The Pandemic Was a Disaster for Housing Affordability. 2023 Might Be a Little Better.

Rents and home prices skyrocketed almost everywhere over the past two years. There's some hope new supply will bring costs down in the new year.

After a COVID-induced roller coaster ride, the dust is starting to settle America's housing market. In general, the pandemic has been a disaster for housing affordability, although there is some hope that relief will come in the new year.

As of November, nationwide rents have grown 4.7 percent year-to-date according to data culled by Apartment List. In a blog post, the company notes that rents have been falling in the last few months and that year-over-year rent growth will likely come in below 4 percent.

That's closer to the typical amount of rent growth we were seeing in the years right before the pandemic. It's well below the 17.6 percent increase in rents that the country saw last year.

Nevertheless, the average rent on an apartment is $1,356 today, or about 20 percent higher than it was in February 2020, according to Apartment List data.

So, while rent growth might be moderating, the country as a whole is still a more expensive place to live. And the nationwide increase in rents masks some of the real housing cost strains that COVID created in once-affordable parts of the country.

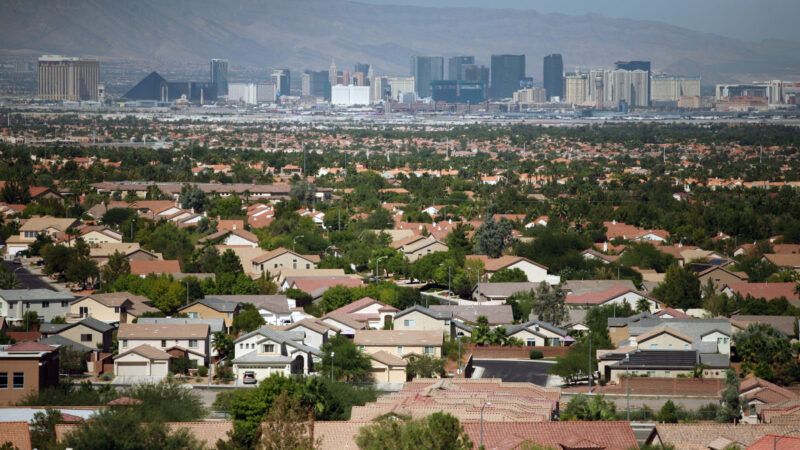

The lockdowns, social distancing, and the remote work revolution of 2020 saw people abandon traditionally expensive downtowns of major metros in favor of life in the traditionally more affordable exurbs of smaller cities and sunbelt metros.

The net effect of expensive areas getting a little cheaper and cheaper areas getting much more expensive is a nationwide price convergence. Apartment List notes that pre-pandemic rents in San Francisco used to be 2.5 times that of Phoenix. Now they're only 1.6 times as high.

It's an even more dramatic story with home prices, which are up some 40 percent nationwide from pre-pandemic levels, according to the Case-Shiller Home Price Index. Here too, the biggest price increases have been in traditionally more affordable areas in the South and Southwest.

The National Association of Realtors notes that of the 10 housing markets with the most year-over-year home price growth, seven were in Florida. The other three were in Tennessee, North Carolina, and South Carolina.

When combined with higher interest rates, housing affordability as measured by a mortgage payment-to-income ratio is at its worst point since the 1980s, reported The Washington Post earlier this year.

Overall, that's a pretty bleak picture. But there is some good news.

There are nearly 1 million apartments under construction today. That's more housing in the pipeline than at any point in the past 40 years. The additional supply will hopefully work to keep rents flat in the coming year.

The picture for single-family housing isn't so rosy. Numbers released by the Census Bureau last week show that permits for new homes and new homes starting construction both continue to fall.

But the completion of new homes has stayed steady, and real estate experts are predicting home prices to stay basically flat next year.

That means next year, housing might not get more expensive. That will be a welcome break from punishing pandemic-era rent and home price increases.

Rent Free is a weekly newsletter from Christian Britschgi on urbanism and the fight for less regulation, more housing, more property rights, and more freedom in America's cities.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Oooh! Oooh! I know! More regulations needed!

Google pay 200$ per hour my last pay check was $8500 working 1o hours a week online. My younger brother friend has been averaging 12000 for months now and he works about 22 hours a week. I cant believe how easy it was once I tried it outit.. ???? AND GOOD LUCK.:)

https://WWW.WORKSCLICK.COM

I get paid over 190$ per hour working from home with 2 kids at home. I never thought I’d be able to do it but my best friend earns over 10k a month doing this and she convinced me to try. The potential with this is endless. Heres what I’ve been doing..

HERE====)> http://WWW.RICHSALARIES.COM

The pandemic was a gift from the taxpayers and the CDC if you were a renter though.

The pandemic didn't drive up home prices -- it was highly paid employees suddenly allowed/required to work from home, wanting to buy homes farther away from the downtown city core (which was mostly shut down and abandoned and stuck with crazy pandemic rules.)

