American Manufacturing Is Growing, but Trump's Tariffs Aren't the Reason Why

A new report shows that American imports from Asia continue to grow, although the tariffs might be responsible for shifting some manufacturing from China to Vietnam and elsewhere.

At the White House's third annual "Made In America" event on Monday afternoon, President Donald Trump singled out a bicycle-maker from Tennessee for special praise. The company, Litespeed Bikes, moved its manufacturing operations back to the United States last year, Trump said, and had seen an explosion in sales since then.

That was evidence, the president said, of "an extraordinary resurgence of American manufacturing."

"When I took office, I was told by the previous administration that manufacturing jobs would be disappearing," Trump said. "There was no way. They said you'd need a miracle."

It's true that American manufacturing has enjoyed a rebound during Trump's tenure, with more than 500,000 new jobs added in the sector. But while that increase is something to be celebrated, a new report finds little evidence of so-called "reshoring"—that is, of jobs being brought back from overseas, something Trump promised would happen as a result of his tariffs on Chinese-made goods.

In fact, more than a year after the first round of tariffs on Chinese imports took effect, the growth of imports from Asian countries to the United States increased by 9 percent in 2018. That's the largest annual increase in more than a decade, according to analysts at A.T. Kearney, a manufacturing and trade consulting firm that publishes an annual "Reshoring Index."

That index—which measures domestic manufacturing of consumer goods against imports of the same products from 14 lower-cost countries in Asia—fell for the third year in a row, which shows that manufacturing firms continue to view Asia "as a more desirable location than the U.S. to produce or purchase a wide variety of goods, notwithstanding the trade measures emanating from Washington, D.C.," the analysts noted.

The report says Trump's trade policies have had a "backfiring" effect on U.S. manufacturing. Although the tariffs were intended to bring jobs back to America, the data indicate that the higher costs created by tariffs have not outweighed the benefits of manufacturing in lower-cost countries. If anything, higher input costs have harmed American manufacturers who import component parts. American audio equipment companies, like Seattle-based AudioControl, might import electronics from China and assemble finished products in the U.S. The company's CEO, Alex Camara, says he's been forced to raise his own prices by between 8 and 12 percent.

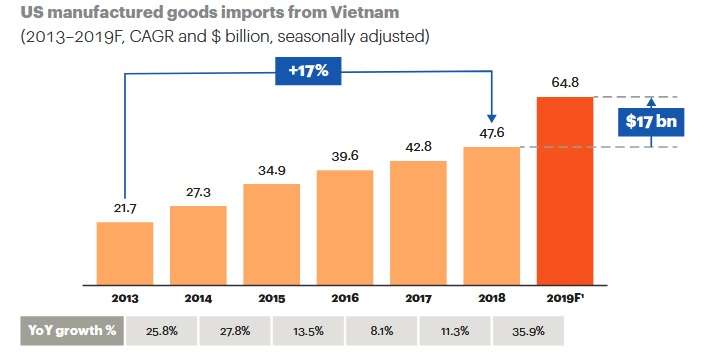

In some cases, the tariffs have encouraged manufacturers to shift production to India, Vietnam, and even Mexico to avoid tariffs—but that's merely an acceleration of shifts that were already ongoing before the trade war, A.T. Kearney's report notes. Vietnam's exports to the United States have doubled since 2013, for example, but the rate of growth skyrocketed during the first quarter of 2019.

Still, China remains by far America's biggest source of imported manufactured goods. Of the $816 billion in Asian-made goods tracked by A.T. Kearney during 2018, about two-thirds came from China.

It may seem pedantic to point out that Trump's tariffs aren't the cause of the manufacturing jobs boom that the president like to talk about. But it matters. American consumers and businesses are paying higher prices as a result of Trump's trade war—and even industries that were supposed to be protected by those tariffs now seem to be losing. If the tariffs are not helping the ongoing resurgence in American manufacturing, why should the president continue to force those taxes on Americans? Unless he's secretly trying to make Vietnam and Mexico great again, the tariffs seem to be failing to achieve one of their primary policy aims: bringing jobs back to the United States.

Trump should enjoy his manufacturing boom while it lasts—because he's not helping it. In fact, the A.T. Kearney report warns, the tariffs might end up having the opposite effect from what was intended. As tariffs increase costs for American manufacturers, they might make CEOs "more likely than ever to orient supply chains" towards lower-cost countries in Asia. And the longer American companies are subjected to higher input costs because of tariffs, the greater risk there is of an economy-wide slowdown.

