Aluminum Tariff Tradeoff: 300 Jobs for $690 Million in New Taxes

New study argues the tariffs have boosted employment, but doesn't examine the costs of President Donald Trump's protectionism.

If you ignore the fact that tariffs are taxes, it's pretty easy to make tariffs look good.

That's what a report released this week by the Economic Policy Institute (EPI), a union-backed think tank, tries to do. By ignoring the costs of higher taxes on imported aluminum, the EPI study claims that President Donald Trump's aluminum tariffs have created about 300 jobs at American aluminum manufacturers. In addition, the report claims, American aluminum suppliers and processors have made more than $3 billion in economic investments since the tariffs were imposed—including the restarting of three smelters that had previously been closed—investments that could, eventually, create as many as 2,000 additional manufacturing jobs.

"We found absolutely no evidence of broad, negative impacts on the economy of steel and aluminum tariffs to date," Robert E. Scott, EPI's senior economist, told CNBC, which trumpeted the pro-tariff study on Tuesday under a headline proclaiming that "steel and aluminum tariffs are not hurting the economy."

If that's the case, Scott and his colleagues must not have been looking very hard. No, I'm not talking about the literally hundreds of companies that have reported economic problems caused by the Trump administration's tariffs—although they matter too.

The bigger flaw in the EPI study is that it fails to account for the costs of the tariffs. Those 300 new jobs didn't just spring up out of nowhere because the president said some magic words—they are the result of businesses shifting resources and strategies in an economic environment where imported aluminum has suddenly been subjected to a 10 percent tax increase. In other words, the trade-offs (in this case, the higher taxes) matter.

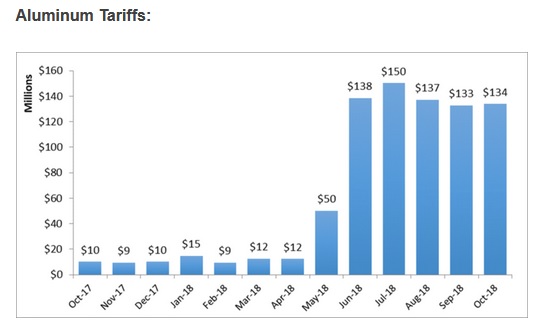

And the trade-offs are huge. Since the aluminum tariffs were imposed on June 1, American companies have paid about $690 million in tariffs to the federal government, according to data from The Trade Partnership, a pro-trade nonprofit, and Tariffs Hurt the Heartland, which is lobbying for Congress and the administration to remove those tariffs.

Do the math. That means those 300 jobs have cost about $2.3 million each. That's insane. Even if you give EPI the benefit of the doubt and assume that those 2,000 additional manufacturing jobs eventually come online, we're still talking about a price tag of about $300,000 per job.

It's no surprise that the tariffs have given a modest boost to American aluminum plants, but economists have warned for months that the economic consequences of Trump's protectionist trade policies would far outweigh the benefits. Shortly after the steel and aluminum tariffs were imposed, The Trade Partnership predicted that the number of jobs in American steel- and aluminum-producing industries would increase by about 26,300, while tariffs reduced employment in the economy as a whole by about 429,000. That's 16 jobs lost for every job gained.

Thanks to the 10 percent tariff on aluminum, a 25 percent tariff on steel, and additional tariffs on more than $200 billion of Chinese-made goods, Americans ended up paying $6.2 billion in import taxes in October, making it the most expensive tariff month in American history, according to Tariffs Hurt the Heartland.

Those taxes are a significant drag on the economy, even if they do spur a low-level of job creation in certain domestic industries. Like the proverbial case of the broken window, it's relatively easy to see the new jobs created by the tariffs—but the unseen costs, like the jobs that are lost or never created in the first place because of the higher import taxes, matter too.

The EPI report highlights the positive consequences of Trump's tariffs while refusing to look at the negatives. That's something I'd expect from the White House, but not from supposedly serious economists.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Everybody knows prices have no connection to supply and demand and that $6.2 billion per month is going to put a huge dent in the budget deficit. Nobody pays the tariffs involuntarily, if you don't want to pay the tariffs, don't buy imported goods. A few people getting harmed is a small price to pay for making America great again. And what about Obama? Hillary would be worse.

Nice summation 🙂

Reason has yet to explain why tariffs on foreign production are a distortion of "muh free market", but corporate and employment taxes on domestic production aren't.

So you don't think there's any problem with adding more distortion?

"including the restarting of three smelters that had previously been closed"

I would have thought that to anyone serious about the aluminum business, real investment in the future would mean building new automated facilities overseas. This reopening of outdated 20th century plants in an industrial wasteland is playing around at the edges. You're being played for a fool for their political advantage.

Robert E. Scott, EPI's senior economist and a mendacious asshole

Fixed that for you Eric.

"...by the Economic Policy Institute (EPI), a union-backed think tank..." and "...but not from supposedly serious economists" are NOT compatible statements.

That is two million dollars in taxes collected at the loss of just one job. If that is true, that would make the tariff the least economically harmful tax in history.

Maths is appearently hard for the free trade cult.

$690 million / 429,000 jobs = $1,608.39 per job lost.

