A National Debt 6 Times the Size of the Economy? That's Where America is Heading.

At this rate we'll get there before the end of the century.

By the time a child born in 2018 is settling into retirement, the national debt could be six times the size of the American economy.

Without making any changes to current policy—in other words, even without the glut of new entitlement spending proposed by some of Bernie Sanders' acolytes—that's the trajectory for the national debt over the rest of the 21st century, according to the Congressional Budget Office (CBO). It's an outlook that the Committee for a Responsible Federal Budget (CRFB), in an analysis released this week, calls "frightening and almost certainly unsustainable."

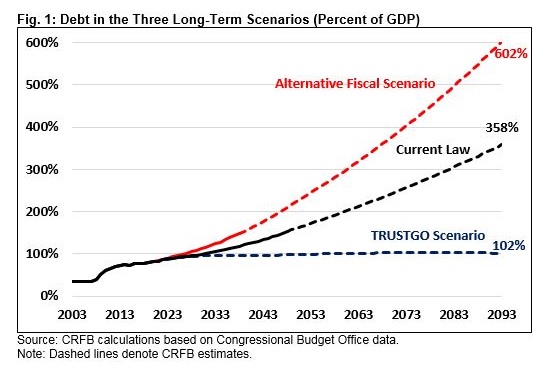

Under current law—which assumes, among other things, that last year's tax cuts will expire in 2025 and not be extended—the national debt will double from 78 percent of gross domestic product (GDP) this year to 160 percent of GDP by 2050. It would hit 360 percent of GDP, and still be climbing, by the end of the CBO's 75-year projection window in 2093. In the so-called "alternative fiscal scenario," which assumes current policies (such those tax cuts) are kept in place, the debt would hit 225 percent of GDP by 2050 and more than 600 percent of GDP by 2093.

Projections for the year 2093 are only so useful at a political moment when predicting what will happen in 11 days is difficult enough, but the CBO's 75-year budget forecast (its longest of long-term projections) makes it clear that the current budgetary course must change.

In some ways, the alternative scenario is likely to be more accurate because it filters out gimmicks written into law. Republicans included an expiration date in their tax bill to improve the legislation's CBO score, but they have already started moving to repeal it.

"While today's high levels of debt already threaten to slow economic growth, there is literally no precedent for deficits and debt at the levels projected over the next 75 years," warns the CRFB. "If policymakers don't act to avoid such high levels of debt, a financial or inflation crisis would likely force action and severely damage the global economy in the process."

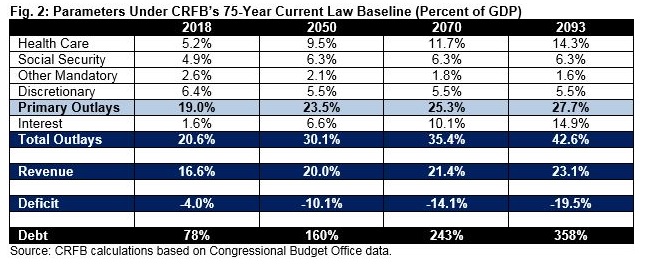

Spending is, not surprisingly, the main culprit of the coming fiscal catastrophe. Driven largely by Social Security and Medicare, total government spending under the "current law" scenario will double as a share of the economy in the next 75 years—from about 21 percent of GDP today to more than 42 percent.

While federal revenue will continue to rise as well, it will not keep up with spending. The CRFB projects that revenue will climb from 16 percent of GDP this year to more than 23 percent of GDP by 2093. The government would be consuming a record-high share of Americans' wealth, and it still wouldn't come close to equaling what's necessary to fund future spending already in the pipeline.

We've never faced debts and deficits like this—at the peak of World War II, the national debt peaked at 106 percent of GDP—and while 2093 sounds like it's a long way off, the time to change course is quickly running out. In his new paper that proposes ways to stabilize the national debt at a mere 95 (!) percent of GDP, Brian Riedl of the Manhattan Institute suggests that 2023 is the first major deadline for action. By the early 2030s, when Social Security will face a funding crisis, the nation is likely to already be entering a "substantial debt crisis," says Riedl.

