America's Sinking Public Pension Plans Are Now $1.4 Trillion Underwater

Taxpayer contributions to pension plans have doubled in the past decade, but pension debt continues to increase.

After several years of steady investment growth and higher contributions from taxpayers, most of America's public sector pension plans are still awash in red ink.

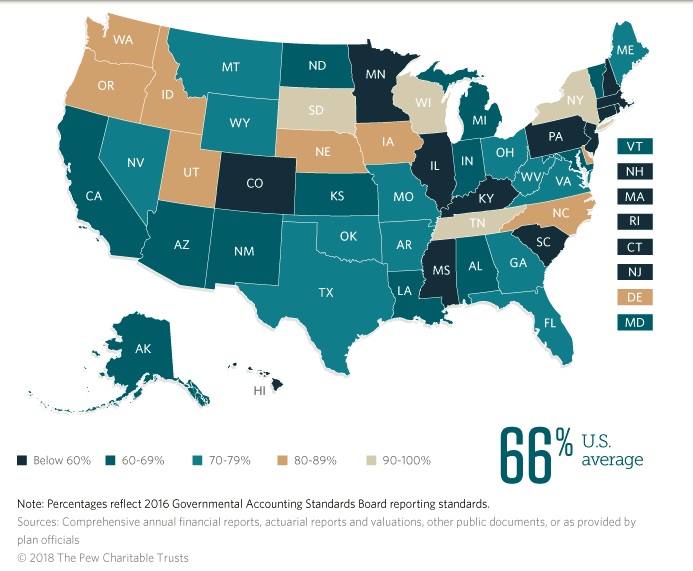

According to a new report from the Pew Charitable Trusts, the states collectively carry more than $1.4 trillion in pension debt—and only four states have at least 90 percent of the assets necessary to meet their long-term obligations to retirees. The Pew paper, which is based on states' 2016 financial reports, shows that pension debt increased by about $295 billion since the previous year, making 2016 the 15th consecutive year in which state-level pension debt increased.

The really scary part is that pension debt keeps increasing despite the fact that taxpayers' contributions to state-level pension plans have doubled as a share of state revenue in the past decade. Also worrisome: Pension plans are chasing increasingly risky investments. The gap between returns on safe investments and state pension plan investment assumptions was the highest in decades, the Pew researchers note, leaving pensions more vulnerable to market volatility and raising concerns that another downturn could drive already deeply indebted systems over a cliff.

Higher contributions from taxpayers and good returns in the market should bring well-structured pension plans back to good health. But only four states—New York, South Dakota, Tennessee, and Wisconsin—have at least 90 percent of the necessary assets to cover their retirement liabilities, Pew says.

There are two problems here. One is embedded in the very design of public sector pension plans. The other involves the politicians who are trusted to keep those plans funded properly.

The systemic problem is that pension plans generally assume unrealistic investment returns. "The median public pension plan's investments returned about 1 percent in 2016, well below the median assumption of 7.5 percent—a disparity that added about $146 billion to the debt," Pew notes. Those high assumptions also help hide the extent of the crisis. If the median assumption across all pension plans was lowered from 7.5 percent to merely 6.5 percent, states' collective pension debt would jump from $1.4 trillion to $4.4 trillion. Assuming 7.5 percent returns every year in perpetuity allows states to pretend they have more future assets than they likely will.

The political problem is that officials have underfunded pension plans for years. Taxpayer contributions have increased dramatically since the Great Recession, yet many states still fail to make the equivalent of a minimum credit card payment each year. "Only 27 states contributed enough in 2016 to expect their funding gaps to decline if actuarial assumptions were met," says the Pew report.

And there was a wide range in states' contributions, with some paying more than 30 percent above that minimum amount while others fell more than 20 percent behind. Making that minimum contribution is not enough to ensure that plans won't accumulate more debt—that can happen anyway if investments fall short of their lofty targets, as they often do—but falling short of the minimum virtually guarantees that a state will fall farther behind.

Of course, every dollar spend on public pensions is a dollar that state's can't spend on roads, schools, or anything else. That's the heart of the political problem driving America's pension plans: Adequately funding pensions is expensive, and politicians would rather spend limited tax dollars elsewhere.

There is no one-size-fits-all solution to the pension crisis, as every state (and city) has unique budgetary situations and pension plans have different underlying sets of assumptions. In Wisconsin, where state pension plans are 99 percent funded, there is a great deal more flexibility in future choices than in New Jersey, where only 33 percent of the state plans' liabilities are covered.

