Americans Are Still Fleeing High-Tax States

Lower taxes create opportunities that draw even those not consciously considering tax rates.

I've never moved for tax reasons, but I have refused to consider some destinations (and turned down jobs) because I didn't want to pay ruinous local rates or live under the intrusive laws that seem to go hand-in-hand with grabby tax regimes. Unsurprisingly, I'm not the only one who takes the sticky fingers of government into consideration when deciding where to live and work; crunching data from government and private sources, the Tax Foundation says that taxes play a significant role in where people choose to live.

You are reading The Rattler from J.D. Tuccille and Reason. Get more of J.D.'s commentary on government overreach and threats to everyday liberty.

Americans On the Move

"Every year, millions of Americans pack up and move from one state to another, providing unique insights into what people value when deciding where to live, work, and raise a family," Andrey Yushkov and Katherine Loughead, senior policy analysts for the Tax Foundation, wrote last week. "The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state's economic growth and governmental coffers."

This may seem like a "duh" moment for many readers. All things being equal, who doesn't prefer to live in places where politicians are less prone than the competition to pick pockets and smother progress? And for normal people, the idea that high taxes are a turn-off is common sense.

But we're not talking about normal people; we're talking about government officials who use their long-suffering subjects like milking cows and prefer to do so without consequences. There's even a cottage industry of pundits—like Stanford sociologist Cristobal Young, author of The Myth of Millionaire Tax Flight—who tell politicians what they want to hear.

That politicians aren't as fooled as they pretend is obvious from the efforts of high-tax jurisdictions to penalize those who flee. In 2018, Illinois legislators passed a law to claw back tax breaks from "any recipient business that chooses to move all or part of its business operations and the jobs created by its business out-of-State."

"What we really could do is erect a border fence and then have gates where we tax people that left the state just because they didn't decide to stay here and do business," Rep. Jeanne Ives, a Republican who opposed the legislation, joked at the time. "I mean this bill is ridiculous."

Other grabby states challenge people's claims that they've moved, making them prove the change of residence. "If you're thinking of moving from your high-tax locale, chances are your state's income tax auditor won't let you leave without a fight," CNBC noted in 2019.

That's because people do consider taxes when they decide where to live and do business. They also consider the economic environment that taxes help to create in a jurisdiction.

Low Taxes Draw Innovators

"Our study shows that higher taxes negatively affect inventive activity and that inventors are geographically mobile in response to changes in tax incentives. As such, tax policy can exert a powerful effect on both the level and location of innovation," Ufuk Akcigit (University of Chicago), John Grigsby (Northwestern University), Tom Nicholas (Harvard Business School), and Stefanie Stantcheva (Harvard University) wrote last year in Microeconomic Insights of a study of inventors' response to tax rates that covered almost a century worth of data.

"Because the impact of taxes on innovation happens over time rather than all at once, our results suggest taxes can influence cumulative technological progress, which is a central feature of economic growth," they added.

Innovators have a documented history of establishing themselves and their businesses in low-tax environments. In doing so, they create thriving economies and opportunities that may well draw other people. That creates patterns that can be analyzed by the likes of Yushkov and Loughead of the Tax Foundation. They compared Census and IRS migration data to information derived from private sources such as U-Haul and United Van Lines which provide the trucks in which household goods are transported from state to state.