"If increased tension between the US and its trading partners persists or escalates," the A.T. Kearney analysts warn, "we may simply be seeing the first harbingers of a considerably darker scenario."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

An "Orange Man Bad" article from Eric Boehm?

Not even "dog bites man". It is "dog licks balls".

Has he actually gone from "Tariffs will destroy manufacturing" to "Manufacturing is better...but no thanks to tariffs?"

We should ignore the earlier pronouncements?

Pretty much.

It goes along with Mauser below, who I'm sure was claiming a few months ago the economy growth is due to Obama and is now saying it is an artificially inflated bubble.

"We have always been at war with East Asia."

#ClownMagazine

It's the tax cuts.

Of course it is. Lower taxes always stimulate investment. I used to believe democrats just didn’t understand the that lowering the barrier to making a profit encouraged investment. No i see that they don’t care and don't want anyone making profits in the first place.

Someone missed the Boosh years, lmao.

Do you mean six years of economic growth after he inherited a recession. This despite a massive attack on our soil. And when he did try to rein in subprime mortgages, he was accused of racism, but he then got blamed when the bubble invariably burst, just as he (and numerous others) had been predicting since at least 2005?

I hate doing these disclaimers but because no one can debate anymore without resorting to straw men or absolutism: there are a number of things you can blame on Bush, but the 2008 recession is hardly his or the tax cuts fault.

Yes. Just think what reducing tariffs (also taxes) might do for the economy.

Or China agreeing to freer trade? Allowing US companies to invest. Protecting US copyrights, patents etc. Decreasing state sponsored corporate espionage. Removing trade barriers to US imports. Etc.*

*Disclaimer: this isn't an endorsement of tariffs, but rather a hope that despite it all, China and the US trade negotiations can benefit the US.

Fully agree with this, although I think that we're going to run into the issue that most people run into with China's government...in that China simply doesn't honor their agreements. They'll blast other people for reneging on agreements, but they themselves feel no obligation whatsoever to honor treaties with other nations (who they see as merely vassal states who have not yet recognized their vassal status). This is a problem that goes back long before our lifetimes.

China might make a deal with Trump or the next president, but it's going to be a constant battle to force them to keep it, because they simply don't care about honoring agreements as soon as they get what they want out of it. So there's a good chance that friction with China will occur for decades after this.

With China, any trade agreement is probably going to require us to have lots of safeguards and punishments in place to protect our interests if China reneges, and the agreement will likely have to be constantly policed.

I don't think there's ever going to be real free trade with China, simply because that's not how their government views geo-politics and long-term free trade agreements don't fit with their political and military goals.

Corporate espionage also results in a loss of dollars, which since you are pulling a chief justice like move... is a tax.

"In some cases, the tariffs have encouraged manufacturers to shift production to India, Vietnam, and even Mexico to avoid tariffs—but that's merely an acceleration of shifts that were already ongoing before the trade war,"

That's good enough for me. I"d prefer we send our money anywhere but China. We shouldn't be financing an evil authoritarian regime that threatens it's neighbors, monitors everything it's subjects do and harvests human organs.

And openly sponsors corporate espionage, copyright and patent infringement.

While illegally manipulating it's currency.

I”d prefer we send our money anywhere but China. We shouldn’t be financing an evil authoritarian regime that threatens it’s neighbors, monitors everything it’s subjects do and harvests human organs.

"we"

So you're happy "financing an evil authoritarian regime that threatens it’s neighbors, monitors everything it’s subjects do and harvests human organs"?

I think the decision should be left up to each individual to decide.

So, how is it a bad thing that "we" meaning the US, is sending less money to China? How is that undesirable?

Would you also support an individual funding terrorists? How about supporting a declared enemy of the state? Where exactly would you draw the line? Or is there a line?

It should not be up to the US government to decide where private corporate financial resources should be allocated.

It should not be up to the US government to decide where private corporate financial resources should be allocated.

Any libertarian devoted to free markets would rightly tell you that it shouldn't be up to *any* government. Trading one government and one peoples' money for another isn't an acceptable alternative and when the alternative government is more invasive and oppressive, it's not exactly a purely principled stance either.

There's certainly a case to be made that the US Government is increasingly invasive and authoritarian, but when it comes to Trump, Trade, China, and this article, that's not the case that anyone is making.

Sometimes it should.

Actually, there are some definite justification to limit private investments to certain countries. I doubt, during the height of WWII you would have been okay with Americans investing in Axis countries.