That's a reason it's unlikely that we'll see a national debt that hits 300 percent or 600 percent of GDP. Various feedback loops—like higher interest rates that increase borrowing costs, and the fact that interest payments must grow along with the debt—could make the national debt a more acute problem in the short term. Using the CBO's alternative fiscal scenario as a guide, the CRFB projects that interest payments "would grow from 1.6 percent of GDP today to an astronomical 27.5 percent in 2093 (compared to 15 percent under current law)."

As interest payments increase to absurd levels, Riedl told Reason earlier this month, it becomes increasingly likely that bond markets stop lending to the United States.

In other words, as bad as the 75-year outlook appears, it's actually revealing a bigger—and more immediate—problem.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

You'd think this would be the kind of issue which would inspire our best statesmen and stateswomen to get to work and solve the problem.

HAHAHAHAHAHAHAHA!

Maybe someone should put together a climate change vs. national debt cage match.

Either way, the same oligarchs win. That's the way they've rigged it.

The best ones don't run as they refuse to pow their knee to the two big parties. We get charlatans and chameleons.

The DEBT is not the DEFICIT. And the DEFICIT is not the DEBT. They are separate problems.

Government BORROWING drives up the debt, not government SPENDING.

The solution to our debt problem is simple: STOP ISSUING DEBT-BASED MONEY! Begin issuing pure "unbacked" fiat money to fund the deficit, rather than going further into debt. The inflationary impact of unbacked dollars is no worse than the inflationary impact of the same amount of debt-backed dollars. Issuing unbacked dollars will halt the increase in the national debt and its crushing $430 billion in annual interest. Paying off part of the maturing debt each year and rolling over the rest will eventually bring the national debt (and its taxpayer-financed interest payments) down to zero. See http://www.fixourmoney.com .

God this is so fucking stupid.

Your 'issue more money to fund the deficit' - are you sure you're not Richard Murphy? Are you going to tell us that we can just tax away the resulting inflation?

Or are you just going to ignore that creating more money devalues the existing money supply? And that destroys everyone's savings? Better make sure you move your paycheck straight into durable goods or else Charles Barr will inflate it to worthlessness.

Oh, and then the next paycheck is worth less and the one after that is worth even less. And then we're Zimbabwe.

And if your suggestion is not a direct highway to hyper-inflation - THE PLEASE TELL US THE FUCKING MAGIC POLICY THAT EVERY POLITICIAN THAT'S TRIED TO FUND GOVERNMENT THE WORLD OVER BY PRINTING MONEY HASN'T BEEN ABLE TO FIGURE OUT.

See http://www.fixourmoney.com . I think it discusses many of the issues you brought up.

See http://www.youreanidoit.com. I think it sums up your claims.

Make more profit weekly... This is an awesome side job for anybody... Best part about it is that you can work from comfort of your house and earn 100-2000 dollars every week ... Apply for the job now and have your first check at the end of the week.

linked here.....=====??? http://www.Jobs73.com

Wait!

Here's the answer.

Make every government employee click this link and give the income to the treasury earmarked for debt reduction.

Problem solved in 6 months.

(about as practical as a 90 year projection)

Debt this size, shows that socialism still does not work even with capitalism trying to hold it up.

Yeah man, per "Iron Pants" Maggie Thatcher, the problem with socialism is that you always run out of other people's money! Democratic Socialism or Despotic Socialism or Surreal Socialism, Machs Nix, you always end up with the same end results...

The republicans really should have stood their ground and shut the government down instead of letting your hero Block Insane Yomomma bake annual trillion deficits into the permanent baseline cake ($9.3 trillion of debt in 8 years).

Yeah, you're missing a key point here: In a democracy, once borrowing to buy votes is on the table, the guy who wants to balance the budget always gets out bid. Always.