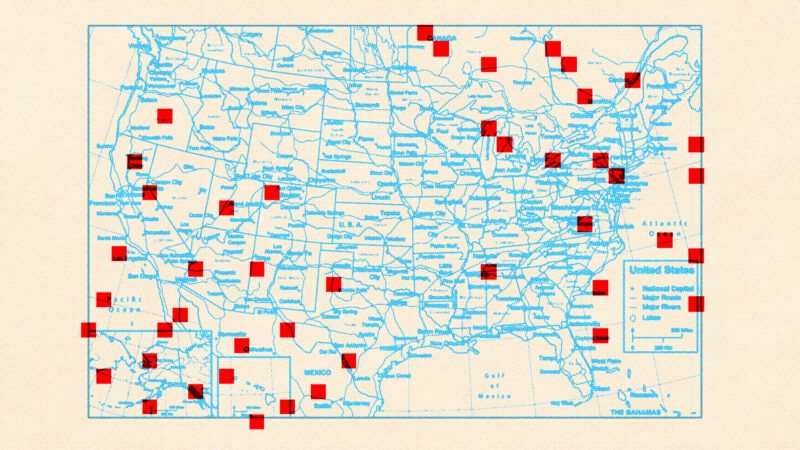

"The IRS data show that between 2020 and 2021, 26 states experienced a net gain in income tax filers from interstate migration—led by Florida (+128,228), Texas (+82,842), North Carolina (+40,828), Arizona (+32,636), and Tennessee (+30,292)—while 24 states and the District of Columbia experienced a net loss—led by California (-158,220), New York (-142,109), Illinois (-53,910), Massachusetts (-25,029), and Louisiana (-14,113)," write Yushkov and Loughead.

"Consistent with last year's version of this publication, it is clear from the 2020-2021 IRS migration data that there is a strong positive relationship between state tax competitiveness and net migration," they add. "Overall, states with lower taxes and sound tax structures experienced stronger inbound migration than states with higher taxes and more burdensome tax structures."

Four of the top 10 destination states don't tax wages or salaries at all. "Eight of the top 10 states either forgo individual income taxes on wage and salary income, have a flat income tax, or are moving to a flat income tax."

This doesn't mean that tax rates are the be-all and end-all when it comes to people's decision-making process as to what makes a desirable place to live and work. But it does mean that taxes are an important factor for many people no matter how inconvenient that fact may be for politicians and pro-tax pundits.

Low Taxes Generate Opportunity, Which Draws People

Importantly, even if many people aren't themselves perusing tax tables and considering the aggressiveness of state revenue agencies in their considerations, taxes definitely play a major role for innovators when they decide where to set up shop, as the Microeconomic Insights paper demonstrates. Those innovators establish companies and create jobs and prosperity that certainly do figure prominently in people's considerations when they're contemplating the next move.

"Sometimes taxpayers choose to move to a lower-tax state at least in part to reduce their own tax burden," comment Yushkov and Loughead. "But even those who do not consciously select for lower taxes may be doing so indirectly when they prioritize job opportunities and other factors related to the state's economic competitiveness."

The effects are cumulative over time, as creative, hard-working people, and the businesses they build, move from high-tax environments to low-tax jurisdictions. Grabby tax environments can pretty soon find themselves running out of cows to milk, and out of taxpayers to mug.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

And then they advicate higher taxes in the cities they move to. Locusts.

They identify as dreamers.

I Am Earning $81,100 so Far this year working 0nline and I am a full time college student and just working for 3 to 4 hours a day I’ve made such great m0ney.I am Genuinely thankful to and my administrator, It’s’ really user friendly and I’m just so happY that I found out about thisI worked Here ══════►►► http://Www.Smartcareer1.com

I don’t think that’s necessarily true.

From what I’ve seen they move away because of taxes, and then demand more government services at their new location. When their taxes go up to pay for all of their demands they get all confused. They thought those things were going to be paid for by everyone else, not themselves. So they move and the process repeats.

“Government is the great fiction where everyone endeavors to live at the expense of everyone else.”

– Bastiat

Don't tax you,

Don't tax me,

Tax the fella

Behind the tree!

Americans want more services than we are willing to pay for. And we want the businesses we work for to get corporate welfare at the expense of everyone else.

What you mean “we” white man?

Most people, no matter where they live, want something for nothing. Doesn't matter where, just some folks live in places where Peter can be robbed to pay Paul and have governments that promise that something for nothing.

Aborigines in the Australian outback might want something for nothing, but the lifestyle they lead doesn't allow for that to be fulfilled.

They should be culled.

This editor gives too much credibility to living in a low tax environment. I have lived in more places than most.

1. Low or No tax places justify a lower cost of living, thus a lower justified wage payment. This typically means job with low mobility and higher paying companies may seek diversity from a large city.

2. Oppositely, a higher tax city typically has a higher cost of living, along with higher wages making those people less entitled to government welfare programs.

I say blame the companies that get incentives for tax credits for "creating jobs". Cities both large and small promote job creation through giving companies incentives. This means the more established organizations are more likely to benefit. That is the long time land owners, the established industry, and conglomerates with deep pockets. If you're not the head of one of these companies then voting conservative does a disservice to your very existence and basically leaves you where you started. Disputing property.

These tax structures don't necessarily reflect on a person's choice for a job. More over it's the lovable wage of the job that determines if they should take it.