Sorry John, sorry, better try it again

John's got a sausage, yeah man

Sorry John, sorry, better try it again

He said Dong was Wong, Wong was Kong

Dong was Gong 'n John was wrong

Unfortunately that 429K number is a purely hypothetical number made up off of a model... Which, granted, is the same as the jobs gained stuff, other than the direct ones that can be counted.

But we're talking about an increase in prices that will raise end prices by perhaps a percent or two for most finished goods, because raw materials are a small part of overall costs... That usually doesn't even factor into anything meaningful as it's within the regular swing of pricing industry deals with constantly for all goods.

Did I forget to mention aluminum and steel prices are lower than they've been in years? So in reality prices are just returning to where they were not that long ago. Market swings on a single raw material input of a few percent don't USUALLY create that big a swing in employment.

Not that I'm big on raw material tariffs... If one is going to tariff anything finished goods are really the only things that should be hit IMO.

But ZOMG the sky is falling hype can get a bit over the top too...

Another belligerent right-wing authoritarian stopped by to convene a meeting of Libertarians For Tariffs And Protectionism.

Welcome back, clinger.

I get tired of these stupid, 3rd grade level economics lessons from people whose understanding is very limited.

First, THE PURPOSE OF THE TARIFFS IS STATED TO GET CHINA TO NEGOTIATE IN GOOD FAITH ON TARIFFS AND TRADE BARRIERS.

I hate typing all in caps, it is like shouting. But Boehm and the rest of the low IQ reporters on Reason, keep refuting points that are not the primary ones. It seems pretty hard to get their attention.

There are two primary issues with Aluminum and Steel with regard to China.

First, China is manipulating that trade using trade barriers to corner those markets.

Second, aluminum and steel are strategic materials that we can't afford to be fully dependent on foreign, "potentially" hostile foreign suppliers for.

In light of the above, it doesn't matter if the tariffs are taxes (of course they are) or it if it results in increased employment or not, it is a national security issue.

Surprisingly enough, Trump has stated that the action was taken on a national security basis. If China is not willing to act in a reasonable fashion, then the tariffs should stay in place indefinitely.

+1000

The fact that every Communist supporter is flipping out about tariifs with china, means that they are working. Otherwise you wouldnt hear a peep.

...Americans ended up paying $6.2 billion in import taxes in October,....

Boehm is upset that Trump's strategy to renegotiate trade policy is working.

Tariffs are a drop in the bucket compared to hundreds of billions lost in trade restrictions, over-regulation, and taxes.

Trump was president when enough regulations and taxes were cut to send the Lefties into crying fits.

How does we get lower trade restrictions? Play hardball with tariffs and threaten access to the best market in the World- the USA.

Nice that you appoint Trump to control my individual liberty.

USMCA is less free than NAFTA. Heckuva good negoitator there, Trump.

loveconstitution1789|12.3.18 @ 10:20AM|#

Keep up the good work, statist fuck.

First... you never read either agreement. Second. His are your freedoms effected by either? Third regulatory schemes change behavior so you wont know which policy was worse until in effect for a number of years. Predictions now are idiotic.

Poor trolls. Their script only allows select quotes to further their master's coding preferences.

Eric. You promised us market collapses due to tariffs. Instead we get a 5% increase in steel production and almost no noticeable change in the cost index. You do have magic numbers from left wing groups, wo you have that going for you. Oh wait. You blamed the Chevy volt and Cruze dismal failure in tariffs too. Forgot about that idiocy.

"You promised us market collapses due to tariffs"

That was just a scenario, not a prediction. So he couldn't be wrong.

That's the way it works with global warming, right?

They also word the articles " some people say...."

Goebbels would be proud.

Boehm is a hack.

When you get owned by amateur commenters, your articles are probably shit.

Eric does a great job repeating the official Democratic (progressive) talking points doesn't he?

You figure Democrats are the only Americans who recognize -- and recognized long before a base of authoritarian, downscale southern bigots put Pres. Trump in the White House -- that tariffs, especially in this type of situation, are daft and counterproductive?

"those 300 jobs have cost about $2.3 million each. " If the only benefit to the tariff is that short-term effect and small gain which no more could really be expected then yes it would be insane. The tariffs have to be part of a bigger longer-term picture to have any value and thus any analysis would have to look at that perspective to have any real value.

Uhhhh... In your own article you mention that in addition to the 2,000 future jobs, they've sunk over 3 BILLION into the economy they wouldn't have otherwise... Not to mention instead of gaining jobs, we probably would have been LOSING additional jobs from the baseline you're using.

So perhaps they would have canned 2,000 more people, which means it's really 4,300 direct jobs... But wait, there's more!

Every job in an actual productive industry creates multiple downstream service jobs, which is a well known effect. People argue about the numbers, but let's use a low end number used that is conservative, which is 2:1. 2,300 jobs now equals 6,900. One could probably pump it up even higher if using the jobs saved that we probably would have lost number, but since I don't know what a real number there is I won't. But it may well be far over 10,000.

Plus, let us not forget the temporary employment and economic activity created by that 3 billion in investment... It doesn't just disappear into the ether. That's equipment being purchased from somebody, probably contractors building or renovating buildings to put it in, etc etc etc.

