Eat The Rich? House Democrats Plan To Pass Huge Tax Break for Wealthy Homeowners.

The party that's calling for huge tax increases on the wealthy is about to hand wealthier Americans a big tax break that will add to the federal budget.

On the campaign trail, Democratic presidential hopefuls are promising huge tax increases—primarily targeting wealthy Americans—to pay for a host of new government spending.

Meanwhile, congressional Democrats are set to vote this week to restore a huge tax break that primarily benefits wealthy Americans—one that effectively shifts the federal tax burden onto middle- and lower-income earners.

That tax break is known as the State and Local Tax (SALT) deduction and it does exactly what the name would suggest. Taxpayers are allowed to deduct payments of state and local income and property taxes from their federal taxes. (In states with no income tax, taxpayers can deduct sales taxes instead.)

The 2017 federal tax reform capped that deduction at $10,000. That means taxpayers who pay more than that amount in state and local taxes cannot write off amounts over that threshold.

But the House is expected to vote this week on a Democratic proposal to lift the SALT cap to $20,000 for 2019 and then repeal the cap entirely for 2020 and 2021. After 2021, the $10,000 cap would again apply—although it is already scheduled to disappear after 2025, when several big elements of the 2017 tax reform will sunset. The bill proposes to offset the SALT deduction changes by raising the top income tax rate from 37 percent to 39.6 percent until 2025.

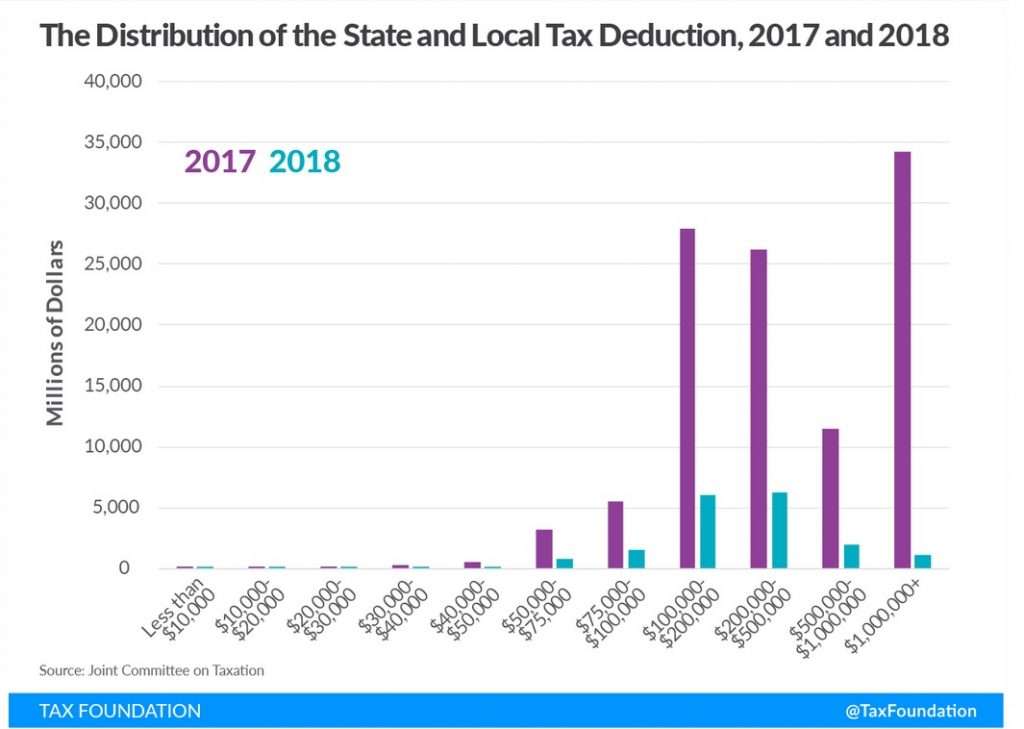

Democrats are trying to sell the repeal of the SALT caps as a middle-class tax break, but historical evidence shows that it almost exclusively benefits high-earning homeowners who live in parts of the country where you must pay high taxes.

"Jurisdictions with higher-income residents received more of a benefit than those with lower-income residents," Nicole Kaeding, then a vice president at the Tax Foundation, a nonpartisan tax policy center, explained to the House Ways and Means Committee at a hearing earlier this year. "In some ways, it allowed high-tax states and localities to export their tax liabilities to taxpayers in other states, particularly low-tax, low-income states."

Prior to the 2017 tax reform, every dollar of additional local and state taxes translated into a net tax increase of only $0.60 to $0.90, depending on an individual's federal marginal income tax rate.

Although the SALT deduction is frequently portrayed as being an issue that pits red states against blue states, Kaeding says that's not really accurate. In reality, the deduction benefits "high-income taxpayers in high-tax jurisdictions," she says.