1. Just how is this an issue?

2. Higher cost of living = tougher conditions.

Companies shouldn't get blamed for wanting lower taxes. The incentives are there to mitigate any tax burdens that shouldn't have existed in the first place. Put the blame on government where they tried to put bandages on a problem they created to begin with.

Grabby tax environments can pretty soon find themselves running out of cows to milk, and out of taxpayers to mug.

"Luckily, a sucker is born every minute"

- NYC

What about all those industrious immigrants and nascent food trucks?

That’s where the real money is at.

Elon Musk is an immigrant.

Same with one of the Google founders.

An immigrant. Not an illegal. A world of difference between the two.

Elon is one of the greatest African Americans.

Best post of the day!

You mean people who dodge taxes and fees by not getting licenses and hanging out in neighborhoods a cop wouldn't dare enter?

According to Pew/CDC, there is also a clump of cells aborted every minute.

Since very living democrat is a clump of cells I should be within my rights to abort them at will. It’s my choice, right?

Only if they are leaching off you. Like welfare recipients. Then it's an abortion and not just legal but your constitutional right in some states.

NYC was the fastest growing city in the US in the 2010s and we would grow even faster were it not for the local NIMBYs who obstruct residential real estate development.

Then they elected De Blasio and shot all that to hell.

NYC is a massive shithole again. Thanks exclusively to democrats.

They obviously want to live in shit, I say, let them.

When I started making real money, I was not yet paying too much attention to local taxes. I lucked into career locations (TX, AK) without state income taxes, though I did get schooled about property taxes in TX.

When I retired, I moved to CO, which was still purple, and where my county was flush with tax revenue from oil and gas production. Now the Democratic fucktards that own the state government keep trying everything they can to raise state income tax rates, and with the decline of oil production, the county has begun sniffing around for other revenue sources.

For the first time, I am considering a move driven largely by tax issues (plus general political nonsense).

You are spot on about Texas property taxes. The property taxes definitely benefit businesses with huge swaths of property, and the smaller residential land owner ends up paying to make up the difference. I owned a 15 acre farm from 2008-2021. I was approved for an agricultural exemption, but my taxes within ten years exceeded the taxes before the ag exemption.

This is to be expected. Republican America. In NYC, homeowners pay a much lower tax rate than that levied on commercial property.

Hey, how can you expect to have a Walmart SuperCenter every 10 miles, unless you give outrageous tax breaks to the corporations.

Uh huh. Amd massive taxes in everything else.

You are such a dishonest shitweasel. Now fuck off, m’kay Shreek?

Considering the average New Yorker lives in a postage stamp sized apartment that in the civilized world we call a walk in closet it's no wonder their property tax bill is low.

Mine would be low too if I didn't have a nice sized house on a large enough chunk of property to do serious gardening.

Even then I'm happy to pay property taxes to my city, county and state since I get good roads, good road maintenance and actually functional public services like fire and police without all the excess baggage of Drag Queen story hour at the local library and free abortions at the hospital. Also no state income tax to penalize me for success.

But you'd hate it here in South Dakota.

Income taxes can be avoided by "misreporting" - Everyone who lives somewhere pays real estate taxes - they are very hard to avoid. Not a bad way to do it

I prefer property taxes to all other forms of taxation. It's nice and simple. It costs X to run the city, county and state services.

We have Y acres of property in agricultural use and Z acres in urban use. Divide X over Y and Z and get what everyone pays depending on what kind and size of property they have. I own farmland and a home. I pay my property taxes without much complaint because I get services that are worth the amount I pay and little else. Good roads that are kept clear of snow and ice. Parks that are kept clean and look nice. Responsive police and firemen who do their jobs and aren't power tripping assholes.

No, we all should be thrilled to pay taxes, that's how we get all that great stuff from the gov't...

NYC has an expensive and controversial shelter system. As a result, we don't have a lot of homeless people sleeping on the streets and in the subways compared to other US cities.

I happen to have visited a city in Florida last week for work. It is a city with a homicide rate more than double that of NYC, but what was really striking and intimnidating is that the downtown area is full of aggressive mentally ill homeless people, who not only panhandle for money but refuse to take no for an answer and try to engage passersby with rants, often bigoted. Oh and I didn't see a police officer at all in the two days I was there. DeSantis's America.