Houses will get cheaper in 2023 because the Fed stopped spending 120 billion a month (to buy Treasuries and mortgage backed securities) to artificially hold long term rates low. That and the inevitable recession brought on by the Fed holding short term rates too low for too long, and being forced to jack them up quickly while chasing the inflation they created.

Agreed. 3% interest rates allowed buying bigger houses. It allowed people to bid up the price. What people really care about is the mortgage payment. The 50% increase in payments with current interest rates is bringing down prices.

Housing prices where I live are "collapsing" where I live, but it has dick to do with "zoning reform".

That spike is over in DeSantis Country!

Speaking of disasters, it's finally here, that moment you've all been anxiously waiting for, the honorary Dipshit Dave Weigel end of the year 2022 stock market report!! You might want to brace yourselves, because this isn't going to be a pretty story:

Dow Jones Industrial Average (DJIA): -3,437.81 (-9.40%)

S&P 500 (INX): 957.06: (-19.95%) (?!)

NASDAQ Composite (JXIC): -5,366.32 (-33.89%) (?!?!?!!)

Contrary to what the fat, ugly, down bad, Ron Jeremy lookin' sad clown, pedophile sack of shit may love to say all the time, the markets absolutely do NOT always do great under democrats. You have your proof in the form of the official final 2022 results!

Here's hoping maybe we all get lucky and actually make some money next year, but I wouldn't bet the mortgage on it!

Analysis by a dullard.

Google pays $100 per hour. My last paycheck was $3500 working 40 hours a week online. My younger brother’s friend has been averaging 12000 for months now and he works about 30 hours a week. I can’t believe how easy it was once.

For more details visit this article.. http://Www.onlinecash1.com

pretty much all of the rightards who haunt the reason dot com comment section have room temperature IQ’s.

real estate experts are predicting home prices to stay basically flat next year.</em.

So basically - no interest in popping the bubble.

It's a bubble when you're trying to buy in, it's a solid value market when you already own or are selling.

Flat home prices plus large inflation = substantial decrease in housing prices in real terms.

But affordability goes down, because mortgage interest is higher by a lot.

Cash generating easy and fast method to work in part time and earn extra $15,000 or even more than this online. by working in 1ce85 my spare time. I made $17250 in my previous (ste-03) month and i am very happy now because of this job. you can try this now by follow

details here…….…….…….…….…….…….… http://Www.workstar24.com

Noooooooooooooooooooooooo. It wasn’t the pandemic.

It was FAKE/STOLEN-$$$$$$$$$$$$$$$$$$$$$$$ being pumped into the housing market by Gov-Gun packing criminals.

As it always has been. If the loan system was controlled by supply and demand instead of Gov-Guns and the trade standard was gold or silver. Houses and Rent would be 1/100th what they are today as they were before all this National Sozialsim(Nazism) started.

P.S. GUNS don't make houses.

…There’s no such thing as a free lunch only a stolen lunch someone else was ROBBED of.

World Boxing Council To Create Transgender Competition Category.

I was wondering if, by any chance, anyone in the Reason commentariat wanted to weigh in with a quick hit on this one?

https://www.nationalreview.com/news/world-boxing-council-to-create-transgender-competition-category/P

My quick hit:

No one cares about the National Review

No one cares about boxing

Men are men

Women are women

It’s the only logical conclusion. You know, other than making you compete against whoever shares your actual biology.

Another logical conclusion would be to just have a sex neutral category and accept that there are actual sex differences in sports performance that mean women are not competitive in most sports.

Women’s sports are a little over a century old. And I suspect they meant popular mostly because men like to see T&A.

Low quality article. The data does not justify the headline conclusion.

Inflation will ease mortgage payments to people who already bought and have long term fixed rates. Except those people who will lose jobs due to recession. And for new buyers mortgages are getting a LOT less affordable due to the increased interest rate, which will make small potential price drops negligible in comparison.

It’s great, but absolutely non-predictive that new housing completion rate is stable. It just means that contractors are getting their supplies in time and did not go out of business yet. Much more interesting number is housing starts, and they are going down, which may signal lesser supply in 12-24 months.

Well, unfortunately, this is a natural process when market prices start to rise. Nevertheless, now there are good options, for example, the continuum condo. I think that here the prices correspond to the conditions provided. This is really a very nice house, something like an apart-hotel, as far as I understand, with excellent infrastructure.

Google pay 200$ per hour my last pay check was $8500 working 1o hours a week online. My younger brother friend has been averaging 12000 for months now and he works about 22 hours a week. I cant believe how easy it was once I tried it outit..

🙂 AND GOOD LUCK.:)

HERE====)> http://WWW.WORKSFUL.COM

Home earnings allow all people to paint on-line and acquire weekly bills to financial institutions. Earn over $500 each day and get payouts each week instantly to account for financial institutions. (bwj-03) My remaining month of earnings was $30,390 and all I do is paint for as much as four hours an afternoon on my computer. Easy paintings and constant earnings are exquisite with this job.

More information→→→→→ https://WWW.DAILYPRO7.COM