Don't Believe the Hype About 'Socially Responsible' Investing

Want to make money and help the world, too? Wall Street says you can!

Want to make money and help the world, too?

Wall Street says you can!

If you invest in "socially responsible" funds, say big investment funds like BlackRock, Parnassus, TIAA-CREF, etc., then they'll do good things for the world, and your retirement funds will grow.

These funds obsess about what they call Environmental, Social, and Governance factors. For example, Parnassus says it picks investments based on "their environmental impact, how they treat their employees, the quality of their relationships with local communities."

People believe. More than $100 billion poured in just in the first half of this year.

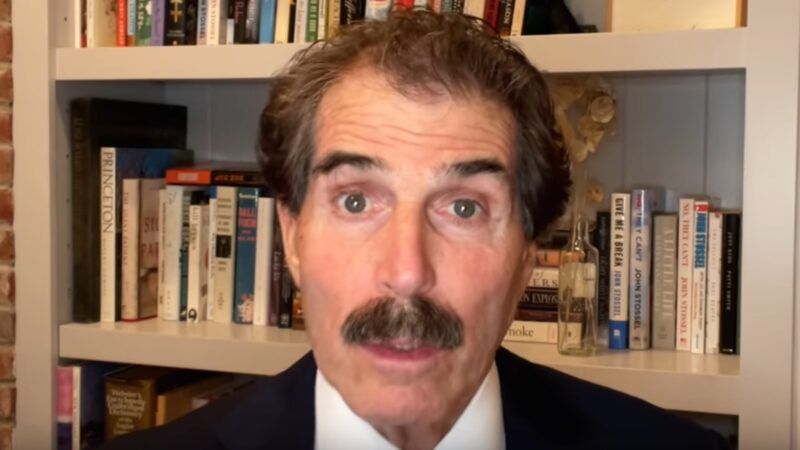

But I won't invest. My new video explains why.

One popular "socially responsible" fund, Generation Investments, is run by former Vice President Al Gore. His website claims they invest in "sustainable" companies that do things "consistent with a low-carbon, prosperous, equitable, healthy and safe society."

If you don't invest, Gore warns, you'll miss out on "the single largest investment opportunity in all of history. He says, "Sustainability can actually enhance returns!"

They do enhance his returns. The management fees help him pay for his many homes.

ESG funds probably won't do as much for you, if you invest.

"I've had a lot of experience looking at these types of investments," says Thomas Hogan, senior research fellow at the American Institute for Economic Research. "They don't actually accomplish the goals of being environmentally or socially responsible."

Al Gore's Generations Investments, for example.

"They're not really making socially conscious investments," says Hogan. "Their No. 1 holding is Alphabet, parent company of Google. They're just buying, basically, regular companies."

So, why do people invest?

"It makes people feel good," says Hogan.

Some "green" investment funds did well lately because oil prices dropped. But most will give you lower returns because they charge higher fees.

A Pacific Research Institute report found that their fees average 0.7 percent per year, which meant, over 10 years, the "green" portfolio was worth about 40 percent less than what you would have gained had you bought an S&P 500 index fund.

On top of that, what Wall Street calls "sustainable" or "social impact" investing is often just marketing.

Parnassus' brags that it owns US Foods and Clorox. What's special about them? Parnassus says food and cleaning supplies help meet U.N. sustainability goals like "nutrition" and "sanitation." Give me a break. US Foods and Clorox make good products, but there's nothing uniquely responsible about them.

The Boston Trust Walden ESG Impact Report brags about its activism, as if as lobbying for bigger government helped the world. They promote their lobbying for the Paris climate accord (see my video on why that's a bad idea) and for tougher workplace regulations in Bangladesh. Do they not know that tougher regulations make employment more costly, leaving more people more desperate?

BlackRock's socially "aware" fund brags that it gives you 2.62 percent more exposure to gender diverse boards. 2.6 percent? So what? Their "environmentally aware" fund also invests in Chevron and Exxon.

I asked BlackRock about these examples, but they never got back to us with an answer.

Worse, some of today's "environmentally responsible" funds probably harm the environment.

For example, most "green" funds wouldn't invest in the Keystone pipeline, but pipelines are much better for the environment than the alternative: hauling oil by train and truck.

Some "green" investors oppose fracking, but the United States led all countries in reducing carbon emissions mostly because fracking's natural gas reduces demand for coal and high carbon oil.

The ugly truth is that most so-called responsible investment funds charge more to sell feel-good nonsense that accomplishes nothing.

Instead, suggests Hogan, invest in any company that produces things people want. All those companies "(create) a lot of value for society."

They do.

I save money by investing in passive investments funds and exchange-traded funds that don't charge fat fees. They grow our economy without misleading people about "sustainability"—or enriching Al Gore.

COPYRIGHT 2020 BY JFS PRODUCTIONS INC.

DISTRIBUTED BY CREATORS.COM

Show Comments (65)