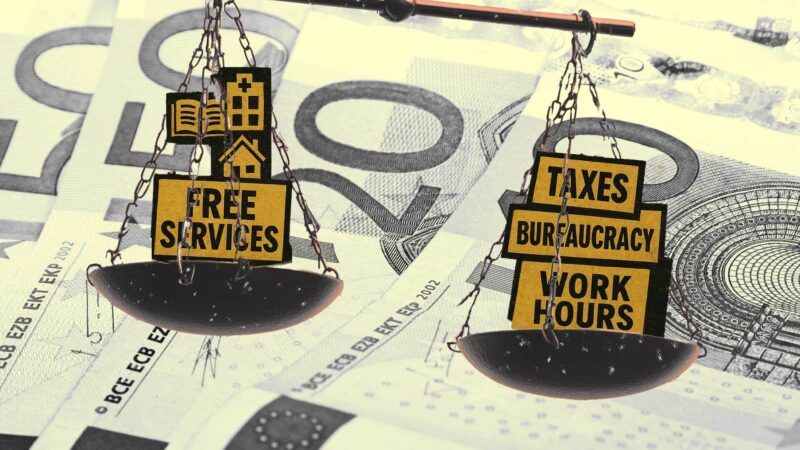

Tax Comparisons Show 'Free' Stuff is Very Expensive

And the stuff you get is of the government’s choosing—not yours.

People who want a larger, more active state frequently point to their favorite European country (usually a small Scandinavian nation) and ask why America doesn't provide lots of "free" services like that alleged utopia. The answer is that it could but that wouldn't necessarily make people happier. The U.S. is a large and diverse country where people don't nearly agree with each other on what they want, and it's difficult for government to provide more services without fueling arguments over what and how much should be provided. Importantly, too, those services aren't free—they carry a very high price tag.

You are reading The Rattler from J.D. Tuccille and Reason. Get more of J.D.'s commentary on government overreach and threats to everyday liberty.

Paying Half Your Salary for Government Services

"Governments with higher taxes generally tout that they provide more services, and while this is often true, the cost of these services can be more than half of an average worker's salary, and for most, at least a third of their salary," Cristina Enache wrote last week for the Tax Foundation. "Belgium has the highest tax burden on labor at 52.6 percent (also the highest of all OECD countries), followed by Germany and France at 47.9 percent and 47.2 percent, respectively. Switzerland had the lowest tax burden at 22.9 percent."

The U.S. government's tax bite comes in at 29.9 percent, according to the Organization for Economic Cooperation and Development (OECD). The average across the OECD as of 2023 was 34.8 percent.

That cited tax percentage isn't a formal rate set by any government, but a "tax wedge" created for the purpose of comparisons across diverse tax systems. The OECD defines the tax wedge "as the ratio between the amount of taxes paid by an average single worker (a single person at 100% of average earnings) without children and the corresponding total labour cost for the employer." It doesn't account for adjustments such as tax breaks offered to families with children. It also doesn't allow for wild variations in tax compliance that can turn nominal tax rates into suggestions when you're discussing the difference between 83 percent compliance in the U.S., 62 percent compliance in Italy, and 70 percent in Belgium, where tax evasion is something of a national sport. But the tax wedge allows us to roughly contrast the cost of government in Belgium with that in Spain or the U.S.

It turns out governments offering lots of "free" stuff to the public, like health care and higher education, charge dearly for such services. You won't have to pay for that appointment or a degree, but you'll also never see somewhere between one-third and half of what you should be taking home in pay.

And the price keeps going up.

"In Europe, the average tax burden on labor increased by 0.12 percentage points between 2023 and 2024," adds Enache. "During this period, the tax burden increased the most in Italy and Slovenia by 1.6 percentage points and 1.4 percentage points, respectively. Overall, between 2023 and 2024, 14 European countries increased their tax burden on labor. Of these, four countries saw a decrease in real wages before tax. And in seven countries, the average worker had a lower real post-tax income in 2024 than in 2023."

Government Services Work Best When Almost Everybody Agrees

For that stiff charge, heavily taxed populations get "free" services of a type and quality specified by state officials. People who don't like what the government offers must pay extra on top of what they are already forced to surrender in taxes to fund services they may not want or that often fail to meet their needs. It's easier to shop for the services you prefer if you don't have to pay high taxes for the ersatz government version to begin with.

Unsurprisingly, it's easier to maintain a tax-funded welfare state if people generally agree on what that welfare state should look like, how much it should cost, and the services it ought to offer. That's why the most successful all-you-can-eat systems tend to be rather small and homogeneous.

In February, The New York Times's David Leonhardt profiled the relative success of Denmark's Social Democratic Party under Prime Minister Mette Frederiksen. Her party has bucked the world's populist tide and retained power in part by embracing restrictive immigration policies for the country of 6 million.

"Leftist politics depend on collective solutions in which voters feel part of a shared community or nation, she explained," according to Leonhardt. "High levels of immigration can undermine this cohesion, she says, while imposing burdens on the working class that more affluent voters largely escape, such as strained benefit programs, crowded schools and increased competition for housing and blue-collar jobs."

Denmark, incidentally, has a tax burden of 36 percent.

High Taxes Have Limits—and Consequences

Even relatively homogeneous countries aren't immune to disagreement and limited tolerance for high tax rates to fund generous (with other people's money) government services. In recent years, Norway's government hiked wealth taxes which reached even for "unrealized gains"—profits that might be seen in the future. Rather than fill government coffers, the rich, followed by their bankers, left for Switzerland.

"When you've made your wealth in Norway, put your kids in school, benefitted from the health care system, driven on the roads and reaped the rewards of its research, it's a breach of the social contract," Prime Minister Jonas Gahr Store complained about those fleeing his government's sticky fingers.

The Norwegian government's "solution" was to tighten the exit tax to raise the price for leaving the country. Germany also imposed an exit tax. Free stuff gets more expensive all the time.

That expense is reflected in the tax bill people pay, of course. But it's also seen in the widening competitiveness gap between higher-taxed countries and those whose governments don't reach their hands quite so deeply into their subjects' pockets. In particular, for years the U.S. has been widening its lead over Europe in terms of productivity and resulting personal income.

"Europe's high wage taxes erode the value of human capital, resulting in a less dynamic labor market, smaller rewards for productive entrepreneurship and lower levels of material well-being," the Cato Institute's Adam Michel noted last year.

Former Italian prime minister Mario Draghi's 2024 competitiveness report for the European Commission called for a "coordinated reduction of labour income taxation" to address the gap. People taxed at a lower rate may be encouraged to work harder—and perhaps they'll see the attraction of using the resulting higher income to shop for services of their own choosing.

Plenty of people are lured by the promise of "free" stuff they believe will make their lives better. They don't realize how expensive that free stuff is for everybody, themselves included.

Show Comments (23)