Trump's Trade War Turns 1. Here's What We've Lost.

Even if Trump's tariffs go away, the debilitating economic effects are likely to linger for years.

A trade war doesn't have a body count, but that doesn't mean it can't put lives at risk. Just ask Judy Bannon.

In 1998, Bannon founded Cribs For Kids, a Pittsburgh-based nonprofit that provides small cribs to low-income parents who otherwise might not be able to afford one. Deaths from sudden infant death syndrome (SIDS), where a baby seemingly inexplicably dies while sleeping, had been declining for years thanks to then-new guidelines calling for infants to sleep alone, on their back, and in a crib.

Anyone could follow the first two rules. But not everyone can afford a crib. In the 20 years since Bannon founded Cribs For Kids, the group has grown from a two-woman operation with a $2,500 budget to a national nonprofit that re-sold, at cost, more than 100,000 cribs last year for about $50 each. The number of babies dying from SIDS has continued to fall.

The cribs arrive from China, packed 1,450 to a shipping container. And each time they are delivered, border tariffs take their toll. "Every time a container of cribs comes in—either to the port in New York or in California or wherever" the import broker who contracts with Bannon's nonprofit "has to write a check for $5,000," Bannon explains. The cribs are held hostage on the boat until the check is written, and those funds go directly to the U.S. Treasury. It's crazy that anyone could think China is paying for the tariffs, Bannon says. She has to immediately reimburse the import broker or else the cribs would never leave the docks.

Cribs—which can be imported under several different classifications—were generally imported duty-free before last summer, when President Donald Trump imposed a tariff to 10 percent on thousands of Chinese-made items worth an estimated $250 billion annually.

Now, the bill might be getting a whole lot bigger. Trump has threatened to raise the tariffs on the items hit with the 10 percent tariffs last summer to 25 percent. Additionally, billions of dollars of still un-tariffed goods could also be slapped with a 25 percent tariff in the coming weeks. As a result, each future shipment of cribs will be subject to an import tax of about $15,000. (Any shipments already on their way are exempt from the increase.)

Paying the tariff bill at the port sets off a chain reaction. As a nonprofit, Cribs For Kids doesn't have a profit margin that can be cut to cover those import taxes. There's no option except to pass along the tariff cost to buyers, which are often nonprofits too, operating on tight budgets, with the generosity of donors. A $10,000 grant to buy cribs for low-income moms will be worth only $7,500 once the full-fledged tariffs kick in. The rest goes to the U.S. Treasury.

"More importantly," Bannon says, "that means 25 percent fewer babies will be given a safe sleeping environment, which will increase the number of deaths that are occurring because of SIDS and accidental suffocation in beds."

It has now been a full year since President Donald Trump embarked on his campaign to reshape global trade by imposing a series of tariffs, first on steel and aluminum, then on about $200 billion in Chinese-made goods. But despite his repeated promises that China would pay, Americans—from babies to beer drinkers to aluminum workers—are paying the price.

In dollar terms, the cost of the trade war is easy enough to calculate: The U.S. Treasury has collected about $18 billion in revenue from the tariffs Trump has imposed since June 1 of last year.

But there are unseen costs that won't show up on a ledger, and losses that won't be fully realized for years to come, some of which will linger long after Trump inks a trade deal with China or leaves office.

The scope of the conflict is still expanding, sometimes in surprising ways. Last week, with little warning, Trump announced to plan to hit Mexican imports with new tariffs—potentially sinking a nascent trade deal still awaiting congressional approval, and signaling that the Trump administration plans to use tariffs not only in trade negotiations but to affect other policy changes too.

We may never know the true cost of the trade war in terms of lost opportunities and unmade investments. Like any war, the longer it lasts, the greater the toll.

The Soybean Ship That Tried to Outrun a Trade War

When it comes to the tangible costs of the trade war, there's no better example than soybeans.

America grows more soybeans than any other place in the world, and nearly half of the crop is exported each year—mostly to China. In 2017, the last full year before the trade war, China purchased 61 percent of total U.S. soybean exports and more than 30 percent of overall U.S. soybean production. That foreign demand has nudged soybeans past even King Corn as America's top crop. Last year, according to the U.S. Department of Agriculture, farmers planted 89 million acres of soybeans and merely 88 million acres of corn.

