IRS Controversially Claims Hiring 87,000 New Agents Won't Mean Higher Audit Rate for the Middle Class

So why do Democrats keep equivocating on the point that households making under $400,000 may be targeted for more audits by an expanded IRS?

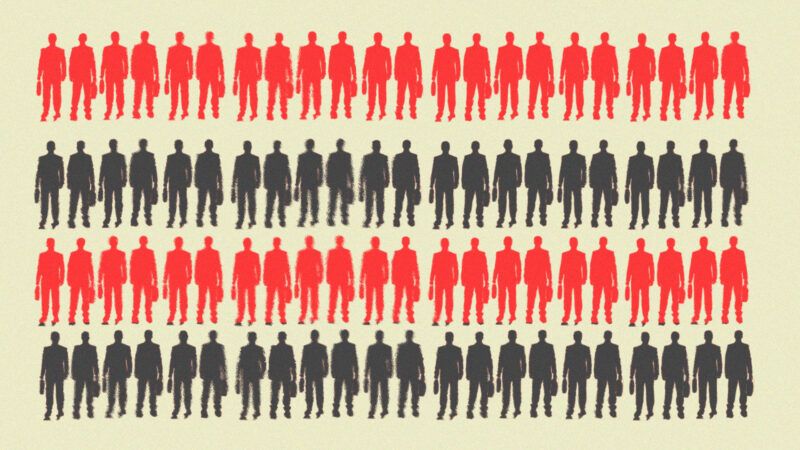

Since the Inflation Reduction Act passed the Senate and is now headed to the House for a Friday vote, Republicans have loudly critiqued the IRS-supersizing provisions while Democrats have tried to assure voters that hiring an additional 87,000 tax-collecting agents, as the legislation calls for, will not lead to higher audit rates for middle- and upper-middle-class taxpayers:

IRS Commissioner: "These resources are absolutely not about increasing audit scrutiny on small businesses or middle-income Americans… designed around Treasury's directive that audit rates will not rise relative to recent years for households making under $400,000."

Liar: https://t.co/D2sgyo0DZo

— Jesse Lee (@JesseLee46) August 9, 2022

The House version of the legislation had originally contained a line saying "nothing in this subsection is intended to increase taxes on any taxpayer with a taxable income below $400,000"—which was hardly a solid guarantee in the first place, and offered no assurance that audits for this income band would not rise. All this was seemingly an attempt to reflect President Joe Biden's frequent campaign pledge, reiterated in his State of the Union address, that taxes wouldn't effectively be raised for the middle class, defined generously.

This isn't true. It's made up to scare you.

The Inflation Reduction Act includes money for the IRS to curb an epidemic of tax cheating amongst the millionaires and billionaires. Under bill, audit rates won't increase for anyone making under $400K. https://t.co/evKDiaZxVU

— Chris Murphy ???? (@ChrisMurphyCT) August 6, 2022

But if Sen. Chris Murphy (D–Conn.) and other Democrats meant what they said, they shouldn't have killed a similar assurance when it was offered in the Senate version as an amendment, "nodding to the notion that taxpayers making under $400,000 wouldn't be the subject of increased audits," says Andrew Lautz of the National Taxpayers Union. Meanwhile, "the oversight and reporting provisions [which were also removed] ensured Congress could keep a regular and watchful eye over the agency's plans," he adds.

"What comfort do taxpayers have in the absence of those provisions? Statements from members of Congress and the administration. That will be cold comfort to some," says Lautz.

Meanwhile, IRS Commissioner Charles Rettig hedges by saying that "audit rates will not rise relative to recent years." This depends on what he means by "recent years." It also depends on what he means by "audit rate." As in, if the total number of audits drastically increases, then the audit rate of certain income bands might stay the same or even decrease—some convenient trickery that may allow him to be correct on a technicality.

"Millionaires in 2018 were about 80% less likely to be audited than they were in 2011," reported ProPublica in 2019. Audit rates circa 2010–2011 were such that about one in six rich households—defined as those earning over $5 million—was audited, versus about one in 50 circa 2019. So Rettig may be counting 2010 as a recent year, or he may be counting 2019 as a recent year, but which years he's referring to matters when assessing how audit rates might change.