In 2016, for example, the average SALT deduction in wealthy Westchester County, New York, was nearly $16,000, while the SALT deduction in relatively poor St. Lawrence County, New York, was only $2,000.

Restoring the SALT deduction would also add to the federal deficit, by perhaps as much as $500 billion, says Marc Goldwein, a senior vice president at the Committee for a Responsible Federal Budget, a nonprofit that advocates for balanced budgets.

"This is serious money," Goldwein tells Reason. "This was perhaps the biggest pay-for in the Tax Cuts and Jobs Act, and so if you repeal the SALT cap, the Tax Cuts and Jobs Act would result in even larger revenue losses and—sort of ironically, I think—even larger tax cuts to the very highest earners."

Reducing Americans' tax obligations is always welcome, of course, but the plan to lift and repeal the SALT deduction cap is still questionable policy at best—a proposal that shifts the tax burden to middle- and lower-class Americans and adds to the budget deficit.

Politically, this week's House vote is potentially both a messaging and policy problem for Democrats.

Leading progressive presidential contenders like Sen. Elizabeth Warren (D–Mass.) are promising to hike taxes on the wealthy by as much as $26 trillion. Even perceived centrist candidates like former Vice President Joe Biden have outlined plans to shift the tax burden toward higher earners.

True, the mechanisms they would use differ from the tax policies included in the SALT bill before the House. But there is an obvious tension between a guiding principle that says the rich must pay a higher share of the overall tax burden and support for specific legislation that would reduce the taxes paid by the rich. On that point, Democrats seem confused right now.

The obvious answer is that this tax break overwhelmingly benefits residents of Democratic districts. An analysis by the Urban-Brookings Tax Policy Center found that 19 of the top 20 districts, ranked by the percentage of households claiming a SALT deduction in 2016, are represented by Democrats in Congress.

Passing this bill, then, is an indicator that Democrats know perfectly well that their own constituents like paying less in taxes, regardless of the campaign rhetoric.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Vox, meet Unintended Consequences.

Unintended, my ass!!

I remember reading something about that this morning...

NJ is working on a similar law.

OT

In a rare public order issued Tuesday, the Foreign Intelligence Surveillance Court condemned the FBI for the errors and omissions in its application to surveil Trump-campaign adviser Carter Page and gave the bureau until January 10th to propose reforms to prevent future abuses.

The order follows the release of Intelligence Community Inspector General Michael Horowitz’s report, which detailed 17 “significant errors and omissions” in the warrant application to surveil Page.

“The frequency with which representations made by FBI personnel turned out to be unsupported or contradicted by information in their possession, and with which they withheld information detrimental to their case, calls into question whether information contained in other FBI applications is reliable,” wrote the FISA court.>/B>

“Therefore, the Court orders that the government shall, no later than January 10, 2020, inform the Court in a sworn written submission of what it has done, and plans to do, to ensure that the statement of facts in each FBI application accurately and completely reflects information possessed by the FBI that is material to any issue presented by the application,” the order continues.

https://www.nationalreview.com/news/fisa-court-issues-rare-public-order-condemning-fbi-for-russia-probe-abuses-and-demanding-reforms/?utm_source=email&utm_medium=breaking&utm_campaign=newstrack&utm_term=18924762

But both things can be true:

The FBI and the Permanent state have engaged in an ongoing attempt to unseat an elected president by employing falsified evidence for FISA warrants, seeding the media with fake stories about collusion and relying on thoroughly debunked dossiers from ex-intelligence officials.

Donald Trump is a bombastic fucktard.

So, it all evens out.

Even? Probably not. Both true? Absolutely.

More to come on Friday:

True, sure. But he ran as a bombastic fucktard, no surprise. And to be real, the world is filled with leaders that are fucktards, so at the least, he can fucktard with the best of them.

What's troubling isn't donnie, it's the criminal activity by our government, protected and supported by politicians, bureaucracy, media, and culture.

Some are even calling him Mr. Boombastic and say he's a fantastic, Mr. lover, lover.

Sorry. But if anyone knows how to do deep fakes please do a Trump as Shaggy video.

As much as I dislike Trump, an unelected and unaccountable bureaucracy lying to a secret court to undermine the election results is 1000 times more scary and evil.

This. So much this.

What he said.

Trump is a jackass - I swear the man has never read a book in his life.

We have wasted what is likely our one and only chance for an "outsider" on a moron.

But this charade of Russiagate/Ukrainegate with the surveillance community and Deep State is more frightening than any game show moron could ever be. The most any president can be around is 8 years. These assholes are around for 30 to 40 and think they have a right to be anything they want.

Yes, blatant civil liberties violations are just meh if the person targeted is a big meanie.

