Study: Trump's Tariffs Are a $42 Billion Regressive Tax Increase

They are also sapping economic growth, reducing wages, and lowering employment. Winning!

The Trump administration's tariffs on steel, aluminum, solar panels, washing machines, and a host of Chinese-made industrial and consumer goods have increased taxes by $42 billion*, with poorer Americans feeling more of a pinch.

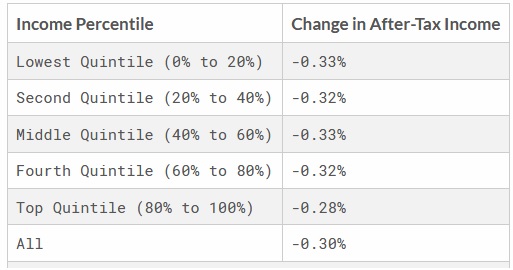

That's the bottom line of a new report on the tariffs published Wednesday by The Tax Foundation, a nonpartisan think tank. The Trump tariffs have reduced after-tax income by about 0.3 percent on average, according to the study, equating to a decrease of $146 in after-tax income for middle class Americans. The Tax Foundation's economic model suggests that the tariffs will reduce the gross domestic product, a short-hand measure for the overall size of the economy, by about $30 billion while also depressing wages and costing more than 94,000 jobs.

"These tariffs will increase the tax burden on Americans, falling hardest on lower and middle-income households, and reduce economic output, employment, and wages," writes Erica York, the author of the study.

What was that about trade wars being good and easy to win?

If Trump follows through on his threats to impose more and higher tariffs on China along with new tariffs on imported cars, after-tax incomes would fall by an average of 0.92 percent, according to The Tax Foundation.

The study makes clear, once again, that American consumers and businesses are the ones who pay the price of tariffs—not China or Chinese-based exporters, as the Trump administration continues to argue. When goods subject to tariffs enter the United States, the import taxes added by the Trump administration artificially increase the price of those goods, and those higher prices are passed along to subsequent buyers. Higher steel prices, for example, get passed along the supply chain to increase the purchase price of everything from cars and homes to beer kegs and industrial widgets.

From the start, the debate has been a question not of whether tariffs would harm the economy, but what the magnitude of that harm would be. A March study by the Trade Partnership, a Washington-based pro-trade think tank, projected that tariffs on steel and aluminum would grow those industries by about 33,400 jobs, but will also wipe out more than 179,000 other jobs. That's about 146,000 net job losses—five jobs lost for every job gained. A similar study by the Coalition for a Prosperous America, which favored the tariffs, projected a net loss of more than 10,000 jobs.

In the months since, hundreds of American companies have reported being harmed by the tariffs. Major carmakers such as Ford and General Motors expect to lose nearly $1 billion this year because of tariffs, and the stock market remains deeply skeptical of the president's seemingly ironclad confidence that trade barriers will work despite all indications otherwise.

The Tax Foundation analysis is a good reminder that the tariffs are not just affecting corporate balance sheets and Wall Street stock portfolios: These higher taxes are insidiously robbing all of us by nudging prices higher and diverting more revenue to the federal government.

CORRECTION: This post has been updated to correct the estimated tax increase tied to the tariffs. It is $42 billion, not $42 million.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

May as well get this out here, he'll be along any moment to proclaim it all fake news because Trump.

loveconstitution1789|12.3.18 @ 10:20AM|#

Keep on Keeping Your Promises.

Elsie's a classic troll.

Content free, counts coup by noting "trolls are angry", plays stupid games, contributes nothing to any conversation.

Don't forget fun to bait while wasting a few minutes while computers finish some task.

Trolls admitting they are trolls is what we like to see here.

And the troll admits it was baited!

a ab abc... admitting to being a troll.

Hilarious!

Screenshot taken.

Its like Boehm contacted the trolls that he was putting out more garbage propaganda today.

Then they back each other up.

loveconstitution1789|12.3.18 @ 10:20AM|#

Keep on Keeping Your Promises.

