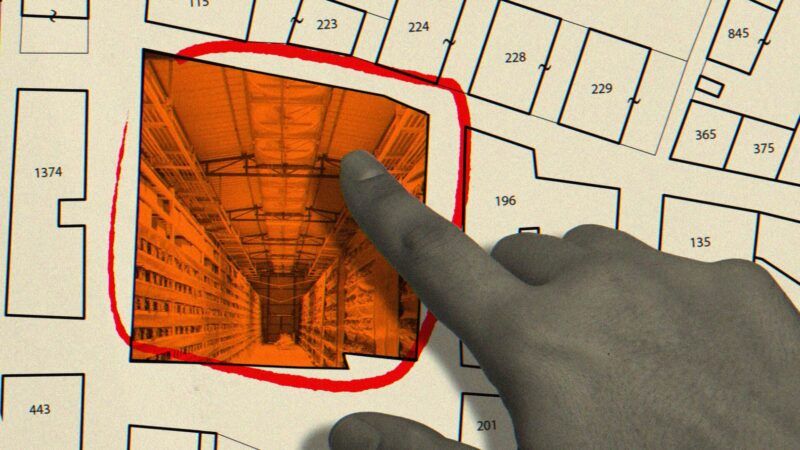

Will Bitcoin Be Done In By Terrible Zoning Laws?

Local ordinances threaten upstart crypto-mining operations.

Since late 2020, a steady hum has been emanating from 15 large metal containers sitting next to an electricity substation in the small community of Limestone in rural Washington County, Tennessee.

Those boxes make up a bitcoin "mine." Inside each one, a network of linked computers works to solve equations that keep bitcoin's decentralized network up and running. In exchange for solving these equations—for performing the work of keeping the bitcoin network alive—the mining computers are rewarded with bitcoins. This process is how bitcoins and many other forms of cryptocurrency are brought into the world; it's complex and computationally intensive, a little like running a video game with cutting-edge graphics.

As anyone who has ever found himself feeling a burst of metallic warmth after pushing his laptop to its limits knows, that constant computational intensity means those boxes are hot—hence the hum, which is produced by all the fans needed to keep this bitcoin "mining" machinery from overheating.

The Limestone bitcoin mine is a mutually profitable enterprise for both BrightRidge, the utility company that owns the substation, and the mine's operator, crypto company Red Dog Technologies.

BrightRidge, which also owns the land on which the bitcoin mine is located, brings in revenue by selling excess power to Red Dog's power-hungry mine, which also happens to be its largest customer. Red Dog, meanwhile, says it expects to make a net operating profit of $36 million on its Limestone bitcoin mine over the next 18 months.

Indeed, the mine seemed uncontroversial enough that the Washington County Commission unanimously voted to approve a rezoning of the BrightRidge property to allow for the construction of a "block chain data center" in February 2020 with no debate or discussion.

Soon enough, however, the county began to change course.

In May 2021, the neighbors started complaining that the incessant vibrating noise coming from the mine's containers of computer equipment was eliminating their ability to peaceably enjoy their own property. Red Dog responded by installing sound barriers, consisting of wood and sound-absorbent padding, while promising to do more to get the noise issue under control.

The county wasn't mollified. Commissioners complained at public meetings that BrightRidge had misled them about the precise nature of this new data center, downplayed the noise it would make, and hid the fact that it wouldn't be operated by the utility company directly.

Some of these accusations are more on point than others.

BrightRidge, per a county planning staff report, had promised that noise from its facility would be "small and will not impact or be heard from adjoining properties."

Neighbors' complaints show that BrightRidge was, charitably, underestimating the noise impacts of the mine.

On the other hand, court filings show that county staff were having meetings with employees from Griid (Red Dog's predecessor company) nearly a year before the county claims it first learned about the company and the real nature of its operation.

In November, the county sued BrightRidge. The county's lawsuit argues that the rezoning of the property to an A-3 business agricultural district might have allowed a blockchain data center, but it didn't allow a "Bitcoin blockchain verification facility," otherwise known as a bitcoin mine, and certainly not one operated by an undisclosed third party. (The zoning code itself is silent on what difference, if any, there is between a blockchain data center and a bitcoin mine, and therefore why one would be allowed but not another.)

In short, Red Dog's bitcoin-mining computers were having code problems—but with zoning rather than ones and zeroes.

For close to a century now, the ever-more-elaborate zoning codes of America's cities, towns, and rural counties have been frustrating the plans of individual entrepreneurs and whole industries to try out new ideas and practices on their own properties.

Cryptocurrency is no exception. The computerized mines that create and sustain these digital monies and the blockchain networks they're built on have raised the ire of private citizens and planning commissions alike. The former primarily object, sometimes reasonably, to the noise and vibrations emanating from the mines that open up next to their quiet rural properties. Planners and politicians, however, have taken some of those more reasonable complaints and used them as excuses to attack the mines for their power consumption, and the perceived damage they do to locally set goals of fighting climate change.

As cryptocurrency continues to rise in value, and some foreign countries put pressure on mining, these conflicts are likely to grow more numerous and less amicable. So even when officials are responding to real externalities, the rush to regulate could end up handicapping this new industry and even make some of the problems they seek to combat worse. Bitcoin and its attendant technologies will inevitably face many political and legal challenges in the coming years, but its first big regulatory fight won't be in Congress. Instead, it will be over a mesh of poorly designed local zoning laws.

Heigh-Ho, High Hums

The bitcoin network is built on a decentralized ledger known as a blockchain. That ledger is a public record of bitcoin transactions that allows everyone involved to know which anonymized bitcoin wallet owns which individual bitcoin, and prevents someone from making fraudulent digital bitcoin copies.

Keeping the blockchain current and accurate requires lots and lots of computers called application-specific integrated circuits (ASICs) plugging away at solving mathematical equations and earning new bitcoins for their efforts. The computations needed to keep the blockchain up to speed are complex. The bitcoins generated from mining go to the machines that solve them first. Those two facts mean you need a lot of ASIC machines burning through a lot of electricity to have a profitable mine.

"These ASICs are not energy efficient. They consume a lot of power," says Artem Bespaloff, CEO of Asic Jungle, which sells the machines to bitcoin-mining operations. He says your average ASIC consuming between 1,400 and 3,500 watts of power is enough to heat up a 900 square foot room in about 10 minutes.

The power consumption needs of bitcoin mining have a major influence on where these bitcoin mines—the largest of which have tens of thousands of ASIC machines—set up shop, Bespaloff tells Reason.

Popular destinations for bitcoin mining in the United States include Texas, where natural gas is plentiful and energy regulation is not, and Montana with its cool climate and cheap, available hydroelectric power.

