Federal Banking Regulations Force Legal Weed Entrepreneurs To Behave Like Criminals

Federal law doesn't prohibit financial institutions from offering banking service to dispensaries and growers, but the added reporting requirements and threat of federal scrutiny keeps many banks away.

When he was first breaking into the legal weed business in 2011, Joel Pepin did what any sensible, aspiring marijuana entrepreneur would do. He didn't tell his bank how he was making money.

"You give them an LLC name and you're sorta vague about the rest, you know what I mean?" Pepin recalls.

He was running a legal business, but if Pepin wanted something as simple as the ability to purchase equipment with a check instead of handing over stacks of cash, he'd have to behave like a common criminal. It's an uncomfortable legal grey area that continues to afflict most of the businesses within America's booming marijuana economy—thanks to federal financial rules that haven't caught up with state-level legalization efforts.

And it's a struggle to stay one step ahead.

"We had accounts shut down at two different banks," Pepin tells Reason. "Once you have transactions where there are comments written on the bottom of the checks for 'wholesale flower' or that type of thing—they figure out that you're working in marijuana, and they write you a letter to say you have to pull out your funds and close the account or else they will do it for you in 30 days."

Things have changed a lot for Pepin since those early days. Today, he's the co-owner of JAR Cannabis, which has 40 employees, two cultivation facilities, an extraction lab, and two storefronts—along with plans for four more—in Maine, where recreational marijuana was legalized last year.

He's no longer scrambling from bank to bank, either, thanks to cPort Credit Union, a Maine-based firm that has bucked national trends and has offered banking services to the state's nascent cannabis industry since 2014. The credit union doesn't offer loans or financing to marijuana-related businesses, but even the stability of knowing that his checking account won't be closed next week gives Pepin an advantage over most cannabis entrepreneurs in America.

Medical marijuana is now legal in 36 states. In early April, New York became the 15th state, in addition to Washington, D.C., to legalize marijuana for recreational use by adults over age 21. There were $17.5 billion in legal sales of marijuana last year, but nearly all of those transactions were conducted entirely in cash. Thanks to marijuana's enduring status as a Schedule I drug, banks that are subject to federal oversight must file Suspicious Activity Reports (SARs) to the Financial Crimes Enforcement Network (FinCEN) each and every time they engage in a transaction with a marijuana-related business—even if the business is fully compliant with state law. The federal law doesn't prohibit financial institutions from offering banking service to dispensaries and growers, but the added reporting requirements and threat of federal scrutiny keeps many banks away.

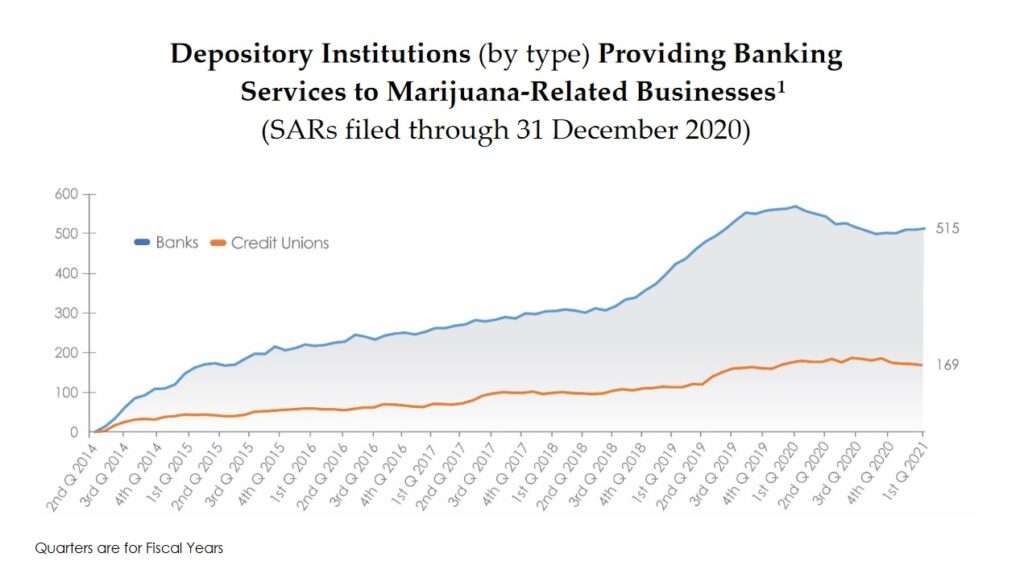

According to FinCEN data, 515 banks and 169 credit unions filed at least one SAR related to a marijuana business during the first quarter of 2021. Both numbers had been steadily growing for years as more states legalized marijuana, but have declined slightly since 2019.

The FinCEN data probably exaggerates how many banks are truly doing business with the marijuana industry, says Morgan Fox, a spokesman for the National Cannabis Industry Association, a trade group. He estimates that the real number is less than one-third of what the federal data would suggest. Because banks are required to file SARs for every transaction that might be related to marijuana, a bank that accepts a single deposit is counted the same way as a credit union that offers its full range of services to a dispensary.