Removing politicians from the equation is a major benefit of transitioning away from traditional defined benefit pension plans and into 401(k)-style plans where individual workers control their retirement accounts. That also helps get taxpayers off the hook for having to make up the difference when markets or political will falls short of pension plans' expectations.

But for now, taxpayers will continue to pay more to finance public sector workers' retirements—and another recession could be a catastrophic blow for all involved.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

"Removing politicians from the equation is a major benefit of transitioning away from traditional defined benefit pension plans and into 401(k)-style plans where individual workers control their retirement accounts."

The problem is that if you introduce a 401(k) plan (which would be 401(c)3 since it's government) to new employees you will just exacerbate the problem in the existing pension system as less people will then be contributing to the plan. Alternatively, most states, due to state law, cannot move all current employees into 401(k) plans and just dump the pension plans.

I guarantee that Illinois is going to come crawling for a bailout from the federal government within the next ten years (if not sooner) and then the real test begins.

Reason seemed to have figured out that balance in Arizona.

That just absolutely will not fly in IL.

On a somewhat related note, the fun $20T that we all know and love, doesn't count the $1.4-4.4T unfunded state pensions that will come due plus the similar unfunded obligations the FedGov owes.

Start making extra cash from home and get paid weekly... By completing freelance jobs you get online... I do this three hr every day, for five days weekly and I earn in this way an extra $2500 each week... Go this web and start your work.. Good luck... http://www.jobs63.com

Start making extra cash from home and get paid weekly... By completing freelance jobs you get online... I do this three hr every day, for five days weekly and I earn in this way an extra $2500 each week...

Go this web and start your work.. Good luck... http://www.jobs63.com

If you're such an economics whiz, why are you inviting the world to enter your market and compete with you?

D'oh!

Start making extra cash from home and get paid weekly... By completing freelance jobs you get online... I do this three hr every day, for five days weekly and I earn in this way an extra $2500 each week...

Go this web and start your work.. Good luck...... http://www.jobs63.com

"The problem is that if you introduce a 401(k) plan (which would be 401(c)3 since it's government) to new employees you will just exacerbate the problem in the existing pension system as less people will then be contributing to the plan."

True, but there will also be less future demand for benefits.

Nope.

It's not state laws that say they "cannot move all current employees into 401(k) plans and just dump the pension plans."

It is the U.S. Constitution that says that "No State shall...pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts..." Article 1, Section 10.

The employment agreement is a contract and cannot be changed unless both sides agree.

Still slopping at the public trough, are you? Trying to show a bogus contract is protected so you can keep sucking taxpayer money?

Pathetic.

And your definition of "bogus" is ... what?

... until it's gone bankrupt??

As I've been saying for years, now... these 'rescue' plans and renegotiations MUST be designed to be phased in over a period of probably no less than ten or twenty years!

The retirees shouldn't be screwed because of stupid mistakes their politicians or unions made decades ago, but newbies entering the workforce, public OR private, should haul their own freight and be funding their own retirements using non-stupid assumptions!

Damage done over a 40+ year working life can't be corrected before the next election!

Ah, forget it... Critical Thinking is DEAD!

Well, tough cookies. State laws can be changed.

... but when the shit hits the fan and the plans go bankrupt. That's how law-makers and law-changers operate, right?

Always.

Everyone can procure 350$+ day by day... You can gain from 4000-8000 a month or significantly more on the off chance that you fill in as an all day job...It's simple, simply take after guidelines on this page, read it precisely through and through... It's an adaptable activity however a decent eaning opportunity.

For more informatiovn visit site.. http://www.profit70.com

AZ IN THE NEWS

How goes the mayoral race?

Pretty rough, after yesterday where you told me I was running for Mayor of Albuquerque I drove out there and was advertising, kissing babies, etc.

But then I decided to look it up, and I'm actually running for Mayor of Phoenix. And so I had to drive all the way back, which is 8 hours almost. I stopped in Hatch and bought several hundred pounds of green chile, so it wasn't totally a wash. But it was still annoying.

Sorry about that. Just smear Tom Woods again. That will probably earn you maybe one vote or something. I believe in you

If I can't win by running for Mayor in one of the two large Democratic bastions in the entire state, then where can I win?

During Happy Hour at the Dew Drop Inn?

If you went to Hatch from ABQ then to Phoenix you increased your return trip by another hour!

Green Chile however is worth an hour easy.

Underwater does not exist in real life.

Sure it does. Just because it was one of Chester Brown's stranger works, doesn't mean it doesn't exist

when the ambitious project was abandoned unfinished by its creator.

As I said...

It still has a few issues you can get. It wasn't completed but has published issues.