Homeless people go to warmer places. Even the most deranged bum would rather be in Miami than the streets of NYC in January

Anyone who isn't deranged would rather be in Miami than New York no matter the season.

Are you shitting me? NYC is overrun with illegals right now thanks to your senile master Biden. And now he’s going after your mayor for pushing back against he onslaught.

Your party is a total failure, and you’re a fucking retarded child rapist Shreek.

The ACLU takes on any city that tries to seriously deal with the supposedly homeless people. The more wealthy the tourists the more beggers come out. From what many investigative journalists have discovered many of the beggers have homes, cars and other property. They make a lot of tax free money begging and the ACLU will defend their supposed right to do so.

Beggers in NYC are likely afraid to collect cash from passerby because they know they will be targets of muggers. I guess the real crime rate has some benefits.

Wealthy people and corporations might flee high tax States, but Joe Sixpack goes where the jobs are.

The reason San Francisco is such a mess (except for violent crime, which remains low) is that there were more jobs than there was housing to house the people holding the jobs. That is actually a direct result of stupid NIMBY policies. Gavin Newsom has run roughshod over the NIMBYs by ending single family zoning, but folks here still trash him. This reform is already helping.

Everything a democrat touches turns to shit.

Thumbs up

A few people leave New York City for Florida or Texas and discover that their property tax rates are 3x what they paid here and they get way fewer services. We don't even have a property tax on cars at all. No wonder NYC was the fastest growing city in the US in the 2010s.

Turns out a lot of people are fine skipping those extra services - such as fleeing the school system, despite one of the highest per student spending on education, hiring private security because your police are no longer effective, etc.

Also notice how you set the goal posts - ending before the FJB crash and Bidenflation. Yes, NYC being the biggest, or second biggest, city in the country had the highest population growth IN ABSOLUTE NUMBERS, but paltry growth in terms of percentages, regaining some of the population it lost in previous decades. And what about the 2020s so far? And how about in regards to income tax base? The illegals being bussed there don’t pay taxes. But the billionaires fleeing the city do, or at least did.

All five boroughs of NYC have increased in population in the 1980s, the 1990s, the 2000s, and the 2010s. The total increase has been roughly the same as the entire population of Dallas or San Diego. With no increased land area. (Dallas and San Diego have annexed like crazy. Phoenix and Houston, too. This overstates their population increases.)

How can the City of Dallas annex like crazy when it is completely surrounded by other cities. The land area of the City of Dallas was 340.52 square miles in 2010, and the land area was 339.58 square miles in 2020. That's a loss of 0.94 square miles over the decade. The City of Dallas is just a small part, about 16%, of the population of the Dallas metropolitan area (source: US Census).

Yes, because the welfare suckers are breeding like the cockroaches.

You use carefully skimmed statistics and ignore a lot of reality to try and sell your wretched hive of scum and villainy. Why is it New York State is trying all sorts of innovative new taxing schemes to keep people from having a business in the state while living in another state if the working population is booming and so happy like you claim?

Not sure what those services are. The government will not protect your business or your property. It will not provide a basic education for your kids. They cannot maintain the infrastructure. They cannot even keep the public way free of human excrement. In fact most large cities have completely abandoned the basic social contract, we'll pay taxes in return for a civilized society. Most middle class taxpayers get jack shit for their money.

Everything the Shrike sock says is lies and democrat propaganda.

Property Tax Rates (from the official NYC web page)

Your property tax rate is based on your tax class. There are four tax classes. The tax rates are listed below. Learn how to Calculate Your Annual Property Tax.

Property Tax Rates for Tax Year 2024

Class 1 - 20.085%

Class 2 - 12.502%

Class 3 - 12.094%

Class 4 - 10.592%

https://www.nyc.gov/site/finance/taxes/property-tax-rates.page

From the Google search results:

The property tax rate in Miami is 20.6152 per thousand of the home's fair market value, making the property tax rate 2.06%.

(the official Miami page returns a PDF not worth copying)

Wow. Facts. I like that. So much better than bullshit and insults. Thank you.

Want lower property taxes? Buy smaller homes on smaller lots. Pretty simple actually. Want to avoid taxes in NYC? Give up. No matter what you do you will get taxed and get crap for your money.