The thing is; what they did was already contrary to policy.

Coming up with a different, supposedly more restrictive, policy doesn't change the lack of accountability that is allowed by the proposed action.

People need to be held publicly accountable, and not in the usual way government types take responsibility, by flapping their lips and then blithely going about the same business they did, prior.

Loss of jobs, pensions and a good amount of time in prison would make someone, intent on doing this in the future, think twice.

I’d suggest a -blank-, but I don’t want them coming after myself and Reason.

"errors and omissions"

The word is PERJURY.

-jcr

How's the old rhyme go?

"Don't tax you...

Don't tax me...

Tax the damn dirty, evil, capitalist one-percenter and then fire up the printing presses we'll keep spending after we squeeze all we can from those society hating producers... tree.

I for one welcome the restoration of federal cover for those states overtaxing their citizens.

I *love* subsidizing blue states.

No one subsidizes blue states. Why don’t you dig into the facts

No one subsidizes blue states.

We're heading back to that setup if this bill becomes law.

There is no "back", it wasn't true before Trump's tax reform, and even if this passes it still won't be true. As a group, blue states are net tax-payers, not net tax-receivers.

And we go full retard with the undergrad study!

Hint...

Remove SS from the study and see how the numbers change. Your purported study hits retirement states (retiree destinations) because of SS funds which is the majority of the receivers on the study. Then remove Medicare and get shocked.

I cant believe dumbasses still push that study.

Remove military bases while you're at it.

“Blue” states aren’t net tax payers. “Rich” states are net taxpayers.

Isn’t that what you would expect?

Sure.

But I'm not the one claiming that "red states" (which are disproportionately "poor") are subsidizing "blue states" (which are disproportionately "rich").

Skipped right over it... lol.

Now justify why you think SS and Medicare should counting the study...

New york tax earner pays taxes his whole life on NY, moves to florida or texas for cost of living in retirement draws SS and Medicare. Your inference is "oh my god... Florida and texas are stealing our taxes!!!!"

And no one should pay more in federal taxes because they pay less in state/local taxes.

"And no one should pay more in federal taxes because they pay less in state/local taxes."

I really don't get this. Two people earn $120,000. The person in the no tax state brought home $120,000. The person in a 17% tax state brought home $100,000. The latter never saw, invested, used or spent that $20,000. But the person in the no-tax state did.

It actually seems perverse to me to call that $20,000 they never saw as income and ON TOP OF THAT, tell them they need to pay another $6000 from their remaining $100,000 as federal taxes on the money they never saw.

The lobby for the high tax state to reduce their taxes. Feds should tax everybody equally. Or are you going to make exemptions for all state fees and taxes, ie sales tax? You seem to only care about one form of taxation in your rant.

^This is my point. I thought I made it pretty clear.

"^This is my point. I thought I made it pretty clear."

The point that you didn't make clear is why it is automatic that someone "should" pay taxes on money they never earned because it was taken by their State. There seems to be this axiomatic assumption that a person who earned $100,000 after local taxes should pay the same federal taxes as someone who earned $120,000 after their local taxes.

The only way that makes sense to me is if you think that is the federal government's money to begin with, and not taking is somehow giving.

You earn your money prior to taxation. The feds just have an allowance for various exemptions. I'd prefer no federal exclusions myself and just have a flat personal exemption.

The fact you choose to live in a high tax state is yours and yours alone. There are other taxes outside of state income taxes through fees or sales. Are we going to make it so complicated we include all of these as fed exclusions? You're asking for a specific exclusion that benefits your choice.

Look man, I appreciate that these threads often fall down to a bunch of snark and such, but to me this is very inconsistent with how fiscal conservatives have argued in the past, and that bugs me as a fiscal conservative. That said, I appreciate sticking it to blue states even if I live in one. I can survive the taxes, but I would prefer not to see conservatives cede important high ground in the process.

IMHO, income taxes are complicated because it is difficult to define what income is. Traditionally, income has been defined as "what I earn for my investment, after expenses". The money I earn for my rental properties is offset by the expenses of servicing mortgages and maintaining the properties. Companies have expenses such as state and local taxes, compliance fees and cost of goods sold. And they deduct these from their income. Likewise, personal expenses necessary to do your job such as travel, training, and supplies (not reimbursed by employer) have also traditionally been no brainers to deduct from income.

None of this is controversial- it takes money to make money and those expenses including SALT have always been considered expenses taken off of Net Income. The standard deduction has always been a short-hand, lazy way of accounting for this, but it was never expected to be a REPLACEMENT. Rental property owners with property expenses, Nurses who must train to stay relevant, tech writers who must buy their own equipment and maintain a home office- all these people have different expenses, and it has always been legitimate for these people to do long form expensing, just like a corporation.