I don't see a promise in any of his posts.

I mean, it was a cesspool of stupid all around, but I didn't see lc making any promises.

English is not this guys first language^

There is also the growing problem of regime uncertainty.

With Trump's flailing about on the economy, confidence that had been gained post Obama is now shrinking, as reflected in business trends.

It's useful to compare with the impact off the uncertainties of Brexit on British financial markets.

Buckle up buckeroos, we're in for a wild ride.

Here comes the next installation of the wild ride!

http://www.aljazeera.com/news/.....30441.html

World markets down after arrest of Huawei executive

Wall Street takes a hit after news broke of Meng Wanzhou's arrest by Canadian authorities acting on a US request.

The drops came after the arrest of Huawei executive Meng Wanzhou in Canada for extradition to the United States in an investigation into suspected Iran sanctions violations by the telecom giant.

OK now SQRLSY here...

WHO in the HELL appointed Trump and the USA to be worldwide police of who trades with who, anyway?!?!

It's a fair question. As far as I know China doesn't have any sanctions against Iran and is one of their few trading partners. I'm not clear how the US thinks it has any right to do this.

We just had a huge tax cut a year ago. This is a small tax increase. Together, they are still a huge tax cut.

Oh right, that justifies it. Also justifies trampling my rights to voluntarily trade with whom I want. But you seem to approve of government doing that at the behest of one man.

Fuck off, slaver.

That is true of every tax. A tariff is just a tax on foreign goods. It is absolutely no different than a sales tax or any other tax. When you pay income taxes that interferes with your ability to freely trade with your employer the same way a tarriff interferes with your ability to buy foreign goods. You are confusing an embargo with a tarriff. They are not the same thing.

So, do everyone a favor and fuck off until you learn what you are talking about.

Think how much nicer the world would be if people had their own opinions and didn't reflexively defend terrible policy just because a senile orange fat man has an (R) after his name.

No one is defending anything Tony. I am explaining what this policy is. It would be nice if you were not a hopeless fucking retard and were interested in understanding something. But you are not. For you ignorance is bliss. I have neither the time nor the inclination to deal with your ignorance. So, shut the fuck up and troll somewhere else.

Not to speak for the poster, but I believe the point is that any tax decreases one's ability to voluntarily trade (because it makes things artificially more expensive). Usually, in libertarian boilerplate, applied to income taxes, which reduce your own purchasing power in the private market, but it equates to the same thing.

But then we're both a couple of big government guys. I'm for a large and robust public sector, and you're for whatever the large and robust president does no matter how nonsensical.

John commenting here during his work hours is a tax on us all.

Bacaulum trolling us here is a tax on us for eternity.

At least one of you Trumpistas admitted tariffs are taxes. That's progress.

Of course tariffs are taxes. How exactly do you think the US paid its bills for roughly half its existence?

A ab abc... hates the USA Because its programmer hates the constitution and everything it stands for.

^THIS^

Our problem is not that we have tariffs, it is that we have an income tax AND tariffs. Kill the income tax and impose broad import and export taxes instead.

We would care a whole lot less about what the rest of the world does, if we were less dependent on them. George Washington would approve.

It just seems like a lot of complaining about a huge tax cut. You'd think a libertarian organization would be happy about a huge net tax cut, but Reason has nothing but complaints.

Maybe because it's equivalent to a huge deficit increase at exactly the wrong time in the business cycle? A pathetic sop so that Trump can say at least he managed to get Congress to do something (the only thing Republicans can seem to manage)?

Your complaint is that taxes were cut instead of raised. You want government to be wealthier and more powerful and the people of America to be poorer and more desperate.

I'm afraid that this is another case where Republicans, by governing so incompetently, end up proving themselves right about debt and deficits--which apparently don't matter to you at the moment?

No one cares about deficits. They aren't even pretending to care any more ? just like Democrats don't pretend to care about poor Americans any more.

When taxes go up $1, spending goes up $2. Taxes don't fill up the treasury, they just make Americans poorer.

