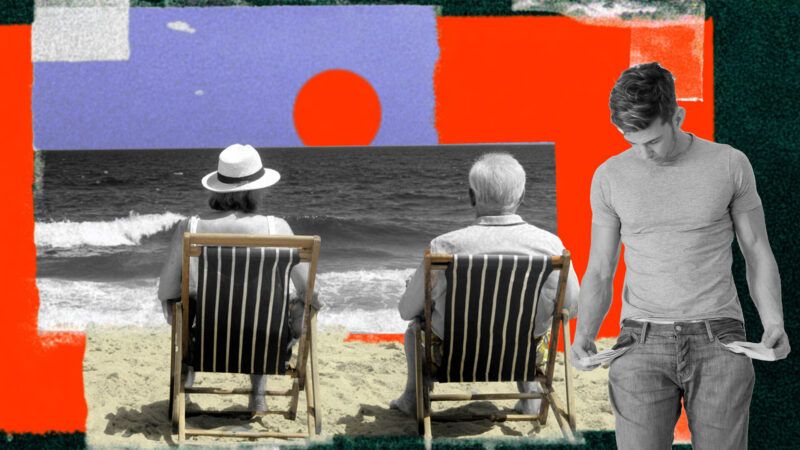

A Social Security Bailout Would Cost Younger Workers $157,000 in Higher Taxes

To keep Social Security solvent without cutting benefits would require a massive hike in payroll taxes, which would fall entirely on working Americans.

The Social Security trust fund will go bankrupt in 2033 according to the Old-Age, Survivors, and Disability Insurance (OASDI) trustees. With neither Democrats nor Republicans appearing willing to reduce benefits or increase the retirement age, the only way to make Social Security solvent is to increase revenue. While this can be done, it will come at the great financial detriment of young people entering the work force who are already struggling with the cost of living.

Romina Boccia and Ivane Nachkebia, director and research consultant for budget and entitlement policy at the Cato Institute, respectively, calculated just how expensive eliminating the Social Security shortfall would be. The researchers cite the OASDI's trustees' report, which concludes that, to eliminate Social Security's projected $25 trillion deficit over the next 75 years while maintaining planned benefits, "Congress would need to raise the payroll tax rate immediately and permanently by 3.65 percentage points."

Increasing the payroll taxes that fund Social Security from 12.4 percent, the current payroll tax rate, to 16.05 percent may not look intimidating on the page, but Boccia and Nachkebia explain what this rate hike means in dollar terms for the young people entering the work force in 2025. The median 22-year-old worker, who starts with an annual income of $66,636 and retires at 67 years old, would pay an additional $2,432—roughly two weeks of pay—every year, translating to an additional $110,000 of payroll tax throughout his working life.

And that's not even the worst-case scenario: To make Social Security solvent indefinitely, the payroll tax would need to be bumped up by 5.2 percentage points to 17.6 percent. For a 22-year-old entering the work force, this means forgoing $3,465 in income every year, nearly three weeks' wages, adding up to a lifetime earnings loss of $157,000. Though young people are not as influential a voting bloc as retirees, it is still politically infeasible to hike payroll taxes on the entire working-age population, so this "solution" is unlikely to be implemented by Congress.

Boccia and Nachkebia detail other ways to close the Social Security shortfall, such as lifting the income ceiling on the payroll tax and borrowing to cover deficits. The first, while more politically viable than increasing the payroll tax rate, "would only cover half of the long-term funding shortfall," explain Boccia and Nachkebia.

Another option is the most likely: Congress can cover Social Security's cash flow deficit without increasing taxes by borrowing more money. Doing so could precipitate a systemic debt crisis in the U.S. as creditors lose confidence and demand higher yields to hold bonds, causing net interest payments, which already account for 14 percent of federal spending, to balloon. Ultimately, this could result in massive inflation as the government prints money to pay its debts, eroding the real value of future retirees' life savings, resulting in another situation in which working-age people are forced to subsidize the retirements of the elderly.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Lump sum payout. Been saying it for 20 years.