And that includes people who may live in Arizona but are forced by their job to work in California for several weeks, thus forcing them to pay taxes in a state that they cannot lobby to change. These are all expenses that subtract from the NET income they bring in.

If your argument is that people should only get the standard deduction (whatever that is), then we are throwing away all sorts of dynamism in our economy. It also transfers tax liability from people with low expense jobs, like Call Center agents and Bank Tellers to people with high-personal-expense jobs, like contractors.

Otherwise, removing SALT as a deduction seems like a capricious move. Why don't you pay income taxes on your FICA taxes? How are those different? Why should people get to put money into a 401k and deduct that from their income? Why should they get to pay for health insurance pre-tax? FICA, 401k, and Insurance premiums are all deductions paid off the income.

It seems to me, replacing all these with a flat deduction goes AGAINST the grain of letting people make the economic choices that benefit them best. So if you really want to be consistent, then we should just tax people on gross income (though that can be equally hard to measure).

Fiscal conservatives have argued for a flat tax with no exemptions, not a high tax with favored exemptions.

You can justify your stance all you want, but you are merely choosing the breaks that would help you out the most.

I'm not even being snarky on the above replies.

Overt is right. Funny how just a few years ago the like of Reason bloggers would've derided the idea of counting income taxed by one jurisdiction as taxable income to another as "a tax on tax" — which it is. Only because rates were low do people not think about the absurd possibility of multiple jurisdictions piling up taxes on pre-tax income to the point where the total tax could be more than the income, but in principle there'd be nothing stopping it, which says there's something wrong with the principle.

New York and New Jersey don't deign to tax the same income when a resident of one is subject to income taxation by the other, so why should state and federal government tax the same income?

JesseAz, I logged in just to enlighten you a little (a difficult task). Overt is making a clear and concise argument about concepts that you can't seem to grasp. Your mentality is that of a myopic and spoiled individual completely incapable of thinking critically. Read what he wrote, and try to take the time to digest it and understand what it means, rather than posting knee-jerk nonsensical reactions.

The SALT deduction *did* have a formula for figuring out all state taxes and fees. If you lived in a no-income-tax state, you could deduct Sales Tax. Or you could deduct Income tax. You could also deduct most state fees, such as property taxes and registration fees.

I did not rant- and I wasn't singling out income tax as the sole tax at hand. I was just making a simple example. And the example carries the same if you exchange "income tax" for "Sales tax and fees". In either case, the person in a high income tax state literally earned less.

The federal government DID tax everyone equally. They taxed everyone on the income they brought home after taxes. Just as today, they tax everyone equally based on how much money they take home after charitable donations.

Californians invest their money in government services through state income taxes.

Floridians don't, because Floridians aren't as stupid as Californians.

One chooses to pay state income taxes, the other chooses to buy a boat or something.

Each made a choice.

Californians whining that they should get special privileges from the federal government because they're morons for investing in the state of California can fuck right off.

No, they did not tax everyone equally because exclusions varied from state to state through exclusions. If you wanted equal taxation the only exclusion youd advocate for is the personal exemption.

" If you wanted equal taxation the only exclusion youd advocate for is the personal exemption."

No- the personal exemption has always been considered a lazy way to account for expenses. It was never supposed to be a replacement. Saying that we should only have one standard personal exemption is like saying that corporations should have only a standard "expense" to deduct from their income. But we don't do that because different companies have different expenses, and forcing them all into a standard deduction would be transferring tax liability (generally) from high-margin companies to low margin companies.

Income tax has always been about equally taxing NET income. And I get that there can be argument about what Net Income actually is, but at the end of the day, if you didn't even bring the money home (as in the case of FICA, SALT, mandatory uniform costs, etc) then it has long been considered an expense.

Again. You're the one who is advocating a difference in taxation based on the state you choose to live in, not me.

Income tax was not always about AGI (you used the wrong term), the original tax had very few of any exemptions. Those were added later to influence behavior or protect favored constituents.

The only fair tax is one without favored exemptions.

You can their it, but as soon as you start with personalized exemptions based on choices, the tax is not equal.

Your comments are logical and well presented. Unfortunately the vast majority of voters have little to no idea what you are talking about, and therein lies the problem. A large number of people casting votes based on "economic factors" when they have little to no understanding of economics and taxation. We literally have the lunatics running the asylum, as we allow the uniformed voters, who greatly outnumber the informed voters, to make important decisions for us.

By the way... another largely uneven taxation from fed taxes is the homeowner subsidy. this is largely the driver for SALT taxes. And it shouldn't be included in federal taxation rates.

You have a good point. Why dont we deduct federal taxes from what you owe in salt instead?