In 2018, "the top 1% of taxpayers by income were audited at a rate of 1.56%. EITC [earned income tax credit] recipients, who typically have annual income under $20,000, were audited at 1.41%," found ProPublica. These converging audit rates, where poor and rich are somewhat equally targeted by the IRS, is due in part to the fact that audits hitting EITC recipients are quite easy to do, frequently called "correspondence audits." The IRS finds lots of noncompliance this way, and is generally able to conduct these audits by mail, assigning low-level agents to these cases. There's no real reason to believe some of these newly hired 87,000 agents—who will necessarily be inexperienced—won't be assigned to conduct correspondence audits or those which crack down on the nonrich. But again, if the overall number of audits drastically increases, then Democrats may be hoping they'll be able to tout the audit rate as having stayed the same for poor people.

There's a separate case to be made that the "working rich"—high-earning doctors and lawyers, with dual-income households generating in the ballpark of $400,000 per year—similarly do not deserve to have a legion of IRS agents breathing down their necks. Given that the U.S. has physician and pilot shortages, perhaps it is a fool's errand for the government to disincentivize smart, hardworking people, who are unlikely to ever require government welfare, from pursuing high-paying professions.

All that aside, the specific claim being contested by today's partisans is whether adding a massive stadium's worth of agents to the IRS is likely to increase audits and audit rates for households making under $400,000 a year. It's hard to imagine it won't, especially given that it is frequently much easier for auditors to go after poorer people than those armed with teams of lawyers. It's harder still to imagine why a provision that attempted to clarify this intention was removed if lawmakers are serious about their promise.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

IRS seeks armed accountants ready for ‘deadly force’.

The IRS is hiring new special agents!

Requirements include working min “50 hours per week, which may include irregular hours, and be on-call 24/7, including holidays and weekends” and “Carry a firearm and be willing to use deadly force, if necessary.”

https://www.jobs.irs.gov/resources/job-descriptions/irs-criminal-investigation-special-agent

Florida man to the rescue;

In 2022 Representative Matt Gaetz of Florida introduced a bill to disarm the IRS after the agency had drawn public attention for a $700,000 purchase of ammunition.

The IRS should not have any police powers at all. If they believe someone has committed a crime, they should have to go to a judge in the jurisdiction where the accused resides, and get the local sheriff to make an arrest if the judge concurs that an arrest is appropriate.

-jcr

I am creating eighty North American nation greenbacks per-hr. to finish some web services from home. I actually have not ever thought adore it would even (vst-27) realisable but my friend mate got $27k solely in four weeks simply doing this best assignment and conjointly she convinced Maine to avail. Look further details going this web-page.

.

---------->>> https://smartpay241.blogspot.com

Yep, they should also need probable cause and a warrant for all audits. But the federal judiciary is not honest enough to require that.

"$700,000 purchase of ammunition."

WTF

Oh. $700k for the IRS. Not for Matt Gaetz.

That's a routine requisition for training. At 50 cents per round (or more for quality hollow points) that's 1.4M rounds. At 1,000 rounds per year, that's enough for 1400 agents.

Why do IRS agents need to shoot anyone? If things get tense you call the cops. You don't shoot the auditee.

Yeah, how do you expect the dead to pay taxes?

The way the government prices things, they'll go through $700,000 worth of ammunition in no time.

Literally armed robbery.

Well said

they deleted the job posting

It's back, although modified from what ML quoted. There's no mention of deadly force, but they do have this:

"Maintain a level of fitness necessary to effectively respond to life-threatening situations on the job."

"Be willing and able to participate in arrests, execution of search warrants, and other dangerous assignments."

I'm glad that they have an appropriate level of fear for the average US taxpayer, but this is still an insane thing for the IRS to be involved in.

>>life-threatening situations on the job

Swinglines are an office danger at all times.

It also says be able to carry a firearm now.

Key Requirements

Be a U.S. citizen

..............

Be legally allowed to carry a firearm.

Seems like a difficult requirement to meet given there's no state listed so that you could know what the requirements are.

Let me guess, the average citizen can't get a permit that lets them carry in all 50 states but a federal bean counter can get one?

Remember Al Capone technically went to jail for tax evasion.

The EPA also has paramilitary units. We should disarm those motherfuckers.

The way I see it there is only one possibility. Someone plans to use the IRS as an army to stage a coup/insurrection in an attempt to take over the US. I'm channeling Alex Jones there for a second. Ignore this.