The business thus relies on container ships to move across the globe—ships like the Peak Pegasus, which in June of last year set sail from the U.S. to China carrying $20 million worth of soybeans. The ship departed just one week after Trump started the trade war by announcing tariffs on steel and aluminum imports. And it was still in the middle of the Pacific Ocean on July 1, when Trump escalated the trade war by hitting about $50 billion in Chinese imports with tariffs.

Trade-watchers predicted that China would retaliate by putting tariffs on American agricultural goods, including the all-important soybean. So for six days in July, the 47,000-ton ship raced the trade war toward the Chinese port city of Dalian, briefly achieving a sort of perverse online fame thanks to automated trackers that showed the ship's location, speed, and intended destination. On Weibo, China's Twitter-like social media platform, messages about the ship actually outnumbered posts about the then-ongoing World Cup soccer tournament. The Peak Pegasus was trying to outrun a trade war.

It didn't make it.

On July 6, when the Peak Pegasus was just 25 miles off the coast, China imposed tariffs on American-grown soybeans. That meant that in addition to $20 million worth of crops, the ship was also carrying an estimated $6 million in new taxes. For the next month, the ship floated off the coast of China, apparently under orders to wait out the trade war. But keeping a ship like the Peak Pegasus at sea costs about $400,000 per month. It could only hold out for so long.

The journey of the Peak Pegasus shows just how disruptive trade wars can be, not only in terms of direct cost but in terms of the uncertainty they create. That uncertainty can have huge and lasting impacts on the American economy. In the soybean industry, it's already made its mark.

In 2016, China imported a record 36 million metric tons of soybeans from America. Last year, it bought just 8.3 million metric tons of the crop, leaving farmers and exporters with a glut of supply and not enough demand. Naturally, prices have dropped sharply.

"Soybean prices are 20 to 25 percent, or even more, below pre-tariff levels," says John Heisdorffer, an Iowa farmer and chairman of the American Soy Association. "The sentiment out in farm country is getting grimmer by the day. Our patience is waning, our finances are suffering, and the stress from months of living with the consequences of these tariffs is mounting."

In October, the Trump administration had tried easing that pain by authorizing $12 billion in payments to farmers to offset losses caused by the Chinese tariffs. After talks with China collapsed in mid-May, Trump announced another round of $16 billion in aid payments to farmers.

Those payments can offset some of the immediate losses. "It would make the difference between operating at a substantial loss for the year and having an opportunity to break even," says Brent Bible, who grows dozens of acres of soybeans on his farm outside of Lafayette, Indiana. His farm usually operates with a profit margin of about 8 percent, so the 25 percent decline in soybean prices since June of last year has dumped him deep into the red. To make matters worse, steel and aluminum tariffs caused a spike in the price of farming equipment.

But the bigger concern for Bible—and for soybean farmers across the country—is the unknown long-term consequences the trade war will have. Will the massive Chinese market for soybeans be there if and when the tariffs are lifted in a year, or two, or five?

Brazilian exporters have already swooped in to fill China's demand. Brazil actually exported so many soybeans in the second half of last year that it had to import some American soybeans to meet domestic demand—and that might permanently reshape the global soybean trade, to the detriment of American growers.

"The logistics and the infrastructure we have here in the United States means we can present that for sale anywhere else in the world. We have mastered that," says Bible. "Our competitive advantage has been that we are a reliable source of product. This has taken that away."

In other words, buyers know they can depend on the American export market. The United States has a huge supply of soybeans, sure, but it also has a dependable infrastructure to move all that product from farms to ports to other countries expediently. If you're buying soybeans from Brazil or from other, even less developed markets, there's a bit more risk involved.

It's a risk Chinese importers are only going to be more willing to take, now that another round of tit-for-tat tariffs have been announced. China is expected to continue making "significant investments" in South American infrastructure, "ensuring soybeans grown there can arrive in Chinese ports more quickly and economically," warns the Iowa Soybean Association.

In the end, the Peak Pegasus couldn't hold out. It went to port and paid the tariffs, adding some $6 million to the price of its beans. The trade war means that next time, the ship might not start the journey in the first place.

