CBO: National Debt Projected to Surpass 150 Percent of GDP in Next 30 Years

Entitlement spending, health care costs, and the GOP tax legislation will drive up the debt.

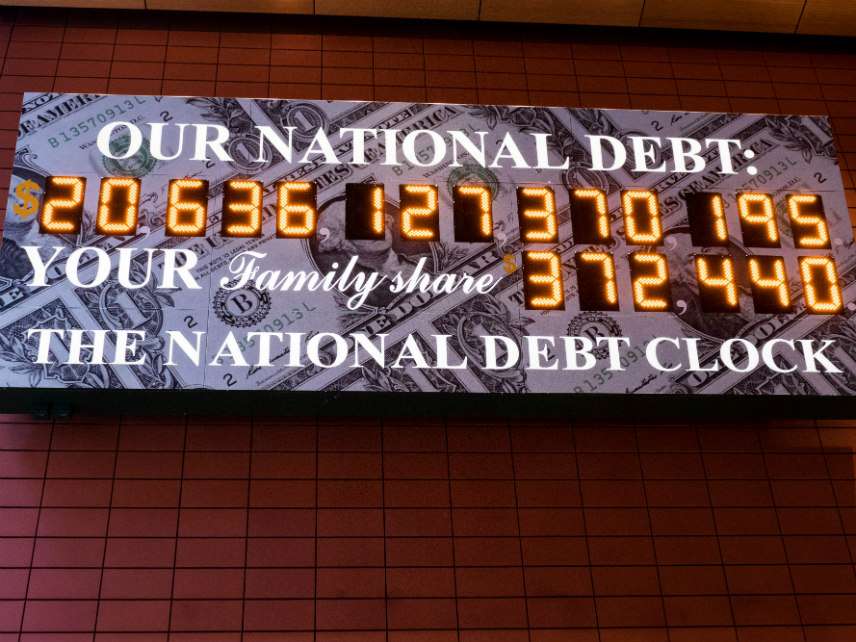

If the federal government continues its current spending habits, the national debt is projected to reach 152 percent of the annual gross domestic product by 2048, according to the latest estimates from the nonpartisan Congressional Budget Office (CBO).

In a report released Tuesday, the CBO said the national debt currently represents the highest share of the GDP—78 percent—since the period right after World War II.

The national debt is projected to reach roughly 100 percent of the GDP by 2030, and it could approach 152 percent by 2048.

"That amount," the CBO said in a summary of its report, "would be the highest in the nation's history by far."

The CBO cited a list of contributing factors to explain its projections.

Spending on entitlement programs like Medicare and Social Security, as well as overall rising health care costs and accumulating interest on the existing national debt, are to blame for the report's grim outlook.

"Projected deficits rise over the next three decades because spending growth—particularly for Social Security, the major health care programs, and interest on the government's debt—is expected to outpace growth in revenues," CBO Director Keith Hall said in a statement that accompanied the report.

Hall added that rising spending on entitlement programs is due in part to "the aging of the population."

But rising spending isn't the only culprit. The CBO also indicated that the tax legislation signed into law late last year by President Donald Trump could contribute to the national debt—at least in the short term—as it reduces the amount of revenue the government takes in.

According to the CBO, the tax legislation will ensure that revenue remains "roughly flat over the next few years relative to GDP." From, there, revenue is expected to increase slowly before jumping up in 2026, when most of the individual tax cuts expire.

After 2028, the tax legislation is not expected to have a major impact on the national debt, Hall said.

However, if the tax cuts are made permanent, the national debt could rise even more.

Overall, the CBO expressed concern that the federal debt situation could "hurt the economy" and potentially even lead to a "fiscal crisis."

"Large and growing federal debt over the coming decades would hurt the economy and constrain future budget policy," the report summary stated. "The amount of debt that is projected under the extended baseline would reduce national saving and income in the long term; increase the government's interest costs, putting more pressure on the rest of the budget; limit lawmakers' ability to respond to unforeseen events; and increase the likelihood of a fiscal crisis."

Show Comments (57)