I think old Alex Jones rants are where the party picks up a lot of its "good ideas".

I wonder how long before Pedo Jeffy slithers in to tell us that this is all totally innocent.

So why don't the republicans offer an amendment to the bill that any newly hired agent working on a return with income less than $400,000 will be immediately fired with loss of pension, and the supervisor will also be fired?

Shouldn't be a problem since it will 'never happen'.

They did offer that amendment and the democrats blocked it.

Because no one promised that audits for those making less then $400,000 would be eliminated.

Fun fact; the number of new agents is larger than the US Army forces landed in Normandy on June 6th.

The official British history gives an estimated figure of 156,115 men landed on D-Day. This comprised 57,500 Americans and 75,215 British and Canadians from the sea and 15,500 Americans and 7,900 British from the air. Ellis, Allen & Warhurst 2004, pp. 521–533.

better title: Weaponized Infernal Revenue Service Lies To You

Agreed sir.

Has anyone in the history of the world hired 87,000 tax collectors with the swipe of a pen? Call Guinness! And whoever writes the history books!

There are ~ 927 billionaires in the US.

So, if they are just going after them, that's 94 (new) agents per audit?

Seems Legit.

Wrong question. Correct question: How many people make more than the $400K that keeps getting ballyhooed?

"approximately 2.8 million people earn over $400,000."

That might be worth hiring 87,000 new assholes.

Well those audits are harder, so I think a team of 10 agents maybe needed per billionaire. Now why the other 86,060 are needed is anyone's guess; mine is because of all the paid leave federal employees get, they are needed to fill the gaps.

But, doesn't the average IRS auditor do something like 8-10 audits per year?

Democrats are now explicitly the party of billionaires. Of course they're strengthening the IRS so it can go after the middle class. 🙂

#OBLsFirstLaw

People who make less than $20k per annum are not "middle class". They also don't have lawyers and accountants. How hard can it be to audit every single poor person in the country?

The debate over the middle class aspect is hilarious. Like it would be wrong to send armed agents to rob someone who only makes $399,999.99 per annum of their stuff, but if they make $400,000 per annum, then it's OK.

Dude, the rich don't pay their fair share. If they did then they wouldn't be rich anymore. The fact that they are rich is proof that they haven't paid their fair share.

Please tell me you're honoring your screen name?

Leftists are not people.

There are no rules, only weapons.

Tax evasion is treason. Why do you want people to commit treason?

I am Spartacus!

tax evasion is mandatory.

"You will own nothing"

No it's not. Read the Constitution and the CFR.

"IRS Controversially Claims Hiring 87,000 New Agents Won't Mean Higher Audit Rate for the Middle Class"

Ya know, the verb "lie" is a perfect fit here.

Not a threat to Democracy.

*ctrl-f authoritaria 0/0*

those all got used up in any article involving Desantis

No I believe they were all overhammered on Josh Hawley articles.

https://twitter.com/TomFitton/status/1557713484565159936?t=UGdw7LSWCGosiQSrOF2t6A&s=19

HUGE DEVELOPMENT: Report Alleges FBI "Had Personal Stake" in Mar-a-Lago Raid - Agents Were After Spygate Documents Trump Was Holding That Likely Implicated FBI

[Link]

Wow, if true.

President Trump declassified a binder on January 19th, 2021 that contains hundreds of pages about the Crossfire Hurricane scandal. It contains damaging information about the corrupt actors involved with our government. Two different DOJ Attorney General’s have defied President Trump’s direct lawful order to publish the binder in the Federal Register. It’s been 19 months as the DOJ defies the order, and every FOIA request to make it public. Can we now raid the homes of acting AG Monty Wilkinson, and Merrick Garland?

Sounds plausible given their prior action.

This is immediately what I thought of. How typical would it be for the Swamp to refuse to follow Trump's legal order, then prosecute him for the fact that the order wasn't followed?

Reason contributor, Brendan O'Neill interviews Helen Joyce: Have we reached peak trans?, with Helen Joyce | The Brendan O'Neill Show

god I hope so. my nephew is not yet my niece but he/she's threatening

Does he pull out his dick, hold a knife to it, and scream “don’t make me cut it off! I’ll do it!”?