"The federal government DID tax everyone equally. They taxed everyone on the income they brought home after taxes. "

Overt: how about a thought experiment?

State A's motto is 'The Low Overhead State'. The only state tax is a 5% income tax, and they only provide the most basic government services like police, courts, and schools. People there just live with potholes, or fill them themselves or whatever.

State B's motto is 'The State that Provides'. It has a 50% income tax, but fills potholes, has free pools and gyms everywhere, with free Evian and personal trainers. The bus system is free, parking is free, college tuition is free, the state pays for maternity and paternity leave, caregivers for the elderly, and gives out free turkeys and champagne to all every thanksgiving, all free, free, free!

The SALT tax exemption means that residents of state B get to pay for their Evian and other goodies with pre-federal-tax money, while the people of state A have to pay for their Evian with after-federal-tax money.

What's unfair about taxing everyone's Evian equally?

This is a weird argument all around. It's not like the money didn't exist, it got taken by the state government. It was shown on your pay stubs, if you bothered to look. You didn't get to take it home? Yeah, that's taxes for ya sparky.

Allowing people to deduct their state and local taxes artificially shields them from the tax burden of the federal government. In other words, it shifts the burden of funding the federal government disproportionately onto people who live in lower tax states. I agree that the taxes in some states (New York particularly) are unreasonably high, but that's not a good argument for making someone in New Hampshire pay a higher share of the federal taxes.

Income Tax has always been about net income- what I take home after expenses. That some people have higher expenses than others has never been a consideration in the past. If you pay some guy $50/hr to paint your rental property, it is deductible from the rental income, regardless of whether or not someone else could have done it for $20/hour.

Are you arguing that people should really be taxed on what the Federal Government THINKS their expenses should be, rather than what they actually are?

If you want to stick it to States, the best way to do it is to tax the states for their income.

Your baseless assumption is states get first cut and then the feds, with the state removing income. That is not how taxes work. The federal taxes make no assumption on state costs. The amendment is not written to consider state first. Youd have a better argument if you argued federal taxes be removed from your state amount.

Maybe don’t live in a state with an income tax?

+1

Oh shit. Matt is gonna brake out the undergrad thesis on federal spending without controlling for SS, Medicare, or defense spending. The widely debunked undergrad study that only dumbasses still push.

So, California residents pay the full cost of the water from all the FEDERAL water projects that supply water to southern California?

You can document this?

The connective tissue on this is that the "deep blue" states/localities have jacked up their local cost of living so high that the "middle class" folks in those areas don't realize that they're actually "1%"ers, and the last thing the pols who keep cashing their checks and presuming their votes want is for them to figure out that they're actually the ones not paying their "fair share". The second to last thing most of those pols want is to have to quantify what the term "fair share" actually means.

Do you really believe nonsense like this?

Restoring the SALT deduction would also add to the federal deficit, by perhaps as much as $500 billion

"Now we *really* have to tax the wealthy their fair share!"

Deficits don't matter. Stop acting like they do.

The one silver lining of the financial collapse in the future will be all the morons trying to yell at the deficit that it doesn't matter as it steamrolls their life.

The deficit definitely doesn't matter to me. I don't owe the money and I can move my funds into bitcoin at any time...

And your bitcoin could evaporate at any time. Heck, it might have happened as I posted this. Better go check on it...

"Tax Cuts and Jobs Act would result in even larger revenue losses"

That is incorrect. The tax reform resulted in increased tax revenue, the highest in history as a matter of fact.

When people keep more of their own money, they spend and invest more, and that means more people have jobs and are earning more, which results in higher tax revenue, even though rates are lower.

This can be proven with the Mean Value Theorem from calculus.

And it was a titanic failure when Regan touted it, so....

Well, for you "originalists", the income-tax was only meant to tax high earners. 1913 original 1040 form shows the first $20K in income was tax free. That is the equivalent of over $500k in today's dollars.

And honestly, taxing earned income is evil, and shifts the burden from the wealthy, to the wage-slave. The wealthy can avoid earned income completely, bypassing contributing to social security, medicare, and capping their taxes at a fraction of the working class.

taxing earned income is evil

You can't say that enough.

It's almost like we can see parallels between the original implementation of the income tax and the wealth taxes now being proposed. But no, I'm sure the wealth tax will always remain very low and affect just a tiny sliver of the population.

A flat wealth tax would be fine.

You pay the government in proportion to the amount of property they're protecting for you.

Wealth taxes are unconstitutional.

Taxes are evil period, because they're taken by force, and there's no such thing as a fair tax. But I agree we need them to pay for investigating crimes, capturing criminals, prosecuting and jailing them, along with national defense and courts to resolve disputes. So let's limit the evil by limiting government to protecting us against others who'd harm us.