It is hard to get precise figures for obvious reasons, but Marijuana Business Daily, an industry trade publication, estimates that about 70 percent of America's cannabis industry is operating without any access to even the most basic banking services.

Beyond the fundamentals like having a checking account, processing credit cards, and paying taxes, that means cannabis businesses have a harder time getting access to capital to cover start-up costs or pay for expansions. "For smaller growers, especially, that might mean they aren't able to keep up," says Fox. Unless you have a deep-pocketed investor or have been around long enough to build up cash reserves, the lack of banking access means most weed businesses can't scale up.

This lack of access can also be dangerous. Since many pot shops have to operate as cash-only businesses, they are obvious targets for actual criminals.

"We can't keep forcing legal cannabis businesses to operate entirely in cash—a nonsensical rule that is an open invitation to robbery and money laundering," says Sen. Jeff Merkley (D–Ore.), one of 27 senators—including five Republicans—to cosponsor the 2021 version of the Secure and Fair Enforcement (SAFE) Banking Act. The bill would change several federal statutes so banks are no longer pressured to consider state-legal marijuana businesses unlawful. An earlier version of the same bill passed the House of Representatives in 2019 with a bipartisan vote of 321-103, but was blocked by the Senate.

Now that Democrats have full control of Congress, the SAFE Banking Act's prospects look better than ever. Of course, an even better solution to the federal government's restrictions on how marijuana businesses can engage in banking would be for Congress to simply order the Drug Enforcement Agency (DEA) to remove marijuana from Schedule I.

Even for businesses lucky enough to have access to some banking services, like Pepin's, there would be huge gains from passage of the SAFE Banking Act or the descheduling of pot—not just for the businesses, but for the entrepreneurs too.

"As the owner of a cannabis company," says Pepin, "I can't use that income from the marijuana industry to get an auto loan."

He's been running a successful, legal business for more than a decade. It's time to stop treating Pepin and thousands of others like him as criminals every time they walk into a bank.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

"As the owner of a cannabis company," says Pepin, "I can't use that income from the marijuana industry to get an auto loan."

Can't he launder it? Just open another business as a vendor to the cannabis company, and show its income for credit?

https://fstoppers.com/video/559362

Making money online more than 15$ just by doing simple work from home. I have received $18376 last month. Its an easy and simple job to do and its SADAS earnings are much better than regular office job and even a little child can do this and earns money. Everybody must try this job by just use the info

on this page.....VISIT HERE

brwtebev https://primo-profits-review-oto-bonus.medium.com/primo-profits-review-rick-williams-chris-x-vivek-primo-profits-oto-discount-5000-bonuses-a37adfa6e8dd

[ PART TIME JOB FOR USA ] Making money online more than 15$ just by doing simple works from home. I have received $18376 last month. Its an easy and simple job to do and its earnings are much better than regular office job and even a little child can do this and earns money. Everybody must try this job by just use the info

on this page…. Visit Here

Oh yeah, I forgot...wurst!

I wish I had some capital and knowledge of financial services.

I see an opportunity to have a credit card clearing service for dispensaries and gun stores.

Both have trouble with national chains as the big companies won’t deal with guns or pot.

https://twitter.com/TitaniaMcGrath/status/1383749407049359363?s=19

Dogs of colour are woefully underrepresented in children's cartoons.

I've watched "Bluey". Believe me, those dogs are oppressively white.

Especially the blue one. [Pic]

Cripes.

And these are the guys who won. Not the heart's and mind's of the proletariat of course, but these are the ones who now hold all the real corporeal and political power.

Luckily Titania McGrath is a satircal twitter account by the editor of spiked, and not an actual person. Poe's law personified.

https://twitter.com/stillgray/status/1383635013418184708?s=19

Rep. Maxine Waters calls for rioters to "stay in the street" and "fight for justice" against police unless Chauvin is declared guilty for murder, not just manslaughter.

"We got to get more confrontational. We got to make sure they know we mean business." [Video]

It would be more believable if she was actually on the streets.

Incitement.

Sullum must be scared shitless right now.

https://twitter.com/KBoomhauer/status/1383575938630225924?s=19

BLM group has assaulted someone in his own neighborhood trying to get home. Police come and detain the man who was just trying to get home.

#Stillwater Minnesota [video]

BLM is in charge of the police.

#Stillwater Minnesota [video]

Earlier: "If you think black lives matter you can come march with us, you can come join us. If you don't you can stay up at your house. You can stay up in your driveway looking at us like we're doing something crazy when we're just here trying to fight for our lives."

#Stillwater [video]

In some ways, Minnesota has become more insane than Cali and NY.

Stillwater and Minneapolis are both in the extremely blue Twin Cities area. But most of the rest of the state is populated by the kind of people who give hunting rifles as wedding presents (and voted heavily Trump). BLM wouldn't try that shit there.

Couldn’t Biden just pen another executive order and phone someone about removing these silly restrictions? After all, he’s sent Harris off somewhere, so she can’t argue about it.

The liberal-libertarian mainstream has made substantial progress against right-wingers with respect to the war on doobies. It is predictable that better Americans will continue to overcome conservative prudishness and authoritarianism in this context.