"The soybean market in China took us more than 40 years to build," says Davie Stephens, a soybean farmer from Kentucky and president of the American Soy Association. "As this confrontation continues, it will become increasingly difficult to recover."

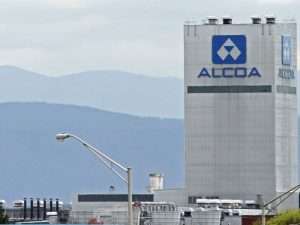

How Aluminum Tariffs Hurt American Aluminum Manufacturing

When the steel and aluminum tariffs hit in June of last year, Alcoa, the country's biggest aluminum producer, looked like a sure bet to emerge as a winner in the trade war.

Tariffs that artificially increased the price of imported aluminum should have been a boon to the 130-year-old New York company, giving it relief from foreign competition and boosting sales and revenue. But less than three months later, Alcoa cut its profit projections and asked the Commerce Department for a special exemption from the aluminum tariffs. Tariffs meant to protect American businesses ended up hurting them.

The problem facing Alcoa was the exact opposite of the one plaguing American soybean farmers. It's not that Americans need to trade aluminum because the country makes too much of it, it's because Americans consume too much. "Even if all the curtailed smelting capacity in the U.S. was back online and producing metal, the United States would still need to import the majority of its aluminum," Tim Reyes, president of Alcoa's aluminum operations, told The Wall Street Journal last year.

An aluminum manufacturing company, it turns out, still has to purchase a lot of aluminum, and the reality of a global marketplace means that doesn't just happen in a single country. In Alcoa's case, the company operates smelters on both sides of the U.S.-Canada border, with different grades of aluminum produced in different places and then shipped to wherever it is needed. That means moving goods across borders—goods that Trump subjected to tariffs.

In Trump's telling, the North American Free Trade Agreement (NAFTA), which governs trade between the U.S., Canada, and Mexico, is a "horrible" deal. Much of the Trump administration's trade war has been oriented toward forcing Canada, Mexico, China, and, to a lesser extent, Europe, to agree to more favorable terms for trading with the United States. But after a year in the trenches, it is difficult for the administration to claim a clear victory on the NAFTA front—despite the inking, in November, of the United States-Mexico-Canada Agreement (USMCA).

The USMCA, which is meant to replace NAFTA, is a far cry from Trump's promise to tear up the old agreement. Instead, it largely updates NAFTA to include provisions, like a mechanism for settling online copyright disputes, that weren't on the radar when the original deal was signed in 1994.

To get a deal that mostly preserves the status quo, the Trump administration whacked American steel- and aluminum-consuming businesses with tariffs that hiked the price of those metals by between 10 and 25 percent—and American producers raised their prices to match. Although Trump rescinded those tariffs on May 17, American metal-consuming businesses are left feeling like they've been used—forced to pay higher prices for 12 months without any real benefits emerging in the USMCA deal.

What the trade war did accomplish, however, was eroding at least some of the trust that has allowed the United States and Canada to share the world's longest border peacefully for centuries.

"It's not just about economics, it's about the rule of law. When you build relationships—trading relationships—they are also about the other side being able to say they trust your word," Rocco Rossi, president of the Ontario Chamber of Commerce, said during a May event in Ohio.

He warned that the damage done to the U.S.-Canada relationship will last longer than the trade war—which, as far as Canada goes, mostly ended about two weeks later with Trump's decision to withdraw those tariffs on May 17.

"Understand that there are many more people in Canada now who believe America will simply act in its own interest and is not the champion of the rule of law that has been a hallmark of the international trading community," Rossi said.

A Trade War With China? Or the World?

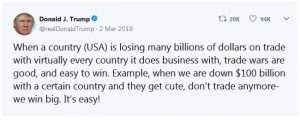

Before the trade war began, Trump famously promised that it would be "good and easy to win." Yet as the conflict enters its second year, there's been a noticeable shift.

