After $1.9 Trillion Spending Hike, Biden Is Planning $3 Trillion in New Spending

This time with tax increases too!

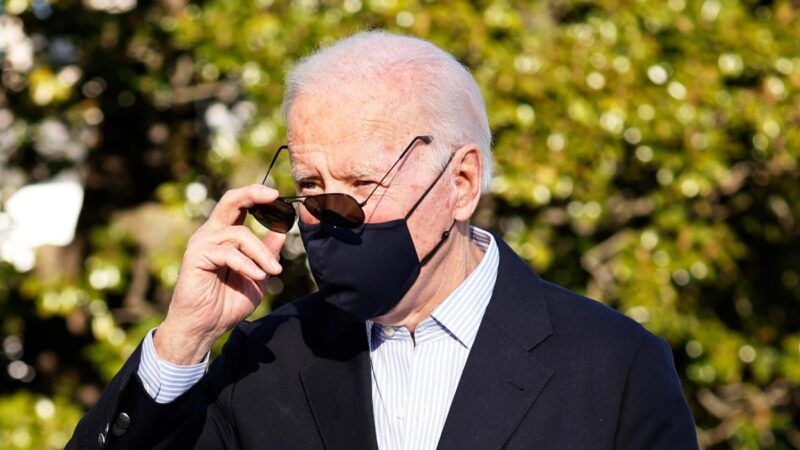

It's been a whole 11 days since President Joe Biden signed a $1.9 trillion spending bill, so naturally the White House is already planning the next, even bigger spending package.

The New York Times reported Monday that Biden's advisors are prepping a $3 trillion hike in federal spending. The money would go to infrastructure projects, climate change initiatives, community colleges, and a variety of other Democratic priorities. The plan may also include higher taxes on businesses and wealthy individuals, but it seems unlikely that the tax increases would offset such a massive spending binge. And that means Biden's plan is almost certain to add to the $28 trillion (and rapidly growing) national debt.

This is the big-time spending package that Biden has been promising since last year's presidential campaign. The pandemic bill passed earlier this month was merely a prelude.

The numbers here are simply staggering. Consider the fact that in 2019, the last full budget year before the pandemic, the federal government spent a grand total of $4.4 trillion. Combined with the bill that already passed in March, this plan represents nearly $5 trillion in new spending.

Though the specifics of the proposal are in flux, it seems to bear some similarities to the $1.9 trillion American Rescue Plan (ARP) that Biden signed into law earlier this month. That bill was ostensibly a COVID-19 relief measure, but only a small percentage of the money was actually directed toward dealing with the pandemic. The upcoming $3 trillion package will be called an infrastructure bill, but the Times says only about $1 trillion would be directed toward such traditional infrastructure items as roads, bridges, ports, and improvements to the electric grid.

The rest of the package will probably be packed with progressive policy items—stop me if you've heard this before—including a new paid family leave program, free community college, and universal pre-K education. The estimated $3 trillion price tag does not include the cost of extending temporary tax cuts, such as the child tax credit expanded by the ARP.

The Times reports that Biden is aiming to raise the top individual income tax rate from 37 percent to 39.6 percent, and that he may propose lowering the threshold for that top rate to $400,000. Currently, it applies to individuals who earn more than $500,000 annually and couples who earn at least $600,000. Biden's team has been kicking around ideas like raising the corporate income tax rate from 21 percent to 28 percent and imposing a higher capital gains tax on individuals who make over $1 million annually.

The corporate tax hike alone would kill 159,000 jobs and reduce long-term economic growth, according to an analysis by the nonpartisan Tax Foundation. Raising the federal corporate tax rate to 28 percent would make the average state-and-federal tax burden for American businesses 32.34 percent—the highest rate in the developed world.

As significant as the tax increases might be, the mounting national debt probably represents the more serious consequence of the Biden administration's plans. Before ARP passed, this year's budget was estimated to be $2.2 trillion. It may be close to twice that high now, before any further borrowing for an infrastructure bill is included.

Thanks to a splurge of federal spending before and during the COVID-19 pandemic, the national debt is now larger than the entire American economy. On its current trajectory—that is, even without any additional new spending—the debt is projected to grow to double the size of the economy within the next 25 years. Even if outlandish amounts of debt don't trigger a major fiscal crisis in the years to come, merely making the interest payments on it will reduce long-term economic growth and Americans' standard of living.

Politically, Biden's proposal will be a major political test for both parties in Congress. With slim congressional majorities, Democrats will have to convince potentially vulnerable members from purple districts and states to support a massive spending bill packed with progressive agenda items. Republicans, meanwhile, have abandoned pretty much any interest in making fiscal policy a political battleground and have retreated into nonstop culture wars.

Speaking on the Senate floor Monday afternoon, Minority Leader Mitch McConnell (R–Ky.) warned that Biden's "so-called infrastructure proposal" might "actually be a Trojan horse for massive tax hikes and other job-killing left-wing policies." That seems like an apt description of what Biden's advisors are preparing.

Show Comments (184)