The addiction to spending money other people earned is trending toward a crisis, as addictions generally do. We will see what happens. Random worrying is useless.

The staff here at Reason are mostly Anarchists and Lefties, so Libertarian positions need not apply.

Then the trolls attack any Libertarian positions with no positions of their own.

This is pretty much accurate.

Many now conflate libertarianism with anarchism, not understanding that libertarianism is the recognition of anarchist ideals balanced by the need for nation-states and government in a minimalist form. They are anarchists who want to destroy the nation-state in chasing anarchist principles while calling themselves libertarians.

The balance are progressives who want to suck libertarians into the progressive movement by emphasizing socially libertine policies. Shitma, I am looking at you as an example.

Libertarianism is too dangerous to leave untrolled.

You're no libertarian.

You're a militaristic command-and-control one-size-fits-all dominationist.

And the biggest troll on the site.

See, trolls dont even know what Libertarianism is and they certainly hate it, whatever it is.

Paleocons probably shouldn't talk about what libertariaism is and isn't.

Trolls hate that there are still Libertarians, like me, here at Reason.

New people can skip the articles and see what Libertarians are saying about issues. It makes propaganda so much less effective.

loveconstitution1789|12.3.18 @ 10:20AM|#

Keep on Keeping Your Promises.

Hahahaha. I needed a good laugh. You, a libertarian? Ha. Not sure if I should laugh that it's so funny or frown that you might actually be that deluded.

Boy, I feel lucky to have so many different troll sock puppets after me today.

I must be doing something right.

I must assume that the reason some people are incapable of understanding the logic behind Trump's tariffs is because they are so deranged from Hilary's loss that their ability to think critically has been destroyed. So allow me to explain it slowly:

1. Trump is absolutely for free trade, but only if it is bilateral.

2. Other countries from Canada to China have had various tariffs on American goods for years but no president has ever had the balls to challenge the status quo. Like the deficit, previous politicians have just ignored the problem and kicked the can down the road, passing the buck to someone else.

3. That someone else is Trump. He understands that the only way to force other countries to drop their tariffs against the US is to retaliate with tariffs against their products while simultaneously making it clear (at least to those without TDS) that he will drop US tariffs if they will drop theirs.

So, if you still can not understand the process, read the above over and over until you get it. Then you can stop spreading blatant disinformation/lies about Trump destroying the world because he decided on a whim just to launch a bunch of tariffs on other countries for the hell of it.

That is the policy Trump has articulated and appears to be pursuing. As I posted above, there are additional issues.

The tariffs and other trade barriers (subsidies like free power for internal manufacturing) that China uses have nearly killed US steel production for example. (combined with crazy unions and stupid management)

There are very real national security risks to not having any significant domestic steel production.

Permanent tariffs could be justified as necessary to assure we maintained a minimum domestic production level even if we were not be traded with unfairly by China (and we are), just on national security grounds.

Unless you get hit by the tariffs and your corporation is not a C corp. Then you just get fucked by the government. If you subsidizing the US steel industry, that 's great, send them a check from your bank account or fuck off slaver.

you *like* subsidizing

- correction damn no edit.

By that logic we subsidize everything that isn't taxed to the maximum extent. If you hate tariffs so much, you must really hate sales taxes, which are nothing but tarriffs on every transaction.

You guys need to learn more about this subject than a bunch of stale talking points to emote.

These people ignore all the trade restrictions and other burdens on trade just to prevent Trump from trying anything good for the USA.

Trump tariffs are expected to have cost $7.5 billion in steel and aluminum tariffs.

CNBC- Steel and aluminum tariffs

Pre-Trump trade restrictions cost businesses and consumers Trillions. Fucking Trillions.

Trump is trying to use Billions on tariffs to multitudes of that knocked off by lower trade restrictions and the America-haters loathe that his is being somewhat successful. All the major trading partners of the USA cracked in less than 6 months. They all said that they would never agree to anything Trump wants and snickered at him.