As for taxation I kind of have a preference for real property tax because property can't leave a jurisdiction. But then if you have one man one vote democracy with few landowners, tenants might try to vote that you can't kick out an existing tenant, even if they don't pay the rent.

Bravo

repeal the 16th for fuck's sake. 17th too.

^this

19th!!!

Ah, libertarians.

"Taxation is theft!" ... unless it's taxes on democrats/liberals/"those people".

State taxes are a state matter, and should not impact federal taxes.

Get out of there with that federalism.

With the new exemptions not only does escher defend blue states... he is solely defending millionaires.

Don't confuse me poking fun at y'all's obvious hypocrisy with me defending anyone.

It's not hypocrisy to oppose arbitrary taxation that privileges some over other at a federal level.

You're not poking fun at anybody you're just proving your ignorance on tax theory. It is the states who cause a delta in SALT, not the feds.

"Don’t confuse me poking fun at y’all’s obvious hypocrisy with me defending anyone."

That's Stewart's shtick; if you're busted for bullshit, claim it was only a joke, right?

And your bullshit is still bullshit.

It is if you pretend that's a principled stance, but your actions reveal that your opposition is more contingent on who is hurt/helped then the "privileges" themselves.

Yes I am. It's you. You're the clown.

(A) A bunch of libertarians acting offended after someone calls them out on their hypocrisy is hardly "busted for bullshit". It's just a defense reaction that says nothing about merits.

(B) Don't confuse me poking fun at something with that something being a joke. Things can be both darkly hilarious and quite serious.

But you didn’t bust anybody. Because it’s not like SALT only affects blue states/democrats.

Personally I feel like salt deductions are tricky because on one hand “less taxes” but on the other hand “basically a subsidy”. So my preferred solution is to eliminate income taxes completely.

This isn't quite accurate. I live jn Texas. We have no income taxes, but property and school taxes total 3.5 to 4% of a home's vakue annually. You don't have to be rich to hit that $10,000 ceiling. We paid $250k for iur home a few years ago and our taxes exceeded the cap last year.

property and school taxes total 3.5 to 4% of a home’s value annually.

So like NJ, but without the income taxes.

Ummm... you may want to look back two years and see what the new personal and family exemptions are for itemizing. It isnt a 10k ceiling anymore.

If you were in California you would have 1/3 the tax rate on 3x the value. Plus income tax.

Who do you think subsidizes so many Dem politicians? High income and high wealth people primarily in bicoastal high tax areas of this country. So, of course, the Democrats want to increase this tax giveaway, even if the rest of the almost wealthy have to pay for it.

Not stealing something is not a "giveaway".

It is when it helps folks libertarians don't like. C'mon man, this is basic stuff.

Every tax break is a good idea. It means less theft.

Exactly. Spending increases tax burdens, not tax cuts. Cut spending, cut taxes.

This has truly become a bizarro world for me. Because it gives the big GFY to Democrats, fiscal conservatives have given up on so many principals.

Double Taxation: A dollar paid to the state is a dollar that a person never received as income. They never enjoyed it or spent it, it was taken out of their paycheck. And yet it is taxed again.

Not Taking is Giving: When the government declines to take money from a company because it invests that money in capital, liberals call that subsidizing, and conservatives correctly deride them for it. But when it is the federal government not taking money that was paid to the local state, well then it is suddenly subsidizing.

And now we see conservatives calling to tax a small share of the rich, and liberals fighting to defend them. Again- total bizarro world, largely driven by TEAM!

I am on the fence about this law. I am happy that it allowed for broader tax cuts. That said, it is also yet another way that the government carves away more and more taxes by targeting unpopular groups. It will continue into the future, unfortunately.

“ Double Taxation”

That’s a good reason for the states to not tax the money you pay the feds.

I'll add that I am one of those who saw his tax bill nearly double last year due to this rule change. I supported it mainly because I believe we need to move towards a flat tax with ZERO deductions. Just, 25% for every dollar over (say) $75,000/$150,000 (single/married). This law got us closer to that, but that is no reason to carry liberals' water on their attempts to redefine what is giving and what is taking.

Blame the state government for where you live then.

Overt appears to want the test of the country to pick up the tab for his choices.

"Overt appears to want the test of the country to pick up the tab for his choices."

Yes, again, you have redefined paying and giving. If a company pays $35/hr for some work that another company pays $25/hr for, the former gets to deduct the $35/hr from their income. We don't say that the latter company is "picking up the tab". It is an expense. And the federal government is only entitled to net income, not all of your income.

This arguing from you guys is truly bizarre.

Your ignorance to both the history and purpose of federal taxation is bizarre. Your claim only works if you assume state is supreme to the feds and they get first dibs.

Likewise you're claiming some expenses are superior to others and shouldn't count against the fed tax.

