlook the extensive state regulation of American banks-and the substantial state subsidies for both banks and internal improvements, which contributed immensely to the panic and subsequent deflation-but it is unduly charitable to the Bank of England and its 1836 bailouts, which hardly brought an end to financial crises in that country. Indeed, a rather severe English crisis that followed in 1847 was hardly noticeable in the U.S., which by then was operating under the complete federal deregulation of the Independent Treasury.

The Many Panics of 1837 is definitely not a book for the general reader. Those not already familiar with the period will find themselves frequently lost or confused by Lepler's grab-bag selection of particulars. Scholars, on the other hand, will find it a superb source of historical details, even if they have to look elsewhere for a compelling or comprehensive integration of these data.

Does the book have anything to teach us about recent economic events? We must be careful to avoid glib generalizations based on superficial or exaggerated parallels; the cause of business cycles remains the great unresolved theoretical problem of macroeconomics. Yet one relevant lesson does apply to both the Panic of 1837 and the financial crisis of 2007-08, a lesson reinforced by Lepler's research: An international crisis invariably involves international causes. Any story that just blames America's domestic monetary institutions and policies, whether for the 1830s or the 2000s, is seriously deficient.

Show Comments (34)