The Impact of Trade and Tariffs on the United States

Under the Part that says "Tariffs and the Trump Administration"

"The rationale for these various tariffs range from national security to misconceptions about trade balances to alleged intellectual property theft by China. Though there is wide agreement that certain trading practices are unfair and call for a response, levying broad tariffs is not likely the approach that will result in the desired policy changes.[32] The effects of each tariff will be lower GDP, wages, and employment in the long run."

Now I know why you are so reluctant to post links to articles. It's because you can't/won't read them.

And the final conclusion,

"History has shown that tariffs fail to achieve their intended objectives, and result in higher prices, lower employment, and slower economic growth in the long run. Rather than erect barriers to trade that will have negative economic consequences, policymakers should promote free trade and the economic benefits it brings."

Poor troll. Thinks I only post links that are 100% biased towards my position.

Since trolls dont read, they cannot expand logic past what they are programmed to troll about.

Poor McGoop.

Poor comrade1789 has to backtrack when it's made obvious that the link he posted refutes all of his claims. Maybe, when he graduates from high school, he'll have the patience to read one of these articles from beginning to end.

Don't forget the reduction in regulations. Anytime we regulate we put a barrier to free trade. When we do it but China doesn't, then we cost the US economy not only money but also jobs.

That is a great point. Surprised me, but a great point.

I don't like subsidizing the US steel industry. But what I like even less is subsidizing millions of US blue collar workers that have been priced out of the labor market by cheap foreign competition.

The more welfare state and barriers to entry we have, the more tariffs and restrictions on migration become necessary. If you want to get rid of the latter, get rid of the former.

projected that tariffs on steel and aluminum would grow those industries by about 33,400 jobs, but will also wipe out more than 179,000 other jobs

I'm actually beginning to think that it may well lead to job increases - mostly in smaller companies that have simply put off expanding in the US for the last 20+ years because they are the ones who get hammered every time either short-term currency fluctuations or 'new' trade agreements reduce intl trade friction. They actually need some friction in order to make decisions. Large companies can buy the currency hedges and shift multi-national production around

Economics assumes that benefits from tariff reductions are linear. But the last 20+ years indicates that may not be so. Beyond a certain point, in a world of floating currencies, overall tariff levels may at a certain point have a very disparate impact on large v small companies. Not by industry but merely large v small cuz the large have the fixed-cost infrastructure in place to handle the entire world as their production setting. So that in effect, net tariff changes since 1990 or so (roughly WTO era) have only served to protect the already entrenched

Look up comparative advantage.

Look up Bastiat's broken window fallacy.

Or find Henry Hazlitt's Economics in One Lesson and at least skim it.

Much as with socialists, if protectionists understood economics they wouldn't be protectionists.

This assumes a few things that may not be true.

Stability has no advantages.

All nations are trading freely and never manipulate certain industries for national security advantage.

Capital does not avoid uncertainty.

In truth all of these assumptions are false.

Stability does have advantages in some cases and people often make decisions specifically to pursue stability.

All nations are not trading freely, and some do manipulate certain industries to gain controlling market share specifically for national security leverage.

Capital flees uncertainty. In particular, firms are slow to expand capacity in industries where expansion is capital intensive and quick to abandon capacity that requires new investment when trading is unstable (usually). This industrial capacity is drawn to the protected and subsidized market. Ie, China

I'm certain I've forgotten more about economics than you ever learned

Just looking at historical tariff levels from 1820-2016 - we have been in a virtually free trade environment since 1980. Whatever Ricardo may have understood as the marginal benefits of free trade may not apply linearly today. Back then, it was easy to switch from truly 'protectionist' (say 40%+ levels) to 'free trade' (say 15% or so). Now what WE call 'protectionist' is 4% and what we call 'free trade' is 3%. If those trade benefits are not linear - but are say power-law (Pareto); then we long ago passed the point where there is little net value in improving the actual economic trade environment.

IOW - the phrase 'free trade' today is more about religion/ideology/PR than it is about actual economics.

IOW - the phrase 'free trade' today is more about religion/ideology/PR than it is about actual economics.