Indeed, bitcoin mining is so energy-intensive that many utility companies are actually trying to court these businesses. In some cases, they have offered incentives to set up shop near their power plants and substations in the hopes of getting a reliable customer to soak up spare power.

In Limestone, BrightRidge offered $100,000 and discounted power to the company that would become Red Dog to build its bitcoin mine, according to reporting from WJHL reporter Jeff Keeling.

The same power consumption features of bitcoin mining that determine where they end up also create externalities that can irritate neighbors.

The heat generated by banks of ASICs requires fans to keep everything cool. Those can produce a tremendous amount of noise as they spin, particularly at the scale at which bitcoin mines now operate.

Traditional zoning regulations usually try to account for noise externalities by relegating heavy industry to specific areas of the city and setting decibel limits for those operations. That sometimes isn't enough to wholly account for the particular, and often constant, sound emanating from some bitcoin mines.

The chief building inspector in Plattsburgh, New York—which has become something of a hub for bitcoin mining—told The Wall Street Journal that the problem isn't so much the volume of bitcoin mines, which is what decibels measure, but the irritating high-frequency pitch that they can produce.

Other people who spoke to the Journal described the sounds of bitcoin mines as akin to the whine of a jet engine, a dental drill, or thousands of hair dryers blowing all at once.

The vibrations can also apparently produce an unpleasant physical sensation. "It's more than a noise. It's a vibration that you can feel across your whole body," said one resident who owns a farm near Red Dog's Limestone bitcoin mine to WJHL.

Even when these mines sit in industrial areas, and often inside older industrial facilities, they still provoke complaints given that the fans hum at a consistent volume for hours at a time, unlike the more sporadic noises produced by industrial machines of old.

In response to complaints from neighbors, some mine owners in the U.S. have switched to water-cooling methods, which produce less noise, or installed lighter fans that give off less sound. Some have also installed sound barriers and berths on the property—basically sound-absorbing walls that surround the mines themselves and which suck in some of the noise they give off.

In many cases, the noise can be addressed through individual negotiation with mining companies. But it can still prove to be a burden on neighbors—what economists call a "negative externality," or a cost born by someone who didn't choose to participate in a project, and isn't a party to any potential benefits. And these sorts of externalities can be difficult to resolve through private mechanisms.

Yet regulatory responses often have serious problems of their own. Cities have adopted bitcoin mining–inspired noise rules that are both heavy-handed and ineffectual. Plattsburgh, for instance, imposed an 18-month moratorium on the establishment or expansion of bitcoin-mining operations in 2018, which obviously attracted the ire of local miners and made starting or expanding bitcoin businesses impossible. And by grandfathering in existing operations, that moratorium obviously didn't address the immediate concerns of neighbors.

Then there's Washington County, which launched a lawsuit against BrightRidge that was initially sparked by noise complaints. Yet one of the issues raised by the county against the company is that its approved site plan didn't include the noise barriers the county had later urged it to install. The county's complaint was that the noise was too loud and BrightRidge should do something about it—and also that the noise mitigation measures hadn't been approved.

And noise complaints have served as catalysts for local governments to take a tougher approach to regulating all aspects of bitcoin mining. That was certainly the case with the nation's first true cryptocurrency zoning ordinance.

The Bark Is Worse Than the Bit

Missoula County, Montana's first bitcoin mine began life as a project that was warmly welcomed by government officials. In April 2017, the company Project Spokane set up its data center in an old timber mill in the small town of Bonner. In June, the mine was blessed by then-Gov. Steve Bullock with a $416,000 grant from the state's Big Sky Economic Development Trust Fund.

Soon enough, however, the whir of fans coming from the Project Spokane site—which would later be taken over by the company HyberBlock—began attracting complaints from neighbors.

"Even some of the longtime residents that clearly remembered the noise from the lumber mill when it was operational at that site said this is very different," says Diana Maneta, the sustainability program manager for Missoula County's Community and Planning Services Department.

While the lumber mill was loud, the noise it produced would come and go. Maneta says people described the consistent hum from the bitcoin mine as more like "a jet engine that never lands."

Prior to the noise complaints, the Project Spokane facility, and indeed the entire cryptocurrency industry, wasn't on the county government's radar. But as those complaints surfaced, Maneta says county staff were directed by the county commission to "learn a little more about this industry and whether it might have other local impacts that we should be aware of."

That piqued the county's interest about Project Spokane's electricity use.

Bitcoin mining's energy intensiveness has made it a target for both environmentalists and already crypto-skeptical politicians who are eager to find any flaw in the decentralized digital currency.

"It's terrible for the environment," claimed Sen. Elizabeth Warren (D–Mass.), who is fond of saying that the average bitcoin transaction uses more electricity than the average U.S. household uses in a month—a misleading statement since there's no direct link between the number of bitcoin transactions and the amount of energy that's needed to sustain the blockchain. Other critics point out that bitcoin uses as much energy as countries like Argentina or the Netherlands, without noting that industries like cement and paper production use even more.

Those concerns were nevertheless enough to push Missoula County—which estimated that the Project Spokane/HyberBlock mine was using about a third as much energy as all households in the county—into action.

Beginning with a temporary zoning ordinance in 2019, which was then made into a permanent ordinance in February 2021, the county imposed a number of new restrictions on cryptocurrency mines. That included requirements that they locate in industrial areas and go through the process of getting special conditional use permits—which comes with additional noise restrictions.

The most significant requirement of the zoning ordinance, however, was its green energy regulations. From now on, any cryptocurrency mining operation setting up shop in Missoula County would have to purchase or produce enough renewable energy necessary to offset 100 percent of a mine's energy use.

Without this requirement, Maneta says the county would be at risk of not achieving its set climate goals of net-zero carbon emissions by 2050.

It's also a significant entry tax to cryptocurrency mining operations that might want to set up in the county. One of the draws of Montana is the fact that there's already so much plentiful cheap energy in existence. That advantage is negated when new mines have to either build out or purchase potentially more expensive renewable energy to cover all their consumption.

It's also a requirement that doesn't apply to any other industry. A developer could build a new suburban subdivision or another sawmill without having to do anything to offset its power consumption.

Project Spokane's successor, HyperBlock, which was grandfathered into the new regulations, ended up ceasing operations in May 2020. Later that year, it settled a lawsuit with the local energy provider, Energy Keepers, which claimed that it owed $3 million in overdue power bills.

Maneta says that some cryptocurrency miners have inquired about setting up in Missoula County since the new ordinance has passed, but none have done so yet. Perhaps they've learned all they needed to know.