That’s good enough for me. I”d prefer we send our money anywhere but China. We shouldn’t be financing an evil authoritarian regime that threatens it’s neighbors, monitors everything it’s subjects do and harvests human organs.

When white people wear sombreros on Cinco de Mayo, it's cultural appropriation. When China redirects trade through proper businesses in foreign countries Trump is a white nationalist.

Vietnam is not the epitome of a free state either.

No, but it is opening up. And it is a good check on China's expansionist hopes. Vietnam is a historical hostile state. They stopped the Chinese in 1979.

Reason shills for Emperor Xi.

It's strange. I could have sworn that Reason was once opposed to totalitarianism.

The tariffs are, in fact, largely responsible for the #DrumpfRecession.

You sound dispirited, OBL. You need to buck up and throw in some love for Kamala and Liz, maybe give the crazy author lady a little pump?

Yea, OBL, you should try to be her trophy hus-, I mean wi-, ...mate?

+1

Concise!

So Boehm has to admit manufacturing is increasing but make sure we understand that Trump isn't responsible or at least make sure we don't credit the tariffs. I can probably agree with the second part, I doubt tariffs have helped reshoring, although it is possible that increased cost of Chinese goods have helped some start ups be competitive (neither saying yay or nay here, I don't have any evidence one way or the other). Boehm probably should have addressed this point.

On an aside, I don't see that increased imports of Asian goods proves anything about the tariffs. Our economy is booming and consumer confidence is increasing, the fact that imports are growing doesn't prove a thing. Also, the tariffs have probably sped up a process that was already happening, mainly US companies moving sourcing from China to southeast Asia. Vietnam is a major rival to China, and one that handed them a fairly serious military defeat in the late 1970s. It may be good for us if Vietnam's economy grows at the expense of China's. China is a bully in the area and Vietnam is one of the countries they're trying to bully. Actually Tom Clancy predicted a war between Vietnam and China, I believe it was in his non-fiction book Fighter Wing. Considering how he also predicted a foreign terrorist (only Japanese in the book) would use a passenger jet to attack DC, it makes you wonder.

On a related note: how well do you thing Xi received this news? It could hardly be good news for China.

We're importing more from China than we were before the tariffs but their growth is slowing to paces not seen in 30 yrs.

Trump: We’re going to win so much, you’re going to be so sick and tired of winning.

Wonks: You can't win a trade war.

Trump: Hold my Russia investigation.

I don't like the guy, I don't think he's very exceptional, and I'm honestly sick of all the winning but his opponents and detractors consistently make him look near super human. Whether he's responsible for it or not, I'd rather be sick of all the winning than sick of the alternatives or just plain sick.

I'm not doubting your assertion that imports from China has increased, though I don't see the reference in the story. I do see Boehm stating that Chinese imports are 2/3rds of Asian imports but not how that compared to the previous year.

Also, I doubt Xi is happy to see business going to Vietnam.

Also, I doubt Xi is happy to see business going to Vietnam.

China trading through Mexico means more jobs in Mexico and, it turns out, we're less reliant on getting our cheap cell phone parts directly from them than they are on getting cheap soy from us.

Sometimes you're a 5D chess mastermind and sometimes you find yourself standing in the middle of a 5D chess board and are just good at not losing.

Whichever it is, I am not shedding any tears for trajectory of China's economy. Especially as Xi is trying to be the second coming of Mao.

C'mon Boehm, get with the program. Help move the goalposts or get off the field. See, even if Trump's stated goal was to bring manufacturing jobs back to the US, as long as China's paying billions and billions of dollars of tariffs into the US Treasury, he counts it as a win. "MAGA" works whether it's making those forgotten American voters better off or the US government marginally richer. And if it hurts the Chinese and makes Vietnam better off, well, "Make Asia Great Again" fits the acronym, too.

Can you explain why hurting China and helping Vietnam, a far more American friendly country, is a bad thing for America?

China’s paying billions and billions of dollars of tariffs into the US Treasury

Huh? Who's paying those tariffs?

tariffs might be responsible for shifting some manufacturing from China to Vietnam and elsewhere.

Note: My company was mulling a pivot to Vietnam from China well before Trump was elected because China has become increasingly difficult to do business in for Western Companies.

I think it is like mechanization. It will happen eventually but sometimes policy speeds up the process. Boost minimum wage, more self checkout lines, and self order kiosks. Everyone bitched at first but now there are lines even for the self checkout and people line up for the kiosks.