If they'd stood their ground, the Democrats would have ended up in control of Congress. Should they have, anyway, just as a matter of principle? Well, maybe. It would have been the last time their principles mattered, but at least the economy eventually crashing wouldn't have been their fault.

Mind, since Democrats control all the history faculties, the history books would say it was their fault anyway...

Every form of government has its failure modes, this is democracy's. Once borrowing becomes politically viable, democracies borrow themselves right into the ground.

Today's Republicans want to overspend just as obscenely as the Democrats. The only difference is which set of cronies gets the taxpayer dollars.

Fiscal conservatism appears to be in the hands of libertarians.

If current trends continue.....the daily high for next August 15th will be -400 degrees F here in Georgia. And I'll be over 140 years old next century. But I suspect that current trends don't continue indefinitely.

Figures don't lie, but liars can figure.

extrapolating

#BREAKING: US economic growth slows to 3.5 percent in third quarter

Paul Krugman's prediction of economic ruin continues to come true.

#DrumpfRecession

#LibertariansForKrugman

Krugman's still an idiot.

This in is good. Good job obl.

Every time a libertarian says "tax cuts don't cause deficits," what they're really saying is "MMM Republican cock git me some, gurgle gurgle gurgle."

You're welcome.

we never say that. when there is talk about cutting taxes, we say cut taxes. when there is talk of cutting spending we say where's that wood chipper.

Well, the people who claim to care about balanced budgets control all branches of the federal government right now.

That's not true, you claim to care, but you are not in control.

I care about economic prudence regardless of who's in power. Republicans pretend to care about it when Democrats are in power because they are power-hungry psychopaths.

But that's not what you said.

And the Democrats don't even bother to pretend to care, no matter who is in power.

51 votes in the Senate doesn't control jack shit.

Only appointments to the most powerful court in the country.

And yet they were almost not able to pull that off.

Its almost like the Republican party has some ideological diversity in it.

Libertarians don't control *any* branch of the Federal government.

And neither the Republicans nor the Democrats control the Judicial. And the Republicans sure as fuck don't control the Executive.

The wood chipper is at the head of that long line of Libertarians with a politician over each shoulder.

Tax cuts don't cause deficits. Tax cuts may make deficits worse, but they don't cause them in the first place.

Spending causes deficits. You could raise the top income tax rate to 100% and even if you got no increase in tax evasion/avoidance, it would even come close to closing the gap between federal revenue and federal spending.

It is utterly impossible to balance the budget long term without addressing spending.

If spending growth was zero from last year we would have decreased the deficit. If the tax cuts had not gone into effects, we would have still increased the deficit. It's the spending fucktard.

If our government had the discipline to not spend more than it brought in, it could have balanced the budget at any time. This is like saying you can keep an alcoholic from drinking every bit of booze he has on hand, by simply giving him more booze than he's currently drinking.

Until there's some control on spending, the federal government will always spend more than it brings in, no matter how much it brings in.

Tax cuts don't cause deficits. Its half-wits like you that whine whenever anyone in government talks about spending within their means that cause deficits.

By the end of the century?

So, you're saying that this isn't my problem?

Exactly; I look at each prediction of when Social Security / Medicare / Medicaid will "run out of money" by comparing it to my expected life span.

Thanks for the valuable information. It's very important to improve the economic side of our country. At https://top-copywriting.com/edusson-review/ I wrote a review about modern approaches in the government development

"By the time a child born in 2018 is settling into retirement, the national debt could be six times the size of the American economy."

Or it could be zero.

Get back to me when you have something other than wild guesses.

Well, it'll be somewhere between 0 and 6 times - and my bets on closer to 6 than to 0.

I'm betting closer to zero, because there's no freaking way we go that long without a crash, after which nobody will loan us money for a good long time.

Japan has reached around 200% of GDP, so it is possible the world might be stupid enough to loan us even a touch more than that, being a bigger/more important economy than Japan. God help us!

