How a Sneaky Crypto Crackdown Plot Blew Up the Infrastructure Bill

Cryptocurrency advocates fight back against major government overreach.

There's a lot to dislike about the so-called "infrastructure bill." It's a trillion-dollar spending package in a time of creeping inflation. Much of it has nothing to do with "infrastructure" at all but is more like a dream Democrat spending bill with a grab bag of hobby horse handouts. And now, the fate of this financial free-for-all-insiders hangs in the midnight balance over a legislative dispute over cryptocurrency consensus mechanisms. Serves them right!

Congress still cares a bit that their spending bills appear to budget neutral—on paper, at least. So staffers worked hard to shake out the federal couch cushions for any kind of loose change revenue sources that might make the infrastructure bill appear to be less of a debt-fueled going-out-of-business bonanza. Crypto is hot. Crypto makes money. Crypto is…weird. No one will notice. Why not slice up this digital cash cow? Should be worth at least a cool $30 bil.

It should be noted from the start that cryptocurrency is already taxed. It has been considered a property for federal tax purposes since 2014, which means that users are subject to capital gains taxes. Users must keep track of the dollar value price of a cryptocurrency when they purchase it and again when they sell it, then pay a tax on any appreciation in the interim.

It's not ideal, as it makes everyday purchases a pain in the butt to track for no good reason. And policy analysts have repeatedly asked the IRS to clarify important questions on the tax treatment of cryptocurrency for years, to no avail.

And yet the feds act surprised when they report that cryptocurrency taxes are underpaid by some tens of billions of dollars a year. The IRS could have saved itself a lot of postage from sending thousands of letters to cryptocurrency users warning them of tax obligations by just rationalizing their rules.

Enter the "Infrastructure Investment and Jobs Act." Go ahead and flip to page 2,434.

The original bill text stated that any "broker" of digital assets would be required to "make a return for such calendar year…showing [the required information]" for tax purposes—in other words, issue 1099 forms to customers.

That would not be controversial if it only applied to entities like exchanges that act like middlemen or brokers in the traditional sense. (In fact, exchanges have been begging for some kind of tax clarity for years.) This simple approach might even help the feds pretend like their spending package was "revenue neutral" by scrounging up more couch satoshis.

But the bill used an extremely broad definition of broker: "any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person." When it comes to cryptocurrency, that could mean basically anyone who runs or builds network software—not brokers by any stretch of the imagination.

Consider miners who add new transactions to the blockchain. They do this using what's called a consensus mechanism like "proof of work" or "proof of stake"—basically the rules about how new entries get stored in the ledger of transactions. These miners "effectuate transfers of digital assets on behalf of another person." So do software developers who build the tools that people use to transact. This loose language could even ensnare higher layer tools like the Lightning network that allows instant bitcoin payments. These are clearly not "brokers," yet they would be treated as such by this law.

The problem here isn't primarily a tax burden, since these entities wouldn't be paying a tax. It's a surveillance burden. All kinds of non-brokers would be legally required to obtain government tax forms for anyone who happened to use their services—or just pack up shop. This means collecting personally identifiable information like user identity and location.

It's bonkers, and it reveals a real ignorance about how these technologies work. Not only should passive network operators not be expected to collect this kind of information, but they usually can't. The idea of requiring a miner to solicit a 1099 form before processing a block is too absurd to entertain. Congress, ladies and gentlemen.

Congress might have thought they could kick around those weirdo cryptocurrency people to gussy up their debt lust with no fight. Boy were they wrong.

The cryptocurrency community—they call themselves cyber hornets or honey badgers—quickly pounced. They pointed out the unworkable absurdities discussed above. They formed alliances with other technology rights organizations to amplify messages. They called their senators. They coincidentally even got strange social media influencers to join the crusade. The Senate was quickly overwhelmed. By the end of the week, proof-of-work was something of a household name—at least in D.C.

I wouldn't have expected that consensus mechanisms would be the sticking point that would hold the nation's latest Hail Mary stimulus-by-another-name hostage in a drawn-out battle of dueling backdoor amendments over an agonizing weekend. But after these past two wild years: why the heck not?

