How Much Will Taxpayers Pay for Virginia's $2 Billion Arena Plan?

How much public money will be used remains unclear. The consensus answer seems to be "a lot."

When the Virginia state legislature opens its new session later today, one of the biggest questions facing lawmakers will be whether to dump a huge pile of taxpayers' money into a new sports arena.

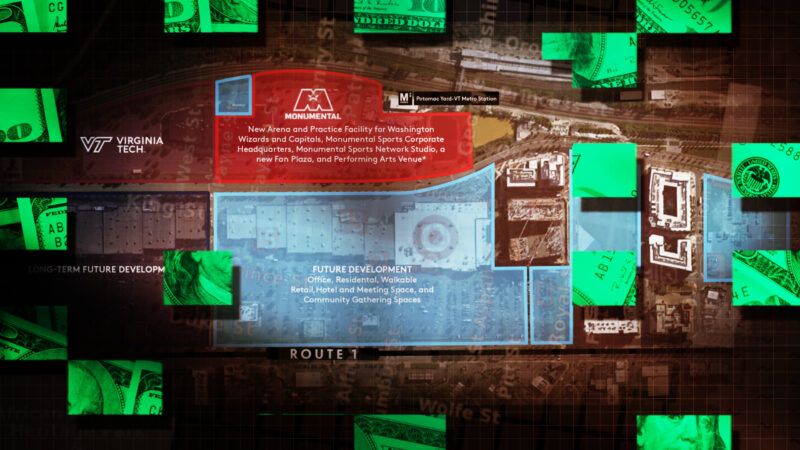

The proposed new home for the National Basketball Association's (NBA) Washington Wizards and the National Hockey League's (NHL) Washington Capitals would be the centerpiece of a $2 billion redevelopment in Alexandria, Virginia. Republican Gov. Glenn Youngkin announced the project in December, but the state legislature's approval is necessary to create the quasi-public stadium authority which will issue bonds to pay for the project and own the land upon which the stadium would sit, according to the Associated Press.

How much public money will be used to fund the project remains somewhat uncertain—and will depend on whatever changes the state legislature might demand. The consensus answer, however, seems to be "a lot."

Citing a leaked JP Morgan study of the subsidy deal, The Washington Post reported last month that "the net cost to taxpayers would ultimately reach an estimated $1.35 billion." More recently, the Alexandria Economic Development Partnership, the entity that would own and operate the arena, published documents showing that taxpayers would put up about $560 million.

Notably, that total does not include several other costs that will be covered by the public, like the expected expansion of a nearby public transit station that comes with an estimated price tag of at least $150 million and about $380 million in property tax breaks. However you slice it, it looks like taxpayers will be on the hook for around $1 billion, writes Field of Schemes blogger and stadium subsidy critic Neil deMause.

Perhaps understandably due to the enormous numbers floating around, public officials have been eager to downplay or explain away how much it will cost. Youngkin's spokesperson told the AP this week that the bonds for the new arena will be "prudently structured and conservatively sized."

"Officials have not, however, publicly released the outside analysis that arrived at that conclusion," the AP noted skeptically. Apparently, this is a deal so good that it has to be kept secret!

Meanwhile, Alexandria Mayor Justin Wilson, a Democrat, tried to reassure city residents last week that at least they won't be left holding most of the bag. In a community newsletter, Wilson wrote that just 5 percent of the project's funding was due to come from Alexandria, and argued that the bonds used for the project would be repaid by tax revenue generated from economic activity at the site. As a result, Wilson argues, "there is no City or Commonwealth tax dollars being invested in the arena."

That's a stretch, says Kennesaw State economist J.C. Bradbury, who has written extensively about stadium subsidy deals.

"To suggest that state and local governments are going to devote $1 billion of public money to construct stadium development at no cost to taxpayers is preposterous," Bradbury told Reason. "These funds can't just be plucked out of thin air, they obviously come from taxpayers whose tax collections at the development will now be devoted to subsidizing the private business operations of billionaire [Wizards and Capitals owner] Ted Leonsis rather than providing other government services."

Indeed, if the development was going to generate enough revenue to support itself, why would the government have to be involved at all? There are plenty of private sector financial institutions that would be happy to lend money to a development project that's supposedly going to generate billions in revenue over the long term, as studies cited by stadium proponents claim.

In reality, stadium financing deals almost never live up to their backers' promises. Bradbury's research shows that stadiums do not drive economic development but merely shift where those dollars are spent.

The specific funding mechanism being used in this case should also draw scrutiny from state lawmakers. The so-called "tax incremental financing" (TIF) arrangement—in which future tax revenue is used to cover the up-front public cost of the project—is an increasingly popular way for cities and states to pay for stadium projects. The setup is supposed to protect taxpayers from footing the bill directly, but if tax revenue is insufficient to cover the debt service payments on the bonds, cities usually end up having to pay the cost out of their general fund budgets.