If you're destitute when you're 65 because you couldn't manage your money, then GFY.

lump sum payment with what? there's no money

Yeah, I've mentioned that to him before. Another popular comment is "cancel SS now!" which assumes 80 million pensioners will somehow make do and the public won't notice.

Don't assume my gender, you bigot.

Your rules, not mine.

Make it the last borrow. People paid into it, they deserve to have it returned. Same goes for Medicare.

Then start shuttering anything and everything that is a Social Welfare money pit for the Federal Government, outside of that which is Constitutionally defined a proper purpose of government.

Show your arithmetic. Here, I'll give you an example.

10% withdrawals means a $2000/month $24,000/year pensioners needs $240,000 nest egg. Call it $250,000.

80 million pensioners means you need $20 trillion.

You're gonna double the national debt. Who's going to loan that, at what rate?

Sure, you've eliminated $2 trillion a year spending, which puts the national budget in balance. But now the interest payments have gone from $2 trillion a year to $4 trillion, but a higher interest rate makes that more like $5 trillion, and now you're running $3 trillion a year deficits.

Go ahead and focus on the splinter in the pinky finger. Ignore the hole in the aorta. See how that works out for you.

You want to save the body, you've got to address the most pressing issue first - the one that WILL kill the patient unless it's immediately focused on and resolved. The rest can come later.

You're here whining about suddenly doubling the national debt, while ignoring the fact that your slow walk to death will triple, quadruple, quintuple it while you do.

Please show me your math. Otherwise I'll guess you didn't do any.

You're right, I didn't do any. Because no matter how this plays out, it's going to cost us. The New Deal FDR Left-wing Socialists (and their Losertarian enablers) screwed us. And they continue to screw us. Plain and simple.

(It's why if I had a time machine, I'd skip right past Hitler and Mao, and I'd kick FDR's dad in the nuts so hard that he'd be sterile for the rest of his life.)

The only way to make it right is to either tell everyone to go f themselves, which I'm against; or to make it right and take it on the chin as the first step towards leaving the hospital.

Repair the aorta, moron. Stop worrying about the splinter. We can get to the splinter AFTER the aorta is repaired.

Make it the last borrow.

There's nothing the borrow. There's no money there.

If they payout a lump sum payment to everyone for their expected SS payout right now the only way to do so is print (ie steal) eleventy trillion dollars out of thin air which will cause even worse problems than it would be intended to solve.

Then cut off all welfare, medicare, and social spending until it resolves itself.

The ONLY thing that gets a budget is the military. The rest goes on moratorium until they make good on SS restitution.

Sunset the entire Ponzi scheme. Today.

You too, with no fiscal details.

Each individual will manage their own situation. It is called personal responsibility.

No, they wouldn't. They would rise up together in armed rebellion.

Lil Rascal mobility scooters piloted by armed geriatric boomers are easy to hit at distance.

Which is what the socialists wanted all along. FDR either got played or he was in on it.

Yep. Cloward-Piven.

80 million pensioners cut off in an instant?

It's a damn Ponzi scheme!

Yes and yes.

No. I retire in 35.

Jack up the payroll taxes on the young!

They are going to fuck us all. Recipients, young workers, middle aged, savers, everyone. They will reduce benefits, disqualify people who aren't poor enough, and tax the shit out of the remaining earners.

Be ready for it

How to be ready?

i leave that up to you but you should expect it.

ok ill bite.

real assets, whatever you think falls into that definition. Land, gold, bitcoin, water rights, oil wells, whatever you think is a real asset.

I've posted versions of this before. I am no financial expert, and I know this is politically impossible. My purpose is to understand a "realistic" plan to convert SSA Ponzi pensions to private nest eggs. I am not saying this is perfect or possible, only that it is the best I could come up with.

The gist is that investing 1/4 of the FICA tax in private DJIA/S&P 500 indexed funds provides enough nest egg that a 5% annual withdrawal matches SSA pensions, and since the average annual return over the last 10 years is 10% (DJIA) and 13% (S&P 500), that still leaves 3%/6% capital growth over the Fed's 2% inflation target (my figures were pre-Bidenflation), and a good cushion for bad years.