Here we go again, folks. Time for libs to tell us taxes need to be raised. However, the real solution to the national debt problem is clearly evident. The feds need to REDUCE SPENDING! They don't like this, as it means their scare tactics will allow them to raise taxes with impunity by frightening the nation with what will happen if they don't. Take a look at the following website if you don't believe the feds spend too much of your money on ridiculous things http://www.nationalreview.com/2015/12.....-expenses/

I expect America to solve this problem.

Either Republicans will regain their mojo and work toward a sensible bipartisan solution with respect to taxation and spending, or Democrats will impose a (likely less desirable) solution unilaterally.

People have been betting and fretting against America for decades, if not centuries. Just like the successive waves of intolerant immigration-bashers, they seem destined to be disappointed as America progresses, improves, and succeeds.

"...Democrats will impose a (likely less desirable) solution unilaterally...."

You're a real laugh riot, asshole.

By the time a child born in 2018 is settling into retirement, the national debt could be six times the size of the American economy.

But think of all the social safety nets he'll inherit.

2093?!??!? it will be all over by 2050!

Since the debt is an absolute number (of dollars), and GDP is measured on an annual basis, this is kind of a pointless comparison. If the year were longer or shorter, the result of the comparison would be different. It's still not good news, but this is not even apples and oranges.

We will never solve this problem without a balanced budget amendment. Politicians lack the fortitude to cut spending on their own. A balanced budget amendment will give them the political cover they need to make more responsible decisions.

Sadly I think not even a balanced budget amendment will do the trick. Politicians will then just shift more spending around into different exempt categories in order to hide the lack of a balance in the budget.

What really has to happen, unfortunately I think, is for the US to no longer have the world's reserve currency. That is the only reason why we haven't yet had to pay the piper - because every other country is more or less forced to subsidize our financial misbehavior.

The one thing that I fear from the amendment approach is that it will almost certainly have some language to allow deficits in national crises, like war for instance. I'd be concerned that gives politicians even more impetus to keep us engaged in never-ending states of war.

You'd need a provision prohibiting any legislator who votes for a deficit to run for reelection. Nothing less would work.

But you're not getting that out of our current Congress, which means a convention is needed.

Why hasn't Reason mentioned the MTV poll which showed that most young people support single payer healthcare? Reason has claimed before that we're in a libertarian moment and that libertarians are the future.of America, so how does that jive with the poll? I want to believe that libertarianism is the future, but I'm not sold. Are these young people going to change their minds about healthcare as they get older?

As soon as they start paying taxes they will.

"Why hasn't Reason mentioned the MTV poll which showed that most young people support single payer healthcare?"

Adolescents favor free shit?! No!

Check with Tony; it is possible to age and avoid maturity.

Are these young people going to change their minds about healthcare as they get older?

The young don't USE healthcare. They just pay through the nose for older people to use it. True single-payer - along the lines of the NHS - is actually a pretty good deal for the young.

If it leads to rationing and death panels - well that's one way of reducing costs.

And since that sort of system will be funded with taxes rather than a flat fee, it will be cheaper for healthy people who haven't scaled the income ladder yet.

Not the best solution - but imo it's long past time for the young to deliver a giant FYTW to their parents/grandparents who have screwed them.

Of course they do. They've never have had to live under such a system. Just like they've never had to live further than three miles away from a supermarket, a McDonalds, or a 24-hour pet grooming service.

Send one of the fuckers to such a system, sans their medical insurance, and capture the look on their faces when the GP they go to see about their slightly tricky malady tells them they don't qualify to see a specialist.

You could always pay for it yourself. But it's free right? Sure, but you don't qualify. But, it's free, right? Hmm, you don't seem to understand how the concept of free works...

"You could always pay for it yourself."

Don't quite understand what the "single" in "single payer" means, do you? Other payers will be illegal.

Don't quite understand that single payer is not a monolithic term, do you? It often refers to the public provision of essential medical services, with anything else paid for by the individual.

Even in countries with very long established universal healthcare systems, where state-funded provision of most services is taken for granted, private insurance markets operate and individuals pay out of pocket when the state refuses to cover their "non-essential" needs.