"The funding mechanism creates the fiscal illusion that the project is costless to taxpayers," says Bradbury. "It's not. Never forget the old economists' adage regarding opportunity cost: there is no such thing as a free lunch."

City officials seem determined to test that theory. While local residents are organizing grassroots efforts to stop the project, Alexandria has reportedly hired lobbyists to help convince state lawmakers to vote for the subsidy deal. That's probably not a great sign for anyone who hopes the various governments involved here will take a serious, skeptical look at the project.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Will Democratic Party staffers be able to film themselves receiving stimulus packages from other members there?

I'm making over $7k a month working component time. I saved hearing other people inform me how lots cash they could make online so I decided to look at it. Well, it turned into all proper and has definitely modified my life. Get this today by follow instructions====>>> http://Www.Smartcareer1.com

Americans do lurv "socialism" when it comes to sports arenas.

I wonder whether any major publicly-subsidised arena has ever turned out to be at least break-even for taxpayers.

How Much Will Taxpayers Pay for Virginia’s $2 Billion Arena Plan?

Citing a leaked JP Morgan study of the subsidy deal, The Washington Post reported last month that “the net cost to taxpayers would ultimately reach an estimated $1.35 billion.” More recently, the Alexandria Economic Development Partnership, the entity that would own and operate the arena, published documents showing that taxpayers would put up about $560 million.

I’m going to guess $3 billion.

Hell, make it $4 billion. And a few bus-loads of children.

Well, silver lining; at least now one won't have to enter that lovely poop-hole destination which is DC to watch games live.

For any given government project:

How much will it cost? More.

How long will it take? Longer than that.

You know who else spent a lot of public money in Alexandria?

I just read some impossible news. Mexico is building a 100 mph tourist train (the Tren Maya) covering 950 miles for a mere 28 billion USD (up from early estimates of 8 billion of course), and the first 290-mile stretch opened up just 5 years after the project started.

But this isn’t possible, since high tech California’s medium speed bullet train (800 miles, 220 mph, but really 110 mph where you want to go) was approved by voters 15 years ago and still has no operating track, with the first 170 mile segment from the middle of nowhere to the end of nowhere not scheduled to open for another 6 years at least, and the system could cost 128 billion dollars.

Eric,

Let me ask a question. Say I own a chunk of the Wizards and the Capitals. I decide that I want to build a new stadium. Do you really think that the politicians are going to let me do it?

Hell no. Read your own article. The "stadium authority" will own the land and the facility. I've always wondered how governments can give property tax breaks on property that is owned by the Government?

By the way, the reason that these things never seem to pay for themselves is usually due to the Governments that own them (usually Democrat) keep refinancing them so that they can do other get elected things with the money that's supposed to pay for them.

SoFi Stadium in LA was privately financed by Stan Kroenke for 5 billion dollars. It is the home stadium for 2 NFL teams (well, one NFL team plus the Chargers) and hosts numerous concerts and other events.

$2 Billion? You bunch of pikers...

Jackson County, MO is looking at paying $5 - 6 Billion (at least) over a 40 year period to keep the Royals and the Chiefs. That's almost $7,000 for every person living in the entire county.

That amount of money would fund a huge mass-transit system for the county. Or IF someone were REALLY concerned about housing the homeless, that amount would buy 20,000 homes @ $250,000 each. But you know... priorities.

Mass transit? Why not just give the poorest third of the residents a new car (21K will get you a new Nissan Sentra or Hyundai Elantra). Then they won't need to take mass transit.

Nobody mentions the hidden opportunity costs. A few years ago when a master plan for the land was announced that section was supposed to be a mix of office/retail and residential, all without government investment. That development would generate substantial tax revenue, which has been left out of the discussions.

I had the opportunity to use Optima Tax Relief for my tax needs, and I must say, the experience was exceptional. From the moment I contacted them, their team of professionals displayed a remarkable level of expertise and professionalism. They were prompt in addressing my concerns and provided clear and concise explanations of the tax relief options available to me, read more reviews on https://optima-tax-relief.pissedconsumer.com/review.html . The level of personalized attention I received was truly impressive. The staff at Optima Tax Relief took the time to understand my unique situation and tailored their services accordingly. They guided me through the entire process, ensuring that I was well-informed and comfortable every step of the way. The efficiency and effectiveness of their services were unparalleled. Optima Tax Relief's team worked diligently to resolve my tax issues, and their expertise in navigating the complex tax landscape was evident. They were able to negotiate with the IRS on my behalf, resulting in a favorable outcome that exceeded my expectations.