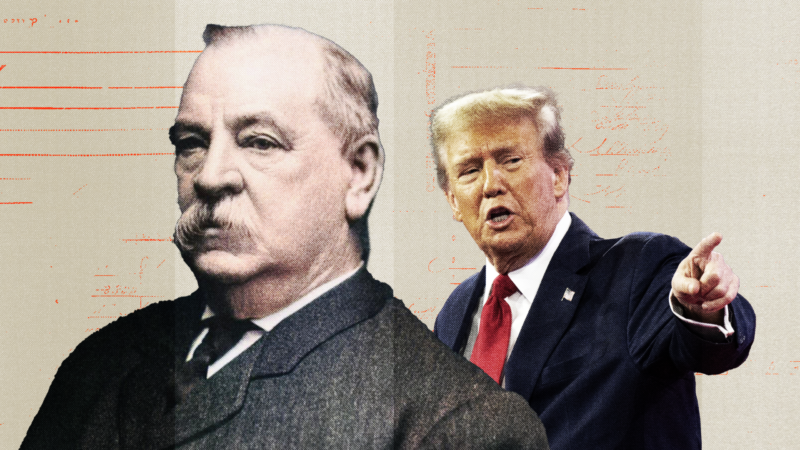

Trump vs. Cleveland: A Tale of Two Tariff Strategies

Grover Cleveland fought high tariffs as a “communism of pelf.” Trump embraces them as an economic cornerstone.

Donald Trump will soon become the second president to serve non-consecutive terms. Naturally, this invites comparison between Trump and the first president to serve non-consecutive terms, Grover Cleveland. In one crucial respect that juxtaposition is both instructive and cruelly ironic.

Trump has made raising tariffs a centerpiece of his economic agenda. Cleveland, by contrast, devoted his career to warning that high tariffs bring a specific and dangerous type of communism to America—a communism of pelf.

"Pelf" is a term for money acquired in a dishonest or dishonorable way, and while it may seem anachronistic, it is the perfect word to capture Cleveland's ideas. As he explained in a frustrated 1894 letter to Mississippi Rep. Thomas Catchings, "The trusts and combinations—the communism of pelf—whose machinations have prevented us from reaching the success we deserved, should not be forgotten nor forgiven." Yet his most consequential statement on tariff reform was a State of the Union message submitted to Congress on Dec. 6, 1887—exactly 137 years from the date of this article's publication.

Cleveland believed so strongly in tariff reform that, because of that State of the Union, he was able to dedicate his entire 1888 reelection campaign to the cause of lowering them. He lost that election in a controversial squeaker, but was decisively reelected in 1892 in no small part because economic events had vindicated his warnings.

When tariffs are too high, Cleveland argued, it means that corrupt politicians and businessmen are able to exploit consumers, often imposing severe hardships through price increases. Just as bad, it means that the government is failing to treat all citizens as equal before the law, instead picking winners and losers in the aforementioned "communism of pelf."

This was the situation that existed in America during and after the Civil War, when politicians imposed weighty tariffs under the pretext of supporting the nation's burgeoning business community. While American consumers initially accepted the additional taxation as a wartime necessity, the high rates persisted even after the nascent military-industrial complex had been wound down.

The problem was both simple and intractable: There were thousands of manufacturing, industrial, agricultural, and other business interests that profited from high tariffs. Each special interest group disregarded the national welfare to protect themselves, and as a result, the government accumulated massive surpluses—$113 million in 1886–1887 alone.

Despite this growing crisis, initially, Cleveland did not prioritize tariff reform. For the first two-and-a-half years after taking office in 1885, Cleveland concentrated on rooting out government corruption, which had reached such a nadir that in 1873 Mark Twain dubbed the post-Civil War era as a "Gilded Age." To the extent that Cleveland's anti-corruption agenda involved vetoing legislation he deemed financially wasteful, he indirectly picked off some of the rotten fruits that grew from the protectionist tree. However, it was not until 1887 that he shifted his attention to a need for sweeping tariff reform. When he did, he transformed the presidency and America in the process.

