California Regulations Prevent Insurers From Accurately Pricing Wildfire Risk, so Now They're Fleeing the State

California homeowners are finding out that government-imposed market distortions cannot be maintained forever.

Like a good neighbor, State Farm Insurance is warning Californians to stop living and building in high wildfire-risk zones. That is the upshot of a press release in which the insurer states that the company, as a "provider of homeowners insurance in California, will cease accepting new applications including all business and personal lines property and casualty insurance, effective May 27, 2023." State Farm is taking this step largely because the California Department of Insurance's system of price controls does not allow it and other insurance companies to charge premiums commensurate with the potential losses they face.

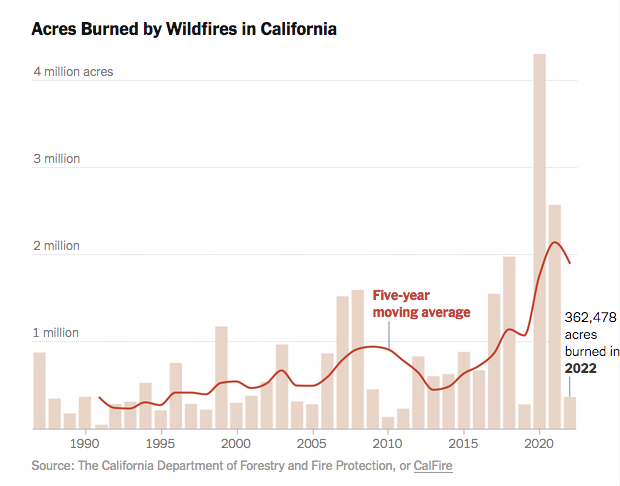

Consequently, State Farm is no longer willing to sell new homeowner insurance policies because the company calculates that it cannot cover potential losses in the face of increasing wildfire risks, fast-rising rebuilding costs, and steep increases in reinsurance rates. Higher rebuilding costs boost the values of the houses and businesses that companies currently insure.

Reinsurance is also a big factor in State Farm's decision. As part of its system of insurance price controls, the California Department of Insurance does not allow insurance companies to include reinsurance costs in their premiums. Reinsurance is basically "insurance of insurance companies" in which multiple insurance companies share risk by purchasing insurance policies from other insurers to limit their own total loss in case of disaster. And disaster did hit in the Golden State. The insurance companies paid out $13.2 billion and $11.4 billion respectively in 2017 and 2018 for fire damage claims resulting from those two catastrophic wildfire seasons. More recently, reinsurers have increased their rates to take into account large losses stemming from events like Hurricane Ian in Florida and Russia's invasion of Ukraine.

So, State Farm is declining to write new insurance policies in California "now to improve the company's financial strength."

One additional complication is that private insurance companies are forced to contribute to the state's backstop Fair Access to Insurance Requirements (FAIR) plan. The FAIR plan is basically a high-risk insurance pool that offers last-resort, bare-bones coverage, chiefly for fire losses, to property owners who cannot obtain a policy in the regular market. It was established in 1968, in the wake of urban riots and brush fires, when the California Legislature required insurance companies offering property policies in the state to create and contribute to the plan. It is not taxpayer-financed, and plan premiums are statutorily required to be actuarially sound.

As private insurers increasingly refuse to renew policies, more California homeowners are turning to FAIR plan policies. FAIR plan premiums have been too low to cover the losses its customers have incurred with the result that the plan is $332 million in debt. In other words, the plan is not actuarially sound. This means that the California Department of Insurance is likely to impose a special assessment on private insurers to make up for the FAIR plan's losses. Private insurers cannot pass along the costs of the assessment to their policyholders. As California's largest property insurer, State Farm would be on the hook for the largest share of any such special assessment. The way to lower or eliminate the amount that a private insurer could be assessed is to limit the number of policies it sells or simply leave the market altogether.

Insurance premiums, like all prices, are signals to consumers. In this case, higher premiums indicate the existence of increased risks. Because of the California Department of Insurance's price controls, homeowners have been deprived of market signals that could have steered them to building in less dangerous locales or encouraged them to build more fire-resistant homes. As California homeowners are about to find out, government-imposed market distortions cannot be maintained forever.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

I wonder, in California, what percentage of homeowners are the ones who actually decided to develop their home site?