"peak trans". Love the term, i'm gonna steal it

You never go peak trans.

Just wait until you hear "unrecognized homophobia".

*can't* *headdesk* *hard* *enough*

Just don't discuss the peeking trans in girls locker rooms or your a bigot.

https://twitter.com/TwitterSafety/status/1557713456098312195?t=YNbeJszd2U4Oa2Agmm1Whg&s=19

Starting today, we’ll begin enforcing the Civic Integrity Policy in context of the US 2022 midterms.

This means we’ll take action against misleading claims about the voting process, misleading content intended to intimidate or dissuade people from participating in the election, or misleading claims that may undermine public confidence in elections outcomes.

Learn more about what else we’ve been doing to address the US elections conversation here

And because every year is an election year on Twitter, you can learn about our global elections approach at

[Links]

Yawn.

big hall monitor vibes here

"This means we’ll take action against misleading claims about the voting process, misleading content intended to intimidate or dissuade people from participating in the election, or misleading claims that may undermine public confidence in elections outcomes."

Like Hunter's laptop

Civic Integrity Policy

Sounds like a Democratic marketing person put the spin on that little title.

We can now understand that what Twitter promises to do and what they actually do will be polar opposite.

So Tweeting "Vote Democrat... or else." would get pulled down for being intimidating, right? How about "Vote in favor of Democrats' climate change policies or more people will die!"?

87,000 more useless eaters.

87,000 people who failed the screening process to work for the TSA.

87,000 more people given access to your personal information after being rejected by the bank for prior felony convictions.

I remember one of the budget gimmicks for the Affordable Care Act was requiring lots more form 1099s to help catch people not paying taxes. That was very unpopular. (But it's back again with the requirement for venmo and gofundme and the like to narc on you.)

Question: which income level of taxpayers is more likely to use enrolled agents with CPAs to do their taxes and which is more likely to wing it on her own, hire some moonlighting bookkeeper at H&R Block, or that sketchy dude they met in a bar that will "guarantee" a hefty refund but don't come looking for me if the IRS contacts you?

enrolled agents (EA) aren't CPAs. CPAs are already recognized to prepare income tax returns for clients and to represent them in IRS inquiries.

Sadly, income taxes are NOT part of earning a CPA license although some choose to specialize in income tax law. However, the various CPA organizations like to skirt around this and feed the public perception that CPAs are automatically tax experts.

GAAP accounting and income tax accounting vary widely. Ask me how I know.

87,000 New Agents

I'm a revenooer man, gonna get 'em if I can...

That might make a good sequel to “Repo Man”.

Republicans have loudly critiqued the IRS-supersizing provisions while Democrats have tried to assure voters that hiring an additional 87,000 tax-collecting agents, as the legislation calls for, will not lead to higher audit rates for middle- and upper-middle-class taxpayers

There is a lot of responses from IRS officials and outside economists that focus on tax policy that this article didn’t include. Some things to note:

The 87,000 hires would be over 10 years.

The IRS currently has about 78,000 total employees, not just auditors. One IRS spokesperson said that almost half of their current employees are eligible for retirement now, and will need to be replaced.

The IRS had 100,000 employees in 2013. So the net gain in employees, after subtracting for turnover, would end up roughly returning the total IRS workforce to where it was a decade ago.

To emphasize the point, this is talking about total employment at the agency, not just enforcement personnel. Though certainly, that part of the agency has atrophied ever since the GOP got serious about working to reduce the IRS funding with the Tea Party wave in 2010.

Basically, there is no reason to think that middle class or working class taxpayers should expect audits more frequently than occurred a decade ago. It is clear to me that those with real reason to expect more audits under this bill are the very wealthy and large corporations. But that couldn’t be used to motivate citizens to vote for the GOP this November. Hence why this article paints the same distorted picture as Republican politicians.

WRONG.

The bill adds 87000 agents over 5 years. These are new billets, NOT replacements for outgoing personnel. To think they don't replace outgoing employees is just plain dumb.

And returning the workforce to its prior size is irrelevant. It's like saying we need 16 million soldiers because that's what they had in WW2.

No reason to expect more audits, except the stated goal for the 87,000 new compliance officers to be self-funding (and even help reduce the budget deficit) by squeezing more out of taxpayers.

Who has money available to squeeze?