Amen.

And that is a fascinating chart. Notice that from 1865 until just before the 1st World War, tariff rates were above 20% on everythign and above 40% in durable goods. Yet the US became the most powerful industrial economy on earth during that period.

None of the free trade religious ever bother to acknowledge that much less try and explain it. We built the largest economy in the world with 20 to 40% tarriffs and somehow going from 3% to 4% today is going to destroy the economy and create the next great depression? Maybe things have changed, but it would be nice if they bothered to explain how rather than just mubling something about Smoote Hawley.

Scroll down in that link to the tariff chart and you will see that before the income tax, tariffs were the only federal tax before the 16th Amendment, adopted in 1913. Even at 20-40% tariffs, the federal government's take of US GDP was only about 2.5%. So in spite of such high tariff rates, the burden on the economy was relatively small, which is how the US nevertheless was able to become the most powerful economy in the world. Compare that to today where the federal income tax itself takes 10% of the economy and now there is a payroll tax that takes another 6% (eyeballing the chart). At this point, going from 3% to 4% tariffs matters more.

Economics assumes that benefits from tariff reductions are linear. But the last 20+ years indicates that may not be so. Beyond a certain point, in a world of floating currencies, overall tariff levels may at a certain point have a very disparate impact on large v small companies.

It is a simple case of diminishing returns. For example, the steel tarriffs that reason is always going on about resutl in at most an increase in the price of rolled steel of $400 per ton. It takes one ton of steel to build a car. So that is an increase of $400 for a car that will sell for $30,000 or more new.

I could easily save $400 if they would let me buy a new car with no backup camera, only two airbags, and dump a bunch of other government mandated "safety" features.

Trump has shown that using tariffs to play hardball negotiation does not send the US economy into a tail spin.

Obviously, prices would be cheaper if all Trump tariffs ended.

Prices would also be a lot cheaper if most pre-Trump trade restrictions were eliminated or reduced.

Tariffs shift the tax burden from domestic products to foreign products.

You get a multiplier effect in domestic production and tax revenue whenever you go domestic.

I expect it is more a case of 'costs to secure a particular trading environment' begin to far exceed any marginal benefits from the trade itself. You can kind of see this with UK in the 19th century (the country that adopted Ricardo's ideas first). It became the low-tariff country in a higher-tariff world. That doesn't produce nirvana for everyone (just ask the fucking Irish in 1846).

And the only way to get others to reduce their tariffs in that environment is to impose non-trade costs on your society - via becoming reserve currency (gutting all mfg/nonfin in favor of financial in order to sustain deficits and supply that currency to the world), imposing 'unequal treaties' on Third World/colony type places via military intervention and colonialism, etc.

That is one of the most interesting points I have read in a long time. I would go even further. I think England's involvement in the Napleonic wars can be traced to the need to maintain free trade. England fought against Revolutionary France because it was afraid the Revolution would spread to England. But it made peace with France after it kicked Napoleon out of Egypt. It only went to war again after Napoleon imposed the continental system depriving England of free trade with Europe. Indeed, the reason why England spent the next century obsessed with maintaining a balance of power in Europe and ultimately went to war in 1914 was because it feared a single dominant power in Europe could impose the Continental System again.

I would go even a step further and say that free trade and its lack of foreign colonies and access to tariff free markets was the reason why Germany, despite having the largest and most advance economy in Europe and having by far the best and largest army, managed to convince itself that it was doomed to be elclipsed by France and Russia and felt it must go to war in 1914.

IMO - Napoleonic stuff and Britain fits much more into just the traditional efforts by Britain since the Hundred Years War to play balance of power on Continent. Basically, Britain really fears a single hostile continental power controlling both southwest-of-Calais and northeast of Calais because that forces Britain into creating/maintaining a bankrupting two-front home navy. Better to fight any wars that threaten that than to sit and watch bad things unfold. The second France invaded Benelux (technically when Louis was still king), France became an existential threat to Britain. So Brit fights when/where it can and assembles coalitions to fight - forever if necessary.