This economy is a house of cards. Bubble after artificially inflated bubble.

Aren't all economies? What a stupid fucking statement.

"artificially inflated bubble" was what they called me when...

Wasn't quantitative easing an artificially inflated bubble?

Does a fat hog fart? Does a bear shit in the woods?

So you admit that all economies are the product of bubbles, always on the verge of bursting. It is the perpetual state of markets.

Worse with government interventions. Malinvestment is the result creating far worse bubbles than normal market conditions.

This is true. So how is Trump's economy artificially inflated? The have more often raided rates then lowered them. While the tariffs have not helped they also haven't hurt the growth. Deregulations and a more business friendly feeling in DC. I would say the economy is more due to Trump and his administration getting out of the way. This argued that any bubble is more naturally occurring then artificial.

I do agree that Trump policies of deregulation and tax cuts have been fantastic for the economy, that is true.

The main job of the government should be providing safe passage (i.e. protecting American flagged vessels) and getting out of the way of private business. Sometimes, though, in the name of National defense the first and second concepts are in conflict.

Unfortunately yeah sometimes they do get mixed up.

Sometimes, even as much as I applaud personal liberty, we do have to sacrifice for the greater good. That doesn't mean I support tariffs, but it also means I am not really sad that China is being hurt, while more American friendly countries are benefitting.

Bunch of ignorant economic illiterates.

If something costs twice as much to make here as overseas, then people are going to buy less of it, and the company will have to lay off a lot of those workers.

Or people will hold their nose and buy that article at twice the cost, and have less money left over to buy other things.

Either way, some workers somewhere are going to be laid off, and some companies are going to reduce staff or even go out of business.

All you Trumpistas high-fiving over Trump's tariffs and sticking it to the evil Chinese are just plain devoid of common sense.

You are also a bunch of authoritarians who think your Trumpenfuhrer knows better than everybody else what is good for them.

Bunch of fucking slavers, every single one of you.

Fuck off, slavers.

Did you miss the fact that the economy is growing, that manufacturing is growing, buyer confidence is growing, Chinese growth is slowing, that unemployment is down etc?

So the best you can do is use sophomoric epitaphs? No real argument other than ad hominems and rehashed talking points?

Did you miss the fact we are near the end of the business cycle?

And?

Did you miss the fact that you are applauding Trump for minding my business on your behalf?

Did you miss the fact that businesses will sell fewer products when the price goes up and have to lay off some workers, and that consumers will have less spare money to buy other products, and those companies and workers will suffer too?

Of course you did -- you're a Trumpista.

Fuck off, slaver.

No, I am pointing out that you didn't offer any arguments other than orange man bad. You didn't offer anything other than rehashed bullshit and orange man bad. If you think my pointing out the economy is good is applauding Trump, all that reveals is the fact that you can only think in simplistic binary terms. This is further reinforced by your constant rejoinder of calling anyone who disagrees with you a slavery. It shows that you are a partisan zealot (and yes you are partisan even if you don't identify as R or D) who cannot grasp nuances. Instead it is an either your with me or against me style argument on your part.

Then you can't read, if my arguments escaped you.

Fuck off, illiterate slaver. You want to control who I do business with? You're a slaver. Don't like it? Don't applaud Trump for minding my business in your behalf.

Fuck off, slaver.

Again, no argument just simplistic ad hominems. Call me a slaver, it demonstrates more your lack of intellectual ability then it impacts me at all. You didn't offer an argument other than well established concepts, e.g. you can either suck up higher domestic prices or import. That is so uncontroversial that stating it is basically the equivalent of stating that at room temperature water tends to be a liquid. It isn't an argument, it's a statement of fact. And it doesn't support any of your accusations. But it does feed your virtue signalling.

Answer the primary question: Why do you think you have the moral authority to control who I do business with?

Haven't ye, probably never will. You are scum.

Fuck off, slaver.

I don't have any business unless you are doing business with someone who is going to do actual harm to me, my family or my community (i.e. if you were funding ISIS) and even then I have no real authority.b

Then answer the question of how hundreds of billions in new taxes help the economy. Don't just say "the economy is great", because that's all Obama ever did. Answer the actual question of how a tax raise helps the economy.

I never said tariffs helped the economy, in fact I believe above I said they didn't. Nice straw man there.

Your support of tariffs says otherwise.

When did I say I support tariffs?