Also, I'm shocked to find Reason didn't cover his book Paying For It. Not many comic book authors do an entire book about legalizing prostitution.

Another point that is often left out of this issue is how many people in each state in members of the pensions currently paying into the pensions and how many are only withdrawing from the pensions. California, New York, and New Jersey probably have millions withdrawing from the pensions. Huge numbers of payees switching to retirees could wipe out a pension.

...in each state *are* members....

However, if you would allow "is" instead of "are", we could have a debate on the meaning of "is".

I'm commenting on Hit & Run in order to buy sex.

Anybody got a problem with that? I'm asking you, FOSTA/SESTA!

The problem with 401(k)'s is that, while they offload contribution obligations on the part of the employer, it's not like individual employees are any better situated to foresee their future financial needs. While I expect Reason commenters are pretty savvy, most individuals would be boggled if they were told how much of their current income they needed to sock away for a secure retirement, and a good number of them just wouldn't do it.

The fact is that, while pensions are going the way of the dinosaur in this country, the system we've replaced it with is rapidly careening towards its own catastrophe. You think bailing out IL is going to be bad? See what happens when everyone's 401(k)'s run out.

Myth: 401(k)-style Plans Offer a Secure Retirement to Workers

Fact: 401(k)-style defined contribution plans have failed to live up to their hype. Instead of assuring a safe and secure retirement for workers, defined contribution plans can offer only a fraction of the value of a defined benefit plan, often at much higher cost. Under a defined contribution scheme, retirement resources are not pooled, not professionally managed, and workers must determine how much to contribute to their retirement. Study after study has shown that workers fail to plan adequately for retirement. Defined contribution plans also leave their participants exposed to a great amount of market risk. During the Great Recession, for example, the value of many investments in 401(k) accounts was wiped out by the stock market crash. This left many retirees with no savings for retirement, even if they had been saving for decades.

you can't be this stupid, can you?

you can't be this stupid, can you?

"Fact: 401(k)-style defined contribution plans have failed to live up to their hype. Instead of assuring a safe and secure retirement for workers, defined contribution plans can offer only a fraction of the value of a defined benefit plan, often at much higher cost."

Fact: Parasites lie to keep the taxpayer money flowing.

Adequate planning for retirement is to max out your 401(k) contributions. If you don't do that, that's your choice.

The market lost about 50% and then gradually recovered. That "wiped out" nobody. Furthermore, most 401(k) plans have retirement-oriented funds that automatically shift into safer investments based on retirement dates.

Tax the rich.

Yeah, trust and vote for Bernie to make THAT happen... and look forward to starving to death in YOUR retirement years.

The PEW study grossly underestimates the pension debt of public defined benefit plans. Actuarial methods use the wrong discount rate and dropping it to 6.5% from 7.5% as PEW does isn't nearly far enough. Correctly valuing just CA's public and municipal pension debt at Treasury rates (http://www.pensiontracker.org/) shows California has nearly $1T in pension debt and just $250B in pension assets - 75% under funded!. That actuaries are wrongly valuing liabilities and have been doing it for decades is old news and stretches back to at least 1980 and Fischer Black (https://www.nber.org/papers/w0533). This is a way bigger crisis than you are reporting and the reckoning is going to be horrific.

"Also worrisome: Pension plans are chasing increasingly risky investments. "

Risky as well as politically, environmentally approved and whatever else blows in on the political wind of the moment and don't forget unwarrented dis-investment.

Part of the solution will be to get all government employees on defined contribution plans. It will not solve the immediate pension deficiet, but it will eventually bring this craziness to an end.

I would love to see a study showing how government pension managers compare to passive, broad-based indexing. My gut tells me that they do not exceed performance of passive investments and therefore offer no added value (except to politicians).

I worked in that industry, and taken as a whole, pension plans underperformed passive alternatives across the asset classes as well as underperforming a reasonably diversified total asset allocation. A small proportion 15-20% outperformed net of fees and costs, the rest did not. Moreover, since no public plans were fully funded on an economic basis nor were they matching the risks associated with the liabilities, the plans were essentially operating as leveraged hedge funds at taxpayer expense.

Back in 2004, after a suggestion from a dear friend of ours, my wife and I handed ALL of our IRA dollars over to an investment MANAGER.

For a fixed percentage of the total balance as their yearly fee, they handled every dollar. I read numerous books by the President/CEO/Owner of the firm and liked the kool-aid of his philosophy and methods.

So, that was just before the Great Recession that so many of you claim "wiped everyone's retirement out."

In a few years, our balance was back to what it had been before the great recession. Their goal was to return about 5-7% per year after fees.