The later Germany stuff from Bismarck to WW1 (including US actual reasons for entering WW1) - yeah a ton of trade/money stuff underneath that conflict.

"It became the low-tariff country in a higher-tariff world. That doesn't produce nirvana for everyone (just ask the fucking Irish in 1846)."

Didn't the u.k. still have the Corn Laws in place until the first potato crops failed? Implying low-tariffs were somehow responsible for the Great Famine seems a bit of a stretch.

The blight was one year - and there had been many previously in Ireland - and that blight was throughout northern Europe (a cause of the discontent leading to 1848 Revolutions - but not famines anywhere else).

The first effect of the Corn Law repeal was to reduce Irish wages, increase rents, increase evictions, reduce potato acreage - and eliminate all possibility of food going to Ireland via market forces because Ireland was now drained of money. Ireland itself was exporting tons of food to England the entire time of the famine (which was 5 years).

Famine isn't ever just a function of a failure of a single crop no matter how dependent on that crop. Disease (malnutrition/homelessness-induced) killed multiples more people than actual starvation.

Interesting, makes sense. Thanks. It's no wonder there is still a bit of animosity between the Irish and British.

You guys keep writing off $400/car as if it's trivial. How do you think a company will offset that? At $20/hr that's 20 man hours per car. It's not trivial and it will cause layoffs. It's not as simple as just assuming your customer will not mind paying an additional $400 for the fun of it. It also puts domestic auto manufacturers at $400 competitive disadvantage against, for example, Japanese auto makers that pay no u.s. tarrifs (that I know of) and are able to buy steel $400/ton cheaper. But yea whatever.....maga.

uh, they build the cars here,, DUH, Koreans not yet..

Not all makes. Okay, then make it the Koreans/euros/mexicans whomever makes you happy.

Poor troll McGoop. Had to come in on a dead thread to post, hoping nowbody would catch the pay day last comments.

It's not dead. You're still here. errr....maybe that actually doesn't prove anything...my bad

The average light vehicle price is over $35,000, and people are taking 6-, 7-, and even 8-year loans to pay for them. Yeah, an increase of a bit over 1% of that cost is pretty trivial.

Yea well to you a 1% increase is trivial but to a company like GM that has a 0.56% profit margin it's the difference from being in the black to being in the red.

Unfortunately Trump was too stupid to make this basic calculation before jacking up the costs for domestic steel consumers. Ford is in a slightly better position, but not much. It wouldn't surprise me to see tariffs on all foreign cars soon. It's really tariff man's only recourse at this point. This is a fool's errand.

I agree with your general point, but need to observe that it does not take one ton of steel to build a car. In fact, most cars weigh about a ton (many much less) when complete. The total steel in a modern car is less than 750 lb, sometimes MUCH less.

The engine in modern cars is aluminum, radiators are aluminum and plastic, much of the rest of the engine compartment is plastic. Most bolt-on body parts are aluminum or plastic, and much of the interior is plastic with lightweight high strength steel framing. Most of the steel that is uses is high strength steel in light gauges used for the unibody structure. High strength steel is specifically used to reduce the amount required due to weight and fuel economy.

In short, not much steel in cars any more.

Boehm will ignore the billions in "regressive taxes" imposed on consumers caused by massive trade restrictions pre-Trump.

I am fine with negotiating with the Commies of China and the Socialists of EU, Canada, and Mexico using hard ball tactics.

They clearly want unfettered access to American markets but dont want to open their markets up to US exporters.

Trump's plan worked. China, EU, Mexico, and Canada cracked in less than 6 months.

Put that in your NAFTA joint and smoke it, Boehm.

Well, yes. Most taxes are regressive except income taxes. Why do you suppose the French are burning things?

Because they already pay 50% income tax, have a 20% regressive VAT tax on nearly everything and Dipshit Macron wanted to levy an additional 23% fuel tax on them to save the planet. I don't blame them. Unfortunately, they are too stupid to realize that capitalism is their only hope.