Bizarrely you've made the claim above that since you never see untaxed I come you should only pay taxes on that portion. It is obvious you've never owned a business or done quarterly taxes.

I honestly dont get why you keep tripling down on a point so easily rebuked.

SALT are not business expenses, they're union dues.

Having never been union labor, I don't know if their dues are deductible... but they damn well shouldn't be.

SALT deductions subsidize the shitty choices of local government a shield you from the full burden of choosing to live where you do, and accept those shitty choices, in a way that people who live elsewhere, and haven't made those shitty choices, aren't protected from.

Economic advantage is given to locales whose government promises more because more won't be required from the residents living there.

If you don't like getting raped by your local government, change it or move.

It is wrong for the federal government to privilege one location over another, which is exactly what SALT deductions do.

I love these people living in who-the-fuck-knows which Red state claiming that Blue states are shitty. Are you really so ignorant? Your existence is dependent on Blue states, and I'm not just talking about who gives and takes more from the tax pile. Seriously, you are too ignorant to even comprehend how dependent you are on those of us carrying your water.

Hahahahahahaha

Your mistake is assuming feds are taxing post state AGI, they are not. They are taxing your income prior to any taxation or adjustments and allowing various exclusions. You have the process backwards.

"A dollar paid to the state is a dollar that a person never received as income."

This is beyond silly. Regardless of whether or not you actually had that dollar in your hand, you earned it.

"This is beyond silly. "

Ok, let me rephrase that. A dollar paid to the state is a dollar that a person never received as NET income. The idea that people ought to pay taxes on their gross income is new, and has nothing to do with blue vs red states. It has always been the case that expenses are removed from your income before determining taxes, and since the introduction of federal income taxes, SALT has been considered such an expense.

That people suddenly want to say "fair" is taxing gross income, is a drastic change in tax policy, and you should at least try to be consistent about it.

You keep using net income incorrectly. You're explaining adjusted gross income, not net income, which is a modification to your taxable income based on government preferred exemptions. You're still taxed on your full income, you're just applying various exempted reductions.

Again, you've got the tax theory completely backwards.

Haaaa, do you even hear yourself? Your definition of AGI is, wait for it, your NET income. He is simply using a more accurate, straightforward term for it.

The trend has been one of eliminating that which one can claim as an expense.

Remember when all interest, even credit card interest, was deductible? Now, only mortgage interest is.

The government always moves in the direction of getting more of what you earn. First by putting a limit, as with the current SALT deduction, then by eliminating altogether.

Even if this demoncrap attempt to give something to their voters goes through - cough, cough, Trump veto - it will be reversed, maybe eliminating even a "capped" amount.

Now remember that it's all the "libertarians" who are saying that dollar you earned rightly belongs tot he fed.

"Double Taxation: A dollar paid to the state is a dollar that a person never received as income. They never enjoyed it or spent it, it was taken out of their paycheck. And yet it is taxed again."

But this is routine. You pay income tax, but then pay sales taxes on the income-tax reduced funds you use to buy stuff. Depending upon the state and locality, you may also pay taxes on car registrations, gasoline, cable TV and mobile phone subscriptions, booze, tobacco, real-estate transfers, and on and on even though you already paid income taxes on the money you're spending. You also don't pay less in FICA payroll taxes based on the income taxes you've paid (or less in income tax because of the payroll taxes). Both are computed based on your gross income.

Personally, I also live in a deep-blue, high-cost, high-tax location. After the change, we went from itemizers to using the standard deduction. We paid off the mortgage because the interest was no longer doing us any good at tax time. So even though the change cost me some money at tax time, I support it -- there's no reason people who prefer high state and local taxes to get deluxe government services should then get to pay less to the feds because they've already spent a big chunk of change on local big government. I want my damn neighbors here to feel the full cost of the policies they're imposing on themselves (and me) -- it's the only way local policies are ever going to change. If they keep being able to vote for ever bigger local government and not have it cost so much because of a fat federal tax deduction, they'll just keep on doing it.

^this

"Double Taxation: "

People are taxed, not dollars. If you don't like your high tax state, move.

You say they never enjoyed it the money paid to the state for taxes, but they do enjoy it in the things that their state pays for. The earner in the lower-tax state may get more take-home money, but doesn't get to enjoy as many state parks (and cheaper state resident fees at them), state education funds paid to local districts, in-state tuition at the better-funded colleges in the higher-tax state.

The taxpayer in the higher-tax state (at least hypothetically) has some control over how high their state taxes are, and what they spend the money on. If they don't want the Feds to charge them taxes on the things they enjoy that their state pays for, they can vote for legislators who want to cut taxes and cut spending (of course, they'll get outvoted by the people who want to soak the rich to pay for the state-provided amenities).

