Peyton Manning Could Pay New Jersey More in Taxes for the Super Bowl Than He Earns For Playing It

The state always takes its cut

This year's Super Bowl, scheduled to be played this Sunday, will be held in New Jersey, even though a lot of news outlets covering the sporting event, and even the NFL, may prefer to call what's officially a "NY/NJ" Super Bowl a New York affair. The football teams that play at the East Rutherford, New Jersey stadium, the Giants and the Jets, are after all New York (or NY/NJ) teams. Sunday's televised coverage is sure to include plenty of bump shots of New York City locations and few actually from the area where the stadium is located, which is basically a swamp. Even the NYPD has gotten in on the "let's pretend this thing is happening in New York" action; promising unprecedented security at the event and deploying 200 "temporary" security cameras in midtown New York.

But one way to ascertain that, yes, in fact the Super Bowl is being held in New Jersey, is to look at whose taxman the Colorado and Washington players competing in the Super Bowl will pay. That would be dirty Jersey, and according to K. Sean Packard, a CPA writing at Forbes.com, Jersey will indeed treat the players dirty when it comes to taxes:

If Manning is able to play next season, his New Jersey income tax would be $46,989 on $92,000 for winning the Super Bowl, or 51.08%. If they lose and he is able to play in 2014, he will pay New Jersey $46,844 on his $46,000, which amounts to a 101.83% tax on his actual Super Bowl earnings in the state—and this does not even consider federal taxes!

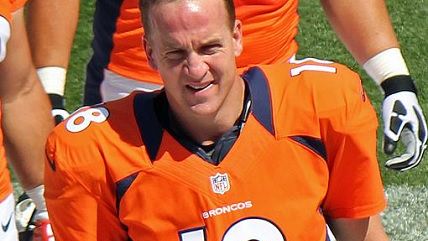

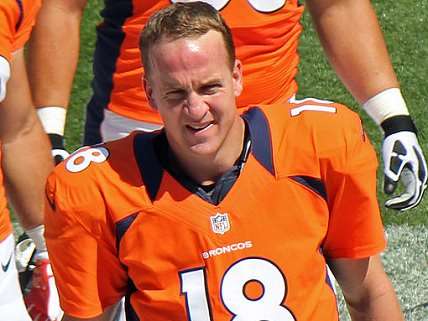

Manning's tax liability would be less, Packard explained, if the 38-year-old Denver Broncos quarterback were to retire after the Super Bowl, because New Jersey looks at the total income, even when not playing in the state, and because the Broncos play the Jets next season, so New Jersey's state government gets a take of that too. The taxes paid by Manning and the other Broncos and Seahwawks players for merely competing in New Jersey in a league event, will also fall quite short of how much tax money New Jersey has wasted holding the Super Bowl.

Bilking athletes, though, is nothing new. Jamaican track star Usain Bolt, for example, is boycotting sporting events in the United Kingdom until their tax laws are loosened, while golf star Phil Mickelson was bullied by wealth redistribution advocates for complaining about his onerous tax rate, eventually apologizing for quite rightly pointing out that onerous federal and state (for Mickelson, California) tax laws would cause him to consider drastic changes in his life. Mickelson pays 61 percent of his winnings in taxes, an uncomfortable fact tax boosters tried to deny.

Show Comments (194)