Tumbling Gas Prices Caused Inflation To Fall to 8.5 Percent in July

Prices for food and housing continued to rise but were offset by lower gas and energy prices.

In more normal times, an annual inflation rate of 8.5 percent would be catastrophic news.

Right now, it might be greeted with sighs of relief.

That rate, reported Wednesday morning by the federal Department of Labor in its consumer price index data for the month of July, is still miles above the Federal Reserve's target rate of 2 percent. Still, it represents a possible break in the fever of rising prices that has gripped the American economy for the past year—in June, annualized inflation rang in at 9.1 percent, the highest level in 41 years.

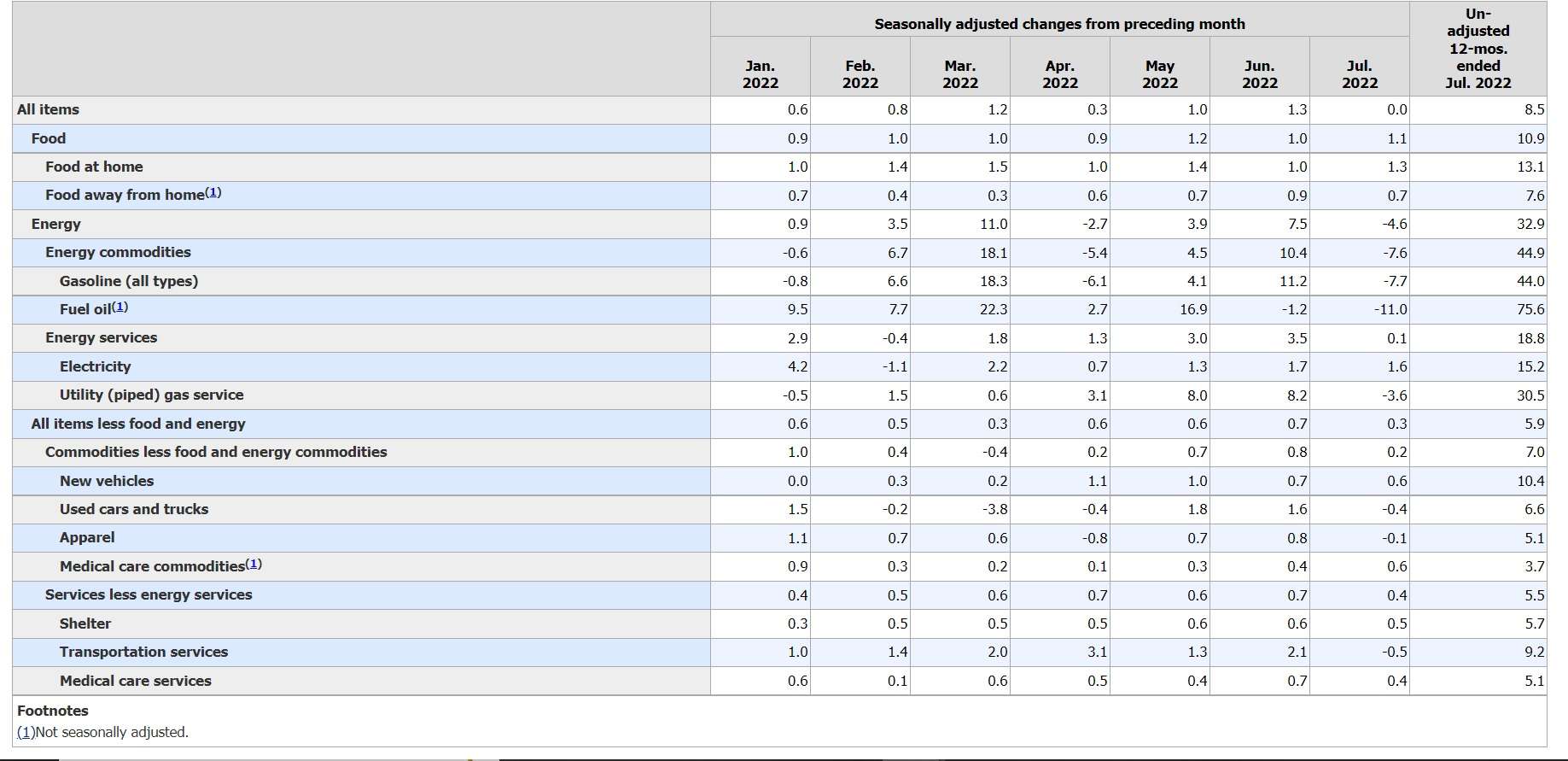

Tumbling gas prices were the primary driver of July's lower inflation rate. Gas prices fell by 7.7 percent, offsetting increases in other categories and causing the overall consumer price index to remain flat during the month.

The national average price for a gallon of gas was $4.01 on Wednesday, according to AAA. That's more than a full dollar less than the recent peak in gas prices of $5.02 during June.

But while consumers have seen some recent relief at the pump, other prices keep rising. So-called "core inflation"—which filters out the more volatile categories of food and fuel prices—continued its upward trajectory in July, climbing by 0.3 percent. That's down from 0.7 percent in June, but the annualized rate of 5.9 percent is still a worryingly high figure.

Mostly, July's inflation data indicate how crucial gas prices are to overall inflation. They affect not just the price you pay to fill up your car, but also the prices of everything that's shipped, trucked, or flown around the world. Transportation services, for example—a category that includes airfares and the costs of maintaining motor vehicles—saw a 0.5 percent decline in prices during July likely due to falling gas prices. Despite that, the same category is still up by 9.2 percent—higher than overall inflation—during the past year.

And despite the easing in July, gas prices are still up by a whopping 44 percent over the past year. Energy prices as a whole are up 32.9 percent.

The big question now is whether inflation has peaked or whether July's slight cooldown is a blip caused by volatile gas prices. Only time will tell. The Federal Reserve hiked interest rates in June and July, and the central bank has indicated it will likely raise rates again in the near future. Higher interest rates signal a benefit to saving rather than spending, which helps pull some excess dollars out of the economy to ease price increases.

Perhaps the biggest sighs of relief on Wednesday morning will be emanating from Congress, where senators have tried to respond to raging inflation by passing a bill called the Inflation Reduction Act that won't actually do anything to ease inflation. Wednesday's report will give lawmakers an opportunity to make it look like they've accomplished something, even if that's not the case.

Show Comments (67)