Social Security Will Be Insolvent Even Sooner Than Expected, Thanks to COVID-19 Pandemic

A new report from the Social Security Administration expects the program to hit insolvency by 2035. Some experts say it could happen as soon as 2028 if there is a serious recession.

The trustees of the Social Security Administration released their annual report on the program's long-term solvency on Wednesday—but the report is likely already out of date since it doesn't take into account the sharp economic downturn triggered by the COVID-19 pandemic.

Even without the pandemic factoring into the calculations, Social Security is heading for insolvency by 2035, the report says. That doesn't mean the program will be bankrupt, but it represents the date when Social Security's reserves would be used up and mandatory benefit cuts would be instituted across the board. If nothing is done to shore up Social Security, current projections anticipate that beneficiaries will receive only 79 percent of expected benefits, with further cuts needed in future years.

Fifteen years might seem like a long time, but it's really not. Anyone over age 50 today is likely facing the prospect of benefit cuts happening before they retire.

And, again, that doesn't account for the current economic crisis.

If the coronavirus results in economic losses of 15 percent for the current year, the program would likely face insolvency by 2034, says Stephen Goss, chief actuary for the Social Security Administration. Another year of losses would move that date even closer.

"We just don't know if we're going to be back to normal this year, next year, or when," Goss said Thursday during an event hosted by the Bipartisan Policy Center, a centrist think tank.

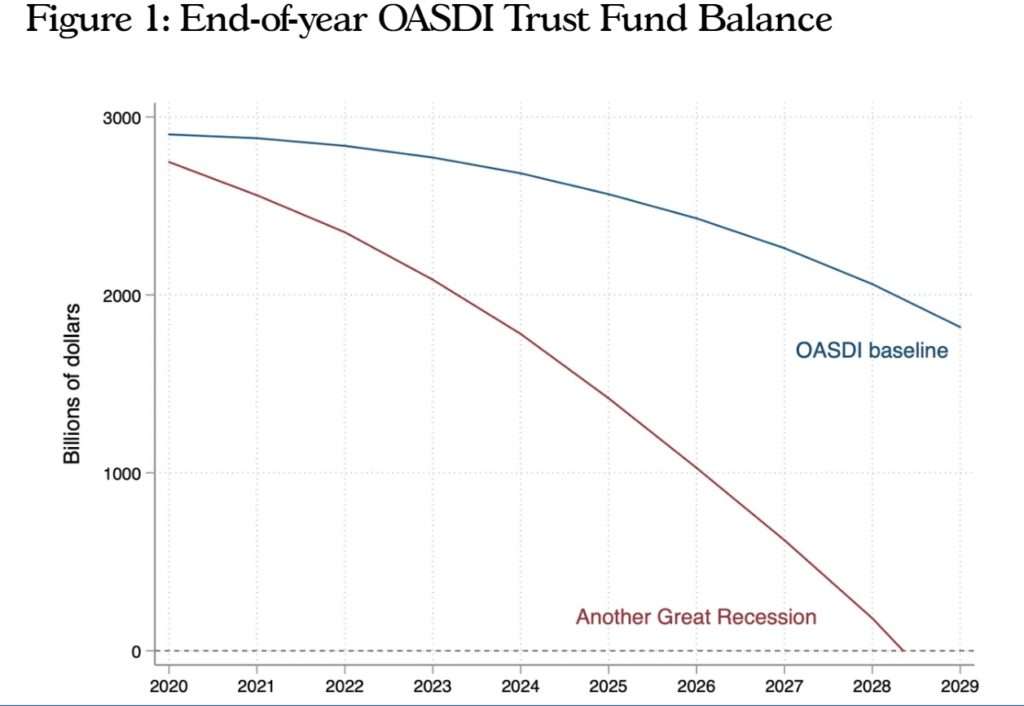

And if the coronavirus response triggers a long-term recession, the urgency of Social Security's status becomes more apparent. According to a projection from the Bipartisan Policy Institute, another recession of the length and depth of the so-called Great Recession that followed the 2008 market crash would cause Social Security to face insolvency before the end of the current decade.

"This is a concerning report, even before the virus crisis hit," says Charles Blahous, senior research strategist for the free market Mercatus Center and a former trustee for Social Security.

More important than the projected dates for insolvency, he says, is the question of how severe the shortfall will be and how long Congress has to act before it arrives. The coronavirus will likely to mean a larger fiscal problem and less time to address it.