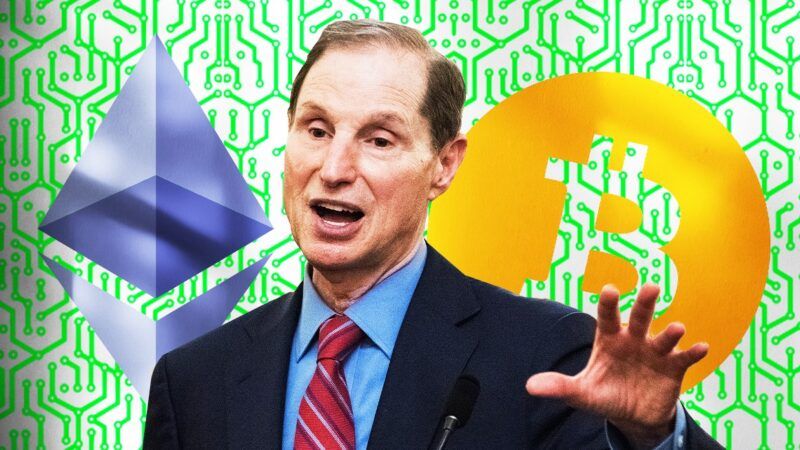

Here's how the amendments shook out. One fix offered by surveillance-allergic Sen. Ron Wyden (D–Ore.) and bitcoin-savvy Sens. Cynthia Lummis (R–Wyo.) and Pat Toomey (R– Penn.) would explicitly exempt activities that would:

[validate] distributed ledger transactions, [sell] hardware or software for which the sole function is to permit a person to control private keys which are used for accessing digital assets on a distributed ledger, or [develop] digital assets or their corresponding protocols for use by other persons, provided that such other persons are not customers of the person developing such assets or protocols.

It was a definite improvement. The drafter of the original text, Sen. Rob Portman (R–Ohio), said that the bill was not intended to ensnare these activities anyway. This amendment would make that clear. Sounds like a closed ticket to me. (There was a subplot involving an amendment from Sen. Ted Cruz [R–Texas] that would have just struck all cryptocurrency language altogether, which would obviously be ideal but unfortunately was not feasible in the august and serious halls of our top legislative body.)

But Portman did not back this language that would have achieved his stated goals. Rather, he joined up with Sens. Mark Warner (D–Va.) and Krysten Sinema (D–Ariz.) to offer his own decidedly inferior product which would only exempt "validating distributed ledger transactions through proof of work (mining), or selling hardware or software the sole function of which is to permit persons to control a private key (used for accessing digital assets on a distributed ledger)."

How bizarre. Why support this narrower amendment? Why not exempt open-source developers? The biggest sticking point ended up being the weird reference to proof of work, which technically does not in fact validate transactions (nodes do that) but also is not the only kind of consensus mechanism.

Proof of stake, for instance, is not as tested or popular, but runner-up cryptocurrency Ethereum is planning to move to that system soon. Ethereum folks started going nuts.

Then we heard news that the Biden administration and Treasury Secretary Janet Yellen in particular were lobbying aggressively for the inferior amendment behind the scenes. Most decentralized finance ("defi") technologies that allow middleman-free financial trading are based on Ethereum. Defi was recently in the congressional crosshairs with a hearing that set up the pretexts for eventual intervention. Was this a stealth attack on defi all along?

Maybe not. Portman-Sinema-Warner eventually relented and added proof-of-stake to the exemptions. But that's still not good enough. Who knows what other consensus mechanisms could theoretically emerge? It would be as if Congress passed a law establishing Betamax as the preferred legal standard in a random tax bill in the 1980s. There is just no need.

It's a big mess. There was a last-ditch attempt at a compromise amendment that Portman et al. got behind that somewhat tightened up the broker language to better exclude passive network contributors. It failed to get the 100 total votes needed, so this stinker of a bill is headed to the House, where there is another chance to get the language fixed. What a great way to decide the future of one of the most innovative industries.

If it was just about lost tax money, all of this could have been avoided if the IRS simply updated its rules on its own to issue some much-needed clarity. There is no need to craft exotic definitions of exempted brokers right before the assignment is due. (This is to say nothing about the major problems with our existing financial surveillance system that this bill builds upon—and the open question of how the administrative state will choose to interpret this law.)

But of course, this is about more than tax money. On a simple level, it's about making this bill look like it's affordable when it clearly isn't.

