A National Debt 6 Times the Size of the Economy? That's Where America is Heading.

At this rate we'll get there before the end of the century.

By the time a child born in 2018 is settling into retirement, the national debt could be six times the size of the American economy.

Without making any changes to current policy—in other words, even without the glut of new entitlement spending proposed by some of Bernie Sanders' acolytes—that's the trajectory for the national debt over the rest of the 21st century, according to the Congressional Budget Office (CBO). It's an outlook that the Committee for a Responsible Federal Budget (CRFB), in an analysis released this week, calls "frightening and almost certainly unsustainable."

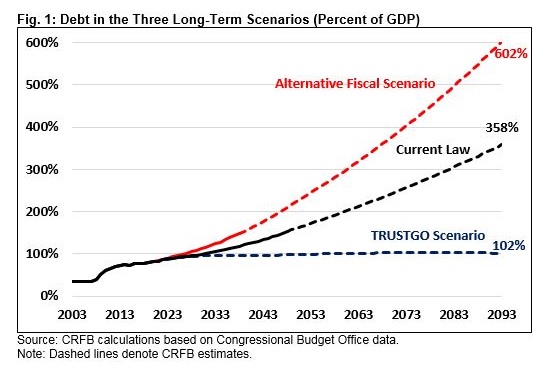

Under current law—which assumes, among other things, that last year's tax cuts will expire in 2025 and not be extended—the national debt will double from 78 percent of gross domestic product (GDP) this year to 160 percent of GDP by 2050. It would hit 360 percent of GDP, and still be climbing, by the end of the CBO's 75-year projection window in 2093. In the so-called "alternative fiscal scenario," which assumes current policies (such those tax cuts) are kept in place, the debt would hit 225 percent of GDP by 2050 and more than 600 percent of GDP by 2093.

Projections for the year 2093 are only so useful at a political moment when predicting what will happen in 11 days is difficult enough, but the CBO's 75-year budget forecast (its longest of long-term projections) makes it clear that the current budgetary course must change.

In some ways, the alternative scenario is likely to be more accurate because it filters out gimmicks written into law. Republicans included an expiration date in their tax bill to improve the legislation's CBO score, but they have already started moving to repeal it.

"While today's high levels of debt already threaten to slow economic growth, there is literally no precedent for deficits and debt at the levels projected over the next 75 years," warns the CRFB. "If policymakers don't act to avoid such high levels of debt, a financial or inflation crisis would likely force action and severely damage the global economy in the process."

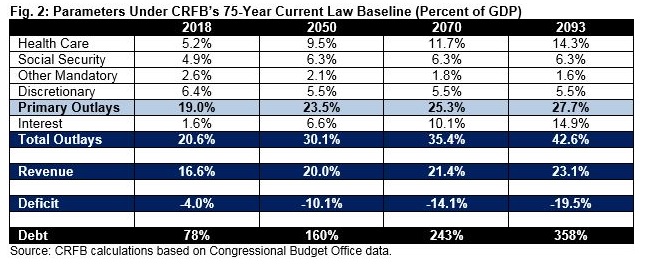

Spending is, not surprisingly, the main culprit of the coming fiscal catastrophe. Driven largely by Social Security and Medicare, total government spending under the "current law" scenario will double as a share of the economy in the next 75 years—from about 21 percent of GDP today to more than 42 percent.

While federal revenue will continue to rise as well, it will not keep up with spending. The CRFB projects that revenue will climb from 16 percent of GDP this year to more than 23 percent of GDP by 2093. The government would be consuming a record-high share of Americans' wealth, and it still wouldn't come close to equaling what's necessary to fund future spending already in the pipeline.

We've never faced debts and deficits like this—at the peak of World War II, the national debt peaked at 106 percent of GDP—and while 2093 sounds like it's a long way off, the time to change course is quickly running out. In his new paper that proposes ways to stabilize the national debt at a mere 95 (!) percent of GDP, Brian Riedl of the Manhattan Institute suggests that 2023 is the first major deadline for action. By the early 2030s, when Social Security will face a funding crisis, the nation is likely to already be entering a "substantial debt crisis," says Riedl.

That's a reason it's unlikely that we'll see a national debt that hits 300 percent or 600 percent of GDP. Various feedback loops—like higher interest rates that increase borrowing costs, and the fact that interest payments must grow along with the debt—could make the national debt a more acute problem in the short term. Using the CBO's alternative fiscal scenario as a guide, the CRFB projects that interest payments "would grow from 1.6 percent of GDP today to an astronomical 27.5 percent in 2093 (compared to 15 percent under current law)."

As interest payments increase to absurd levels, Riedl told Reason earlier this month, it becomes increasingly likely that bond markets stop lending to the United States.

In other words, as bad as the 75-year outlook appears, it's actually revealing a bigger—and more immediate—problem.