CBO: National Debt Projected to Surpass 150 Percent of GDP in Next 30 Years

Entitlement spending, health care costs, and the GOP tax legislation will drive up the debt.

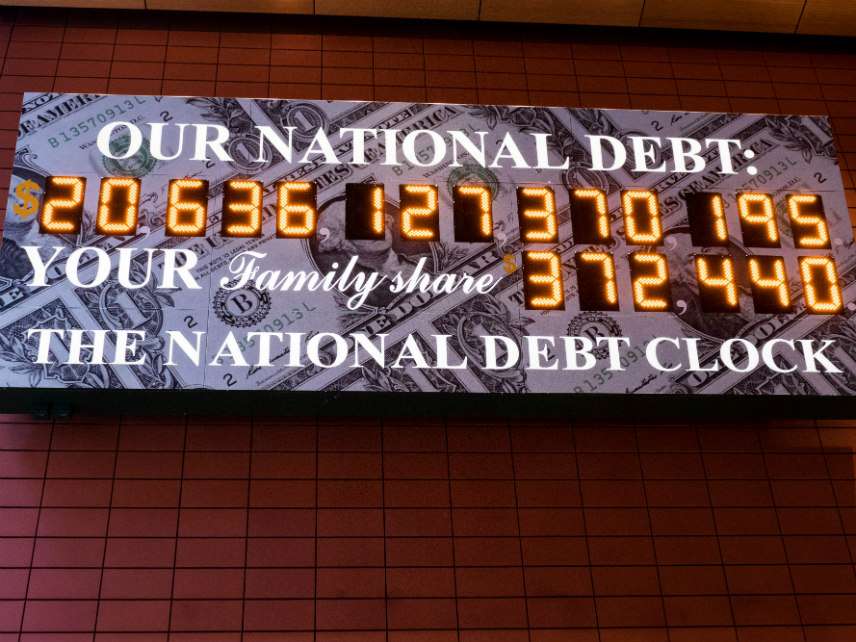

If the federal government continues its current spending habits, the national debt is projected to reach 152 percent of the annual gross domestic product by 2048, according to the latest estimates from the nonpartisan Congressional Budget Office (CBO).

In a report released Tuesday, the CBO said the national debt currently represents the highest share of the GDP—78 percent—since the period right after World War II.

The national debt is projected to reach roughly 100 percent of the GDP by 2030, and it could approach 152 percent by 2048.

"That amount," the CBO said in a summary of its report, "would be the highest in the nation's history by far."

The CBO cited a list of contributing factors to explain its projections.

Spending on entitlement programs like Medicare and Social Security, as well as overall rising health care costs and accumulating interest on the existing national debt, are to blame for the report's grim outlook.

"Projected deficits rise over the next three decades because spending growth—particularly for Social Security, the major health care programs, and interest on the government's debt—is expected to outpace growth in revenues," CBO Director Keith Hall said in a statement that accompanied the report.

Hall added that rising spending on entitlement programs is due in part to "the aging of the population."

But rising spending isn't the only culprit. The CBO also indicated that the tax legislation signed into law late last year by President Donald Trump could contribute to the national debt—at least in the short term—as it reduces the amount of revenue the government takes in.

According to the CBO, the tax legislation will ensure that revenue remains "roughly flat over the next few years relative to GDP." From, there, revenue is expected to increase slowly before jumping up in 2026, when most of the individual tax cuts expire.

After 2028, the tax legislation is not expected to have a major impact on the national debt, Hall said.

However, if the tax cuts are made permanent, the national debt could rise even more.

Overall, the CBO expressed concern that the federal debt situation could "hurt the economy" and potentially even lead to a "fiscal crisis."

"Large and growing federal debt over the coming decades would hurt the economy and constrain future budget policy," the report summary stated. "The amount of debt that is projected under the extended baseline would reduce national saving and income in the long term; increase the government's interest costs, putting more pressure on the rest of the budget; limit lawmakers' ability to respond to unforeseen events; and increase the likelihood of a fiscal crisis."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Entitlement spending, health care costs, and the GOP tax legislation

One of these things is not like the others

One of these things just doesn't belong

??

Yeah. The Feds do not have an income problem. They have tons of money.

Their spending problem is beyond repair. And the mainstream GOP can't even agree to cut a fraction of 1% of spending.

Yeah. The Feds do not have an income problem. They have tons of money.

If we went back to 2008 levels of spending ($2.9 trillion), we'd have a $500 billion surplus. That would mean cutting SS by $215 billion Medicare/Medicaid (mostly the latter) spending in half from $1.4 trillion to $700 billion. We actually spent more on defense in FY08 than we did in FY17 ($594 billion vs. $568 billion), although this is slated to go up, but we could save money there just by pulling out of the Middle East and Africa. It remains to be seen what kind of savings will result from ending the joint exercises in Korea, if that goes forward.