Go East, Young Man

Bitcoin miners might be having a tough time in Bonner, Montana, and Limestone, Tennessee. Those in China are having a much worse experience.

Beginning in June 2021, the Chinese government ordered five state-run banks to cut off all cryptocurrency transactions. That was followed in September by the Chinese central bank's total ban on cryptocurrency transactions.

This has been hugely disruptive for bitcoin. Prior to the ban, as much as 80 percent of new cryptocurrency was being minted by Chinese mining operations, according to Nikkei Asia. The industry is now fleeing the country, with North America being the primary destination.

"These miners that have become quite well to do have the means now to transfer their hardware overseas," says Max Song, a partner at Hong Kong–based investment firm Pacific Century Group. "So we see now a huge concentration of the world mining in North America, specifically in Canada and the United States."

With more mining operations establishing themselves in the U.S., local conflicts about noise and energy consumption are only going to grow more frequent. That presents a challenge for local governments and the industry itself.

The noise produced by bitcoin mining can be a serious nuisance. It's reasonable that neighbors would want those noise impacts mitigated, and there's a role for local governments to play in making that happen.

Too often, however, governments' response to the racket—as the cases of Washington County and Plattsburgh show—has been to use heavy-handed rules to shut down the cryptocurrency industry rather than pursue peaceful coexistence.

Worse still, legitimate concerns about noise externalities can morph into a wholesale effort to regulate other aspects of the bitcoin-mining industry—including its energy use.

Those regulations, as the example of Missoula County shows, can be a huge effective entry tax on bitcoin mining. That's economically costly, and potentially environmentally counterproductive.

Mines that would have once set up in the county to take advantage of its abundant (carbon-free) hydroelectric power could instead go to other areas of the state or country where dirtier coal-fired power is king.

Elsewhere, companies are installing mines at oil and gas wells where they use spare fuel—that would otherwise be "flared" or burned off into the atmosphere—to power their operations. Those mines are thus reducing carbon emissions. Under Missoula's regulations, they'd still be required to build out more renewable power anyway.

Bitcoin, and cryptocurrency generally, is a new industry that's hard for most people to understand and even harder for politicians to control. The result is a drive to quash or regulate it at all levels of government. As more and more cryptocurrency mines are set up in the U.S., it looks like the real threat to the industry isn't the U.S. Securities and Exchange Commission, but rather the local county planning commission.

Rent Free is a weekly newsletter from Christian Britschgi on urbanism and the fight for less regulation, more housing, more property rights, and more freedom in America's cities.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

More than 1,000 people have so far signed up to the pro-Trump cryptocurrency magacoin, including conservative media personalities and Republican figures, the Guardian can reveal.

Here are 7 at-home jobs that pay at least $100/day. And there’s quite the variety too! Some of these work-at-home jobs are more specialized, others are jobs that anyone can do. nnc They all pay at least $3000/month, but some pay as much as $10,000.

GO HOME PAGE FOR MORE DETAILS.>>>>>>> Click Here

If it's not based in Silver, Gold, or Platimum, MAGAcoin means as much as a hotel, magazine, steak, university, marriage, or labor contract involving Trump. I'll pass.

Get $192 off an hour from Google!… Yes, this is Authentic as I just got my first payout, and was really awesome because it was the biggest number of $24413 in a week. (Hav20) It seems Appears Unbelievable but you won’t forgive yourself.

If you do not check it go this site…… Visit Here

In short, Red Dog's bitcoin-mining computers were having code problems—but with zoning rather than ones and zeroes.

Oh there are still plenty of zeroes causing problems on both sides.

I must throw the BS flag on this one

"15 large metal containers sitting next to an electricity substation in the small community of Limestone in rural Washington County, Tennessee.

Those boxes make up a bitcoin "mine." Inside each one, a network of linked computers works to solve equations that keep bitcoin's decentralized network up and running. "

Bullshit. Not THAT much parallel processing.

Soneones doing sonething ELSE with all that horsepower which is certainly the latest in hardware.

See, as my MSCE Mentor ( who helped develop the PC...) taught me, high power parallel processing MUST be done close together. Theres WAY too much latency if the micros are spaced apart. Thats why such systems are placed in a circular orientation...short path for hi speed signals and cooling.

That many servers located on a T1 line cutting across rural TN, maybe.

But that " aint lake Minnetonka" to quote Prince in Purple Rain.

There ecists another realization of this false meme in WA State at LIGO.

Thats a spy facility masqurading as space research.

Enough parallel processing to choke a team of horses and some BS about a special detector designed to decode gravity wave pulses.

Thats BS bc those arexl at extremely low frequencies and their detector has a 1x10 ^ 6 detector BW.

I was told " the Spooks are constantly in and out of here" by one if the Scientists there.

????????

PS remember about the advantage of the Derivatives Traders..the ones physically located nearest the destination computer wins.

Closest to a T1 line, I assume, in this case.

Uh...I hope you are posting this in parody.

The "parallel processing" of Bitcoin mining does not require low latency and close proximity. This is because the operations being done are discreet and not dependent on one another. If you are doing a massive physics simulation, where each "frame" of the simulation depends on the previous state of the simulation, then yes latency will set an upward bound on your performance.

But Block Mining is basically taking 1 bajillion potential values, plugging them independently into an equation and determining if the answer is "You Win!". The only data that needs to be passed between the ASICs is what range of numbers they should use ("You start on 1 - 400, you start on 401 - 800, etc") and whether or not the latest block was mined and they should start over again.

In many ways, this is much like the old SETI at Home distributed network from circa 1999- where your computer's extra cpu time could help perform signal analysis on recordings from the SETI observatory.

Here are 7 at-home jobs that pay at least $100/day. And there’s quite the variety too! Some of these work-at-home jobs are more specialized, others are jobs that anyone can do. They all pay at least $3000/month, but some pay as much as $10,000.

GO HOME PAGE FOR MORE DETAILS………

Click Here

In Bitcoin or MAGAcoin?

dog money

You probably won't find a bigger BTC maxi on these comments than me, but the whole point of this article really has nothing to do with Bitcoin. It is the age old problem of connected corporate interests working hand in hand with the bureaucracy supposed to regulate them, against the interests of the local population.

While Mr Britschgi wants to bring up environmentalist climate change concerns, the actual problem here is that the power company and mining company have colluded to setup a noisy data center right next to residents, potentially lying about the environmental consequences in the process (on the application, they said that there would be no noise).

The problems of environmental impact to neighboring properties certainly require some libertarian thought, but it is hard to get started when underneath this problem is a shaky and rotten foundation of monopolies, subsidies and government misallocation of resources.