"Our progress toward a wise conclusion will not be improved by dwelling upon the theories of protection and free trade," Cleveland wrote in his message to Congress, alluding to the various nationalistic arguments made by the protectionists. "It is a condition which confronts us, not a theory." From there, Cleveland proposed moderate tariff reductions, focusing on increasing access to raw materials for ordinary consumers and adding the federal government's financial obligations could be met through internal revenue taxes levied on luxury items (particularly "tobacco and spirituous and malt liquors").

In the long term, the message was good news for America, as the 1887 State of the Union completely dominated national politics for the next year. In the process, Cleveland strengthened the office of the presidency, which had become weak in shaping policy in the more than two decades since the Civil War. Of equal importance, he raised awareness about a grave economic injustice. Finally, Cleveland gave the Democratic Party a new sense of identity after nearly a quarter-century of post-Civil War ennui. Democrats who did not support tariff reform were no longer viewed as proper Democrats; the same was true for Republicans but in reverse, as practically overnight they redefined themselves around the cause of protectionism.

In the short term, though, the message had negative results. Cleveland's tariff reform proposals passed the Democrat-controlled House of Representatives but failed in the Republican-controlled Senate. Even worse, despite winning the popular vote, Cleveland lost the 1888 election to Republican nominee Benjamin Harrison amid Electoral College disputes in the key states of New York and Indiana. (Unlike Trump, Cleveland accepted his defeat with grace and peacefully ended his term in 1889.) The Republicans took office and passed a high tariff law (framed by future president William McKinley, then an Ohio congressman). The McKinley tariffs raised the average duty on imports by almost 50 percent, and as Dartmouth University economist Douglas Irwin demonstrated in 1998, these tariffs did little to stimulate the economy even as they imposed considerable suffering on low-income Americans.

This is why, just like Trump, Cleveland was able to comfortably get elected to a non-consecutive term by promising to lower prices. The key difference is that, unlike Trump, Cleveland proposed an intelligent solution to the problem—lowering tariffs, not raising them.

Unfortunately for both Cleveland and the Americans of his time, he would not live to see his vision for tariff reform realized. America plunged into an economic depression shortly after he took office in 1893, compelling Cleveland to confront a number of unrelated crises before he could get to tariff reform. By the time a tariff bill did reach his desk in 1894, special interest groups in both parties had diluted it almost to meaninglessness. Cleveland couldn't bring himself to veto the Wilson-Gorman Tariff Act of 1894, and he only allowed it to become law without his signature. Adding insult to injury, McKinley and the Republicans politically benefited from the economic misery they'd helped cause, with Democrats getting blamed for the depression because of their incumbency and McKinley winning the 1896 presidential election in a major realignment.

Tariff reform along the lines Cleveland advocated would not become the law of the land until the Underwood-Simmons Act of 1913, which was promoted with far more political effectiveness by Woodrow Wilson, the first Democratic president to serve after Cleveland's administration. By then, Cleveland had been dead for five years.

Yet, Cleveland's tariff reform message was not a failure. In addition to putting himself on the right side of history, Cleveland offered a potent and timeless warning about the dangers of protectionism.

"When we consider that the theory of our institutions guarantees to every citizen the full enjoyment of all the fruits of his industry and enterprise, with only such deduction as may be his share toward the careful and economical maintenance of the Government which protects him, it is plain that the exaction of more than this is indefensible extortion and a culpable betrayal of American fairness and justice," Cleveland wrote. "This wrong inflicted upon those who bear the burden of national taxation, like other wrongs, multiplies a brood of evil consequences."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Trump has made raising tariffs a centerpiece of his economic agenda.

This is a misstatement. The centerpiece of Pres Trump's economic agenda is tax rate sanity, and deregulation.

Pres Trump advocates using tariffs to achieve specific policy outcomes; that is a very different proposition than a centerpiece of an economic agenda.

Once I read that gem, I figured the author had his own agenda.

Matt Rozsa is a professional writer whose work has appeared in multiple national media outlets since 2012 and exclusively at Salon since 2016.

That tracks.

We are seeing more and more crossover with vox, salon, and other sites from a leftist perspective.

What a surprise. Reason is just the hipster version of Salon. With just a little faux libertarian edge.

Since when is free trade advocacy a "faux libertarian" position?

+1 This was my thought from "Trump embraces them as an economic cornerstone."