One can argue it's all still not worth it if you want... But to be disingenuous about how you spin your numbers and the math like you are is utter bullshit.

Also, at least the national debt is 690 mil lower. Also also, nice way to mix the costs of just aluminum with the total losses projected from aluminum and steel! No sleight of hand there...

Did I forget to ask, how much GROSS economic activity is being created in the US per annum from that 690 mil in taxes? Is that the US now producing 2 billion a year in aluminum? 5 billion? Because all those dollars will be floating around in the US economy instead of abroad now... And it will be going downstream to suppliers, aluminum mines, etc too.

How many of those thousands of workers that now have jobs (including the down stream ones in service industries) were on public assistance before this too? Did we just take 6,900 people (minimum) and change them from being -$40-50K a year in welfare usage, to being $50-100K a year actual producers? Like it or not, people don't just starve to death in the street in the USA. We have a welfare state, so creating a job isn't the only math that counts. a $50K a year job isn't worth ONLY $50K, it is often worth $90-100K because you're not shelling out welfare anymore.

The math on this shit is SO much more complicated than tools like to pretend. People who over simplify this shit are disingenuous tools.

"Do the math. That means those 300 jobs have cost about $2.3 million each."

Do the math. 690 Million in New Taxes weren't *spent* for the jobs.

What happened to all of Reason's whining about deficit spending? Well, the deficit just got reduced by 690 million.

You're welcome.

If we followed Adam Smith, tariffs would be a lot higher. "muh free markets"

Adam Smith on Tariffs and Taxes on Domestic Production

"It will generally be advantageous to lay some burden upon foreign industry for the encouragement of domestic industry, when some tax is imposed at home upon the produce of the latter. In this case, it seems reasonable that an equal tax should be imposed upon the like produce of the former. This would not give the monopoly of the borne market to domestic industry, nor turn towards a particular employment a greater share of the stock and labour of the country, than what would naturally go to it. It would only hinder any part of what would naturally go to it from being turned away by the tax into a less natural direction, and would leave the competition between foreign and domestic industry, after the tax, as nearly as possible upon the same footing as before it."

Come on dude, everybody knows Adam Smith was a moron. And totally a socialist, commie, big government shill! It is KNOWN!

I love how some people have taken common sense, and logical, arguments made by people like Adam Smith... Who had a lot of sane, and reasonable real world caveats in his work... And turned it into this ridiculous pseudo religious belief system that there can NEVER possibly be ANY negative repercussions from one sided free trade. Which neither Smith, or most any other originators of this line of thinking, ever said.

Even when basic math can actually refute that argument by looking at capital accumulation over time, employment figures if not at 100% employment, etc. It's amazing how some people can slap the blinders on and just ignore reality so well.

Deontology is the myopia of moral reasoning.

"Muh free trade"

Ignoring that tariffs are just one of the zillion and one ways that the world is not the Muh Anarchy of their self righteous dreams.

Adam Smith was grown up. They're children.

Pretty much it. I still agree leaning libertarian in almost all issues is the best practical, real world way to do things... But usually not when taken to the 100% extremist interpretation. The real world is too messy a place for being a purist, especially when those you are competing with are playing by a different set of rules. You really do have to be a child to believe some of the things purist libertarian believe.

I don't get it, Boehm wrote an article just a couple of days ago about Trump not taking the deficit seriously, now hes complaining that Trump is raising revenue for the US treasury.

TDS influences reason writers differently.

The low donations this year likely impacted things a bit too.

You mean, since the writing here has turned progressive it is harder to get people to send them money?

Huh, imagine that.

The reason the US steel, aluminum and other metal industries closed was they were unable to compete with imported metals that were usually subsidized by governments so they could be sold at ridiculously low prices. The tariffs only equal the playing field and if they work, these industries may return to the US. I have no idea if it will work but we already know what we have been doing for decades does not and the US trade deficit has only gotten larger and larger. Cheap products do not matter when the costs are driven up by unfair trade practices and is anyone really going to argue that the cheap products we get from oversees remotely compare in quality to those made in the US?

Tradeoff?

Usually, the headline is "Tradeoff: X Jobs for $Y loss of tax revenue." When tax incentives are given.

So . . . . sounds like Trump has a WIN-WIN here!

If you don't count all the jobs that these taxes have killed.

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you .

http://www.Mesalary.com

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty

consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to

you for giving American explicit this remarkable opportunity to earn more money from domestic. This in

addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this

website online domestic media tech tab for extra element thank you .

http://www.geosalary.com

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you .

http://www.Mesalary.com

essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you .

http://www.Mesalary.com

QuickBooks is a huge accounting software with numerous features. QuickBooks Point of Sale is one of them. Users often face error initializing QuickBooks Point of Sale application log due to the compatibility of two or more software, damage in windows system files, etc. There are various methods through which you can resolve the error effectively. Visit our blog to know more about the error initializing QuickBooks Point of Sale application, causes, and solutions.

Our experts are available round-the-clock to guide you. Call us on our QuickBooks Point of Sale Support Number 1-888-986-7735.