Bitcoin actually CAN be a good way for solving some of these problems in the future, if we ever peel back the regulatory burden. Bitcoin is a highly abstracted store of excess energy that would otherwise be wasted. The problem is that government regulation has confused the market on what is excess and potentially wasted. These aren't code problems, they are problems fundamental to resource allocation and usage in our society and while they make a good hook for an article to get clicks, we are going to need the analysis of someone more capable than Britschgi to analyze them.

Amen.

And, who titles the articles here? FFS.

"The problems of environmental impact to neighboring properties certainly require some libertarian thought"

The solution is already in the mail. It should be noted that "proof of work" validation, where hashes are validated by miners, isn't the only way cryptocurrencies can or do operate.

"Proof of stake (PoS) protocols are a class of consensus mechanisms for blockchains that work by selecting validators in proportion to their quantity of holdings in the associated cryptocurrency. This is done to avoid the computational cost of proof of work schemes.

https://en.wikipedia.org/wiki/Proof_of_stake

Ethereum was supposed to go from PoW to PoS at the end of 2021, but they put it off until 2022. It will be interesting to see--when that really happens. Serious cryptomining hardware is specifically built to maximize performance to mine a specific currency, and when you go away from proof of work, you make the billions they spent on mining equipment suddenly far less valuable (if not worthless).

So, the people who are making most of the money from mining Ethereum may be the people whose support is necessary (directly or indirectly) to get rid of the need for electricity and go to proof of stake in an effective way. If the miners can't mine it anymore, they'll probably go back to mining an old fork of Ethereum ("Etherium Classic"), which OTBE should put serious downward pressure on the value of Ethereum 2.0 going forward--at least in the short term.

It's important for libertarians to get out ahead of this and point out to the general public that not every cryptocurrency consumes a lot of energy. Not only that, the second biggest cryptocurrency by market cap, Ethereum, is moving to a model that won't use mining to validate the block chain at all. It's bad enough trying to defend these things from legitimate concerns. The spectacle of people railing against a cryptocurrency like Ethereum for gobbling up power (when it doesn't) would be nauseating.

""Proof of stake (PoS) protocols are a class of consensus mechanisms for blockchains that work by selecting validators in proportion to their quantity of holdings in the associated cryptocurrency. This is done to avoid the computational cost of proof of work schemes."

Yeah but PoW is a trap and should be avoided at all costs if you want a stable currency. 🙂

Did you mean proof of stake is a trap?

Yes sorry...see below.

To follow up on my statement, a good currency needs to represent tradeoffs in the productivity they abstract.

In early colonial america, when settlers had excess productivity, it tended to be reflected in excess corn, because the corn could then be directly converted into durrable, portable, divisible whiskey. This was not just the origin of american bourbon but also an early american currency. In ancient civilizations, nations and empires had to make similar calculations- do I spend precious productivity growing crops, fortifying defenses and building infrastructure, or do I dig shiny gold rocks out of the ground.

In both these earlier currencies, the currency itself represented a tradeoff that every producer needed to make. Creating the gold or whiskey was an OPPORTUNITY COST over something more productive. That kept the currency from over-inflating or deflating because natural price incentives would keep the supply tied to the economy.

Bitcoin is similar in that Proof of Work calculations will only be done as long as there is excess productivity to capture in the market. If there is more bitcoin than demand for it, it will not make sense to spend precious electricity on mining it- thus the work necessary will reduce to a level that makes bitcoin mining profitable.

Proof of Stake is essentially privatizing the fed. When you PoS you merely put some sum up as collateral locked in your validation node. But it still earns you interest, and many schemes are being created to let you take loans against this stake, meaning that the opportunity cost of staking currency is even lower. The net result is that while I agree that PoS may be a more energy efficient way of solving the Byzantine General problem, it also essentially turns all the whales of Ethereum into a distributed Fed.

Bottom line, PoW keeps the currency pegged to the excess capacity of the economy it represents. Proof of Stake pegs the currency to the liquidity needs rich whales in the eco system.

I see bitcoin as being like the California gold rush. It's what brought people into the state, but the real money in California wasn't in gold. It was in real estate, oil, agriculture, railroads, entertainment, and tech. Miners supply bitcoin because people demand it, and they want to get rich. Ultimately, people will supply Ethereum to people who demand it for what they can do with it--more like oil, agriculture, railroads, etc.

My Brave browser pays me about $120 a year in BAT for the ads I see while browsing, and BAT is Ethereum. I use that money to pay for a subscription to the Wall Street Journal. Ultimately, my demand for Ethereum, in this case, is being driven by desire for a subscription to the Wall Street Journal--and the people are supplying me with Ethereum are also being driven by my demand for a subscription to the Wall Street Journal.

None of that will change when Ethereum goes to a Proof of Stake model. They will supply me with Ethereum to the extent that I find Ethereum useful independent of their concerns about their investment. The value of the currency will ultimately be driven by demand, the question of why I need Ethereum. And I see a bright future for the currency.

Ethereum may be able to do banking with less expense than a bank (and less concerns with identity theft and credit fraud) and they can do it faster without those concerns. I think there are myriad ways to use Ethereum for authenticating everything from intellectual property, like music and movies, to stock trading and financial transactions--at lower costs than we thought were possible. And it's those applications that will ultimately drive the supply of the currency.

Bitcoin has a problem there in that it's mostly just a lump of gold, so you need to justify mining for it in narrow terms. Ethereum is more like a personal computer than it is a lump of gold. Ethereum is like in that era between the time Jobs and Woz put together a PC in their garage--but before the consumer browser was invented and the internet went mainstream. The value of a PC was determined by what you could do with it, and suppliers like IBM, Comaq, and Dell made them available to consumers because consumers wanted to do things with them.

That's what will or won't drive miners or stakeholders to supply Ethereum.

"I see bitcoin as being like the California gold rush. It's what brought people into the state, but the real money in California wasn't in gold."

While this is correct, what you are missing is that the California gold rush was a reflection of American Excess productivity. Americans crossed a continent to get to the west largely because the country had amassed enough capacity to spare digging up rocks from the ground. What you see as people "going off to make it rich" was actually people trading off the value of their labor growing crops/digging ditches for the labor of digging a rock out of the ground. This tradeoff is precisely what makes gold valuable as a currency- it is a battery charged with the excess productivity of the nation.

I don't disagree that there is value in an eco-system that allows people to trade goods and services friction free. My point is that Ethereum (and I own quite a bit) is making moves that will devalue it as a currency. Will that be enough to sink it? Probably not, since the American Dollar is an alternative and seems to be doing fine. But just because Fiat currency works passably doesn't change the fact that- as constructed- it is unstable, and corrosive to free market action.

