Rare Coins: Ten Reasons to Invest

Take advantage of one of the last remaining free markets.

The topic of rare coin investment brings mixed responses from the average investor. Many have heard about spectacular profits but are concerned about their lack of expertise. And it is true that any new investment area requires some specialized knowledge, but this need not inhibit the novice. Lacking the time or the inclination to acquire this knowledge, one always has the option of retaining an expert in the field, either through an advisory service or through individual consultations. There is no reason why the potentially large profits of investing in rare coins should escape anyone.

Many sophisticated investors have been profiting from investments in collectibles since before modern markets were organized. Their secret of success was simple: buy proven rarity and hold. As the collectible markets broaden in interest and investor demand (typically in times of inflation and monetary uncertainty), greater fortunes will be made and preserved than in the past—and more quickly.

RISING VALUE

The first and foremost advantage of rare coins is appreciation. Clearly, the best way to preserve capital is to increase it. A comparative study of markets can show that the coin market combines the most consistent and stable appreciation with the least risk to the investor. Like any other investment, it's not foolproof. There are risks, but they can be minimized.

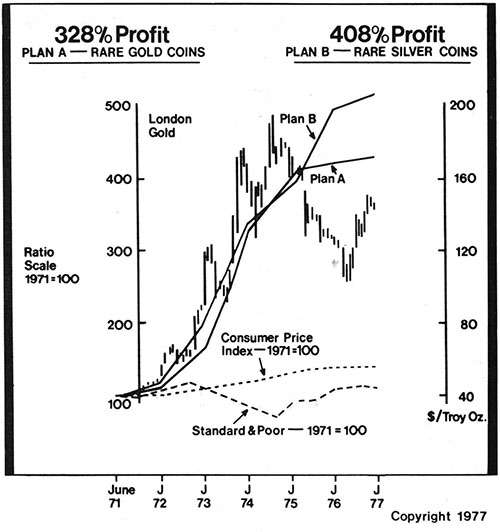

Even a cursory look at numismatic price history reveals astounding advances. Over the past 40 years, appreciation rates have averaged 10-25 percent per year (varying for different areas of numismatics). Since 1971, appreciation has been even greater. Consider, for example, the composite price indices (prepared by my research staff) for two particular rare coin portfolios, one in silver and one in gold. Each portfolio contains 12 different US coins, representing the most common date of each major design in brilliant uncirculated condition. Both of these portfolios were easily affordable in 1971, when retail prices were $1,492 for the 12 gold coins and $847 for the silver. By 1977, these prices had risen to $6,410 and $4,355 respectively. Many numismatic coins did considerably better than this sample, but the deliberate intention here was to select coins that were relatively common, affordable, and diversified. The accompanying chart graphically demonstrates the course that these two groups, and other intelligently constructed portfolios have followed in recent years.

The monthly high and low of the London P.M. gold fix was included in the chart for comparison with the price action of the numismatic gold coins. Note that the coins appreciated sharply in sustained bull markets in gold. The rare coins also demonstrated extreme downside resistance during the 1975-76 correction in both silver and gold. Because of their numismatic value, price corrections in coins have tended to be periods of dormancy rather than any severe decline such as that experienced in bullion. This is one of the major long-term advantages of rare coins for the investor: protection of purchasing power and capital appreciation without the extreme market corrections sometimes seen with other "hard money" investments.

The supply and demand relationship in rare coins is very bullish for prices. The supply side is continually reduced by natural disasters such as fires and floods; by mishandling of uncirculated and proof coins, which impairs their quality; and by the retirement of individual coins into museums or large private collections that may never be sold. Since US coins are not produced after their year of issue, the potential supply has a definite ceiling. The demand side steadily increases at all times, except in serious and prolonged deflation. The growth of population, greater affluence and leisure, and perpetual inflation contribute to increased demand. While demand may ebb and flow, it has been in an overall uptrend since records have been kept.

MINIMIZING RISKS

A second reason to invest in rare coins is their low, low risk. By following a few simple rules, their risk can be minimized. Of course, there are exceptions to these rules, but on the whole, you will come out ahead by following them.

• Never invest in coins that are less than 10 years old.

• Do not buy coins directly from governments.

• Buy coins only, not medals or nonlegal tender issues, and avoid even the legal tender issues of private mints. (Frequently, would-be investors purchase private mint issues, which they innocently refer to as "coins," but when they consult a rare coin dealer about the value, it usually turns out that they have medals, medallions, or silver ingots whose value is only the intrinsic value of the metal, probably 10-50 percent of the issue price.)