You are making assertions about what people said/mean without providing evidence. You are so convinced of your own superior morality that any minor disagreement must be because we are evil. And this leads you to make assumptions about our stances without adequate evidence to support your assumptions.

He is rather redundant and lacking of self awareness. Sock or NPC?

Can you admit ever that we have never had free trade with China? No point in arguing with your idiotic views while you remain arguing from an ignorant base assumption.

Then explain how a company can sell just as many products when the price goes up, and explain how consumers, having spent more on those products, still have as much money left over to buy all the other products they used to buy.

You can't, because consumers can't

Did I disagree with this? No I pretty much stated it was established fact.

Yet you denied that I made any arguments.

Bait and switch?

Losing your marbles?

Didn't take notes on what position you had staked out?

That isn't an argument that is a statement of fact. You did not expand upon how this demonstrates the rest of us are "trumpistas" because of our posts. You made a rather benign statement of fact and then launched into attacking every other poster in here. You didn't make an argument other than orange man bad.

No, like I said you don't understand nuance. Or even how to make an argument. You basically sound like a Christian fundamentalist arguing against evolution, or a granola arguing against GMOs. You're using the same tactics.

ABC argues from a platform build on ignorant base assumptions. He then uses general rules accepted by all sides as proof his base assumptions are correct, and therefore he wins the argument. It's an idiotic argumentative style.

Is that clear enough? I've broken it out into three separate posts. Surely you can answer at least one of them. Well, probably not, but you have fewer excuses now.

Fuck off, slaver.

And everyone was a straw man. You tried to make arguments based upon statements I never made.

What I said is that you didn't offer any new argument, nor make any point other than orange man bad and anyone who disagrees with me is an authoritarian slaver. Basically, pure intellectual dishonesty on your part.

You are also a bunch of authoritarians who think your Trumpenfuhrer knows better than everybody else what is good for them.

It is possible to celebrate the retooling or diversification of China's economy without it all being about Trump. Matter of fact, it would seem like a libertarian magazine that really did want to diminish Trump's influence and relevance would present it or at least seem like it was capable of presenting it as such rather than viewing it, and everything else, solely through a Trump lens.

It is NOT possible to mind my business without being an authoritarian. If you cannot grasp that simple concept, your are a slaver. If you think sneering at Trump for being an authoritarian on your behalf makes it all about Trump, then your are suffering from Trump Derangement Syndrome, where your refuse to admit Trump can do any wrong and you have to rise to his defense over these horrendous insults.

Fuck off slaver. Mind your own business, not mine. If you want Trump top mind your business for you, fee free to cower and submit to him.

"It is NOT possible to mind my business without being an authoritarian". Is this a typing error or did you actually mean to write this sentence? Because if so, logic also seems to be a weakness of yours. How is minding your own business the equivalent of being an authoritarian? (This so where you launch into an ad hominem and accuse me of being an illiterate slaver, authoritarian who is praising Trump, despite nowhere did I praise Trump). This is because your world is defined by a concept of what you believe and everyone else is your enemy and evil.

If you mind my business for me, without my permission, or if Trump minds it for me, of if anyone but me or my agents minds my business for me without my permission, they are authoritarian fucks.

How much clearer can it get? How much more illiterate are you? Do you not understand "MYOB" or authoritarian or "without my permission" or "slaver"?

Fuck off, illiterate slaver.

That isn't directly supported by your sentence. In fact your sentence can be read that minding your own business makes YOU an authoritarian. That is why I asked for clarification. But you are so ready to attack everyone who is not lockstep with you and resort to ad hominems you are basically unhinged. Are you incapable of having a meaningful discussion?

When it comes right down to it, your insistence on demonizing anyone who may disagree with you as slavers and authoritarians, that seems less as someone who honors freedom then someone who demands strict adherence to his theology.

I demonize as slavers and authoritarians all who want to mind my business without my permission.

You are one of them.

Fuck off, slaver.

When have I tried to mind your business for you?

When it comes right down to it, your insistence that you mind my business makes you a slaver and authoritarian.

How much clearer does it have to be to sink into that rock you have for a brain?

Fuck off, slaver.

Again, when did I say I had a right to mind your business? Straw man much?

Can we get rid of the fucking flag already... Or at least give people the option of unflagging people when they accidentally flag someone (because of the fucking squirrels, which seem to be back).

Maybe if everyone flags everyone, they'll add an undo.

Yeah, it is almost as if they haven't been reading the fact that no one likes the flag option. But then again how much they defend Twitter, Google, YouTube, it may be just a matter of time. Boiling the frog, right?