As opposed to people who bought a new home in a development by a developer, or a previously lived-in residence, which are both already sited.

I wonder if there's anything California does that isn't completely pants-on-head retarded.

retarded where it's not pants on head retarded you can safely bet they are much worse than that.

California appears to have finally "cracked the code", and have determined that they have the power to force vendors to sell below their costs if they sell within the state. They even provided that "after the fact" assessments can be layered on a company, even if it's not making a profit.

What they haven't figured out so far is how to prevent insurers from exiting their market, de facto by refusing to issue new policies or if necessary, in toto by leaving the state completely and neither selling nor renewing policies. The sheer size of the California market makes it a difficult decision for any vendor to depart the market, unless "law" requires them, if they operate, to operate at a loss.

But nothing is too good for Californians. Perhaps a law can be developed, either to forbid insurers from departing the state, or assessing them for some period of years after their departure.

In the world of software development, the DevOps methodology has become increasingly popular in recent years. DevOps is a combination of software development (Dev) and IT operations (Ops) that emphasizes collaboration and communication between development and operations teams to increase efficiency and productivity. The goal of DevOps services is to streamline the software development lifecycle and promote continuous delivery and integration.

◄ JOIN WORK AT HOME ►

I am making a good salary from home $6580-$7065/week , which is amazing under a year ago I was jobless in a horrible economy. I thank God every day I was blessed with these instructions and now it’s my duty to pay it forward and share it with Everyone,

Here is I started ———————>>> http://Www.Pay.hiring9.Com

What effing difference does it make? Builders build them because people want them and buy them. Stop doing that and developers will stop building them. Now that State Farm is leaving and the remaining insurers will be stuck with divvying up its share of a FAIR plan assessment, see how many will follow.

In some of the parts of Northern California which burned catastrophically a few years ago, the local property owners were taking the power utilities to court and obtaining injunctions preventing the company from clearing potential fuel from around transmission lines. Then when the area was wiped out and thousands of homes were destroyed, the State fined the private utilites (but not the government-run ones who rely on the same grid) for being uniquely responsible for not having cleared those areas; I've got no idea where the money to pay those fines (which were big enough to literally bankrupt the power companies) is coming from though since as part of the state's electricity "deregulation" regime, the CPUC (government regulators) dictates maximum rates for residential power service.

The state also doesn't allow insurers to use location as a factor for determining fire risk, which combined with the state using forest management techniques that the US Parks service learned in the 1980s ultimately lead to uncontrollable forest fires (when half of Yellowstone Park went up in flames), premiums on homes deep within urban centers are up 30-40% despite being separated from the fire areas by 20-30 miles of continuous pavement/developed land.

No, they're fleeing the state because they're feeling the real effects of Global Climate Change.

Its all that methane being released on the sidewalks of San Fran.

No, Bailey says that it is all the fault of government-imposed market distortions. Has nothing to do with effects of climate change, except to the extent that government meddling had deprived consumers of the signal(s) not to build where it was so fiery.

But if government had decided not to zone an area for building because that area was too fiery, someone else at reason would be complaining that rising housing costs (and the homeless problem) was all due to government not allowing enough building, and the government should just get out of the way and let the building happen.

So, it is simple: It is always the government at fault, never the market, and never changes to climate. But especially always the government and never the market. Although also not climate change. To simplify, market=good, everything-else=bad.

It could be that, or it could just be that California is a globohomo shithole.

I have made $18625 last month by w0rking 0nline from home in my part time only. Everybody can now get this j0b and start making dollars 0nline just by follow details here..

🙂 AND GOOD LUCK.:)

HERE====)> https://www.apprichs.com

How about you let people build in fiery areas, but don't require insurance companies to subsidize their insurance.

Lets not forget that in California vegetation management is also restricted or controlled by multiple state agencies. what used to be done naturally or by the native Americans is not largely prohibited by these agencies.