That said, despite being heavily invested in Ethereum, my bet is that Ethereum's convoluted burn algorithm, mixed with Proof of Stake are going to do much to decouple its value from excess productivity. The more that happens, the more distorted its price signals will be, and the less efficient its eco-system will become.

"My point is that Ethereum (and I own quite a bit) is making moves that will devalue it as a currency. Will that be enough to sink it? Probably not"

Right now, Ethereum holdings are driven by mining and a lot of the people holding it are doing so because they mined it. When they can't mine Ethereum 2.0, OTBE we should expect Ethereum to fall in price and Ethereum Classic to rise. That will be a one time event when and if it happens.

Over the long term, the price of Ethereum will be driven by demand for the currency based on what you can do with it.

The U.S. dollar works the same way. You can pay taxes with the $US; you can buy treasuries with the $US, you can buy stocks on the NYSE with the $US; you can buy a barrel of oil with the $US; you can pay rent with the $US, and the grocery store down the street accepts the $US.

Over the coming years, I'd expect Ethereum to become increasingly useful--and in some ways, more useful than the $US. And ultimately that's what will drive both demand for it and its supply.

I am not an investment advisor, and you should consult a professional on any trade you make beforehand. There may be an arbitrage opportunity in shorting Ethereum and going long on Ethereum Classic--over the next year when they go PoS. If they both trade up and down with Bitcoin, then that's probably the overwhelming factor, and there isn't a smart arbitrage opportunity there at all. Does Ethereum ever trade against Bitcoin? How often does Bitcoin go down on the a day when Ethereum is up?

Can you short cryptocurrencies?

If you can't hedge your bets, that sucks.

>Over the long term, the price of Ethereum will be driven by demand for the currency based on what you can do with it.

Cryptocurrency was sold as a way to anonymize your transactions. It was cash for the internet.

That proved to be a lie, so what is the point? It's proven to be a highly unreliable and unsafe store of wealth. It's easily stolen from unregulated "wallets" and something like 20% (30%?) has been irrevocably lost.

Spend 10 minutes of reddit/r/wallstreetbets and imagine your currency value being driven by those monkeys.

In a truly astounding stat, 20% of existing Bitcoin (worth ~$140B) is either lost or stranded in digital wallets, according to Chainalysis data cited by the New York Times. https://thehustle.co/01142021-lost-bitcoin/

I've already mentioned a number of practical applications--one that's paying me $120 a year for the ads I'd see anyway as I browse. Eliminating the possibility of credit card fraud and identity theft may be another. Protecting intellectual property is another obvious application. You could trade stocks without needing a clearing house. Ethereum isn't supposed to be anonymous, and isn't just a store of value.

Look through the list of members in the Enterprise Ethereum Alliance, and you'll see some of the world's biggest software companies, banks, and accounting firms. Again, because no one could see Facebook, YouTube, Quake III, Netflix, and Napster in 1983, didn't mean there weren't any legitimate consumer applications for the personal computer. The big internet application came later while the PC proved amazingly useful for writing and spreadsheets.

I should say, too, that those large companies in the Ethereum Alliance are less likely to adopt Ethereum applications if it makes them complicit in global warming by way of mining. Leaving proof of work behind for proof of stake may be a necessary step to keep the likes of Ernst & Young, FedEx, Microsoft, and Santander on board. And when those guys start using it earnest, that's when the market cap of Ethereum will spike.

As a libertarian, if someone approached you on the street and offered to sell you a 90" 8K TV for $100, are you morally obligated to reject the offer? How about if he says his aunt died, waves her death certificate in front of you, and lowers the price to $50? Still obligated not to buy? Are you making the morally or libertarian-correct decision by turning around and walking into Wal-Mart to buy a 60" 8K TV made in China for $2000?

I won't tell you that crypto isn't a scam. I also won't tell you there can never be a moral obligation to part a fool and his money.

"Cryptocurrency was sold as a way to anonymize your transactions. "

By whom? You can, today, go to Satoshi Nakamoto's initial writings about Bitcoin. In those writings everyone is transparently clear that BTC is pseudonymous, not anonymous.

The "selling point" of BTC was that it was a currency that could be traded between people without the government's control- the government cannot control its supply and cannot prevent people from using it. And that has proven remarkably true.

"It's easily stolen from unregulated "wallets" and something like 20% (30%?) has been irrevocably lost."

It is not any more easy to steal than your bank account, if you make the mistake of doing so. The "20%" is based on 1) a sum of money that hasn't moved since the beginning of bitcoin, and likely was lost when people who mined the coins never bothered to save their wallets and 2) intentional burning of the currency.

But that has nothing to do with the coin you have. If you are responsible with your wallet, then if other people lose their coin, so what? What is likely to happen is most people will never interact with bitcoin, they will interact with a layer 2 derivative.

Ctrl+F 'anonymous':

Except that a brokerage operates under the the same 3rd party pretext that the banks do. One does not simply walk onto the floor of an exchange, cash in hand, and say "I'll buy a million shares of Tesla." while all the brokers stare at each other wondering who that guy is. They go through a broker, i.e. one, or two trusted third parties.

Ctrl+F 'pseudo': No results.

Some pseudononymous individuals might say this makes you a disingenuous, if not lying, shitbag.

Except that Bitcoin doesn't reflect the amount of excess productivity in the economy because its creation rate is constant. If the economy threw twice as many resources at it, it would just become twice as hard to mine, thereby keeping the creation at a fixed rate.

While there will likely be ways to unlock the stakes, there won't be a way to stake more money than exists, as in a fractional reserve system. I do think most people's assumption is that the vast majority of the coin will be staked. So, ultimately, PoS air drops coins at a fixed rate proportional to one's ownership of the coin and PoS air drops coins at a fixed rate proportional to one's ownership of ASICs. Is there a reason why one makes a better currency than another? Both would seem to be inferior to a currency backed by a fixed amount of an asset as opposed to increasing at a constant rate regardless of excess capacity thrown at it.

But again, this isn't about "consuming lots of energy."

It's just one example of regulatory capture and being a bad neighbor.

And then they use this example to somehow make zoning look bad?

It actually isn't even clear to me that- absent subsidies- Texas is really a good place for data centers. Yes, NatGas power is very cheap there, but the cooling costs are outrageous. I've worked with some of the most efficient datacenters in the country, and they have all tended to be in the north where power is so cheap they give it away (in return for job creation) and you only have to actively cool the datacenter some 2 - 3 weeks a year. When there is a heat wave pushing that up to 4 - 5 weeks a year, these datacenters bleed red.