• Buy from a reputable dealer who has been in business for some time, preferably 10 years or more, and who will provide a written guarantee of authenticity.

Third, an important reason to own rare coins is for diversification. If you own no rare coins, you should start now to buy them. A good strategy is to invest 5-10 percent of your portfolio in a selection of rare coins, although some put 100 percent in rare coins and are quite comfortable doing so. Obviously, each person's situation is different, but don't let an academic discussion of which percentage is "best" prevent you from taking action. If you're skeptical, even one percent is better than nothing. Take a small portion of your funds and judge the results for yourself.

A recent survey by a national magazine showed that as income rose, so did investments in precious metals and "other investments" (other than savings, real estate, securities, and life insurance). In fact, twice as many people with a $40,000 or higher income invested in precious metals as in the $30,000-$40,000 bracket—and four times as many as in the groups below $30,000. The comparison in the area of "other investments" was almost as dramatic. Historically, the high-income brackets have been the "smart money." Although rare coins still represent a very small percentage of total investments, this market is clearly where smart money is moving.

The numismatic market is vastly underresearched, and this scarcity of research equals profit potential. While this factor may inhibit novice investors, those who do their own research or purchase the services of an expert are far ahead of the majority. There are still "sleepers" or undervalued issues that can be identified after careful scrutiny. This is a demand-sensitive, short-supply market. In some cases, the total market value of a given issue may not exceed $1-$2 million. This permits an occasional market "corner," but a knowledgeable or well-advised investor can take advantage of even this situation by liquidating into the rapidly rising market.

FLEXIBILITY

Rare coins are very portable. They represent a concealable asset of high value and small size. Coins are frequently exempt from import/export regulations. There are no restrictions or duties on taking coins in or out of the United States. It is relatively easy to structure a portfolio of 10 or fewer coins with a weight of a few ounces and a market value of $50,000 or more.

With rare coins, you have a liquid asset with an international market. Coins are easily salable in most Western capitals, particularly in Europe and North America; and there are active coin markets in the Far East. Although the best market for a country's coins is generally within its own boundaries, there are some US coins that have stronger markets in other countries.

In the United States, the coin market never really closes. There are national teletype systems connecting dealers across the country, and there are no time or price limits on trading, as there are in commodities and securities. Unlike businesses, coins don't go bankrupt or suffer from fires, floods, strikes, or poor management. There are many dealers in the United States, along with an increasing number of coin brokers who will handle purchases and sales on a commission basis.

If privacy is important to you, consider the fact that the coin market is one of the last truly free markets left. It is not subject to government regulation or record-keeping requirements, except for the normal business-practice and fraud statutes that cover all businesses. Because it is a cash market, it is relatively easy to consummate confidential transactions. Under the US Gold Reserve Act of 1934, no one was required to turn in numismatic gold coins. No one was prosecuted under the provisions of this act for retaining numismatic gold coins.

If you pay taxes in the United States, you can receive favorable capital gains treatment on profits in coins. In addition, a recent IRS ruling has allowed tax-free exchanges in coins, permitting an individual to carry the tax base of an appreciated issue forward into a new acquisition.

Rare coins have aesthetic appeal. You can experience the pride of owning museum-quality rarities at a far lower cost than in other areas—for example, art. Many, if not all, European monarchs own cabinets of rare coins. The Caesars, the Borgias, and the Medici amassed large collections, as did the Dupont and Lilly families in more modern times. But you don't need the wealth of royalty to begin collecting or investing in rare coins. Many rare coins of the highest quality and known scarcity are available in the price range of several hundred dollars per coin. And they are beautiful.

The last, and perhaps most important, reason to invest in rare coins is that they are the only real money. All coins issued by the US government are legal tender. Legal tender status greatly lessens the possibility of confiscation of a nation's coins by its government. The most important function of a monetary asset is to provide a store of value. Historically, rare coins have more than fulfilled this requirement, keeping their owners ahead of inflationary trends. Even in the incredible 3.2-trillion-to-1 inflation of the German mark in the early 1920's, rare coins provided a vehicle for retaining virtually all of the purchasing power of a person's assets.

When you consider the track record of rare coins, their low risk, their role in ensuring privacy and diversification—and all of their other advantages-it becomes obvious that some portion of your investment assets should be placed in a selected portfolio of rare coins.

A financial consultant in Chicago, Mr. Perschke specializes in coins and is the president of Numisco.

This article originally appeared in print under the headline "Rare Coins: Ten Reasons to Invest."

Show Comments (0)