State, Local Governments Are Posting Surprisingly Sunny Revenue Projections. Democrats Want To Give Them $350 Billion Anyway.

Most states managed to avoid much-predicted fiscal crises during the pandemic. Congress wants to shower them with more federal aid anyway.

Dire predictions about state budget woes turned out to be much too gloomy. Despite this, Democrats in Congress and the White House want to send the states billions more in federal aid.

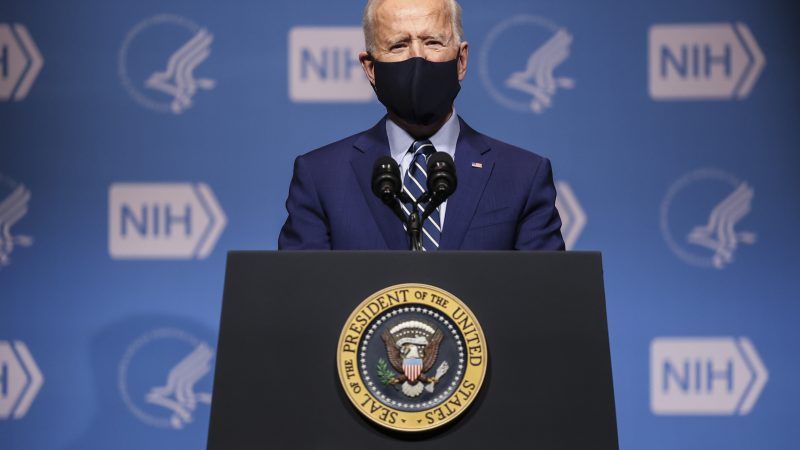

Today, the House Committee on Oversight and Reform is set to mark up the $350 billion in state and local aid included in the $1.9 trillion relief package being pushed by President Joe Biden and congressional Democrats.

The plan, according to a one-pager released by the committee earlier this week, is to spend $195 billion on aid to state governments, and another $130 billion on counties and cities. The other $25 billion would be split between territories and tribal governments.

Most of the money reserved for state governments under this plan will be doled out based on each state's number of jobless workers. Each state is still supposed to get a minimum of $500 million from the feds.

This is in spite of many state governments being in pretty good fiscal shape. The Wall Street Journal reported last week that at least 18 states will close out fiscal year 2021, which ends June 30 in most states, with revenues above projections. State revenues fell only 1.6 percent in fiscal year 2020, despite early estimates that they would fall as much as 8 percent, according to the Journal.

State revenues, on the whole, are still expected to fall some 4.4 percent in fiscal year 2021, according to the National Association of State Budget Officers (NASBO). These declines, nevertheless, come after nine straight years of growing state government revenues.

Leaner revenues compared to pre-pandemic projections are still forcing states to trim their budgets. One NASBO report finds that spending is set to decline by about 1 percent during this fiscal year, which will be the first time in over a decade states enacted a net spending decrease.

"Most states are having to tighten their belts, which is not a bad thing," wrote the Cato Institute's Chris Edwards in a blog post in late January. "A course correction is needed, but there is no broad‐based 'state fiscal crisis.' Most states still have cash in their rainy day funds, and money is still flowing into their coffers from past federal aid packages."

And while the overall fiscal picture for states is one of marginally declining revenues and spending, a few are raking it in.

That includes California, where Gov. Gavin Newsom has proposed a $227 billion budget for the coming fiscal year. The Associated Press reports that this is the largest budget in the state's history. New Hampshire's budget projections are looking good enough that Gov. Chris Sununu is proposing a round of tax cuts.

There's a number of reasons for some states' surprisingly sunny fiscal shape. California's high taxes on capital gains and income have buoyed state revenues in an economic recession that's nevertheless been pretty good to the stock market and high-income earners. Rising home prices in most of the country are boosting property tax revenues, too.

The shift from consumption of services to more heavily taxed consumer goods is also helping to boost revenues, reports The New York Times.

Federal spending is also a major factor. The feds have provided some $300 billion in transfers to state governments. On top of that, stimulus checks and unemployment insurance have also boosted individual incomes, spending, and thus tax revenues.

Showering massive benefits on people and places is a hallmark of the Biden administration's approach to pandemic spending, noted Reason's Peter Suderman last week, writing that "in pressing his case for a deficit-funded $1.9 trillion legislative response to the COVID-19 pandemic and its effects on the economy, President Joe Biden has consistently argued for bigness as a virtue."

The flip side of that approach is that the federal government is accumulating record deficits and levels of national debt to provide these large, untargeted benefits.

Congress has thus far approved some $4.1 trillion in COVID-19 spending, helping to produce record deficits and levels of debt. It's now looking to add more debt to assist states that are in a much better fiscal position than the federal government is.