* Keep the FICA tax on all workers to pay current SSA pensions. It will decrease from its current 15.3% over time as current pensioners leave the system. Everyone contributed to this mess, everyone has to pay to get out of it. Neither the Lone Ranger nor Harry Potter is coming to the rescue.

* No new SSA pensioners. All employees keep paying FICA and get some prorated reduction in their buyout costs.

* Add a new 4% payroll tax which goes directly to individually owned DJIA/S&P 500 indexed accounts. Yes, all employees get a 4% pay cut. We all contributed to this mess, we all have to get out of it. When the 15.3% FICA tax drops 4%, the pay cut turns into an increasing raise.

* Minimum SSA retirement age is 67 years. Average life expectancy is 80 years. If half of pensioners are dead in 13 years and the 15.3% FICA tax can be cut in half to 7.65%, it would drop 4% in 7 years. This is a gross simplification, but close enough for starters.

* As time goes buy, SSA pensioners die off or take a lump sum nest egg buyout. Since this is spendable and inheritable, its value can be less than the strict 10%/13% necessary to maintain their current SSA pensions.

* I *think*, as an uneducated uninformed wild ass guess, that the FICA tax would disappear within 20-30 years, leaving only the 4% nest egg tax. That's a 10% raise for everybody.

* The new nest egg tax invests $500 billion a year into the stock market. 50 years (working age 20-70) of that will stabilize at $25 trillion. Google says current mutual fund capitalization is $56 trillion. I do not think adding $500 billion, 1%, every year would destabilize the stock markets.

* Whether the new 4% nest egg payroll tax remains mandatory is a political decision. I'd be perfectly happy to make my own decisions and risk ending up in a bunk bed charity, but do-gooders and sob sisters will latch on to every pensioner who blows it in Vegas or loses it to a con artist, and try to restore SSA. Insurance companies could play a part. Guardians who have to approve unusual withdrawals could play a part. Legally binding waivers could play a part. But those do-gooders and sob sisters will also play a part.

The biggest problem is the 4% remains in the hands of the government. As it grows, how will they resist finding a way to funnel those fund one way with the promise to finance them in another way in the future. The whole mess begins anew.

The researchers cite the OASDI's trustees' report, which concludes that, to eliminate Social Security's projected $25 trillion deficit over the next 75 years while maintaining planned benefits,

The mortality assumptions in that report are being whitewashed. In particular, the life expectancy for the lower-income elderly has not changed much for decades - and won't improve in future. It may even get worse since that demographic is being killed by 'the American lifestyle'. The life expectancy for the high-income elderly has increased hugely - but while that has a big negative impact on expected SS payments over their lifetime, it has an even bigger impact on Medicare payments. IOW - we have created an entitlement for the elderly that is not at all a 'safety net' but has become an entitlement program for the middle-class and above. Where the medical expenses for those 80+ year olds in their last two years of life are not remotely covered by Medicare taxes or premiums and far outweigh any SS income they receive then.

I don't expect any public discussion of any of this. The last public discussion of entitlement reform happened in 1983 when most boomers had only recently left college (the young will never care about 'retirement issues' far in the future) and Congress was full of the WW2 generation who chose a reform that would kick the can down the road for a few decades to ensure that all discussion would become a third rail of politics.

Public discussion essentially ended in 1964 when Goldwater's modest SS reforms were thrashed by Greatest Generation voters seduced by promises of a "Great Society." Since then, no politician who wanted to get re-elected has made any serious effort at reform, let alone getting rid of SS. (And no, Bumper Hornberger is not a serious politician.)

Actually there were discussions as recently as HW when the pundits and press declared, with unassailable authority, that it was the third rail and any politician that stepped on it was toast. The only constant in this nearly century old discussion is that to the Democrats SS is revered as a sacrament and to question even the plain math is blasphemy. The commercials with evil Republicans pushing Grandma off a cliff don't embarrass them a bit. They actually believe this shit. We've lived through Covid cults and climate cults but nothing has the power of the New Deal cult.