That should be a $400 billion surplus, not $500 billion. Receipts in FY17 were $3.3 trillion, outlays in FY08 were $2.9 trillion.

Fine. You want a tax cut, then cut the spending. Convince Congress to cut the spending first. See how that works out for them.

They couldn't even agree to cut a mostly symbolic, what, $15B?

In libertarian fantasy world, we can do that. In the actual world, it doesn't work, is impossible, and ends in electoral loss. If Obama treated the deficit like Bush or Trump have, he'd be sainted.

""They couldn't even agree to cut a mostly symbolic, what, $15B?"'

I doubt they could agree to cut $1B

Obama averaged $1.1 trillion deficit per year over his term

We had the worst financial crisis in over 70 years.

The deficit in 2016 was the same percent of GDP as 2008.

These deficits are predicted without a recession occurs. Do you really think that Trump has ended the business cycle?

There wasn't anything in that response other than infantile caterwauling.

Also, two of those are the same thing. So I'm going to just post this song too

In other words, our three problems are actually one problem and half of a solution. Progress!

But one of the problems is bipolar.

Two of the things are helpful to average people and very popular.

One is not.

Did I answer right?

Nope!

When a warning light starts flashing it's time to disable the warning light.

Who cares about the national debt? No one cares about the national debt. There are far more exciting issues to get worked up about. For example, immigration, standing for the national anthem, bombing terrorists.... But now Trump is losing on all these issues. Meaning we will begin to turn our lonely eyes to more mundane pursuits.

But now Trump is losing on all these issues

Really? Overall Democrat support has dropped by four points since the immigration freak-out started, the majority of people surveyed support deporting entire immigrant families back to their home country if any of them entered illegally, the Supreme Court just affirmed his travel ban, the NFL's going to fine any players that don't stand for the anthem, and no one gives a wet turd that we're still conducting combat operations in the Middle East, not even the commies, or they'd be protesting in force over it (probably because ISIS has been reduced to a shell of itself since Trump took office).

if that's what losing is like, winning would probably result in mass shitlib suicides.

I'm confused. Are polls a good thing or a bad thing? Everyone keeps changing their minds.

The 2016 election was an outlier due to some really obvious oversampling in the surveys and cognitive bias of the media. For the most part, they're a good indication of the general mood of the populace at the time.

The final polls were very close to the final margin. Millions move voted for Clinton than Trump. A small amount on the margin in three states gave a fluke result, that will change the course of our country for a lifetime.

It's enough to make you wonder why Democrats insist on playing a game (the popular vote) that doesn't actually win elections. Does the party have a learning disorder?

Also, Democracy is a terrible system. Why do Democrats have such an infatuation with it?

Democrats are stupid. What on earth would make them clear the field for Hillary?

Republicans are crazy.

The people lose.

The final polls were very close to the final margin.

They were also wrong.

A small amount on the margin in three states gave a fluke result

No, Hillary stupidly ignoring the Midwest to try and run up the score in urban bughive enclaves gave the final result.

Joe, I'm sure you're a nice young man just getting started in life and with good intentions and all, but your homework assignment for tonight is to do some research Hauser's Law, and to report back on your findings in your next piece.

Hall added that rising spending on entitlement programs is due in part to "the aging of the population."

*** rising intonation ***

I think I see a partial solution.

Put term limits on individuals?

Put term limits on individuals?

Cut spending. On everything.

It would be an interesting experiment to implement an across-the-board *real* cut of a whopping 1% and see what happens.

Tens of millions of people would see reduced entitlements, and tens of millions more would have their employment affected. The cuts would be done in the most painful way possible so as to stir up the most unrest. As every politician faced a genuine threat of being thrown out of office, the cuts would be reversed and the status quo would be restored.

"Fuck you, I'm not seeking reelection"?

The businesses whose subsidies get cut won't hire them as a lobbyist.

This.

This.

We had the sequester. It slowed economic growth, didn't do a whole lot for the budget, and was massively unpopular.

Republicans pretended to care about spending and the deficit until Trump was elected. Then, they reversed course immediately busted the caps and cut taxes.

Republicans pretended to care about spending and the deficit until Trump was elected. Then, they reversed course immediately busted the caps and cut taxes.

They didn't really reverse course, they acknowledged that none of them had the balls to cut spending while Democrats were holding up large placards with pictures of all the dead kids that would result from cutting even the rate of growth.

They never have wanted to cut spending.

There are only so many unpopular things they can sign on to.

Of course, and this is why spending won't be cut. The fact that taxes can never make any difference in this realm is, of course, why the nation will inevitably implode.

I suspect if Republicans had a supermajority, you'd see some cuts but they still wouldn't be popular and they wouldn't be large enough to make much difference in terms of debt. The very notion of cutting spending to a Democrat is akin to treason against the people, so they can be safely discounted in any equations.