I've lived in MI CA and IL. Moved here because houses are much cheaper. What I didn't think through is the effect of the ridiculously high property taxes on the value of the property and my ability to keep it after paying off the mortgage and retiring. Most people are looking at their comfort level with the monthly payment when they buy a house. But in Illinois the percentage of the payment going to taxes is much higher than in a low tax state. For the same money you can buy a more expensive house elsewhere and benefit from more appreciation as time goes by. It may not be a better house and there may be a tradeoff in the form of other taxes, but when your income drops in retirement you'll be far better off. If I knew then what I know now...

An example: For physicians, it is well known to avoid Illinois if at all possible. Taxes are high, malpractice costs are high, wages mediocre. No reason for a top grad to go there.

Or Idaho.

https://www.nytimes.com/2023/09/06/us/politics/abortion-obstetricians-maternity-care.html

Uh huh. NYT leftist propaganda.

Just don’t murder babies.

I see NYT in the address and I realize everything after it is propaganda. They've been caught making shit up more often than Hollywood.

The problem with three-year-old IRS data is that it isn't catching the wave of migration that's beginning out of anti-woman/anti-minority/anti-LGBTQ/anti-freedom red states. So far this year I've helped three families pack up and leave this backward Southern state.

Low taxes are wonderful, but when your neighbors and legislators hold you in low to no regard, pass laws against obtaining legal medical procedures (sometimes even trying to ban leaving the state to get treatment!), ban forms of entertainment, etc., it might be worth a few extra dollars to live in a state where your elected representatives don't think you're Satanic and must be destroyed.

It’s so oppressive when you can’t murder babies, or sexualize children.

Seriously, just stop with your bullshit. You have no place here. Except as an object of ridicule and derision.

Your second paragraph fits you exactly. You're no libertarian. Why don't you go back to Gateway Pundit.

Nothing more libertarian than murdering people is there?

I'm a non believer in regards to religion, an anarchist in regards to government and a felon in regards to having sold weed 20 plus years ago. I live in the redest of the red states. South Dakota. We are so red we ignored COVID.

I never feel like I am extra oppressed by the red voters around me. They don't care that I don't share their gods or their politics. They don't care that I was busted for selling weed in another state. I get more crap from the minority of Democrats who apparently stick around looking to get oppressed by someone.

I suspect you just don't feel good unless you think someone is oppressing you. Maybe you have a masochistic streak and just need the services of Mistress Tatiana to fulfill your need to be whipped and tortured.

“As a dog returneth to his vomit, so a fool returneth to his folly.” - Proverbs 26:11

Regardless of your beliefs, I think we can agree together that this describes Anastasia to a T.

“…anti-woman/anti minority/anti- LBGTQ….”

Lol. Where is mike, our resident “victimhood narrative” identifier?

Everything Is So Terrible And Unfair, Ana.

Haha.

Politicians in high tax states don't want innovators. They want compliant drones, government dependence, and widespread poverty. And they are achieving that.

The democrats have to go. Or we will not survive as anything resembling a constitutional republic.

The Democrats represent about half the country, because half the country has become government dependent. You can't fix that by eliminating a political party, you can only fix it by radically transforming society, the education system, and the economy, back to what it used to be.

Unfortunately, both libertarians and conservatives have been utterly incompetent at changing society or changing minds. To the contrary, libertarians pay lip service to about half the b.s. progressives are pushing.

You're not wrong.

I don't think government is the path to fixing the nation. Look what happened to Trump. Love him or hate him he has had the most legal action taken agai st him of any former president. Even Nixon was left alone after he got out of office. Washington DC won't change unless it is nuked. Even then the rot will just move up.or down the coast and a new swamp will be created.

Any change has to happen at home and in neighborhoods to make government irrelevant.

Subsidies also play a significant role in where people choose to live. A central fact of US political economy is that public support for seniors (Social Security and Medicare) follows them as they move, while public support for younger people (education, primarily) is drawn from states and localities. Not every state can be a Florida. It’s simply impossible.

Another central characteristic of US political economy is that you can produce in low-tax states and sell to high-tax states; states don’t control the conditions of commerce.

Finally, notice how Republican attorneys general have sued to prevent the National Flood Insurance Program from setting rates that more adequately address the level of risk. In this and other respects, low-tax states often do not bear their full share of costs.

Florida ranks #1 in higher education and #14 in K-12.

California ranks #3 in higher education and #38 in K-12.