Bush Jr, to his credit, tried to bring up the idea of privatizing SS at the very least. Dems raked him over the coals for even mentioning it.

Privatizing SS solves nothing unless it also includes the 'ok so what will happen when things go wrong (eg a bear market that starts at someone's retirement) or people still need an actual safety net'.

If the answer is - let them die. Well - that is certainly an answer that solves the problem but in that case, tell me how you are selling that idea. If the answer is - silence - then you haven't solved a damn thing and you are just virtue/intelligence signalling.

This! I am so sick of these kinds of people, author very much included, whining about this issue without ever even attempting to look at it realistically. Just "REEEEEEEEEE I don't like it!"

With neither Democrats nor Republicans appearing willing to reduce benefits or increase the retirement age, the only way to make Social Security solvent is to increase revenue.

You missed the obvious way: create money out of thin air and inflate the dollar into worthlessness.

Printing money to backstop the insolvency is exactly what is going to happen.

100%

prepare accordingly

+

+

+

Yep. If there's one thing they've got down pat, it's that.

My fix is easy. Eliminate the wage cap altogether. In addition, tax ALL personal income except for tax exempt bonds interest. These two measures might even make it possible to reduce the employee and employer withholding rates.

Show your arithmetic.

Sure. Do you have any idea about how SS benefits are calculated? Under current rules lifting the cap will also lift the benefits.

Or do you just want to redistribute (more) wealth?

I'm guessing it's the redistribute thing. Billionaires will pay for it and stuff.

ALL? How'd you figure out how to get tax-exempt personal income?

Hop to it. Tax them all at $157000 per year. I am close to retirement and this sounds great to me.

No worries.

Shift funding from all federal agencies not specifically authorized by the US Constitution, and eliminate that agency.

Security for Socialists would be at the top of that list.

We've been having this argument since Reagan fixed it and Al Gore proposed the Lock Box. But it's a straightforward Ponzi scheme and operating precisely as it was designed to. FDR purportedly saved capitalism but left us with a socialist welfare state. In the meantime generations have paid in at ever increasing rates. Which generation gets fucked? Any structural changes at this point kick the can down the road and we'll be having the same conversation 20 years from now. We are very close to the end of the dollar as an asset. Once it becomes an obvious liability SS will be the least of our problems.

We are very close to the end of the dollar as an asset.

^THIS... Ever since FDR you can't even wear out a tractor faster than the government wears out your $. I'm sure Venezuela never thought they'd collapse all the sudden either but that's exactly what [Na]tional So[zi]al[ism] leads too every freak-en time.

Big Shocker! /s

Security for Socialists will break the USA and put working citizens into poverty.

Hmmmm... Wonder where that has happened before. /s

You can thank FDR(D) and his (D)trifecta for that one...

And many more to come.

'The Social Security trust fund will go bankrupt in 2033'

Fuck you, retard.

You know full well that most common idiots will read "bankrupt" and then expect the program--and benefits--to end. Instead, the current payroll taxes can cover about 90% of current benefits. A haircut, yes, but not a catastrophe.

Again, fuck you.

The law requires that benefits be cut by 25% when the fund becomes insolvent.

Now, repeat your analysis for Medicare.

End social security now. I am sick of these loser: who have been fleecing the US for decades.

Indeed. +100000. It's time to put an end to all Gov-Gun'em down 'armed-theft' Selfish-Entitlements. It's past time to start defending Individual Liberty and ensuring Justice for all. Once upon a time others labors/resources required EARNING them and that's how Justice got ensured for-all till criminal-minds elected the 'Guns' for their Demand-side only economics. It'll never work because Santa Clause isn't real and resources don't just trickle-down from the north-pole magically.

At the very least keep it within a very strict local welfare department or open-door prison welfare. Democrats aren't doing the people any favors by teaching them they don't have to EARN anything and everything will be just fine. Selfish Greed has no boundaries. Again; resources don't fall from the sky.