As I wrote at this same time last year, the problem facing Social Security is really one of time more than money. If changes can be phased in over a longer period of time, they will be less likely to disrupt retirement plans for current workers or beneficiaries. The last time Congress enacted substantial changes to Social Security was in 1983, and those changes won't be fully adopted until 2027.

It should be obvious that the longer Congress waits to act, the less time will be available for a gradual adjustment.

Any reforms should also consider two systemic problems within the Social Security system. When Social Security launched in 1935, the average life expectancy for Americans was 61. That means the average person died four years before qualifying for benefits. It was imagined as a safety net for the truly needy, not a conveyor belt to transfer wealth from the younger, working population to the older, relatively wealthier retired population.

As a result, the worker-to-beneficiary ratio has shifted dramatically. Last year, there were 64 million Americans getting benefits from Social Security, while 178 million people paid into the system via payroll taxes, according to the trustees' report. That's less than three workers for every beneficiary, a near-historic low.

Congress is going to have to consider all available options, says Blahous. That means changing eligibility ages, moderating benefit growth, and probably hiking payroll taxes too.

"We're not going to have enough from any one of those pots by themselves to be able to close the shortfall," says Blahous, "and that's even before taking into account the worsening that is going to occur as a result of this year's economic slowdown."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

That doesn't mean the program will be bankrupt, but it represents the date when Social Security's reserves would be used up and mandatory benefit cuts would be instituted across the board.

"Go ahead. Declare bankruptcy. I *dare* you!"

Change Your Life Right Now! Work From Comfort Of Your Home And Receive Your First Paycheck Within A Week. No Experience Needed, No Boss Over Your Shoulder... Say Goodbye To Your Old Job! Limited Number Of Spots Open...

Find out how HERE......More here

Ther difference when SSI started and now is we're putting in a lot more money than back in the day. Reason would say that SSI should have more money to keep up with inflation. Problem is CONGRESS dipping into SSI to use for other issues. They should never have touched that money. We the middle class pay enough taxes to offset anything else. The 1% group should be paying more than 26% with new Trump tax laws. They should be paying at least 40%. If I made 1% money I would gladly give more. They are too greedy.

And you are too generous with other people’s money. I guess you figure they owe you, right?

You ugly.

Try again. The 1% pay the plurality of taxes, much more than the middle class, when you increase it to the top 5% they pay the vast majority of taxes.

The problem is birth rates, in reality. It's a classic pyramid scheme that relies upon having an ever increasing amount of individuals paying into the scheme, to fund the smaller amount of those individuals that are taking money out.

It's also one of the reasons massive immigration has become fiscally necessary in Western welfare states, because the native populations simply are not reproducing at a fast enough rate to fund the ever increasing burden of services being paid out to an aging population.

The Libertarian Wet Dream is happening! Full collapse of government guarantees! No one will trust government ever again!

p.s. Which is why everyone and their uncle will be spinning this crisis as being the libertarians' fault...

I don't think most people are even aware libertarians exist, and those that do would never give us enough credit to think we could fuck something up this badly.

But people will rapidly discover that "their SSN account" doesn't actually exist. That the government was never "saving" away from them. And they'll ask why. And fingers will be pointed at libertarians and other free market types.

"They did it! Those poeple over there! The kept us from raising taxes on the ultra-moguls to pay for the Free-Shit-For-You Plan!

No matter that we've been telling them for years that this is going to happen, and all the "free" shit they want is going to make it impossible to cover the shortfalls when they finally arrive. I agree with you, I'm sure they're somehow going to blame capitalism for the government's failures yet again.

Lane, Make 6150 bucks every month... Start doing online computer-based work through our website. I have been working from home for 4 years now and I love it. I don't have a boss standing over my shoulder and I make my own hours. The tips below are very informative and anyone currently working from home or planning to in the future could use this website.... Read More

Lane Lily started working for them online and in a short time after I’ve started averaging 15k a month••• The best thing was that cause I am not that computer savvy all I needed was some basic typing skills and internet access to start••• This is where to start… More Details

The sooner this ponzi scheme dies the better.

Does this study account for all the SS beneficiaries dying off due to COVID? It's kinda dark, but there's probably been a non-zero effect because of it.

The number of dead compared to the number receiving benefits is probably statistically insignificant.

Probably true, but the way the whole thing works if someone kicked the bucket 5 years before the SSA thought they would that can be a pretty significant amount of money.