Spending cuts are only even theoretically possible with a Republican supermajority, and no one bats an eye at this.

During the W years, the Republicans held all three branches for years and the filibuster was still not in routine use. Republicans could pass a budget almost at their will. There was no interest. Cheney told us that deficits don't matter.

Now, Republicans control all three branches. If they wanted, they could have autopiloted spending, seeing that they cannot manage the budget process. But, they added on trillions of spending. It's not that they can't do it, it's that they know they can buy votes by blowing up the deficit, and hang the consequences on Democrats.

They can blame it all on Obamacare, which they have gutted.

They can blame it all on Obamacare, which they have gutted.

Start with tax expenditures.

Like the Earned Income Tax Credit? Is that what you mean?

"The amount of debt that is projected under the extended baseline would ... increase the likelihood of a fiscal crisis."

Nah. The U.S. is too big to fail.

Too big to fail without taking ROW with it, maybe.

But what about the rabbits? Tell me about the rabbits too, George.

Is this the same CBO that said the ACA wouldn't rise the debt?

"But rising spending isn't the only culprit. The CBO also indicated that the tax legislation signed into law late last year by President Donald Trump could contribute to the national debt?at least in the short term?as it reduces the amount of revenue the government takes in."

Humm, didn't we have record revenue last year and this year? So it's not the revenue that's the issue. Also, Obama said that the years of 3% growth are over. Right now, the prediction is 4.5%. Does the CBO take that into account? NOPE.

I'm tired of the CBO complaining because I have to less money taken by the government. Where is the CBO's recommendation to cut stuff?

So you expect a report like this to not even discuss revenue, at all?

Record revenue, but the tax cuts haven't taken effect. Some of the repatriation amnesty has, though. But that won't last much longer. Where have you seen a GDP growth rate prediction higher than about 3% at most?

Record revenue, but the tax cuts haven't taken effect. Some of the repatriation amnesty has, though. But that won't last much longer. Where have you seen a GDP growth rate prediction higher than about 3% at most?

My "share" = $0.

"Entitlement spending, health care costs, and the GOP tax legislation will drive up the debt."

No they won't. Government *borrowing* drives up the debt, not government *spending*.

The solution to our debt problem is simple: STOP ISSUING DEBT-BASED MONEY! Begin issuing pure "unbacked" fiat money to fund the deficit, rather than going further into debt. The inflationary impact of unbacked dollars is no different than the inflationary impact of the same amount of debt-backed dollars, and such a policy will halt the increase in the national debt and its crushing $430 billion in annual interest. Paying off part of the maturing debt each year and rolling over the rest should eventually bring the national debt (and its taxpayer-financed interest payments) down to zero. See http://www.fixourmoney.com .

Can you elaborate. What is unbacked money? M1? Why is it no more inflationary? Don't we already pay off the maturing debt? Wouldn't not doing so be defaulting?

Currently the U.S. government issues interest-paying bonds to fund the deficit. If the government instead issued this money directly instead of borrowing it, the inflationary effect would be the same because total government spending (the amount of new money introduced into circulation) would be the same. But the national debt would not increase, and taxpayers would not be on the hook for additional interest payments. This is explained in much more detail at http://www.fixourmoney.com .

If the federal government continues its current spending habits, the national debt is projected to reach 152 percent of the annual gross domestic product by 2048, according to the latest estimates from the nonpartisan Congressional Budget Office (CBO).

And if the temperature trend continues unabated after I turn on my thermostat in winter, my house will eventually light on fire and melt it's way to the Earth's core.

Also, you can't control debt through taxation. Ever. And it's obvious that no one in Congress has the balls to take an axe to any spending, so...what now? I guess we're headed for the core after all!

Apparently, without the tax cuts, future debt would be lower. CBO estimates $1.8 trillion. If debt were our priority, we definitely could absorb higher taxes, at the cost of some growth. But the debt would definitely be lower, and our financial health improved. Of course, no Republican running for office wants to hear this.

According to the CBO revenue will double in the next ten years. GOP Tax cuts are the only thing keeping that from being worse. Keep in mind we also have to pay tons of federal fees, payroll tax, sales tax, state income tax, property tax, and imbedded business taxes.

The tax cuts largely expire in this projection.

Revenues increase because population increases, income increases, and inflation.

GOP tax cuts will make it $1.8 trillion worse according to CBO. Not that you can take their projections to the bank by any means.

There's no way they can project out 30 years. It could be a lot worse or a lot better than they project. The wisest way to deal with uncertainty would be to focus on existential threats (including financial) and get our financial house in order.

The debt is a number of dollars. GDP is a number of dollars per year. Divide one by the other and you don't get a dimensionless number, you get a time. Why not say "555 days" or "1.52 years" rather than "152 percent"?