Certainly not the working poor who file 1040-EZ.

Certainly not the wealthy and big corporations who hire the best tax attorneys.

Mostly it is small business owners who have a lot of expenses in the gray area, and people trying to earn income on the side off the books, i.e. the middle-class and upper-middle-class.

A couple glaring issues:

The very wealthy and corporations have the means to hire a qualified person to do their taxes, and happily do so to avoid the headache. The peace of mind from knowing it frees you up to do more enjoyable things, plus the T's are crossed and I's dotted is something the wealthy do. The cost/benefit of just hiring it out is very in favor of the wealthy.

Furthermore, if you look at developed countries and compare to the US, what's the most glaring thing you see. It's that our tax code is significantly MORE PROGRESSIVE. The rich here pay significantly more proportionally, and the middle class pays much less. The socialist utopias the progs desire to be like have WAY higher rates on the middle class.

Put those together. The middle class is where the money hasn't been squeezed yet, and they are much more likely to have done their taxes by themselves / Turbotax. This is a no brainer.

Oh also add the govt requiring reporting of 600$ on venmo or 10,000$ of bank transactions. Sounds a lot like they are looking at the middle class and below...

The socialist utopia that Leftists long to realize, the vision of a European-like nation, will require roughly doubling all taxes. Of course, this won't mean revenue doubles.

And, consider that a portion of the annual IRS audits each year are randomly selected COMPLETE audits. They IRS uses the non compliance data gathered from these to SELECT the majority of audits where additional taxes might be assessed.

That may be a PIA for many but, you have to admit it is a solid policy.

Those who pay attorneys and accountants to guide them in their income tax situations and file all the required documentation are not going to have a great deal of noncompliance. The people they hire are not going to cooperate in illegal tax evasion schemes because they would share in the liability and lose their license to practice and thus their livelihoods.

This is part of the reason "The Big Eight" faltered and consolidated, starting with the Enron shenanigans at the world's oldest accounting firm, Arthur Anderson. Which led to their demise.

Missing from your analysis is that half of the IRS retiring immediately would be the most beneficial thing the federal government has done for the average citizen in at least a century. The only way it could be better for us is if they just shuttered the entire thing.

Your premise is that the levels in 2013 were fine, I disagree. 100,000 IRS employees is 100,000 too many. The argument of "well this many parasites didn't kill the host" doesn't mean parasites are good for you.

No it's not. The best thing that could happen is to simplify the IRC.

But, I'm not holding my breath having been through several tax acts in my lifetime.

From the proggie's perspective, the best thing that could happen is lots of leaking information about tax cheating prosecutions of "the rich".

Who is John Galt?

Basically, there is no reason to think that middle class or working class taxpayers should expect audits more frequently than occurred a decade ago

imagine being the kind of normie who can believe this bullshit. Amazing

One IRS spokesperson said that almost half of their current employees are eligible for retirement now, and will need to be replaced.

This is very suspicious when coupled with the news that the IRS is hiring 87,000 employees. Even if over 5 years. If employees were retiring, then you don't announce a plan to hire their replacements, you replace them. full stop. The only way you'd need to allocate resources and budget to hire 87,000 employees is one of two conditions:

1. Those employees are above and beyond the natura attrition/replacement rate.

2. If they were replacements for IRS employees who were at their peak earning (and retiring), the 87,000 new hires would-- for some inexplicable reason be paid more than the retiring employees.

If I run a company and we're not in a 'growth' mode, and I have the natural attrition of employees retiring, quitting and I'm planning on doing 1:1 replacements, I don't make big hiring announcements. Bob left, we need a replacement for Bob.

Everything the democrats or deep state says is a lie, so yes audits will increase for the average American.

With Democrats, every day is Opposite Day!

The "working rich" execute a lot of fraud by taking business expenses where they shouldn't. I hope some of that money goes into some more phone support for people who are audited when they shouldn't be.

These Kulaks! They must be found out and stopped!

YES. I missed putting some withholdings on my tax return this year and therefore my return showed less of a refund than I was actually owed. My return was rejected and I had a letter that gave me 20 days to fax back to them a copy of my tax return and all my income and withholding documents. So basically they were asking me to resend the information they already had on my w2s. I didn't make the deadline because I received the letter the day before a vacation. I called 6 times on different days wanting to speak with someone and ask questions and was literally hung up on by the IRS because they were too busy to take my call.