Either the writer doesn't know that the cornerstone, in actuality or as euphemism, isn't just a stone in the corner of a building and is, instead, the reference stone from which all the other stones in a building will be set, or he does know that and he's wrong about Trump and tariffs.

He’s even more wrong than JD Vance.

Regulations don't raise prices. Only Jones act and tariffs. Ask Boehm.

TTTAAAARRRRIIIIFFFFSSSS!

I heard that in Shatner’s voice.

The centerpiece of Trump's campaign has been sticking it to foreigners in the form of protective tariffs and mass deportations.

sarcasmic, you're shifting the goal posts. My comment was directed toward what is the centerpiece of Pres Trump's economic agenda. Pres Trump spoke at length on Rogan about making the US a more favorable business climate relative to global competitors, with lower tax rates. Separately, he has also spoken at some length regarding deregulation, and how that contributes to a more favorable business climate, and higher revenues.

As far as his campaign goes...yes, deporting every illegal alien we can lay our hands on and using tariffs to achieve specific policy objectives were prominent in the campaign. Rightfully so.

I think you're mistaken when you say he wants to use tariffs for specific policy objectives. Trump just likes tariffs. He's been promoting protective tariffs for four decades. Bringing back manufacturing jobs is not a specific policy objective. It's a protectionist objective that can only be achieved by causing the prices of products to increase to the point where it's cheaper to make them here. That kind of economic thinking was proven to be destructive three centuries ago. But he and his defenders think they know better. Or maybe they think it will be different when they do it. You know, like those who think communism or socialism will work if the right people do it hard enough.

You survived Trump's tariffs in his first term, and you have survived Biden's tariffs too.

Trump was unable to achieve his goal of blanket tariffs on all goods coming into the country because that requires Congress. So he had to settle for targeted tariffs.

If he gets his way and imposes a 25% federal sales tax on all goods coming from our closest trading partners, then the result will be inflation.

I can't tell if you Trump defenders simply don't understand that a blanket 25% tax on all imports will raise prices across the board, or if you're just lying and don't care. I think it's the latter, because nobody is that stupid.

It won’t be necessary, because they will cave in and do what they’re told. Which is the whole point. You’re too obsessed about this (and undoubtedly too drink as well) to possibly understand.

Instead we get your retarded drunk ravings.

Are you retarded sarc? He has literally tied tariffs to policy.

At this point you have to just be lying. You've been given links and quotes. See the Canadian and Mexico tariffs tied to cracking down on illegal border movements.

You are so fucking dishonest.

He's tied tariffs to policy because that's the only way he can raise them on his own as president. The blanket tariffs that he says that he wants can only be done by Congress. Without Congress his options are limited to moving a country off of 'most favored nation status' and/or citing security concerns over specific goods. Meanwhile he's been advertising his fondness for blanket tariffs since the 1980s. Not as a policy tool, but as an economic tool to make imports so damn expensive that they're cheaper to manufacture at home. That's because he and his defenders are protectionists and a mercantilists who rejects all economic thought since the 1700s.

No, you’re just a deranged drunk that doesn’t understand economics and is obsessed with your hatred of Trump.

Tariffs and deportations ARE Trump's economic package. Everything else is just payoffs for supporters.

The two Presidents to do the most to create sane tariff policies were Wilson and Franklin Roosevelt.

Trump has made raising tariffs a centerpiece of his economic agenda.

This is a misstatement.

No. This is a misstatement.

Joking aside, and realizing we could waste all day arguing what a "centerpiece" is, I'd say your critique is somewhere between wrong and a nitpick. The guy has literally said, "To me the most beautiful word in the dictionary is ‘tariff.'"

And he's literally Hitler too, right TDS-addled steaming pile of shit?

I know a lot of commenters must think Sevo's infantile, repetitive, pointless, boring insult posts indicates an obsessive person of diminished intelligence, but...uhhh...I forgot where I was going with that.

Not uncommon for TDS-addled shit-piles.

Your inability to post anything of substance proves that the anti Trump crowd is right.

His comments are still better than yours.

Yeah, gotta give him credit. He has his audience.

And you have yours……..

You don't need TDS to believe that any knee-jerk, impassioned defense of every one of Trump's poorly considered policies is infantile and cultish.