Comments are closing @Reason.

As well they should, really. Can't have old fashioned libertarians pissing in the cornflakes of the new Woketarian Reason.

Google searches over Reason articles:

site:reason.com/2019/06 "Comments Are Closed"

About 222 results

site:reason.com/2019/06 "Leave A Comment"

2 results

When I pointed out in May that Reason was starting to shut down their comments section, @kmanguward categorically denied it:

Not sure what exactly you saw, but our comments are definitely not closed! They are never closed, in fact!

https://twitter.com/kmanguward/status/1128377976230428673

Which is why I go to Quillette anymore for deep discussions and debate about abstract concepts that used to be common place here.

An example of the coarsening of Reason can be seen with the NPC "alphabet soup" above. When your best attempt at meaningful debate is fuck off slaver...

Oh good heavens. The comments section at Quillette are almost as bad as here.

Really? Because on Quillette I see actual discussions on Locke and Smith, on physics and history, on Voltaire and Jefferson etc. Yes, the woke trolls are starting to invest and there are a few screed throwing right wingers, and both of these, unfortunately, are growing. But deep discussions can still be had. Of course you probably don't like it because they are probably even better at calling out the simplicity of you absolutism as we are here.

Says the dumbass citing ratical.org

Tariffs, in the long run, usually only hurts both sides of the equation.

Trump should continue to lower corporate and income taxes further AND remove tariffs.

Then growth should improve.

This is the truth. His tax reforms and some deregulation effort probably aided the recovery.

I would urge the president to end all trade wars on our allies. But he should maybe stand his ground a bit longer on China, given that country actually does run concentration camps. If our companies are "forced" to move production to Vietnam to dodge tariffs, what's the harm?

Korea and Japan are in a trade war of their own and Nintendo announced that they're moving some production to Vietnam. There will always be nations offering cheap labor to the big players, we don't have to go out of our way to accommodate commies.

[…] “American Manufacturing Is Growing, but Trump’s Tariffs Aren’t the Reason Why,” by Eric Boehm […]

[…] “American Manufacturing Is Growing, but Trump’s Tariffs Aren’t the Reason Why,” by Eric Boehm […]

[…] “American Manufacturing Is Growing, but Trump’s Tariffs Aren’t the Reason Why,” by Eric Boehm […]

You do realize that moving production from China to Vietnam or Mexico is a WIN from the angle Trump is looking at things from? Frankly, I agree.

China is our number one geopolitical enemy. They're not like saaay India, which just wants to develop, get richer, and be cool. They want to DOMINATE. Politically, militarily, and economically.

And they're a ruthless dictatorship. AND they've been screwing us.

So even if jobs don't come here, taking them away from China, and potentially getting some trade concessions from them is a win. One can argue if the cost is worth it, but it is a positive thing.

[…] his bellicose trade policies by citing the importance of American manufacturing jobs . Trump talked about “an extraordinary resurgence of American manufacturing” during a photo op at the […]

[…] in mind that even before this last escalation, jobs in manufacturing were waning. Economists now worry this might throw the economy into reverse. Former car czar Steven […]

[…] in mind that even before this last escalation, jobs in manufacturing were waning. Economists now worry this might throw the economy into reverse. Former car czar Steven […]

[…] in mind that even before this last escalation, jobs in manufacturing were waning. Economists now worry this might throw the economy into reverse. Former car czar Steven […]

[…] in mind that even before this last escalation, jobs in manufacturing were waning. Economists now worry this might throw the economy into reverse. Former car czar Steven […]

Does he, under this ID, actually espouse those stances? If so, his arguments are even less coherent.

I may have misinterpreted Mauser to a degree. He does seem, at least on this thread to be arguing absolute free market principles. I can respect that while disagreeing. I am generally for full free markets (and my opposition to China is because it isn't a free market) but occasionally do see that national interests do supersede individual rights to freely trade with anyone and everyone they want to. The problem is that while I think the tariffs are not a good thing, I also agree China needed to be encouraged to stop some of its worst practices.

That's a hell of a screed, Jack Johnson.

Well said

Yeah, basically. Though I wish they had a better human rights record. But China is not any better (probably worse under Xi).

Sometime next summer right before the election.

While possible, it is getting less and less likely.

If Trump is reelected, the chances are that we will have a recession sometime in the 8 years. And he will be blamed. But the chances of that happening in the next year and a half are growing more remote.