Rare Coins: Reasons for Caution

You will quite probably lose money if you do not have some degree of expertise in numismatics.

A recent advertisement argues for investment in rare coins. It is illustrative of other pitches for investing in collectibles. The ad reports that certain coins the firm recommends had increased 250 percent in value over the 10-year period 1967-77, or 25 percent per year.

This certainly is cause for thought. Even in our inflationary age, a return of 25 percent per year is excellent. It compares very favorably with the 5-8 percent return available on savings, and it outperforms real estate and common stocks as well. In short, an annual return of 25 percent is an exceptionally high return on capital.

INCOME VS. PROFITS

Historically, most investments have been made into income-producing propositions—bank accounts or bonds yielding interest, real estate with rental income, or stocks with dividends. In such cases, measurement of yield on investment is relatively straightforward and simple. One need only divide the annual income by the cost of the investment. The resulting percentages offer a simple but reliable method of measurement.

Over the past few decades, however, these forms of investment have become less attractive. Bank interest and bond yields have failed to keep pace with inflation. Real estate has become subject to more and more government interference and regulation, resulting in greater complexity than many investors wish to cope with. And, for a number of reasons, the stock market has performed rather badly.

Consequently, more and more investors are turning to investment media that yield no income at all but stand a good chance of increasing in price. Precious metals, rare coins and stamps, collectibles of all sorts, and some commodities are held primarily for the potential price increase. And real estate and common stocks are sometimes held at least partially for these reasons.

These rather specialized investments offer certain other advantages as well. Profits realized from their sale are usually taxed at lower capital gains rates. The storage cost is usually quite low. There are no property or intangible taxes on holding metals, coins, stamps, or other collectibles. They are frequently undervalued in estates (or sometimes completely slip the tax collector's notice).

But the evaluation of price performance of these investments is not so simple or straightforward. First, because these goods are usually held over a period of several years, a substantial portion of their price increase may be inflationary in origin. Second, yield on investment over a period greater than a year is not directly translatable to annual yield because of the effect of compound interest.

COMPUTING PROFITS

Let us consider the investment in rare coins mentioned at the outset. The material increased in price 250 percent over a 10-year period. Thus, for each $100 invested in 1967, one could receive $350 in 1977.

But the 1967 dollar and the 1977 dollar are different commodities. The 1977 dollar will buy much less than the 1967 dollar. In fact, according to the Bureau of Labor Statistics, September 1977 dollars can purchase only about 54.3 percent as much as 1967 dollars. In other words, the $350 in 1977 is only equivalent to about $190.22 in 1967.

But that is an increase of 90.22 percent over 10 years, which comes out to an average of 9.022 percent per year. That seems like a reasonable return on investment, especially considering that it takes inflation into account. Or so it seems.

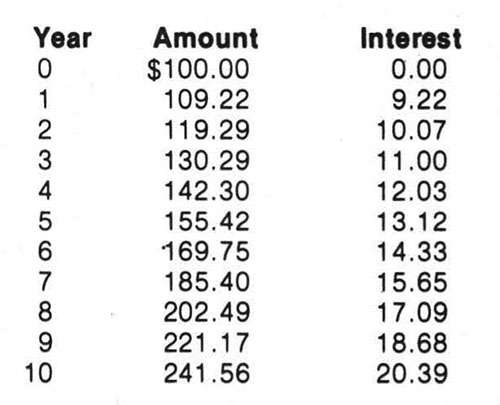

Unfortunately, it is not so. Such an analysis fails to take into account the effect of compound interest. Suppose you take $100 and invest it at 9.022 percent for 10 years, without withdrawing the interest earned each year. The accompanying chart shows the capital plus accrued interest at the end of each year. We see that if the annual return actually was 9.022 percent, the total profit after 10 years would be $141.56—not the relatively paltry $90.22.

The original analysis quite clearly failed to take into account the effect of compound interest, which must be considered in order to figure out the return one receives each year. The actual rate of return on the 10-year coin investment is only 6.9 percent per annum. Not a bad return—but a far cry from the 25 percent advertised.