In April, during an interview with Bloomberg News, Kevin Hassett, chairman of the White House's Council of Economic Advisers, compared the tariffs to a bitter pill that must be swallowed to improve the economy in the long-run. "We've had these very bad trade deals, and we are taking the medicine to improve them," he said. A few weeks later, White House Advisor Larry Kudlow bucked the official presidential line and admitted, under questioning by Fox News' Chris Wallace, that American consumers and businesses are indeed paying for the tariffs. Later in May, Sen. Tom Cotton (R–Ark.), a key Trump ally in Congress, compared the plight of farmers suffering from tariffs with the sacrifices made by American troops in real wars abroad.

"These tariffs are going to end up hurting both Chinese and some Americans, I'll grant you that," Cotton told CBS' This Morning on May 13. "There will be some sacrifices on the part of Americans, I grant you that, but I also would say that sacrifice is pretty minimal compared to the sacrifices that our soldiers make overseas that are fallen heroes that are laid to rest in Arlington make."

That's a long way from "easy to win."

The shift in rhetoric seems to mirror a shift in strategy. The lifting of the steel and aluminum tariffs on imports from Canada and Mexico means Trump might be less likely to pursue obviously counterproductive tactics—and that he might be recognizing the value of not going it alone.

But the shift toward China portends a protracted, painful trade war between the world's two biggest economies.

That could happen because the real friction between the U.S. and China is not—no matter how many times the president talks about—the trade deficit. It's really about two bigger things: China's abuse of international rules governing the intellectual property of foreign businesses operating there, and the Chinese government's desire to achieve technological parity—or superiority—to the United States. Those issues lurked in the background during trade talks that began last year and ended in mid-May without a deal.

It's still possible a deal could be reached in the coming months. American companies could shift supply chains to countries like Vietnam, as Trump has urged. China could respond by making concessions on trade.

But what if that doesn't work?

"You could see this bifurcation of the global economy—one set of standards led by the Chinese and one set of standards led by the United States," says Dan Ikenson, director of the Center for Trade Policy Studies at the libertarian Cato Institute. "That is going to be very difficult to untangle."

The split is already happening. As part of the latest hit at China, the Trump administration has effectively blacklisted Chinese telecommunications firm Huawei from doing business in the United States. It's a potential bargaining chip for an eventual trade deal, but if China and America settle into a long-term stalemate, Ikenson says, the world could end up divided between a Chinese sphere of influence where Huawei tech prevails, and one where American companies like Google hold sway.

"The costs of this process are going to continue to manifest themselves for a while," says Ikenson, "and probably long after any agreement is reached."

In the weeks after Trump lifted steel and aluminum tariffs on Canada and Mexico, a move that was intended to smooth the congressional passage of the USMCA, it looked like he might be narrowing the focus of the trade conflict to China.

But the president remained angry about what he sees as Mexican indifference toward migrant caravans crossing into the United States from Central America. At the end of May, he ordered new tariffs on all Mexican imports to begin the second week of June. The initial 5 percent levies will increase to 25 percent between June and October unless the Mexican government acquiesces to Trump's yet-unstated demands.

The threat of escalating tariffs adds a new dimension to the trade war. Previously, Trump's defenders had been able to argue—perhaps unpersuasively—that the president was using tariffs to achieve better trade deals for the United States. That might require short term "sacrifice" or the swallowing of some "bitter pills" but it would be worth it in the long run.

But that argument has collapsed. Trump's new tariff threats against Mexico have likely ended the chance for a speedy passage of the USMCA through Congress. He has, effectively, killed the one tangible achievement of the trade war.

"Trade policy and border security are separate issues. This is a misuse of presidential tariff authority," Sen. Chuck Grassley (R–Iowa), chairman of the Senate Finance Committee, which handles trade issues, said last week. "I support nearly every one of President Trump's immigration policies, but this is not one of them."

"This is a tax."

Judy Bannon has just returned from two days in Washington, D.C., where she crisscrossed the Capitol building to plead her case with lawmakers from both parties.

"This is a tax," she tells them. "This is a blatant tax on a nonprofit organization that's devoting its time to getting the infant mortality rate down in this country."