Precisely. I voted for Biden and Harris partly because of their career-long commitment to legalizing drugs.

#LibertariansForBiden

The biggest prudes and authoritarians are on the left now. You missed the cultural shift and that makes you - the desperate bitter clinger.

You stepped in your own pile of shit.

Yep. He stepped in himself.

Well... the thing I learned from you guys oh, over the course of roughly 2017-2020, was that whenever some politician did something that sucks by imposing a brand new set of oppressive laws that cause people to be, say, warehoused in a fucking concentration camp that the act of worrying about such politicians or such laws was, in effect, “pants-shitting”. And that furthermore worrying about laws/politicians that suck ass meant that I had “X Derangement Syndrome.” So now, when politicians do something that sucks or lie their ass off I tend to not worry about that. I mean, who wants to be deranged or shit their pants. Not me. Do you? I should probably start a parody account where my real goal is to express indifference to the suffering of people with no power who are being oppressed by the government. That the real goal of libertarians now.

"warehoused in a fucking concentration camp that the act of worrying about such politicians or such laws was, in effect, 'pants-shitting'"

Actually, Koch-funded libertarians like Shikha Dalmia (and commenters like myself) have repeatedly denounced Orange Hitler's concentration camps. Because we were so deeply disturbed by that viral photo of kids in cages.

And as frequently as I criticized Drumpf for building and running those monstrous facilities, I have been just as vocal in crediting Biden for liberating and dismantling them. So please don't act like nobody here was on the right side of history on the immigration issue.

#DemocratsDontCageKids

SleepyJoe just opened another one.

Oh, hi, racist.

I hope you didn’t put much effort into this.

Just re-read it, as you read every comment for the last 4 years, and it will make perfect sense.

"Well… the thing I learned from you guys oh, over the course of roughly 2017-2020,.."

That implies a capability to learn, and as a parasitic pile of lefty shit, that is not possible.

Fuck off and die.

BTW, commie-kid, I notice a new, misleading, handle.

AFAIK, earning the ban-hammer is the only time you need a new one, and getting banned here requires some real scum-baggery.

Did you link kiddie porn like your lefty-shit comrade turd, or what other sort of assholishness got you banned?

Given that you're a parasitic pile of lefty shit, it's not any personal interest to me. I'd just like everyone here to know what got a scumbag banned; you deserve it.

Yeah with shifty sleepy senile Joe in office you can expect all kinds of crazy new laws.

What's the rush? Recreational drugs is the last remaining growth industry under capitalism. We don't have to saturate the market overnight.

Lol.

"Federal law doesn't prohibit financial institutions from offering banking service to dispensaries and growers

Aren't they opening themselves up to money laundering and aiding and abetting charges if they don't file those suspicious activity forms with the government?

If so, that quote appears to be both inaccurate and counterproductive. Why do we need the SAFE banking act if federal law coming after the cannabis industry isn't the problem?

Another question--why haven't the cryptocurrencies directed at the cannabis industry taken off? Enquiring minds want to know.

https://en.wikipedia.org/wiki/SAFE_Banking_Act

Come on Ken, banks don’t do business with the marijuana industry because they think it’s icky and won’t make them money.

Yeah, isn't that an absurd statement I quoted?

Because there isn't a law specifically stating that it's illegal for banks to serve the cannabis industry doesn't mean they can't be or won't be charged with money laundering or aiding and abetting the distribution of drugs.

>Federal Banking Regulations Force Legal Weed Entrepreneurs To Behave Like Criminals

But they literally are criminals, are they not? Until it's legal federally, it's illegal. The executive branch declining to enforce the law doesn't actually make it legal.

This situation is stupid and they should either legalize it or prosecute it. It would increase the stupidity, not decrease it, for Congress to make an exemption in banking laws for an *illegal* product rather than legalizing the product.

"Federal Banking Regulations Force Legal Weed Entrepreneurs To Behave Like Criminals"

Criminals are a protected class now. The "domestic terrorist" group is the undesirable one.

Democrats?

Federal law doesn't prohibit financial institutions from offering banking service to dispensaries and growers, but the added reporting requirements and threat of federal scrutiny keeps many banks away.

They're private companies. They can do whatever they want.

A long time ago in a galaxy far, far away, me and three others bought (very cheaply, since we were poor) the remains of a business which we thought gave us better opportunities than the comatose job market at the time. As luck (and sweat equity; you can make PB&Js for cheap) would have it, we were right.

Except, after some 3-4 years in business, we missed a state quarterly tax payment.

OK, by that time, we do have a bank balance sufficient to cover the amount owing, except for the slight problem that the state had frozen our account; no, they would not 'un-freeze' it to allow payment, so we had to take a short-term note from somewhere.

Turns out the cheapest alternative source was a dealer known to one of us; an early lesson regarding the relative values of gov't and even (illegal) private enterprise as regards running a business.

"I got a guy..."

We’re the largest Credit Union in Central Ohio with all the products and services you expect from a big bank, but with better rates and personalized service. With 10 Central Ohio branches, more than 5,500 Shared Branches. Apply for business credit card.