To be fair, Bitcoin is probably more profitable (for now) than ad-supported web sites, but it is also way more volatile such that I have a hard times seeing how they are getting reliable loans to build this infrastructure without some wildly optimistic subsidies.

Behind all this is China, BTW. They want bitcoin as a reserve store of value, but they do not have the energy to spare mining it, so they are encouraging all of their BTC companies to move to the US where they are greasing palms and using their "Special Relationships" to setup subsidized mining deals that may very well not be economically sound.

Didn't China recently ban crypto mining?

Nevermind, that was apparently addressed in the article.

This wasn't fully discussed in the article, but China is still quite open to Etherium and many other alt-coins. And the companies coming over here to use our excess electricity are still Chinese owned, including all the ties to the CCP that it requires. China didn't ban bitcoin so much as they have banned mining of bitcoin on their electric infrastructure.

Chinese miners still own a significant (15 - 20%?) amount of Bitcoin in circulation. Don't think of China's recent actions banning bitcoin transactions as anti-btc. It is more like Executive Order 6102 in the US that confiscated all gold bullion for the government. This wasn't anti-gold- it was a clear recognition that the sovereignty afforded by a stable currency was so important that citizens shouldn't be allowed to have it.

A lot of Texas natural gas production is in the cooler North/West portions of the states. It's not Montana, but it's not San Antonio, either.

"It is the age old problem of connected corporate interests working hand in hand with the bureaucracy supposed to regulate them, against the interests of the local population."

Blue Ribbon comment.

At least noisy crypto mines don’t chop up eagles the way noisy wind turbines do.

The solar plant you see on the I-15 as you drive into Vegas from SoCal incinerates 6,000 birds per year.

https://www.youtube.com/watch?v=emBY6phmn9E

The birds ignite in flight.

The birds are unvaccinated so totes ok.

Q: Do birds in flight have a carbon footprint?

A: Not if we convert to solar.

They just become carbon...no CO2...

Feature.

See the Utube vid " woodpecker has a bad day.,

FJB

Feature.

"Prior to the ban, as much as 80 percent of new cryptocurrency was being minted by Chinese mining operations, according to Nikkei Asia. The industry is now fleeing the country, with North America being the primary destination."

Emperor Xi shut that down for a number of reasons, some of which have noting to do with maintaining government control of the currency. Employment in China is largely manufacturing driven, which requires a lot of power, and crypto mining operations don't use the power they consume to create as many jobs as a manufacturing facility. Xi wants to keep the cost of power cheap for manufacturers--even as the government tries to shift away from using so much coal.

When the regulators come for cryptocurrencies in the United States, it'll be over similar concerns. It won't just be the environmentalists. It'll be because people are angry about skyrocketing energy prices. When people can't afford to heat their homes in the winter because somebody on the other side of town is paying a premium to use that energy for cryptomining, politicians turning against miners will be an easy sell. Populists Republicans railing against the elite and environmentalists will come together on that issue.

I wonder if Dutch tulips were cultivated on land used for food production and resulted in driving up food prices (due to scarcity).

I touch on this above, but this is one of the key points of a currency that many people have not realized- the currency needs to represent the tradeoffs between the producer producing the currency and doing something else with that excess productivity. In the past, people just called this "Scarcity"- the notion that a currency should be hard to come by. But really, it should be "hard to produce"- except to accept that definition is to realize that fiat currency isn't really a good currency.

If tulips had been durable, they might have made a good currency since they generally met all the other requirements of a currency (portable, fungible, even divisible into petals I suppose).

But in fact, one of the reasons the tulip crash was so damaging was exactly as you said- the Dutch had moved so much production over to Tulips that they were relying on those sales (and derivatives on the sales contracts) to cover the cost of importing instead of growing their own food.

Read my tulips. No new taxes.

Do you know what is better than roses on a piano?

Tulips on my organ.

If you can provide a miniature keyboard, Joe Friday can whip out a tiny pianist.

I have the World's Smallest Violin for the bit players and a Big Axe for the headliners I can bring to the session.

True. Bitcoin and others have a limit that can be produced, some don't.

I don't know what the future holds here. Some blockchains show promise. Bitcoin...ugh...really it's just that it was first to market and big name.

Honest you can say the same thing for stocks. Good earnings, it crashes because of guidance. Or drops because of the Fed rising rates. Is the stock really tied closely with the company or just sediment?

I think that many BTC maxi's don't realize that Bitcoin's value is precisely in its ability to mint new bitcoin on par with the economy's growth.

Satoshi Nakamoto (the person, or the group of them, who knows) had some brilliant ideas, but they just took for granted that "scarcity" is what makes a currency useful. As I note above, it isn't scarcity, but rather than a producer of new currency has to make a tradeoff in their own productivity to mint new coin. If I can mint new coin for free (a la Fiat), then I have incentive to inflate away the currency in order to spend it.

But if it costs me productivity (capital) to mint a currency, I have a choice. I could use that capital to do something to buy the currency from others (grow food, perform goods and services, host cloud applications). Thus I am always forced to make a tradeoff- spend money to mint new currency, that will inflate a tiny bit, or spend money to make money doing any other thing demanded by the economy.

Bitcoin's problems will start when the mining cap is hit. My bet is that in 4 more years people will realize that they need to keep minting new Bitcoin, and that will be ok. True, you cannot get your bitcoin and hold it for 10 years and it be worth a billion dollars. But instead you can get your bitcoin, and it has the same general value in 10 years. That would be a huge win in and of itself compared to fiat.

Don't forget to calculate in the fact that for manyyears the export of tulip BULBS was very strictly prohibited, as they wanted to guard all production at home in Holland. But, as always, SOMEONE managed to smuggle enough bulbs out of the country to break their monopoly on cultivation. That was one of the major factors leading to the crash.

SOrt of like silly US exporting so much production to China we got cheap goods for a while.. but now with tariffs, supply chain and transportation issues, quality issues, China's slowdowns )purportedly"due" to the virus they exported to the world) etc, have proven that to be bad policy.

When people can't afford to heat their homes in the winter

But Ken, what if they're just trying to power their 'just really popular' EVs?

True. I've also heard that it uses what 2% of the world energy but no-one can really prove that figure.

Funny, people will be upset here but most parking lots have lights on constantly. Cities are always bright. Basically, we waste a lot of energy. I'm not saying that it isn't needed (Crime) but still.

I'm fan of other chains then Bitcoin. Bitcoin was the first but I think some of the other chains with smart contracts are much more promising.