In fact, it's a tax on everyone. If Trump follows through with his threats to hit all Mexican imports with a 5 percent tariff, the overall cost of the trade war will exceed the cost of the 1993 tax hikes signed by then-President Bill Clinton, when measured as a percentage of gross domestic product (GDP). If he escalates things further and hits all Chinese and Mexican imports with 25 percent tariffs—which he has threatened to do—it would be the biggest tax increase on Americans since the Lyndon B. Johnson administration.

If we reach that point, the cost of the trade war will have canceled out the benefits of the 2017 tax cuts for all but the highest-earning Americans, according to a new analysis from The Tax Foundation, a nonpartisan tax policy center. Tariffs are regressive taxes that hit low- and middle-income earners hardest.

But now that the less politically palatable tariffs on steel and aluminum imports have been partially lifted, Bannon's not sure there is much hope for congressional relief.

"The president is right to confront Beijing on issues like intellectual property theft, forced technology transfer, and cyber theft of trade secrets," Sen. Pat Toomey (R–Pa.), one of the lawmakers Bannon met with last week, told Reason in a statement. "However, using tariffs to force an agreement with China hurts Americans. The hardship Cribs for Kids is facing is a clear example of this. I hope the Chinese agree to major structural changes soon that lead to the mutual removal of all tariffs."

Bannon has also filled out forms with the Commerce Department to request a special exemption for imported cribs. At a series of hearings in August, the Office of the U.S. Trade Representative's special tariff committee heard from individuals and businesses seeking relief from the new tariffs. Kelly Mariotti, executive director of the Juvenile Products Manufacturers Association, said the tariffs on cribs and other nursery items would "significantly" increase the retail prices for consumers. Worse, she said, was the danger posed to children.

"Preventing accidental deaths related to the care of infants, SIDS, and sleep-related causes of infant deaths will not be enhanced by increasing costs to the American consumer," Mariotti said. The tariffs "will only prevent the average American family from obtaining safe certified juvenile products that are necessary for the care and protection of their children."

The committee was unmoved. In September, the tariff exemptions were granted for car seats, high chairs, and some other nursery gear. Requests for exemptions for bassinets, diaper bags, and other items, including cribs, were denied.

What should a nonprofit like Cribs For Kids do? On Twitter, the president has suggested that businesses wanting to avoid tariff payments have an easy alternative. "Build them here!"

Sure, says Bannon, she'd love to do that. There's just one problem.

"Nobody in the United States makes these cribs. They're only made in China. No place in Vietnam makes them, no place in India makes them," she tells Reason, frustration rising in her voice.

Tariffs on imported child car seats were lifted in September of last year, but tariffs on the component parts of those car seats were left in place. That puts American manufacturers of child safety equipment at a significant disadvantage unless they can somehow source all those component parts in America too.

"And who is going to invest in a factory" to make cribs or car seats or anything else, Bannon wonders, when "next week he could drop the tariffs and everyone is going to be able to run back to China?"

Trump's surprise tariffs on Mexico will only add to that uncertainty. Indeed, after a year of fighting a trade war, the administration still does not seem to have a clear idea about the goals of the conflict, or an exit strategy.

Cribs For Kids, like the other victims of the president's attention-deficit trade policy, thus has little choice but to pass along the added cost of the tariffs. This, in turn, has led to buyers accusing her organization of trying to run a scam.

"They'll say 'what are you talking about, the president says China is paying the tariffs,'" she fumes. "We're being governed by tweets."

What have we lost in the trade war? Trust.

Between the heads of nonprofits that otherwise share a common goal of improving the lives of poor mothers and babies, but now wonder who is scamming whom. Between long-time allies like the U.S. and Canada. Between soybean buyers in China and farmers in the United States—people who never met each other and never will, but who trusted in the almost magical power of supply and demand to ensure both got what they needed, when they needed it, even on the opposite side of the world.

The president cannot be trusted not to lie about the most basic reality of his trade policy. Even after signing a trade deal with Mexico, Trump betrayed that trust with more tariffs. Why should China trust him? And what happens when a global superpower and a rising rival can't trust each other?

The battle for tech supremacy between China and the United States is likely to continue for years to come. For the foreseeable future, that means the cribs Judy Bannon wants to import—and the infants who could be sleeping in them—will be caught in the crossfire.

Show Comments (181)