BULLSHIT.

In Canada (except in Quebec for some things) it is illegal to pay for health care when it's covered by the socialized system. You can't just walk into the doctor's office and say, fuck the lineup, here's 10 grand I want that MRI right fucking now. Only doctors can opt out of the socialized system and operate ENTIRELY on a pay-for-service basis. Of course, almost no doctors do this because Canuckistanis except health care to be free.

And that's why single-payer in the US context is not as constructed in Canada. There's more than one way to skin a cat. Look at the vast, dominant socialised health systems in Britain, New Zealand, Europe, etc. You're perfectly entitled to have medical insurance and private hospitals operate accordingly.

Don't be so dumb as to think "single-payer" means what you think it means. To most folks it's synonymous with a large public health sector that covers everyone but is not exclusive of other provision if you can afford it.

Hell, even Obamacare was pretty weak compared to public health provision in other countries. It was nothing more than subsidised insurance. Single payer as you construe it would never fly in the US.

Amazing how you can write a long article on debt growth and not really mention one if the biggest drivers of an assumed 3.5% spending growth every year as part of baseline budgeting. This is before Congress begins adding to the till. This rate is 1% higher than o amas average growth rate. It's 0.03% higher than historical growth rates. That assummed spending increase is the number of new problem in our debt. You can't grow spending faster than economic growth as a baseline assumption. It doesn't work.

So things continue on a path until they don't? Got it.

Nowhere in the article does it address GDP growth, technology, or any of a million other variables that would impact the discussion.

I would bet money that health care costs will decrease in 50 years not increase and the interest payments with it. Those are the two large numbers in this simplistic equation.

I guess debt is global warming for the right. They don't actually believe it based upon their actions but they use it for fear mongering.

I am all for fiscal responsibility and lower spending but articles like this aren't helpful IMO.

It would be great if Reason actually did the work and presented reasonable forecasts/guesses for the next 20 years but that would require the writers to actually work.

I think it's is for the US to no longer have the world's reserve currency. That is the only reason why we haven't yet had to pay the piper!!!

Yeah, man, but it's a dry debt.

Maybe we should use harsh language.

Maybe we can build a fire, sing a couple of songs, huh? Why don't we try that?

Yeah; we could print up a couple of million dollars instead of kindling for the fire.

Thanks for killing the Aliens riff. It had real potential.

If the debt is a number of dollars, and GDP is a number of dollars per year, how can one be a dimensionless multiple of the other?

They're trying to compare current total debt in any given year to that year's GDP. Not dimensionless. The problem with the comparison is that it assumes that the entire debt would be due in any given year, which is far from true.

don't get me started about the fallacy of simplistic projections that attempt to predict conditions 50 or 100 years from now.

This is the inevitable result of fractional reserve banking. I don't want to be one of those raving Libertarian lunatics on here against the Federal Reserve, but understanding money creation through the commercial banking sector is essential. Your budget-baiting story makes no sense otherwise. It's also the secret China figured out in the past decade or so: you need the debt in order to fund the expansion of the economy, and then you need to burn off the debt through asset "lining out" from time to time. It's monetary policy, not fiscal policy, stupid.

The problem America has at the moment is is the excess money created is being put into existing fixed assets instead of building new fixed assets. That's where China has pulled ahead of the US: they are smart about it. What the Fed and commercial banking sectors need to do as long as we're stuck in this fiat-money debt and devaulation cat and mouse game is implement window guidance. In other words, rather than driving up the valuation of fixed real estate, which redistributes wealth opposite of the progressive taxation system, banks should direct the lending into capital and infrastructure. Instead of causing a housing crunch, you end up building something with all that excess money created by the excess debt when commercial banks line in a fractional M4 money supply. when it all crashes, you are left with a nice spiffy functioning high speed rail system, a dam, a fiber optic network, etc, instead of underwater real estate.

Afsh Al-Hasa Transport Company is one of the best moving companies in Al-Ahsa city. Transportation of furniture