Of course, that assumes that the higher-tax state

doesn't just use the increased revenue to pass more and better benefits for their cronies, and leaves the rest of the taxpayers out in the cold.

How about dropping SALT entirely? Also drop charitable deductions.

The larger standard deduction largely eliminated the benefit of itemizing charitable deductions

Any tax break that Congress passes is meant to help themselves first and foremost. The citizens can go to the devil.

salt deduction limit should be $0

mortgage interest deduction limit should be $0

student loan interest deduction should be $0

medical bills deduction limit should be $0

etc etc

the standard deduction should be higher and/or rates should be lower.

I disagree with this. Standard Deduction was always a fast and lazy way of calculating your expenses that should be deducted from Gross Income, before calculating taxes. Setting aside SALT, the federal government saying that everyone has the same expenses is a totally un-libertarian thing to do. It might be fine as a fast way to do their taxes, but people should be allowed to do their own calculation of expenses, for such things as passive income, business expenses, and the like.

Now, a close idea is to get rid of deductions at all and just tax Gross Income. Exempt the first $XX,XXX and charge 20% on anything above that. That would be logically consistent, and get rid of all these carve outs.

your second paragraph is a more succinct way of describing the taxing paradigm i prefer.

no carve outs / distortions

His second paragraph is a contradiction to his first. Wonder when he will realize it

"Now, a close idea is to get rid of deductions at all and just tax Gross Income. Exempt the first $XX,XXX and charge 20% on anything above that. That would be logically consistent, and get rid of all these carve outs."

Besides which, it would reduce my spending on some clever guy to read the tax statutes end-to-end in order to keep as much of my earnings as I can.

We get it. you prefer taxes that help you instead of fair taxation. You've made it clear.

Student loan deduction shouldn't be zero unless the government reverts it's dischargable status to the same as any other common debt.

"about to hand wealthier Americans a big tax break that will add to the federal budget."

There are no "tax breaks" that add to the federal budget. Only spending adds to the federal budget.

All reductions in federal revenue are a good thing. No exceptions.

"Reducing Americans' tax obligations is always welcome, of course, but the plan to lift and repeal the SALT deduction cap is still questionable policy at best"

Nope. you're wrong. All tax cuts are good.

^+1, ^^+1, ^^^+1

So what the democrat house is doing is giving the rich a tax break while giving the middle tax payer a tax increase. At the same time the house is shifting the tax burden in these high tax states from their residents to the rest of the taxpayers in the nation. State and local taxes should not be a deduction on the federal taxes. Each state's residents should feel the full burden of the taxes their own politicians have put upon them. Until this happen these tax happy states will not have a reason to change their ways because the residents of the other parts of this nation are also carrying these states tax burden.

Do corporations also have a limit on the state and local taxes they can deduct on their federal taxes?

Nancy Pelosi has a roughly $100 million net worth, much of it in illiquid real estate in California, which includes a $25 million vineyard in Napa Valley. Napa residents pay a mill levy based on market value. At her valuation, she's paying about $200K a year in property taxes for that one property. She can only deduct $10K. Her salary in Congress is about $179K. She owns several more properties valued at over a million, in California.

So yeah, that's why she wants a tax cut. It's also part of why she hates Trump so much.

In the grand scheme of things, the state deduction is inconsequential. The big issue is that our tax system is now dangerously progressive. With 44% of our voters paying zero income tax, there is an increasing incentive for politicians to promise free stuff without worrying that voters will concern themselves about how the stuff gets paid for. When that number reaches 55-60%, the show will be over. Any prayer we might have for responsible fiscal policy will vanish completely.

”A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury”

Alexander Fraser Tytler (disputed authorship) ~1800

And the FSM can’t get us out of this jam.

There's a lot of spin and deception in this piece. I expect better from Reason.

I expect better from a union thug.

Oh wait, no I don't.

Tax cuts for the rich and themselves. All to subsidize the wealthy to buy even bigger houses with a larger carbon footprint. Ahhhh the irony.

Does the bill have any chance? Are there any Repub takers? Sadly nobody is covering anything other than the doomed impeachment. It's refreshing that Reason has picked up the slack here but more info on this would be great.

https://www.se7a4evryone.com

"Eat The Rich? House Democrats Plan To Pass Huge Tax Break for Wealthy Homeowners."

This should come as no surprise.

The democrats have been the party of the rich elites for decades.

The only time the democrats are the party of "the little guy" is re-election time.

But the good news is Obama can now enjoy a nice tax break now that he bought that house in the Hamptons.

Isn't being rich wonderful?

good lord they are transparent. restoring deductibility to the hyper overtaxed blue states is the plainest of bribes for east coast liberals one might imagine. people people people...if they hadn't restored the deduction the hacks running those failing states would have to cut spending.