Raising taxes just expands government instead cut the max payment so no one gets more than where the middle of the bell curve lands - the top 50% get less/bottom doesn't see a cut (It's supposed to be a safety net) - the more one makes while working the bigger the cut. Richer people live longer (statistically) so they are getting more Medicare so it makes sense they get less cash SSI payments. Additionally raise the age and change the number of years counted when calculating payments to 40 from 35.

[WE] got BIG plans on how to spend those productive people's $. /s

Or just open the prison-door for welfare and everyone else can learn how to support themselves instead of milking their younger generation dry. Endless accounting games/planning =/= making or creating human resources. It's a zero-sum resources end-game.

Not saying increasing the SS tax is the answer, but this article only addresses half the equation. What impact does the increased employee/employer contributions have on the recipient’s monthly benefit amount?

Currently, none.

The benefit amount is based on employee earnings, not employer/employee taxes paid.

Yeah, you’re right assuming the individual recipient benefit calculation formula remains the same.

Note that the employer contribution is not capped.

-dk

Fun Fact. The USA not only worked just fine for 150-YEARS without SS; it was the fastest wealth-growing nation on the planet.

Nothing but Frogs hot-tubing in their pot of water on the stove having little to no perspective on how good things could be for them if they'd just GTFO of the hot-tub.

Apparently, NO ONE CAN DO MATH ANYMORE.

OASDI (Old Age, Survivors, Disability Income) Social Security to you and me, is funded by taxes on employers as well as employees. The 12.4% current rate is split: 6.2% to employers and 6.2% to employees. Only half of an increase of 3.65% would only be paid by the employee. On a $66,366 annual income that 0.01825 x 66,366 = $1,216.11 more.

1.825% is less than the annual rate of inflation ALMOST EVERY YEAR.

Does more tax hurt us. Yes.

Is it two weeks of pay? No. its less than 1 week.

If you're going to raise hell on behalf of all working people in the US, understand how taxes work and check your math first. Maybe have someone who understands taxes and math do it for you.

Yeah man... What's another 4% on-top of 12% on top of 10% (income) on top of 5% (state income) on-top of 5% (state sales) on top of 5% (Medicare tax) on-top of any other Excise Taxes???? /s

FFS man.... That's only 1/2 of your total income getting STOLEN man w/o any consideration for Excise or Property or etc, etc, etc, etc Taxes... /s

Like I said, no one can do math anymore.

Other obvious option: unlimited guest worker visas for young, high-skilled workers (or maybe even any workers at this point). That would increase the amount of people paying into the system without necessarily increasing the amount of users in the long term.

Unfortunately, that fight within the Republican party over Indian workers earlier this year shows that the Democrats will have to be the ones to try that. If MAGA is opposed to immigrants even if they are high-paid tech workers who came legally, such a solution would meet heavy resistance from them. They hate immigration so much that they are willing to hurt other Americans in order to reduce it.

Programs like that are impossible without a secure border and effective immigration enforcement. It doesn't matter what our rules are when people can literally walk around them. Now that the Trump administration is creating the conditions necessary for an orderly guest worker program, support for trying it might increase.

This..

Mass flooding of low skill workers only makes this worse, not better. More even republicans aren't against immigration, they are against mass invasion and open border nonsense. And especially being told we aren't allowed to have a say/choice because some rich billionaire asshole and multi nationals demand more slaves to in order to earn extra pennies.

You want to solve this problem, you stop trying to drive everybody into slave wages.

Another option is to adjust the payouts to match social security's finances, in other words a reduction in benefits of about 23%.

Every other proposal just screws some Peter to pay some Paul, that is a game for socialists, the same fools who got us into this mess.

Give it a rest.. society isn't buying what rich elites and their libertardian shills have been pushing for a century. The clock is not turning back, 1st world nations aren't going back to rich elite playgrounds.

SS was decided a century ago. time to move on, joining the rest of the adults in the room and work on making it better.

I remember this game.. it will certainly without doubt run out of money about 3 different times in my life, two of which have already passed.