McGoop just an unpaid troll once his supervisor sees he not the last commenter.

Unlike you comrade. You get the big rubles.

I think labeling tariffs "consumption taxes" is more neutral than "regressive" which implies a desire for "progressive" rather than flat taxes which apply to everybody .

Tariffs are the main original constitutional source of revenue and that's not lost on Trump et al .

after 40 years of other countries getting away with willy nilly unfair trade practices against us. 1 president finally steps up, yeah it's painful, but since 1991 Kuwait war, China went whole hog after our Tech. and the Clinton financial scandals prove it. Trump is a free Trader, he has said so, but how would the Journalists at REASON get that done? after 40 years of nothing... Huh?? bow to the other countries?? make nice?? c'mon. criticism is OK.. but what's YOUR solution?? (crickets chirping) Grow up...get real, and quit whining..wait for the outcome. that's what counts, not how we get there, (unlike all socialist democratic policies , that always fail outcome)

I must assume that the reason some people are incapable of understanding the logic behind Trump's tariffs is because they are so deranged from Hilary's loss that their ability to think critically has been destroyed. So allow me to explain it slowly:

1. Trump is absolutely for free trade, but only if it is bilateral.

2. Other countries from Canada to China have had various tariffs on American goods for years but no president has ever had the balls to challenge the status quo. Like the deficit, previous politicians have just ignored the problem and kicked the can down the road, passing the buck to someone else.

3. That someone else is Trump. He understands that the only way to force other countries to drop their tariffs against the US is to retaliate with tariffs against their products while simultaneously making it clear (at least to those without TDS) that he will drop US tariffs if they will drop theirs.

So, if you still can not understand the process, read the above over and over until you get it. Then you can stop spreading blatant disinformation/lies about Trump destroying the world because he decided on a whim just to launch a bunch of tariffs on other countries for the hell of it.

reply to this report spam

Bullshit study points out that tariffs after you have lost most of your production capacity for those products is expensive.

Duh!

And how expensive would the loss of that production capacity be if access to those same necessary materials was cut off suddenly as an economic weapon by your sole supplier?

Kinda like owning some Gold is not a great investment. On the other hand, owning some gold looks much better when looked at as insurance against a bad event.

Maybe using tariffs to maintain production capacity for critical materials looks better when looked at as insurance premiums.

Right now, American taxpayers are paying the price of millions of blue collar workers who have left the labor force because cheap Chinese labor and illegal migrants are doing their jobs for less. And the price of that is probably significantly higher than 0.3%

The study makes clear, once again, that American consumers and businesses are the ones who pay the price of tariffs?not China or Chinese-based exporters

And once again, this is true because increasing domestic production of steel is not instantanous. When capacity increases and the quantity of steel imported from China reduces, and the scrap steel we ship them stays here for remelt, it will most certainly bite China hard.

The study is cooked to get the answer they wanted.

Yes, that seems to be the plan and steel production is increasing but still has a way to go before we get to even 2014 levels. To me, the question is will the government ratchet down steel tariffs as production increases to take pressure off of steel consumers? Until then, the domestic steel industry is partly being subsidized domestic steel consumers at a competitive disadvantage to foreign steel consumers.

And even if Reason and the authors of this study don't know that, China damned sure does.

It did not take long for them to start wanting to discuss things and make nice did it?

" with poorer Americans feeling more of a pinch"

"More of a pinch" being 0.05% more, even with their made up numbers.

Reason is such propaganda.

Short term pain for long term gain.

We can only hope. Could be short term pain for long term pain.

I essentially started three weeks past and that i makes $385 benefit $135 to $a hundred and fifty consistently simply by working at the internet from domestic. I made ina long term! "a great deal obliged to you for giving American explicit this remarkable opportunity to earn more money from domestic. This in addition coins has adjusted my lifestyles in such quite a few manners by which, supply you!". go to this website online domestic media tech tab for extra element thank you .

http://www.Mesalary.com

AO* Algorithm

AO* Algorithm