The formula for calculating the rate of return that accounts for the effect of compound interest is: I = (FV/PV) 1/n – 1. While the formula may appear confusing or complicated to those not accustomed to mathematics, it is actually quite simple conceptually. FV/PV is simply the ratio of the future value (FV) of the investment to its present value (PV)—that is, the value at the end of the time analyzed (after n years, or periods) compared to the value at the beginning of the time period. In our example, the ratio is 1.9022 (the inflation-adjusted return divided by the initial investment: $190.22 ÷ $100).

To calculate the return per year, we must take the nth root of the ratio—that is, we must find what number multiplied by itself n times will yield that ratio. Ordinarily, this sort of calculation is complicated and time-consuming. Happily, many inexpensive calculators make it quite simple. To calculate annual return on investment using a calculator, simply follow these steps:

1. Divide the future value by the present value.

2. Press the yx key.

3. Enter the decimal equivalent of the reciprocal (1 ÷ n) of the number of years involved.

4. Press the = key.

5. Subtract 1.

Using our example, the calculator will display 0.069. To convert the answer to a percentage, multiply by 100, yielding 6.9 percent.

GET RICH QUICK?

What is the significance of all this regarding coin investments? Rate of return on coin investments (and other investments bought primarily for price appreciation) must be calculated taking into account the effects both of inflation and of compound interest. And proponents of investments (usually those who are selling them) frequently fail to take these factors into account, thus substantially overstating the rate of return on the investments they purvey.

The sales pitch of those selling such investments is often characterized by other inadequate arguments as well.

First, they frequently fail to take into account the difference between what dealers will pay ("bid") and what price they sell at ("ask"). In the case of precious metals or stocks, the difference is small, usually only a few percent. But in the case of rare coins or stamps (or other collectibles) the difference is quite often substantial. It is normally at least 20 percent. And in many cases, the difference is 100 percent or more—especially for firms that "specialize" in investments. Often the "specialist firm" actually specializes in selling to the credulous or the foolish.

The notion has gotten around that coins (or stamps) are almost always a "good investment." This is simply not true. The same caveats that one should remember in making any kind of major outlay apply to the purchase of collectibles as well.

The fact is, if you do not know quite precisely what you are doing, if you do not have at least some degree of expertise, then you will quite probably lose money on your investments—no matter what investment medium you choose.

Second, such arguments for investment in collectibles often tacitly assume that past performance is a good indicator of future performance. They argue that an item that has increased substantially in price in the recent past is likely to continue to increase in price in the near future. If investment were that simple, we would all be millionaires. And while this idea makes at least superficial sense in the stock market, it makes no sense at all in the rare coin market.

A much stronger theoretical argument can be made that precisely the opposite is the case—that a strong upward price move is a good indicator that the given item is likely to stop moving up and may be due for a fall. For a strong upward move normally results in moving the item out of the reach of a certain number of collectors, thus reducing overall demand. And it will encourage some investors/collectors to sell and take a profit.

Of course, strong upward movement frequently attracts unsophisticated investors, and sometimes items continue to move upward in price as the result of their buying activity. But ultimately, prices cease to move upward when the supply of new investors runs out. Then the market moves sideways for a period. Some investors, looking for stronger performance and uninterested in such quiet markets, begin to sell their holdings. Prices fall. Others see the price drop and also begin to sell. Frequently a full-fledged panic ensues. And all the unsophisticated investors lose—although they rarely understand how it happened.

There is one other problem in evaluating the sales pitch mentioned at the beginning of this article: it is generally impossible to check the raw data. How can we verify the prices of 10 years ago and today's prices? Price lists and catalogues help very little: coins frequently sell at large discounts or premiums from the catalogue prices. And dealer price lists frequently contain inaccurately graded coins.

More importantly, the difference between two coins is often subtle to the point that it defies quantification. No two rare coins are identical, so a coin's value is always in the eye of the beholder. Numismatics remains an art, not a science. And the efforts to portray it as a science are more often than not attempts to increase the interest of unsophisticated "investors" in rare coins.

The main tools needed to evaluate an investment in rare coins or other collectibles are the same tools needed to evaluate any investment proposition: common sense and a healthy skepticism.

There is no Santa Claus in any investment field.

Mr. Bradford holds a B.A. In philosophy and is the proprietor of Liberty Coin Service in Lansing, Michigan.

This article originally appeared in print under the headline "Rare Coins: Reasons for Caution."

Show Comments (0)