Rent Free is a weekly newsletter from Christian Britschgi on urbanism and the fight for less regulation, more housing, more property rights, and more freedom in America's cities.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Well, after all, they never suspended lottery sales because of the plague.

Biden said. “We’re going to have a fantastic third quarter. 2021 year is going to be an incredible year for jobs. Here is Job opportunity for everyone! Because of Corona Work from comfort of your home, on your computer And you can work with your own working hours. You can work this job As part time or As A full time job. You can Earns up to $1000 per Day by way of work is simple on the web. It's easy, just follow instructions on home page, read it carefully from start to finish Check The Details.

||||||| Visit Here To Earn Dollars |||||||

[ USA PEOPLE COME HERE ONLY ]

Seriously I don’t know why more people haven’t tried this, I work two shifts, 2 hours in the day and 2 in the evening.

And i get surly a chek of $12600 what's qasw awesome is I m working from home so I get more time with my kids.

Here’s sign up for details.......... AMAZING JOB

Change Your Life Right Now! Work From Comfort Of Your Home And Receive Your First Paycheck Within A Week. No Experience Needed, No Boss Over Your Shoulder... Say GoodbyeBHYT To Your Old Job! Limited Number Of Spots Open... Find out how HERE....... Visit Here

Change Your Life Right Now! Work From Comfort Of Your Home And Receive Your First Paycheck Within A Week. No Experience Needed, No Boss Over Your Shoulder... Say GoodbyeNJK To Your Old Job! Limited Number Of Spots Open... Find out how HERE....... Visit Here

We are enslaving the next generation for decades. But if you point that out to them, they get infuriated. It's the result of public school indoctrination. You'd think they'd rebel but they only dig themselves in deeper. For example, if you tell young people they'll never see a penny from social security and medicare, they will call you dangerously autistic, rabid and high.

Of course, the solution isn't to slink away in defeat (and blame 'election fraud' when the feds squander more trillions) but to keep fighting. Eventually the kids will get it. The war today is online not in the streets (or at the capitol).

the solution is to create an app. Where all the lizard brain and psychological manipulation is done not for the benefit of advertisers desperate to change and brand the buying behavior of 17-35 yo's. But to change and brand the voting behavior of 17-35 yo's using the same lizard brain psychological manipulation.

The solution is to slink away from the fight and blame your loss on 'election fraud' and insist the libs cheated because of course most kids oppose social security and medicare because why wouldn't they and then pop up here and cowardly attack your allies in impotent rage when they challenge your narrative.

So easy!

Right on time with my prediction that Trumpists would start to care about the debt only after Biden takes office.

Welcome back. I've been here the whole time. Where were you when we were running a trillion per year deficit during a boom? Oh, celebrating the "record stock market" with Trump? Well, congrats on being a Keynesian then.

Funny - just what I was going to say about you. Glad you saw the light. Now instead of bickering with your allies here in your safe space, get out there in the real world and fight.

Lol, oh wow.

You two definitely deserve each other.

>>[FOR USA ]<>>> PART TIME ONLINE JOBS

Wars cost money and this civil war 2.0 is gonna cost America in wealth and blood before its resolved.

Deporting American commies to communist china is gonna be hilarious.

Shut up stolen valor

Pusher has to keep the addict high.

It’s only numbers on paper, not real money.

Makes sense, el presidente biden is not a duly elected American president. His banana republic government just cant get any legitimacy.

>>much-predicted fiscal crises during the pandemic

all the bullshit meant to inspire fear in women?

Dollar goes boom.

It's not like they'll be spending this money on all the states and counties and cities, just the ones that need it because they foolishly refused to stop spending money like drunken sailors.

It's kinda like the student loan thing - they're not proposing paying off everyone's student loans, just the loans of students who took on lots more debt than they could possibly handle. The students who took on no debt or only as much debt as they could safely handle don't need their loans paid off.

"spending money like drunken sailors."

Don't slander drunken sailors - they are spending their own hard-earned money. These pols are spending our hard-earned money.

And the drunken sailors stop spending when the money runs out - - - - - -

From the article:

"Most of the money reserved for state governments under this plan will be doled out based on each state's number of jobless workers."

Your state wants LOTS of fed money? FREEEEEE money?!!? Institute a "compassionate" min wage of $50/hour for your state, watch your unemployment skyrocket, and cash-cades of FREEE fed money come pouring in!!!

What could possibly go wrong with this $$$$scheme?

$100 an hour minimum for minorities and women, because we care.

Not Asians, though. Only "real" minorities.

Shut up stolen valor

flag, refresh

Boy, I really wish there was at least one fiscally conservative major party left.

