California Gov. Jerry Brown Called Gas Tax Opponents 'Freeloaders.' Now He's Spending Billions of Their Money to Fund Transit They Don't Use.

$2.4 billion of new gas tax revenue will go to light rail and electric bus networks.

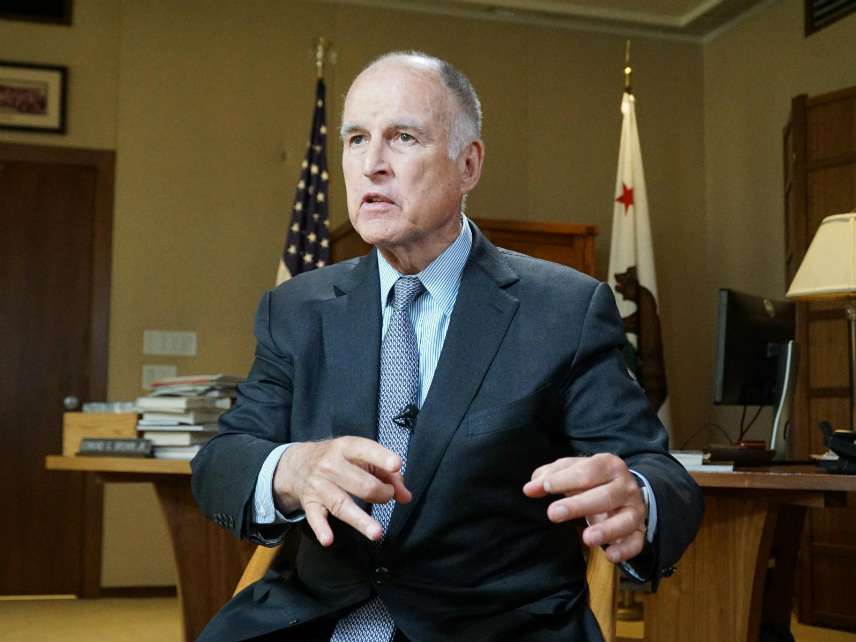

When California Gov. Jerry Brown was defending SB 1—last year's transportation funding package, which included $5.4 billion in annual gas tax and vehicle registration fee increases—he had an uncharitable term for his opponents: freeloaders.

"The freeloaders—I've had enough of them," he said at an Orange County event. "Roads require money to fix." The state was strapped for cash, he argued; drivers needed to pay up, lest the roads and highways devolve into gravel paths.

That argument didn't carry much water then, given that Golden State motorists were already paying some of the highest gas taxes in the nation. It certainly doesn't carry much water now that we have a firmer picture of where this new money is going.

On Thursday, the state's Transportation Agency announced grant recipients for some $2.6 billion of the transit funding raised by SB 1. The awards include $28.6 million for 40 zero-emission buses in Anaheim and $40.5 million for light-rail vehicles in Sacramento. Los Angeles snagged $330 million to build out its rail transit network in preparation for the 2028 Olympics.

A total of 28 projectswere awarded SB 1 money. None of them involves road upkeep at all.

The grants were supposed to be announced on April 30. Carl DeMaio, a former San Diego city councilman (and former contractor for the Reason Foundation, which publishes this website), thinks the announcement was bumped up for a political reason: The governor knew that on Friday activists looking to overturn SB 1 and all its tax and fee increases would start submitting signatures to place a repeal initiative on the November ballot.

"The governor is using the entirety of the government infrastructure to go out and hold press conferences to say everything but vote no on the gas tax [repeal]," says DeMaio, who is leading the repeal effort.

He has a point. The Transportation Agency's list of awards comes with a prominent SB 1 logo right at the top. The state government also runs a website rebuildingca.ca.gov, which describes SB1 in such neutral terms as "landmark transportation investment" and "job creator."

Democrats in the state legislature have been happy to play up this angle as well. At a press conference yesterday, Sen. Jim Beall (D–San Jose) summed up SB 1 repeal's effects on transit projects in his district: "Poof! It all goes away."

Assembly Speaker Anthony Rendon (D-Paramount) dismissed critics of SB 1 as fringe loonies yesterday, telling the Los Angeles Times that "local Republican leaders around the state were an important part of the SB 1 coalition, so I'm not sure how the more radical members of the party will be reconciling that in their attacks."

"This gas tax is not about fixing roads," DeMaio counters. "It about the ongoing assault against the car."

The hostility of California's climate-conscious, transit-obsessed politicians to traditional automobile travel is no secret. Gov. Jerry Brown has suggested banning all gas-powered cars. Los Angeles' explicit policy is to reduce the number of vehicle miles traveled.

SB 1's spending priorities reflect this. $100 million of the state's road funding is dedicated to "active transportation"—i.e., bike lanes, sidewalks, and recreational trails. Bike lanes built with these funds often come paired with the destruction of existing car lanes, which merely adds to the California drivers' woes. Meanwhile, about 1 percent of the state's trip takers use bikes.

Another $200 million in annual road funding is allotted in "self-help" funds to counties that have increased sales taxes to fund transportation. That would make Los Angeles County eligible, as its voters passed a sales tax hike for that purpose in 2016. The county's spending plan adopts a "multi-modal" approach, meaning those sales tax dollars and "self-help" funds can easily work their way into mass transit projects.

A $250 million congested corridor relief program is similarly prohibited from being spent on adding traditional highway lane miles.

Meanwhile, taxpayers have little reason to believe that the $2.8 billion in SB1 money that is specifically earmarked for highway and local road maintenance will be spent wisely. According to a report by the Reason Foundation, California spends $84,005 per mile to maintain its highways, compared to a national average of $28,020—while ranking 46th in the quality of its urban highways.

A basic principle of transportation funding is that users should pay for the infrastructure they use. A gas tax in theory fits the bill by collecting money from the motorists, truck drivers, and transit buses to pay for the roads they drive on. California apparently prefers to spending its gas tax dollars and vehicle registration fees to pay for modes of transportation the motorists don't use.

Rent Free is a weekly newsletter from Christian Britschgi on urbanism and the fight for less regulation, more housing, more property rights, and more freedom in America's cities.

Show Comments (149)