Trump hasn’t made tariffs his centerpiece. Reason has. I’m surprised Boehm didn’t write this crap. Does he have the sniffles? Or is this part of a ‘one-two tariff punch’. with Boehm’s ravings coming this afternoon.

the federal government's financial obligations could be met through internal revenue taxes levied on luxury items (particularly "tobacco and spirituous and malt liquors").

So a internal federal sales tax on the vices?

No thanks, tariffs are way better.

Need to lean into it: Fed-er-al. Not state alcohol tax or state prostitution tax or state tobacco tax or state ammunition tax or state licensing fee, Fed-er-al.

The fact that the author highlights "communism of pelf" and then plays "taxes on luxury items" off as though it's not more explicitly a scheme to redistribute wealth is flagrantly dishonest.

Ironically, the article below talks about taxes and regulations causing black markets.

JD Tucille is wrong about regulatory costs.

"the federal government's financial obligations could be met through internal revenue taxes levied on luxury items (particularly "tobacco and spirituous and malt liquors")."

NEXT: Cigarette Taxes and Regulations Continue To Fuel a Thriving Black Market

Cleveland, by contrast, devoted his career to warning that high tariffs bring a specific and dangerous type of communism to America—a communism of pelf.

"Pelf" is a term for money acquired in a dishonest or dishonorable way, and while it may seem anachronistic, it is the perfect word to capture Cleveland's ideas.

Sounds like a good word to describe the profits that politically connected companies are going to reap when Trump uses tariffs to raise the prices of their competition.

You’re an incredibly stupid creature. You have no concept of how economics works and should never speak.

Antiprotectionism has been the consensus among trained economists across the political spectrum for decades, Peter Navarro notwithstanding.

TARIFFS!

The American Way, or at least what used to be the American Way, is that no business was so sacred that the government needed to ensure that it saw no competition.

Tariffs are slap upon the American Way. Trump is out to make sure there is no competition with non-American manufacturers. And domestic manufacturers are ecstatic because they know it means they can raise prices because there will be no competition to keep them down. We've seen this every time tariffs have been levied.

The problem with US Steel was not that a Japanese firm was looking to acquire it, the problem with US Steel was that it spent half a century under a protectionist scheme for steel. It can't compete because it has never learned to compete because it never had to compete.

Is steel a "militarily strategic good" that needs to be protected? Maybe, maybe not. But Trump is not arguing on the basis of military strategy, but on the basis of a knee jerk protectionist reaction. If we need a guaranteed supply of steel, let's do a steel reserve instead. Bam. Done.

And this asshole is arguing as a TDS-addled steaming pile of shit.

The problem is that you’re not capable of understanding that it’s not prudent to allow certain industries to be owned by foreigners in the interest of national defense. Something you don’t value.

Read US history.

Tariffs were the main source of taxation up until income taxes.

And what a horrible trade that was.

Read economics.

Tariffs can be protectionist or for revenue, but not both.

For a tariff to raise revenue is must be low enough to not change consumer behavior. If it's too high then people will buy domestically produced goods instead of imports, and the tax won't be effective at bringing in revenue.

For a tariff to be protectionist is must be high enough to change consumer behavior. If it's too low then people will still buy the imports instead of the domestically produced goods, and the tax won't be effective at protecting domestic industry.

These things are mutually exclusive.

So anyone who tells you that they can do both, as in protect domestic industry without raising prices, or that the federal government was funded by protectionist tariffs, is either stupid or lying to you.

But Brandy’s argument is “that no business was so sacred that the government needed to ensure that it saw no competition.”, which seems silly when tariffs (both for revenue and protectionism) were used in the past as the primary funding mechanism AND as a driver for domestic production.

Wow dude. I just explained how tariffs cannot be used for both revenue and protectionism, and you then repeat the lie that they were historically used for both. Do you have any reasoning skills at all?

Allow me to clarify since I obviously did a poor job expressing my point.

The federal government in the past implemented both revenue generating AND protectionist tariffs (obviously not at the same time on the same import). The revenue generating ones were their primary funding mechanism. The protectionist ones were used as a driver for domestic production (or at least an attempt at such.) Thus Brandy is wrong in their assertion “that no business was so sacred that the government needed to ensure that it saw no competition.”