CARB - restricts or has for the most part banned for over 40 years control burns in many areas

Regional water quality control - requires extensive permits and environmental review of vegetation management to prevent exposing soil or causing run off. they also fine you extensively if you mistakenly contribute.

CalFire- Many departments prohibit or ceased issuing large scale low level vegetation burn permits since the mid 1970's

Only open brush fields can be burned any burning that occurs under a tree canopy requires an entirely different permit, EIR etc

Local counties do not follow through with dense vegetation oversight

Liability- state law does not incentivize proactive management or vegetation reduction your best course of action is to do nothing.

State law prohibits insurance companies from assessing each property and its owner on a case by case basis so bad behavior or lack of care can not be penalized

State law has become so onerous and costly that it has de-incentivized the logging industry from operating in the state.

Developments can be built anywhere, climate change isnt the issue its the large scale 100+ year's of man suppressing fire in the landscape, excessive vegetation growth and no repercussions

CA does seem to make-up their very own climate hoax alright.

And you're right; Their made-up climate hoax + Gov-Guns has made massive effects.

And it'll only get worse once the oceans start boiling and major Category VII hurricanes start making landfall every single day of the year. And it's coming. It's coming. Wait - for - it!!

If only they could afford to buy beachfront property next door to the pols who continue to warn us about the impending rise in sea level.

Who would spend $8million for a beach house on Martha's Vineyard if they truly believed that the ocean would be rising by 20-30 ft in the next few decades?

Didn't Ayn Rand predict this? Specifically this situation? Where businesses cease doing business due to Mouchian policies?

Yep.

Have no sympathy for the insurers. State Farm, as an example, has gone scorched earth on homeowners in Texas in response to losing money in California.

This is an excerpt from an actual letter from State Farm regarding services my company provided to a homeowner after a loss that is fully covered under their policy.

In other words, "We don't give a fuck what it actually cost to fix your covered loss, this is what we will pay to the people who actually fixed your covered loss and you are on the hook for the rest."

Our invoice is for $32,000. We regularly have to discount our invoices to accommodate the bullshit that insurance adjusters decide is not "fair and equitable", but this is a whole other level of malfeasance.

The best part is that the client is an elderly lady whose husband is dead. If she does not cough up the $19k, we probably have to sue her before she will concede that she needs to sue State Farm.

Have no sympathy for the insurers!

Just like doctors, huh?

I am very limited on homeowners' insurance. The nearest manned fire station is 8 miles from my house. Most insurers have "less than five miles" clause in their policies or a huge deductible.

I did the libertarian option. My house is surrounded by sprinklers. The sprinklers are connected to a well with a back-up jenny.

In case of forest fire, grab the pets and the guns, start the jenny, open the valve, and haul ass.

Insurers are notorious crooks. Finally, the nanny state is applying thumbscrews to the right people for once.

Funny stuff.

You are truly stupid. This will do nothing but drive up rates and reduce coverage, but please carry on with your retardation.

I don't have much sympathy for insurers - first, that they can determine how much they want to pay you, second, that it's easier for them to argue "clean hands" than clients, third, that when they made an incorrect forecast (or the reinsurers did), they rely on consumer stickiness to replenish their vaults. But at the same time if someone takes on a high risk - like say moving into a flood zone - they can't expect insurers not to charge them more (and nor should they expect the state or taxpayers to underwrite the additional risk.)

In other words, “We don’t give a fuck what it actually cost to fix your covered loss, this is what we will pay to the people who actually fixed your covered loss and you are on the hook for the rest.”

Insurance companies are giant bags of shit for lots of reasons, but this ain't it chief. What they agree to pay for stuff is clearly spelled out. They do this because they don't have the time, resources, or desire (who does?) to negotiate with every single vendor for every single case. And this absolutely goes both ways. I've had medical procedures that were $350 if you pay it yourself or $5k if you let them bill insurance. What they are gonna pay is what they are gonna pay. You can live inside of it and only buy what the payment will afford, you can live outside of it and pay the difference, or you can find another insurer. That's the magic of an open market.

