The Craft Brewed Cannabis Goldrush

Who Needs Weed When You Can Use Yeast?

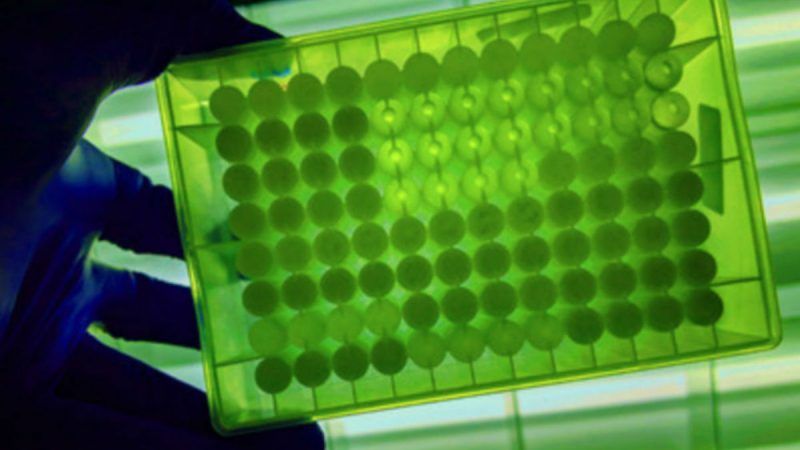

Biotechnology is on the verge of disrupting the cannabis industry. In February, a team of synthetic biologists led by University of California, Berkeley biomolecular engineer Jay Keasling published a study in Nature reporting that his team had engineered brewer's yeast into a chemical factory that produces marijuana's main ingredients. This was achieved by inserting more than a dozen genes—many of them copies of genes used by the marijuana plant to synthesize cannabinoids—into the microbe's genome. The engineered yeast now secretes marijuana's main ingredients: high-inducing tetrahydrocannabinol (THC) and non-intoxicating cannabidiol (CBD), as well as novel cannabinoids not found in the plant itself.

The San Francisco-based market research and consulting company Grand View Research projects that the global legal marijuana market will grow from about $10 billion in 2016 to more $146 billion by 2025, of which $100 billion will be spent on medical applications. The Food and Drug Administration has approved medications containing THC as treatments to reduce nausea in cancer patients undergoing chemotherapy and to improve appetite in AIDS patients. The agency has also approved a formulation of purified CBD marketed as Epidiolex to treat intractable pediatric epilepsy. More applications are on the way.

Arcview Market Research, also headquartered in San Francisco, more modestly projects that spending on legal cannabis worldwide will rise from $10 billion today to $57 billion by 2027. For comparison, the global beer market was valued at about $530 billion in 2016. Interestingly, both consultancies focus chiefly on agricultural cannabis, not taking much account of developments in the biotech sector. A March 2019 report by Whitney Economics found that the legal cannabis market in the U.S. is a job creation machine, responsible for 211,000 full-time jobs.

Keasling has transferred the technology to his startup company Demetrix with the goal of scaling up yeast fermentation to produce large quantities of cannabinoids for the pharmaceutical and flavor industries.

But Demetrix is not alone in engineering microbes to ferment cannabinoids. Competitors pursuing the cultured cannabis goldrush include San Diego-based Librede, Boston-based Gingko Bioworks, Bay Area-based Amyris, and Hyasynth Bio in Montreal.

"The economics look really good," Keasling said in a statement. "The cost is competitive or better than that for the plant-derived cannabinoids. And manufacturers don't have to worry about contamination—for example, THC in CBD—that would make you high." In the Nature study, Keasling and his colleagues reported that yeast fermentation yielded about 8 milligrams per liter of THC and a bit less CBD.

However, in order to make fermented cannabinoids cost-competitive, yields would have to increase by nearly 100-fold. Demetrix researchers told Nature that they are already well on the way to achieving those yields. David Kideckel, an analyst with AltaCorp Capital in Toronto, Canada, told Nature that he estimates it will likely be 18 to 24 months before fermented cannabinoids become cost-competitive enough to sell to pharmaceutical and consumer cannabis companies.

Besides higher purity and lower costs, Keasling and other biotech cannabis entrepreneurs also point to the environmental benefits of cannabis fermentation. Growing cannabis outdoors produces problems like soil erosion, fertilizer run-off, and stream diversion for irrigation. Indoor cultivation—under grow lights with ventilation fans—uses a lot of energy. One study calculated that Denver's 300 grow facilities now use 4 percent of that city's electricity. Another study estimated that California's cannabis industry accounted for 3 percent of the state's electricity usage. In addition, it takes about three months to grow a marijuana plant, while yeast takes only a week to begin producing cannabinoids.

Pure fermented THC would obviously find a market in filling THC oil cartridges for the

On the other hand, so long as brewers don't sell their products across state lines, federal regulators have so far generally refrained from hampering the production of beverages infused with CBD. As a result, dozens of brewers are now offering CBD infused beers. For example, Oregon's Coalition Brewing began in 2017 selling its Two Flowers IPA infused with five milligrams of CBD per pint. Besides beer, the market for CBD-infused sparkling water is exploding. Companies such as Colorado-based Bimble and California-based Sprig sell soda waters dosed with 25 and 20 milligrams of CBD per twelve-ounce serving respectively.

As noted above, medications are projected to account for the largest share of the cannabis derivatives industry in the future. The National Library of Medicine's ClinicalTrials.org lists more than 300 studies involving cannabinoids. Research on CBD in particular focuses on treatments for anxiety, cancer, inflammatory diseases, rheumatoid arthritis, and pain. Keasling observed that there is also "the possibility of new therapies based on novel cannabinoids: the rare ones that are nearly impossible to get from the plant, or the unnatural ones, which are impossible to get from the plant."

Growers beware and consumers rejoice. Cheap, pure, fermented cannabinoids are on their way.

Check out the rest of our stories for Weed Week 2019.

Show Comments (7)