Is that clear enough, or do you want to condescend and insult me some more?

Let me guess, he copypastaed his usual bs.

He's not worth your time.

Fair enough. You say they weren’t the same tariffs, but still claim protectionism built the country. Everything I’ve read on the subject, including this article, says otherwise. Protectionism and mercantilism do not work, and that the country was not built on protectionism. Instead it lines up with what Brandy said. That protectionism breeds complacency by protecting companies from competition, and creates stagnation instead of economic growth. Meanwhile politically connected businesses laugh all the way to the bank.

Sorry, I wasn’t trying to say that the “protectionist” ones built the country, but it’s unequivocally true that the main source of revenue for the federal government was tariffs until the ratification of the 16th.

Hate to break it to you, but there really isn’t an appetite for Sarcsplaining here. Maybe your retarded ramblings would go over better at Salon.

By your own assertion ... "For a tariff to be protectionist is must be high enough to change consumer behavior."

0% Tax - Importers.

80% Tax - Domestic.

Seems the only 'protectionist' going-on is 'protectionist' of China/Foreign.

I find it amazing you can try to peddle such things upside down.

Funny how Tariffs was written in the original US Constitution and Income Tax came WAY later.

Learning what the US-Way was would be a big step.

Whether tariffs were Trump's #1 policy or his #3 policy hardly matters. The tariffs he's promising to implement are economically insane. (We already know that Trump doesn't understand international trade and evidently doesn't care to.)

TDS-addled shit piles ought to keep their worthless opinions to themselves until trump actually DOES something. Otherwise, they simply prove themselves to be lying piles of TDS-addled shit.

It seems as though you’re the one with TDS here. Critics of tariffs are giving reasonable explanations why they are bad and literally quoting Trump himself re what he plans to do with tariffs, but you’re lobbing cruel insults at them in response. This is what a deranged cult member does.

It won’t happen. Canada and Mexico need us a lot more than we need them. This is why Trudeau came to Trump in needed knee, begging.

Is _Reason_ enforcing its requirement that commenters pay for the privilege? It would warm my heart to think that all the non-libertarians who infest the comments were through their revealed preferences[1] demonstrating that they supported _Reason_ by giving _Reason_ money.

[1] https://en.wikipedia.org/wiki/Revealed_preference

Do you have a list of these ne’er-do-wells?

I see Pedo Jeffy as a morbidly obese, blue haired version of Snidely Whiplash.

Now tell us how "communist" DOMESTIC taxes are.........

And contrast it's rates with "?Trumps? Tariffs"

Seems a couple authors at Reason are entirely inflicted with TDS.

You know that tariffs are paid by American businesses that pass the costs to consumers, right? It's a domestic tax that has the added effect of being terrible for foreign relations. If you value competition, want to see lower prices, oppose burdensome taxation, and care about maintaining stable trade relationships, then you should reject pro-tariff, "rah-rah Amurka" protectionist propaganda.

It isn't a Tax at all at ZERO%.

Why should importers be tax exempt?

That's where the 'protectionist' narrative has water.

Protecting the importers and making domestic pick-up the national defense bill.

Why shouldn't the international market pick-up the bill for the international-affairs (fed) government?

Why are so many people coming to a libertarian website and defending tariffs? Is “owning the libs” so important that you need to get down with anti-free market ideas like tariffs just because someone liberals hate loves them more than he loves his own wife?

The Trump crowd hates free markets.

Probably has a lot to do with Reason Tariffs being 99% 'Trumps' and 1% 'Biden's' problem. Don't have to be a rocket scientist to see the party-shilling on that one.

Or maybe it has to do with the 0% Foreign-Import to 80% Domestic-Tax OBVIOUS unfairness.

Only when both of those aren't the factor does your comment speak anything at-all about being Libertarian on the subject. Unless you think being Libertarian is all about being a TDS addled POS or picking Foreign markets over Domestic.

Maybe you're right. The Libertarian party has been reduced to Foreign FIRST. That would definitely be inline with Reasons immigration propaganda as well. I guess old Libertarians got left behind on the New Libertarian Crusade ... "The *special* foreign people/markets RULE!"