So yes, we need a shit ton of more IRS employees or agents or whatever you want to call them that can answer the phone and just fix your problem then and there. And if these agents can do that then let's go for it.

They won't be able to "fix" your problem via telephone. Hell, most governmental agencies still want paper checks!

Government just won't be dragged into the 21st century. It would be unfair to the lower class who might be "unbanked", don't have credit cards and haven't seen a W-2 in years.

They mean 'rate of audits done' not 'rate of audits of the middle class'. They'll continue doing the same percentage, just a whole lot more of them.

“Equivocating”. Somebody give these people a dictionary.

Why?

They get to make up and/or change definitions at will.

"We are not in a recession"

"There is zero inflation"

It doesn’t mean using a word incorrectly, it means using a word with multiple correct senses within an argument.

Equivocation

In logic, equivocation is an informal fallacy resulting from the use of a particular word/expression in multiple senses within an argument

The deep staters at IRS won't audit taxpayers based upon income level, but rather will audit taxpayers who are registered Republicans (just as deep state IRS agent Lois Lerner did a decade ago to benefit Obama and Democrats).

"The Inflation Reduction Act includes money for the IRS to curb an epidemic of tax cheating amongst the millionaires and billionaires."

Says Chris Murphy without a shred of evidence. This is 100% aimed at small business owners. They're going to audit them into bankruptcy. The same way COVID hysteria wrecked many small businesses, this bill will continue that trend.

Big business needs their government lackeys to take out their competitors. Government is happy to centralize business, where they can more easily apply pressure for social change and censorship of speech that isn't approved by government/progressives.

The vast majority of those new hires will be diversity consultants.

They need one employee to represent each gender. We are up to at least 80k different genders now right?

I've had to endure a few diversity hire auditors. They didn't know shit for shinola. But, they were easy to defeat.

1) Kiss their ass and tell them how wonderful they are and,

2) Put computer printed spread sheet summaries in front of them even though you've overridden the calculations and the columns don't total correctly. They're too stupid to audit the math and, they think whatever comes out of a computer is infallible.

Never give the government power that you don't want used against all people in the country.

This is always the way. If the government can do it, they will.

Never give the government power that you don't want used against all people in the country.

"Those white trash hillbillies? Fuck 'em!" - Coastals

Are people from Arkansas considered "white trash hillbillies"?

Even if they're now living in New York?

Or, even if their spouse is named "Billy"?

Inquiring minds want to know.

If you like your doctor, you can keep your doctor.

And, you're going to like your auditor just about as much.

87,000 new IRS agents, folks.

What? You thought they would call the secret police 'Secret Police'?. LOL! You better practice sounding sincere about your loyalty to the government for your interview.

I'm not really sure what they do at the IRS.

I'm still waiting for my 2020 Income Tax Return check (about $300)! Each time I have called, I wind-up waiting for a couple of hours before a real live human agent answers. After a few minutes researching my problem, they let me know that if I haven't received my check by November, I should contact them again.

I feel that this is relevant:

https://www.youtube.com/watch?v=G56VgsLfKY4

As I said a couple of days ago, I question whether they can find 87,000 qualified people to hire.

Who says they have to be qualified?

Bingo! Government hiring is AA at it's finest.

If the democrats are correct, then the government hired 87,000 people only to target the multi millionaires. Which amounts to "It's ok, we'll only target icky people that we and most people don't like".

87,000 agents are enough to be 3 regiments. In a time of massive inflation and supply shortages, the government is sending massive signals to the high incomers to take their money and asset out of the country.

But I'm not under some illusion only millionaires will be targeted for audits. People making 400,000 outnumber that group probably 10 to 1, and people make all kinds of mistakes on their tax forms. It's not gonna be pretty.

87k people contributing nothing to the economy.

IRS Agents will now be armed.

There is no difference between a criminal with a gun entering a business or a store demanding money and an armed IRS thug going after a taxpayer for more of the same.

In Christ's time, the taxman of the Pharisaic Sanhedrin was armed and authorized to kill. Christ was also killed over "hate speech", or speech that the Pharisees didn't like.

interesting parallels I think since it's the same people with the same ideology implementing the same sort of regime