This is also why I appreciate the Reason comments section, that comment on many other sites would've resulted in a lot of people accusing me of wishing death upon their Grandma.

that comment on many other sites would’ve resulted in a lot of people accusing me of wishing death upon their Grandma.

But isn't that true? *ducks*

I assure you I want your grandmother to be dead for reasons wholly unrelated to Social Security.

I'm going to assume it's because that makes the sex kinkier.

"The number of dead compared to the number receiving benefits is probably statistically insignificant."

Absolutely! Currently there are 64 million beneficiaries. And 50K dead of Covid19. So, just a rounding error. Which is good for the population. The economic hit is overwhelmingly negative. SS will run out of money even sooner than expected.

#donotresuscitate

https://www.ssa.gov/OACT/solvency/PRyan_20100427.pdf

To me, I have not seen a better way out of this mess. This plan would ultimately get the government out of the inflation indexed annuity business.

"Indexing the normal retirement age (NRA) for increases in life expectancy. "

Yes, since the original plan had benefits paid at an age beyond the prevailing life expectancy, just increase the age, now, to beyond 78.93 years.

I'm sure people will be working to that age, so that there will be no gap between retiring and collecting SS.

Let's see how that one is received by the people.

Much less how it's received by people in the age bracket that's currently collecting SS benefits and wouldn't be getting them again for ten more years under the plan. Y'know, the most politically powerful age cohort in US politics.

Stop saying that all of the economic calamity is caused by covid 19. Yes, there would have been some economic disruption in any case, but the fear and panic peddled by the media and the illegal (in my view) government overreach has been the major cause.

Yes. This isn't the SARS-COV-19 recession. This is the GOV-PANIC-20 recession.

I'm in my early 30s. I don't know a single person in my age range that thinks they will recieve anything from social security

That is a very healthy attitude. Too bad more people don't think that way. I have been receiving SS for four years. I figured out when I was about forty that I would never be able to count on SS except maybe for "mad money," and I was right. I feel sorry for anyone trying to actually live solely on their SS check.

Actually, I get along quite nicely on social security benefits alone. My pension money is just for fun.

I took the precaution of earning a lot of money while I worked, and did my planning to be debt free at retirement.

While my income is just above half what I had in the years just before retirement, I don't have to support the kids anymore, so there is enough to pay taxes (THAT never stops) and utilities and keep up yard a bit. After groceries, gas, and the like there is actually money left over. No commuting means one car and less insurance. And my wardrobe consists of jeans and t-shirts, with a couple of golf shirts for 'dress up'.

All in all a good life.

I know a few folks who get along well with SS as their primary retirement. They made pretty good money while they worked, but seem to have made some poor choices, or maybe it was just bad luck, as to what to invest in for their retirement.

i think i might get something (age 38), but i'm hardly planning my retirement around it.

SSA will be there for you and your generation. It will be in a different form, but it will be there.

It'll be there to suck a little more wealth out of my life, I'm sure.

"I’m in my early 30s. I don’t know a single person in my age range that thinks they will recieve anything from social security"

The math says your wrong. You'll get roughly 75% of what current retirees get, unless there are large changes to the system.

As the law is written currently, sure. But we all know the second that the shortfall hits, and they realize they can't tax enough to cover it (as if they'd even try), they've got three options:

1) leave the law as-is, reduce benefits, and get creamed in the elections;

2) print money at an unprecedented rate to cover the shortfalls and precipitate a federal debt crisis and possibly hyperinflation;

3) maintain current benefits by issuing bonds, in effect trading away the future benefits of younger folks to maintain full benefits for the current retirees.

The question isn't whether they're going to do #1 - it's never gonna happen. The only real question is what combination of #2 and #3 they're going to do, which is gonna depend a lot on whether or not the younger folks understand how the bond issue is going to fuck them over. If the media decides to be friendly and uncritical of the administration (so if we're in Biden's second term, I guess) then it's unlikely that they'll catch on in large enough numbers to make a stink and the powers that be will choose door #3. However, if we have socialists or populists still in charge by then, I personally think some amount of #2 is likely, and things are gonna be worse sooner, but probably worse for a shorter time.

"The math says your wrong. You’ll get roughly 75% of what current retirees get, unless there are large changes to the system."

The only way that's true is a drastically devalued currency.

You are lying or delusional.