Honestly, living in Texas is already a pain in the ass because of the property taxes. Our mortgage dropped by $500 a month when we left the state a few years ago. The lack of income tax doesn't really make up for it.

Hate to sound simple, but the way to make the argument between the insured and the insurer is to advise the insured that the cost of the required repair is $32,000. That is the amount of money you will require upon completion of the repair, and if you are not paid a mechanic's lien will be filed on the property with an interest penalty attached (include in the contract for services). Now, if the homeowner wants the damage fixed, the fight isn't between you and the insured. It's between the insured and the insurer as the insured reaches for his checkbook. If the state makes some requirement on you to provide service below cost, or does not allow mechanic's liens to protect the tradesman, you're in the wrong state, and that's on you!

Sounds to me like you need to put your agents’ and brokers’ E&O carrier on notice that you fucked up. LOL!

Blue Collar Comedy: "You just cain't fix stoopid..."

If the government has to intervene in insurance, then at least let them price in a spread over expected losses, as they can do with Obamacare.

And it's ridiculous that they can't use reinsurance costs - because that's how often enough insurance companies price policies in the first place. If for example Swiss Re charge Big Insurance $10 per $1000 in coverage, the insurers then charge customers $12 per $1000 (or more - I've seen much wider spreads in weather contracts.)

Looks as if the regulators understand neither markets nor insurance.

Obamacare runs at a loss

The CBO originally estimated that Obamacare would cost $940 billion over ten years. That cost has now been increased to $1.683 trillion.

We're not talking about the Federal component but the fact that insurers had a cap on profits - but they weren't required to lose money.

Congress forgot to cut the federal funding for the Medicaid expansion (and leave the states holding the bag) after 5 years like the original plan called for. Since that expansion was pretty much the only way in which Obamacare actually expanded the number of people with coverage, the level of denial needed to see the scheme as anything but an abject failure is downright orwellian.

Since the whole thing was the "signature achievement" of St Barack the Infalliable (until it became "racist" to associate his name with it), the MSM has long since put all of the claims that it would literally save the government hundreds of $Billions down the memory hole; I almost wouldn't put it past CNN/NYT/WaPo to have even "corrected" all of their digital archives to quote official statements as warning that the plan would "cost $Trillions but be worth it" so they can claim the real numbers are actually an outperformance of the forecasts.

State Farm earned $849 million in profits from homeowners and lost $13.4 billion on auto insurance last year. From State Farm’s 2022 financial report:

Homeowners Insurance – Earned premium was $27.6 billion. Incurred claims and loss adjustment expenses were $20.0 billion and all other underwriting expenses totaled $6.7 billion. The underwriting gain was $849 million.

Auto Insurance – Earned premium was $45.7 billion. Incurred claims and loss adjustment expenses were $48.4 billion and all other underwriting expenses totaled $10.8 billion. The underwriting loss was $13.4 billion.

"Like a good neighbor, State Farm Insurance is warning Californians to stop living and building in high wildfire-risk zones."

Farmers Insurance has also been "scaling" back insuring houses in many areas of CA for years. They often use a subsidiary for high-risk areas. We lost our house in the "Camp Fire" in 2018. Farmers was very quick to pay out, but also notified me that if I didn't rebuild within six months, they would not re-insure my house. That was not a problem for me -- we moved to greener pastures.

we moved to greener pastures.

Literally or figuratively?

Literally -- coastal Oregon.

There were approximately 400 native languages and dialects in California before the invasion of westerners. the one thing that the Indians knew and understood was that California NEEDED to burn regularly in order to support wild life and game and food.

in fact REGULAR burning assured that only underbrush and duff burned and that adult trees would generally survive.

the California INDIANS, even though they have so many languages burned pretty much the entire state every 7 years. this was their wild fire control.

I am making a good salary from home $6580-$7065/week , which is amazing under a year ago I was jobless in a horrible economy. I thank God every day I was blessed with these instructions and now it’s my duty to pay it forward and share it with Everyone,

🙂 AND GOOD LUCK.:)

Here is I started.……......>> http://WWW.RICHEPAY.COM