Looks to me Florida is better both for seniors and for young people.

https://www.usnews.com/news/best-states/rankings/education

NO!!

Florida is terrible! Stay away!

Ron DeSantis is governor; it's awful here.

We refuse to lock down.

We don't force kids to get 'the jab'.

We officially state men can't be women.

Seriously, stay in NYC.

Florida is full now.

Well, if you don’t want a high earning small government potential DeSantis voter in Florida, that’s fine with me. I wouldn’t be caught dead in Florida anyway.

I live in one of the other liberty-minded low tax states. No, I won't tell you which one.

Do you want a bunch of California and New York liberals flooding to your state? I tell people we don't even have hospitals in South Dakota. I tell them the internet is still dial up and it takes hours to download porn.

Do you want a bunch of California and New York liberals flooding to your state?

They won't. They are scared to death even of their own inland areas, they will certainly not move to a red state.

This must surely explain why people are flocking to New Hampshire, Delaware, and Alaska, which are the 3 states with the very lowest tax burdens in the country. And also why people are fleeing Texas for Pennsylvania's lower tax burden. Source: https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494

*ahem*

https://en.wikipedia.org/wiki/California_exodus

Not the only place where it's happening either. Many Democrat-run cities are getting the same issue.

I just want everyone to know that here in South Dakota we don't have hospitals or internet. We are a backwards place without theaters or concert halls. If you are thinking of moving here, don't. You will hate it. You will be SOOOOO miserable.

Except for 10 days in August - - - - - - - - - -

Those ten days drive the leftists out of our area effectively.

"like Stanford sociologist Cristobal Young, author of The Myth of Millionaire Tax Flight—who tell politicians what they want to hear."

Gotta love how the link for that book is to Amazon, whose founder just moved to Florida for tax reasons (even if he lied and said it was for family reasons).

Facts are inconvenient things, eh? Author says it was for family reasons, but that doesn't fit in your worldview so automatically the author is lying.

People like you make it so easy to know who to place on Mute.

OK, you keep believing that it was just to be closer to his parents. Oh, and why are his parents in Florida anyway? They moved there first, also for tax reasons.

The fact that the author thought he had to explain his reasons is rather suspicious.

We here in California, under our current Governor NEWSCUM are being taxed to death (highest in the nation), suffering from more and more Woke Legislation and now PG&E. our local power company responsible for buring down whole communites because NEWSCUM WOULD Not LET THEM CLEAR TREES, PG&E has been granted a $36.00 rate hike. (code for tax) Might not seem like alot, but when they are the HIGHEST rate gas/elec company in the FRIGGIN UNITED STATES, it hits hard.

Everything people talk about Kalifornia I think of the Dead Kennedys. Their song about Governor Jerry Brown could be remade today about Gavin Newsom. The rhymes might be a little off. Also Holiday in Cambodia makes me think of Kalifornia as well.

“There’s a forest fire climbin’ the hills Burnin’ wealthy California homes Better run, run, run, run From the fire”.

“But some of us stay to watch And think of your insurance costs And we laugh, laugh, laugh, laugh At your lives.”

Vintage DK Cali.

Taxes are a topic that worries both the poor and the rich in one way or another. However, the rich simply have more to lose, so I am not surprised by this migration. The same applies to obtaining passports from other countries. I have an average income, I have a part-time job (read Melbet official website review). But I find myself thinking from time to time that I shouldn’t show some small income on my return. It's just ordinary life.

very informative!

I think this article suffers from two major fallacies...

First is "confirmation bias fallacy". Us folks that follow Reason are typically libertarian in our approach. So we are, for the most part, against most (or even all) forms of Taxation. When there is an issue, it is one of the easiest for us to attack because we disagree with them.

The second and most importantly is "correlation causation fallacy". The years in question are the heavy migration from large cities to less congested areas during the Covid panic. I am a Florida Home Inspector and I was swamped with work from 20-22. The vast majority of my clients cited the reason for a move was to get away from draconian Covid response or to get out of congested Covid breeding grounds.

Occasionally, I get the "Taxes" response to my "what brings you to Central Florida?" question. But those are fairly rare.

I am sure Taxes came into the thought process when those folks were fleeing NYC, but the move was much more complex than just one item.

Right now, the real estate market across the state has slowed to a trickle. If the "Tax Evacuation" was the primary driving force, the migration would still be in full swing.