No, I can read and do math. It's all in the annual SS trustee report. There's always been enough incoming revenue to guarantee a certain amount of benefits. That level is projected to drop to about 75% for SS.

And if they devalue the currency, well then you'll get more devalued dollars. But the real value will stay at about 75% of the current level.

Now as Halykan points out above, politicians might change the rules when retirees are faced with only getting checks for 75% of what they currently get. But that's all hypothetical.

Not surprised. We've had, what, ~26 million working age people (mostly Gen-Xers and Millennials) lose their jobs and go on unemployment in the last month or so for what? To extend the lives of mostly retirees (Boomers) another year or two so that they can continue sucking the SS system dry before they finally shuffle off.

Of course now the problem is you've saved up for retirement, thinking that Social Insecurity would not be there. But the politicians will do anything to "save" it which will be destroying the currency. And that money you saved is now inflated and getting worthless. And then they start robbing your 401k because they decide to change the law and make you pay the tax now. And of course they change inheritance laws so nothing you own will go to your next of kin, but to the government. Finally they decide to hell with it we need the votes everyone is now on the government dole and they pretend to pay you and give you medical care.

That is real scenario and a probable outcome. I will be gone by then but you won't.

"And then they start robbing your 401k because they decide to change the law and make you pay the tax now. "

I've always felt that this is exactly what will happen to Roth money. It will be too tempting a target for politicians. I resisted switching over completely to Roth, because of the political risk.

I’m sure AOC will solve this problem.

Trump threatens to block aid for U.S. post office if it does not raise prices for Amazon

Will Reason writers:

a. Shit

b. Go Blind

He should just cut aid to the post office altogether, no condition. Then privatize it if anyone wants to buy it and if not then we know what it was really worth.

c. they'll close one eye and fart.

My f**king god--this is unreal. The fact that anybody in office, especially the president, can do something like this practically defies belief!

SS will not run out of money

not when money printer go brrrr. pay no mind that your monthly benefit won't buy groceries....you'll get exactly the dollar amount promised!

I recall a news bit from many years ago. Old people in Russia were receiving Soviet Social Security checks, even though the USSR had ceased to exist. (Russia was paying them.) The amount of the check was about $30/month.

I used to be concerned about the solvency of social security, then I realized that the answer was the same as every time the government finds something it wants to spend money on but doesn't have the funds: Print more.

At this rate we'll be lucky if social security checks can cover the postage on the letter it takes to send them.

It's just an accounting gimmick. If we want to give a bunch of money to old people, just fund it with a permanent appropriation. But we shouldn't give a bunch of money to old people.

So obviously editors here do not understand modern monetary theory. Pretty sad that a site called ‘Reason’ does not use any when it comes to how our currency system actually operates. This is just another fine example of journalistic incompetence.

They probably don’t understand the ideology of the Jonestown cult either, what’s your point? MMT has been tested and refuted by hyperinflating countries since ancient Roman times, try and at least cling to a worldview that was only discredited in the last century maybe.

Maybe some day you’ll actually figure it out.

https://www.nakedcapitalism.com/2020/04/max-blumenthal-and-ben-norton-with-michael-hudson-us-coronavirus-bailout-is-a-6-trillion-scam.html

“ Why is it okay for the Fed to create $1.5 trillion to buy stocks to prevent rich people from losing on their stocks, when it’s not okay to print only $1 trillion to pay for free Medicare for the entire population?”

I get it, you’re a communist, for private corporations only.

"I get it, you’re a communist, for private corporations only."

Nope.

You're a fucking lefty ignoramus.

Hint: There are NO Jackson-tree orchards, but that shouldn't have to be explained to an adult.

So, obviously Kirk doesn’t have an argument or any way to back it up, which is why he’s just going to scoff and project his Communist idiocy outward.

https://www.nakedcapitalism.com/2016/05/the-7-biggest-myths-and-lies-about-social-security.html

https://neweconomicperspectives.org/2012/03/mmt-for-austrians-3-how-do-you-propose.html#more-1269

Lefty bullshit 2

Fuck off, you pathetic piece of lefty shit.

Lefty bullshit 1

editors here do not understand modern monetary theory.

Of course they do. It's the latest euphemism for robbing the public by diluting the currency. I know you Keynesian twats like to pretend there's something sophisticated about your bullshit, but wishing doesn't make it so.

It's the very same scam that goes all the way back to Diocletian.