Can't fans be designed not to produce those annoying frequencies? Or better yet, can't cooling techniques be designed that can recapture some of that heat and use it to generate more electricity? Could Peltier coolers do that? The same energy being converted several times from electricity to heat and back again? (Obviously not with 100% efficiency, but still a significant fraction of it.) Or perhaps capture the heat and pipe it (as hot air) to buildings that need to be heated?

"Could Peltier coolers do that?"

A Peltier device moves heat from one side of the device to the other side of the device, creating electricity and additional heat. The process of taking heat to produce electricity, always results in waste heat. Fundamentally you are either producing more heat (counter productive) or you are merely moving heat around (with more heat, but this is basically what an air conditioning unit does at very high efficiency).

In general, the laws of thermodynamics makes this tricky.

Alternate energy fantasies violate the laws of physics.

No, you have no leading questions that arent known already...

There are industrial grade/capacity air movers that are very energy efficient AND quiet. Not cheap... but most ikek far cheaper thanhaving to up stakes and shift the entire operation off to somewhere less grouchy.

Setting up multiple enterrises sharing common or proximal space could easily

One thought I had was to place the BTC mining operation next to a controlled atmosphere grow operation. The excess heat generated by the mine could easily be pumped off (use a total liquid interface and tarnsport system) to raise the temparature inside the grow houses. Run grid of tumes in the soil underneath the structure,, warming the ntire patch of soil. Use that same heat to maintain optimal wter temps for an aquaponic operation, which heat would also be thrown off into the structure housing the whole operation. P3rhaps etablish some in-open-ground beds for dissipating excess heat in warmer months. Locate near a geothrermal source, convert that heat and pressure to electricity to power the fluid pumps, return some of the warmed water to the generator plant loop. Get a few undred acres in the right area, no neighbours close enough to even know you are there, let alone hear any noise. Crank out BTC and good food. A full sectioin or two might be a good size to start with. IN the right location.

stupid comment.

A few hundreds of watts/ KW arent worth keeping.

Its entertaining to see you conspiracy nuts and tech wannabes flail around with your fantasies.

Making bullshit up is fun, huh?

Sadly for the idiots in TN, bitcoin mining will do just fine without them.

Something about miners and learning to code?

Yes we wont be UNDER it when it goes down like Kamala on Willie.

Yes, we idiots should learn to love the sound of nature on our property replaced by the constant whine of jet engines. All you city people love it. Why can't we?

>1,400 and 3,500 watts of power

So.... a hairdryer?

>Other people who spoke to the Journal described the sounds of bitcoin mines as akin to the whine of a jet engine, a dental drill, or thousands of hair dryers blowing all at once.

Yep. Exactly like a hairdryer. That's not ok, and exactly what zoning laws are designed to prevent.

and

"The average energy consumption for one single Bitcoin transaction in 2021 could equal several hundreds of thousands of VISA card transactions."

https://www.statista.com/statistics/881541/bitcoin-energy-consumption-transaction-comparison-visa/

While the marginal cost of a bitcoin transaction might be close to zero, we do need to account for the energy required for mining the bitcoin.

For an apples to apples comparison, we need to account for the fixed energy costs of a VISA transaction as well.

For an apples to apples comparison, we need to account for the fixed energy costs of a VISA transaction as well.

Knuckle-buster, weekly-settlement fixed energy Visa costs or EMV, screen-for-fraud-and-update-your-account-near-instantaneously fixed energy costs of a Visa transaction?

Surely the writer is confusing watts with watt-hours-per-[time period]? Even assuming a 5v processor (not a good assumption these days, I suspect) that's 700 amps that would be required for an instantaneous power usage of 3500 watts! Pretty damned big arc-welder territory, and no you aren't getting that much current flow into any kind of computer motherboard.

Now I am confused.

Reasonistas are loudly against zoning, at least when some property owner tries to keep his neighbor from turning a single family home into a 12 apartment hobo camp complete with pot dispensary and massage parlor.

But now we want to debate about living near a buzzing box?

Have you ever lived next to a constant noise source? Especially when it's a high-pitched whine, after about a week of that earworm you are ready to commit arson for a good night's sleep.

40 hours a week in the middle of a room full of hair dryers makes two weeks in the middle of nowhere seem like a vacation and I'm of the age where I'm empirically less sensitive than many of my younger peers.

We live out in the country, among other reasons, because we can't stand that constant noise.

Asshole ( Bidens) at it again. Or never stopped...

He has more ManDates than Buttigeg.

Now hes attempting to interfere with insurance contracts to force them to pay for virus testing.

Fortunately Pres. Depends is out, his own Party cant stand him.

It creates no jobs, creates nothing tangible, is a noise nuisance and uses ungodly amounts of electricity, what's not to like. Fuck bitcoin.

itll be entertaining WHEN bitcoin goes down like Buttigeg on his BBF and the suckers lose all their dollar denominated inputs.

Ha!

I wont be under it.

Is the relevance that Biden pays for his Man-Dates with bitcoin?

The author didn't do much research. Yes, Bitcoin and Eth are currently power hungry. Eth actually is going to proof of stake as Ken have pointed out.

Solana achieves consensus using a proof-of-stake mechanism, as well as a "proof-of-history" mechanism

Point is there are more then just POW

This is line the False Meme of " phone chargers waste energy when not charging."

Its a lie. Wal Warts USED to use a microscopic amount when they used transformers, but theyre all Switchmode supplies now ( 90+ % efficient) and they turn themselves OFF when not charging. Microamp currents on idle.

Similar with this False Meme ( or sarcastic meme).

A very SMALL number of BC miners use a lot.

Not a lot of users. Wont even show up as a blip in utility co. data.

I again push back against this notion that proof of work is some sort of bad thing.

People who let this slide basically accept the notion that people in general can dictate what is a "good" use of productivity. Proof of Work is an energy intensive process that secures a distributed, secure network of currency that represents A TRILLION DOLLARS (give or take) in economic activity. Who is some asshole environmentalist to say it is a good use of energy. If they don't think it is a good use of energy, don't buy bitcoin and instead buy something else.

Those same asshole environmentalists say a truck is more car than you need, a gas furnace is more heater than you need, nobody needs 23 different types of deodorant and a whole lot of other "I'm super smart so obviously my preferences are always 100% optimal". Stop giving them this power.

If Bitcoin's energy intensity really is "wasteful" then the utility people get from using Bitcoin will not be enough to justify the energy required to mine it, and the hash rate will decline to the point it is either in equilibrium or stops working as a currency. Fretting about whether it is a good use of energy is evil and anti market.

You are on to something signficant here.