There is. The problem is that the elections are stolen from us. So we need to focus our efforts on fighting here on Reason against anyone who says otherwise. Feel free to demonstrate:

And sarc manages to talk to himself again.

fuck off tulpa

Shut up stolen valor

"Most states managed to avoid much-predicted fiscal crises during the pandemic. Congress wants to shower them with more federal aid anyway.'

Shouldn't that be, "Democrats want to shower them with more federal aid anyway."?

We spent a lot of time in comments talking about Trump refusing to bail out the states.

Why is it only become a topic of conversation at Reason now--that Biden has been elected.

This was one of the best reasons to vote for Trump. If Trump had been elected, there would be no bail out of the states.

Who do they imagine is in a position of power and gives a shit about what they think of bailing out the states?

That issue only mattered insofar as it might have changed the outcome of the election. Now, it doesn't matter anymore.

No one in a position of authority cares if Republican voters, swing voters, Democrat voters, and libertarians all unanimously don't want the states bailed out by the federal government. The only thing that mattered was whether the Democrats control the Senate and the White House. If you failed to bring this topic up before the election to stop this from happening, you have no business complaining about it now. You're part of the reason why this is happening.

This isn't even subject to a filibuster because it's considered a budget reconciliation issue.

Unreason and the democrats wanted a civil war 2.0 and they got it.

el presidente biden doesnt even have any legitimacy in this banana republic. They make decrees and send money to people and places that means nothing.

As we know from the supply shortages from kungflu, you can be a billionaire and starve in your new york city apartment.

Civil war 1.0 was started by democrats after years of conflict without actual fighting, culminating with the lincoln election of 1860.

They are selling out every aspect of the USA and initiating pure socialism/communism under the disguise of 'fiat' money -- pure and simple.. And it's selling fast by people's own greed and lack of principle.

When everyone's income comes the the Gov via Stimulus, Bailout, and/or Gov Wages the Communist Government will be in FULL CONTROL.

Your article is good and value able information ...sir keep up the good work thanks for sharing this everbest article… thankyou somuch...

https://www.stickers2go.co.uk

"Congress has thus far approved some $4.1 trillion in COVID-19 spending, helping to produce record deficits and levels of debt. It's now looking to add more debt to assist states that are in a much better fiscal position than the federal government is."

Because they have convinced themselves that the federal debt does not matter. The federal government can go into infinite debt in order to finance any pet project or inequity and nothing bad will happen. At least, not until they are retired, and, if not, they still will not be blamed for what ever financial crisis it causes.

State and local governments are in a fantasy world with their rosy revenue projections. The economic disaster caused by COVID mitigation efforts is still AHEAD of us, not in last year's numbers. Businesses in hard-hit industries have clung on, eating their seed corn and burning through federal aid. State and local governments still fantasize that a day is coming soon when the COVID "mitigation" fascism will be declared over. Then they can just blow a whistle and yell "everyone back in the pool!", and the economy of Feb. 2020 will suddenly reappear, and revenues will go back up as if nothing had happened. That's not going to happen. Even if you accept the false assumption that the COVID regime will be "over" soon, hard hit business sectors are in critical condition and will not be able to just resume where they left off last February. A major and prolonged reduction in government revenues is coming due to the economic damage already caused by the COVID "mitigation". State and local government services will have to be drastically curtailed. Along with this, we'll have to cope with high or hyper-inflation due to pouring trillions onto a half-shuttered economy. I'm glad I'm not young.

Trending stuff ahhhhh.....

https://theinsidekhabar.in

How much of the revenue will CA have to spend to make landlords (and possibly other industry) whole? Cites like Anaheim that actually depend on tourism and businesses tied down to their location (Disneyland) have reported 50% reduction in revenue last year.

What is going on with the naivete in this publication? CA either has to cut spending or take in gazillion of dollars from federal aid. Companies are starting to leave the state, and 2020 will be the last time the pay taxes here unless Sacramento makes good on the threat to tax any business that makes on CA even if they're not physically located there.

Both amazing and shocking isn't it Britches?

That Democrats might simply enjoy throwing the levers of power - especially in the form of wealth transfers to favored constituencies.

Maybe you should stop imputing bona fides where none exist.

Makes you look either naive or serially mendacious.

DementiaManBad

Things like parks were closed, many services suspended, schools were closed so money was saved even though they paid teachers not to show up. Liquor stores remained open they are safe even if other retail is not, do we need to guess why?

Well, either they lie about revenue projections, or they have to cut spending, so - - - - - - -

State and local governments can't make money appear out of nowhere like the feds. If they don't spend within revenues, the checks start bouncing.

The economy must be destroyed, seems the lock-downs just weren't enough, so rampant inflation in now the answer. Then the Constitution can be suspended.