-jcr

Oh, and by the way, F. Hayek came to the U.S. to take advantage of social security.

https://www.thenation.com/article/archive/charles-koch-friedrich-hayek-use-social-security/

Yeah, we get it. You’re a fucking liar.

So you're full of shit besides.

If any of you dipshits took the time to read about MMT, you might find that you like it; for one, MMTers are against a payroll tax. Then again, by the responses, this is a den of reactionary trolls. Take the blinders off.

You.

Are.

Full.

Of.

Shit.

MMT is an infantile fantasy, as attached to reality as the Jackson Tree orchards I mentioned above.

I might go to Canada to make use of their child benefits, popping a truckload of brats and getting paid professional-class salary for it. Welfare systems are meant to be abused, because they have low self-esteem. Doesn't mean I respect the system. But if it's there, it's there. If it's gone, I go back to work and making myself useful to society again.

Due to Covid-19 effects all-economy goes to hell. A lot of brands especially Brookstone faced many difficulties during this era. Totally manufacturing disturb due to this virus. And in the international market also crash due to the lockdown situation.

Fear! Porn! It’s a vicious circle.

If anything, the numb nutted author should have taken the unusual step of reserving a full 20 seconds to critically think about the article he was writing, because the elephant in the room clearly slipped by him.

You dumb motherfucker, coronavirus is attacking the very demographic that is drawing all the social security.

So figure it out you used condom, you can have Social Security running out, or you can have candlelight vigils on Zoom for grandma - but you can’t have both.

The colostomy bagged estimate of 2034 certainly didn’t take into account the 15% reduction in the elderly population every year from now on. Eat cop dick.

Dumbfuck. The number. Of deaths. Is statistically. Insignificant. Overall.

Learn some basic math, Millenial shitsucker.

"shitsucker"

No, this is not due to the disease. If it were, we'd have it once a year since we are still well under the annual average death toll for the seasonal flu.

This is the result of a population of a supposedly free country PANICKING and willfully turning over the economy to the government.

Shameful!

Is no one going to state the obvious?

Social Security has been funded by having four (or more) taxpayers paying in for each retired person collecting benefits.

The solution is to bring in more tax paying young people to pay into the system.

So end abortion?

Good luck with that.

Wrong. Wrong. Wrong. The only way SS will run out of money is if Congress decides to stop funding it. The federal government is the ISSUER of the currency. It can produce as much money as it needs to fund its programs. It can NEVER run out of dollars. This has been repeated publicly for decades by Federal Reserve officials.

The USA has a floating currency. We have not been tied to gold since 1971. Stop living in the past. Haven't you noticed how it produces trillions of dollars at will to bail out banksters and fight foreign wars indefinitely? Did you get a bill fpr those expenditures? Did your federal tax rate go up? It doesn't need your federal tax dollars or payroll taxes to fund itself. It can pay for anything which can be bought with USD. The reason you don't get free health benefits and free education and a robust SS program is because YOU ARE NOT WORTHY. Just because you have more than your neighbor, you think you got it made. You are slave labor for the machine.

Think about it. The fed can issue tons of money at will, and it does, BUT NOT TO YOU. You have to fight for scraps with your fellow citizens. Wake up chump.

"Did you get a bill for those expenditures?"

No, but we are getting a giant pile of debt. So it's obviously not free. If the government could just print money to pay for anything, then why the debt?

Private debts are different than public debts.

"Wrong. Wrong. Wrong. The only way SS will run out of money is if Congress decides to stop funding it."

Which, to lefty fucking ignoramuses, is a valid argument, right lefty fucking ignoramus?

SS won't run out of 'money'; the 'money' will run out of value.

A six-pack of TP: $2500.00! Good luck, lefty fucking ignoramus!

So in 2028 I'll be 91! I hope I make it!

Will the dreaded p-word ever get mentioned? Privatizing it for future generations... at least partially? The more decision-making is decentralized, the more fiscally responsible a program / people become. Let's be as right-wing as the Swedes when it comes to our pension system.

No way to privatize a venture which is underwater deeper than Cousteau.

The only way it sells it equal to its value; pennies on the dollar. Regardless of the fucking idiots above puffing dollars worth pennies.

That is what 401k and IRA plans are supposed to be about. Because few people can retire on SS alone.

What is happening now is younger people are needing to dip into those, which are dropping in value anyway. So there will be less when they hit retirement age.