WHatever happened to a true free market policy? SUre, don't do something that makes ejough noice to upset your rose-smelling neighbours. If they DO complain, be prepared to invest in what it takes to return the 'hood to what it was before you got there, noisewise, at any rate.

On the other hand, sometomes that same neighbour will have a dog that barks and howls all night long, or a cat that sits under my window and fights with other cats he lures over . Or maybe his yard is so full of ugly molehills you can't even see the green. Living in the same county sometimes requries abit of give and take.

I will admit, though, that the large volume and particular sound of these operatioins IS an issue... but, when allowed to deal with it in their own way, anyone who wants to do so can easily take care of the situation. Noise IS a nuisance.. but since it is a physical thing that follows certain mechianical laws, it CAN always be dealt with.

I remember back when the early diesel railroad engines made an incredible rumble as thye ran along, and emitted HUGE clouds of noxious black smoke. Then the menufacturers went to work and fixed both of those problems. One can barely hear today's engines from any distance, and one almost never ever seens any detectable smoke emitting from them. HOW did this happen? The engineers who design them put on their thinking caps and found ways to limit both the noise and noxious exhaust by fine-tuning the engines themselves, learning how to control fuel delivery (volume, character, and timing) in such a way that the engines in use for more than twetny years burn a small fraction of the fuel they used to consume, emit almost no detectable exhaust (sight or smell) and run far longer than tey used to run before overhaul. And there was NO gummit regulation driving this. It was purely a case of lowering operatioinal costs to the railroads. An industry cured its worse offenses, no government provocation or threats.

Tjis industry is new, and if gummit backs off and allows the key players in it to work out the issues, it will all be solved. Now, that does not meen they can continue to drive people berko with noise and other noxious "emissioins", but for gummit to make up their collective weak minds that "Not In My Backyard" is the standard, things will not "go well" long term.

Seems like some of the gummit response to these bit farms has been more NIMBY and we say so because we can have been largely driving things. The owners/lessors of the land they are using have their rights as well as those already there. Soewht like the regulators coming down hard on Los Angeles Internaiotnal Airport when some eedjits bought houses under the east and west approaches to the tarmac, complaining about "the noise" that had been there for decades already with no gummit action. If all parties put on their Big Boy Pants and decide "we can work it out" guess what? They WILL work it out.

"WHatever happened to a true free market policy?"

That went down the toilet with NAFTA.

When Govt chooses winners and losers everyone ends up losing.

Just one "Carrington Event" will destroy most of the little shoe-string crypto mines. Too bad, so sad. The crypto mines that survive will be deeply shielded, hardened sites with UPS for 6 months.

If we get to a point where that much of our bitcoin mining is destroyed, your problem is that most of our electrical infrastructure will be gone as well. No power grid, no internet, no cell phones, no trains or trucks to deliver food and supplies. It will be less important to check your bitcoin, and more important to check your ammo stores. Los Angeles 4 weeks after such an event will be a place where no dollars, bitcoin, gold or anything will buy you anything. Any food you have will be protected by a gun or belong to someone else.

Los Angeles after 4 weeks will have hardly anyone still living.

Wait for it....

....

quakes coming in 30 years.

Portland M 9.2 PLUS " not " if" but " when"

Its close enough that we left the NW to not be under the stampede of those fleeing.

In the unlikely event that anyone is interested in facts, the problem in Plattsburgh isn't noise, it is that the city power department has a long term deal to buy 103MW/mo at a favorable rate from nearby power plants on the St Lawrence river (not Niagara falls as often misreported) and when the bitcoin miners make them go over that, the price more than doubles.

103 MW is cell phone power...

I don't get from the article that the author truly understands bitcoins.

Bitcoin is not an industry. All those resources and energy do not create anything. It is hugely wasteful, and contains truly epic negative externalities to third parties.

POW is a much better alternative. One that should be encouraged by forcing current non-POW bitcoin miners to pay for their negative externalities. The more the real cost of non-POW bitcoin mining is properly assigned to their miners, the more POW bitcoins will be adopted.

I get from your post that you don't understand bitcoin (note it isn't plural).

"All those resources and energy do not create anything."

Yes they do. They create a distributed, digital, cryptographically-secure ledger of transactions from people participating in the payments eco-system.

"It is hugely wasteful,"

No it isn't. It is exactly as energy intensive as necessary to secure a massively distributed, digital, cryptographically secure ledger. If the amount of economic activity requires more energy, the system automatically scales up and when activity is low on the chain, the system scales down, avoiding waste.

"contains truly epic negative externalities to third parties."

Citation please.

"POW is a much better alternative."

Do you mean PoS?

"The more the real cost of non-POW bitcoin mining is properly assigned to their miners, the more POW bitcoins will be adopted."

Assuming you mean Proof of Stake, there will never be a PoS Bitcoin, so this sentence is incoherent.

So, a countertop toaster oven. The horror!

bs.

They dont have enough heatsink area.

Zoning laws have been killing American business for years. Many of these plants were built far from homes only to have people build next to the then complain. Unless these laws are stopped there will be no more investment in America and everyone will be jobless.

Thank you so much for the information. its really very useful

relax...now we have China and Wal Mart to kill US businesses! Zoning be dashed.

Zoning rules are typically reasonable and easy to understand. The reason the author is calling them terrible is because they have the opinion that these rules shouldn't apply. Bull crap. There is no reason that these facilities shouldn't follow the same rules as any other business would. In no way should you be able to build ugly crap that negatively impacts others just because you are cheaping out.

Crypto-money only works if it is freely traded, free from govt. control and therefore unstoppable, untouchable. Therefore, if law can stop it, it's worthless.

Just like with free speech and public accommodations, not exactly. Just because the government doesn't control it, doesn't mean it's free speech/enterprise/currency.

A big deal is made about crypto being decentralized but, definitively, no blockchain is decentralized. It's an authoritative techno parlor trick whereby 10,000 mom-and-pop stores don't count as being decentralized because the ownership and all the employees work in one building and they all use the same currency, but Wal-Mart isn't centralized because there are branches all over the world that report back to corporate, which doesn't have one office either. Nevermind that 5,000 of the 10,000 mom-and-pop stores will sell you ammo over-the-counter, no questions asked while all 10,000 of the Wal-Mart stores won't sell you ammo, no way no how, because of an incident that occurred at one Wal-Mart in TX.

This isn't to say that BTC or blockchain is inferior to non-blockchain currencies, just that the claims of decentralization, rather than distribution, are false.

Even if the fans disturb the neighbors, a decent legal system would let neighbors sue the miners for the disturbance. Zoning is always just a way for NIMBYs to forbid development they don't like without having to prove harm.