On a deeper level, everyone knows this bill is not about infrastructure. Everyone knows it will not be paid for. Everyone knows that no one really reads these mega-bills anyway. Congress is used to getting away with it. They didn't account for how engaged and effective the crypto community can be.

This brouhaha is just another entry in the sad and growing annals of institutional decline. Actually, it's a good advertisement for buying bitcoin. Just remember that you may not always be able to count on cryptocurrency policy advocates to eventually win the day.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

As the Biden regime continues to erode the value of the dollar they need to punish crypto as it becomes a more viable alternative. The dollar will remain the “world currency” for the remainder of Creepy Joe’s lifetime but probably not Harris’.

Yep.

Fantastic work-from-home opportunity for everyone… Work for three to eight a day and start getting paid inSd the range of 17,000-19,000 dollars a month… Weekly payments Learn More details Good luck…

See……………VISIT HERE

TLDR: The bill is bad.

I'm convinced that they write these things in some kind of circle-jerk, where everyone has one hand on their genitals.

And they make the taxpayer eat the soggy biscuit.

Everyone knows it will not be paid for

Weimar inflation levels are the goal, not an unwanted side effect. It's no secret the in the last four years governments, billionaires and multinationals have been borrowing unprecedented, record-breaking amounts, and plowing it into infrastructure and land.

"... billionaires and multinationals have been borrowing unprecedented, record-breaking amounts, and plowing it into infrastructure and land."

Which PROVES to "poor" and envious right-wing Marxists (like MammaryBahnFuhrer) that, just exactly like privately owned websites, ALL of these goodies need to be confiscated from the evil capitalists, and be, instead, controlled by MammaryBahnFuhrer and minions, via Government Almighty.

All HAIL, Comrade! Hail MammaryBahnFuhrer!

Here, let me try your gobbledygook: "Sqrlsy, scourge of the weak. A junior fascist on a mission to afflict the afflicted and comfort the comfortable."

Did I do it right?

Now fire up your brain cell and try to explain to me just why you think corporatism is good from a libertarian perspective.

Calling for control of other people's property and justifying it simply by calling them-it (anyone and their shit that You want to steal) "corporatism" is just another name for Marxism, MammaryBahnFuhrer! Jawhol, comrade!

"You shall not covet your neighbor’s house. You shall not covet your neighbor’s wife, or his manservant or maidservant, or his ox or donkey, or anything that belongs to your neighbor.”

MammaryBahnFuhrer, Renowned Christian Theologian, should know these things! "Anything that belongs to your neighbor” includes web sites, MammaryBahnFuhrer! Or did Jesus tell you otherwise? Or was it Marx? Are Jesus and Marx the one and the same, in Your Theological Mind, maybe?

There's nothing "creeping" about inflation.

It's a 'scientific' fact that the more abundant a USD is the less *value* it contains BECAUSE political printing of USD'S doesn't *create* value. What it does do is makes every *earned* USD be worth only a proportion of the *value* it took to earn it.

It is 'fiat' theft and forced theft of labor is slavery.

Uuuuuh, delayed does not equal “blew up”. What is this pathetic wishful thinking bullshit? The senate is getting ready to vote on this shit right at this very moment, it’s going to pass and go to the House, and believe me when I tell you that the plastic Joker-faced old hag running the House isn’t going to waste a lot of time before ramming it through in its current form. The congress critters want to go on vacation already.

This is what you wanted Reason, so this what you’re getting. It’s a little too late for you to have buyer’s remorse now!! I’m afraid there’s nothing left for you to do now but bend over and spread those cheeks wide. Janet Yellen has a raging powerboner and she’s coming in hard, whether you like it or not.

This is going to be “interesting”.

It is pretty important to mention that the mechanism they are trying to destroy via taxes and regulation, Proof of Stake, eliminates the absurd energy usage of software like Bitcoin.

Is it too cynical to think some Top Men would like to be able to keep the handy "but it uses too much energy!" argument in their toolkit?

any reason a spending bill blows up is a good reason.

Cryptocurrency advocates fight back against major government overreach.

I'm still confused. If crypto is done right, and reaches its full potential, there's nothing government can do about it.

Right?

i like cripto for making Computer Full Form in high definition