Assuming you have $20k now at age 35 and put in $1k a year for 30 years you would have $246 k at retirement assuming average returns of 7%.

If you pull that now it is a huge loss.

From Warren Mosler’s ‘Seven Deadly Innocent Frauds’ -

Deadly Innocent Fraud #1:

The federal government must raise funds through taxation or borrowing in order to spend. In other words, government spending is limited by its ability to tax or borrow.

Fact:

Federal government spending is in no case operationally constrained by revenues, meaning that there is no “solvency risk.” In other words, the federal government can always make any and all payments in its own currency, no matter how large the deficit is, or how few taxes it collects.

Deadly Innocent Fraud #2:

With government deficits, we are leaving our debt burden to our children.

Fact:

Collectively, in real terms, there is no such burden possible. Debt or no debt, our children get to consume whatever they can produce.

Deadly Innocent Fraud #3:

Federal Government budget deficits take away savings.

Fact:

Federal Government budget deficits ADD to savings.

Deadly Innocent Fraud #4:

Social Security is broken.

Fact:

Federal Government Checks Don’t Bounce.

Deadly Innocent Fraud #5:

The trade deficit is an unsustainable imbalance that takes away jobs and output.

Facts:

Imports are real benefits and exports are real costs. Trade deficits directly improve our standard of living. Jobs are lost because taxes are too high for a given level of government spending, not because of imports.

Deadly Innocent Fraud #6:

We need savings to provide the funds for investment.

Fact:

Investment adds to savings.

Deadly Innocent Fraud #7:

It’s a bad thing that higher deficits today mean higher taxes tomorrow.

Fact:

I agree - the innocent fraud is that it’s a bad thing, when in fact it’s a good thing!!!

Free online for austerity fetishists!

Maybe we should let more immigrants in so they’ll be able to pay payroll taxes in order to keep Social Security solvent, hunh OBL?

I order to have a great immune system it helps to exercise. In order to exercise you have to have a good outlook of life. In order to have a good outlook on life you have to be happy.

So, you know what makes me happy? Watching these Trumpian buttholes argue that shining a UV light in your lungs is a great idea after having Dear Leader recommend it, then having Dear Leader metaphorically invade Poland from the East circa 1939 by claiming he has being sarcastic, and then watching these Trumpian Bolsheviks laughably have to walk things back in their little keyboard Politburos. Thanks to all these Dear Leader bullshitters, I can feel my immune system raring to go! Bring it on COVID-19... I’ve got laughter on my side!

https://apnews.com/b44f4531071e6204023f7b8e16f59d4b

You know what makes me happy? Seeing weak, pathetic socialist assholes who need to be lead so badly that they obsess over politicians they disagree with and their supporters.

Haha. What a doosh.

SS has never been solvent. The "trust fund" is nothing but a pile of IOUs left by the congress as they looted the SS tax receipts for anything and everything they wanted to waste money on. If any private organization tried this shit, everyone involved would end up behind bars.

-jcr

Begin winning $120-$200 every hours for working on the web from your home for scarcely any hours every day… Get ordinary installment on a week by week premise… All you need is a PC, web association and a little available time… Peruse increasingly here Read more here>https://bit.ly/2V0yjLa

[ For USA ]

my friend's sister is dropping 12 kilos each 3 weeks. She has been over weight however final month she commenced out to take those new nutritional nutritional dietary supplements and she has out of place 40 pounds so far. check the internet website on-line proper right here.....

HERE►►► Read More

God bless american.

The politicians will never act on this until people start screaming about it. That won't happen until the crisis is imminent.

One quibble, average life expectancy doesn't mean the average age at which one dies. It was 61 because childhood deaths were much more common, as were accidental deaths in the workplace, the workplace being a lot more dangerous back then because it was labor intensive (we've automated a lot of the more dangerous parts of jobs). If you survived childhood you could expect a better than even chance to live past 61. Now the proportion of the population >61 was less than the proportion >65 today but that is because your chances of dying in a workplace accident or childhood are considerably less, so more people live long enough to become elderly. It doesn't dispute the overall theme but it is a pet peeves of mine that people misuse average life expectancy as in people started dropping dead as soon as they reach the average life expectancy. Eighty is probably about the maximum life for most people.

"Life expectancy isn't the average age people die, it's all the ages people died at added together and then divided by the member people."

The corona virus could've been a surprise reprieve for social security if the government hadn't insisted on helping so much.