They did. Aside from the recent volatility, which they also predicted a year ago for this year, our combined IRAs are down a bit less than 5% over that nearly 14-year period, INCLUDING all the fees AND our 'living expenses withdrawals' amounting to a bit over $900k for the same period.

So put a sock in it... When public employees get screwed because their "money-mismanagers" over-promise and under-deliver, the blame must be shared between the mis-managers and the employees who let them get away with it!

Over 13 years and 10 months, including fees and withdrawals, our IRAs have plummeted about 0.35% per year.

Continued...

Part 2...

Here's the math I used to NOT be in poverty in MY retirement...

1) Estimate your gross income at retirement.

2) Assume that, other than wardrobe changes or commuting costs, your total living costs won't change much at all in retirement unless you sell your home and move somewhere lots cheaper.

3) Assume that you, with the help of a REAL money manager, will have an average return of about 5% per year. If you do some research, you'll discover that the stock market has AVERAGED a bit more than that for MANY decades, including all recessions and volatility!

4) So, as a back-of-the-envelope approximation you'll need 1/0.05 times your final income, or 20 times your gross income at retirement IN YOUR IRA when you retire. If you don't you will not do well at all.

5) This can include the assumption that SocSec WILL go bankrupt and not add ANY dollars to your retirement income. I'm approaching my mid-70s, so using SocSec for about 30-40% of our cash needs is probably not unreasonable for now. Plan for a lower percentage if you're lots younger today.

Continued...

Part 3...

Stop believing what all the TV stock-market 'gurus' are telling you. They get paid regularly to lie to you and keep you coming back for more, just like the entertainment-news talking heads.

Oh, and if stocks return about 5+% per year, WhyTF are you in bonds, which ALWAYS return less? Lower volatility? I don't see that. Mutual funds? most of them charge too much for doing too little for you. And the "Passive Investments" y'all have talked about simply buy the whole marketbasket of stocks blindly and you're paying them to do that, too.

I at least, understand the investment philosophies of our manager and they have done very well by us.

And, of course, you don't have to believe one word of what I've said. Read everything from Ken Fisher.

Good luck to you all.

"According to a new report from the Pew Charitable Trusts, the states collectively carry more than $1.4 trillion in pension debt?and only four states have at least 90 percent of the assets necessary to meet their long-term obligations to retirees. The Pew paper, which is based on states' 2016 financial reports, shows that pension debt increased by about $295 billion since the previous year, making 2016 the 15th consecutive year in which state-level pension debt increased."

Hmm...

Looks to me like pension liability jumped about 25% in just a year ($1.1t + $295b = $1.4t)

So... can we expect pension debt to increase 20+% annually?

That would be bad news.

Just cut pension benefits to public sector retirees. Problem solved.

"We promised you $XXX, and you trusted us? What are you- retarded?"

FTFY 🙂

Every time I see artcles like this I am struck with the fear that Tennessean politicians, where I live, will think that they can join the rest of the states and reduce pension contributions or decide to increase pension benefits.

Government Pension plans are pure political pork. Why do the rest of us have entirely different options and required social security payments. Funded on a 7.5% estimated annual return. As if the "investors" controlling the "account" were all Buffet.

Garbage in garbage out.

The way I view it, pensions were offered to workers as part of their compensation package, no different then salary, health care or vacation time. The governments underfunded the pensions for decades, either by negligence, incompetence, or poor advice from financial advisors. But regardless the reason, I believe the workers are still owed their promised pension. You can not retroactively cut somone's pay, and likewise you should not cut their pensions. The taxpayers benefited from reduced taxes while the pensions were underfunded an the delayed bill has now come due.

You can't retroactively cut someone's pay because you've already paid out the money. You can certainly not pay them in the future.

You're welcome to test that theory... as taxpayers move out of state. That's what I'm doing.

This is a major problem across the world. Concerns over the stability of our pension systems can drop from sight but have a way of quickly resurfacing. Pension funds blowing up and going bust in coming years are set to become a "trillion dollar crisis" extending from coast to coast.

This has been made much worse by Washington and those placed in a position to mandate change sidestepping responsibility and failing to take any real action. Problems existing in Illinois and the others concerning CalPERS, the massive California Public Employees' Retirement System scream that we have been warned. More about this forming disaster in the article below.

http://brucewilds.blogspot.com.....-bomb.html

The right to vote should be restricted to net taxpayers.

Does that apply at the state level for electoral votes?

Karena para pemilih selama bertahun-tahun yang lalu, biarkan mereka menendang yang dapat menyusuri jalan daripada bersikap realistis (artinya, membayar dengan cara mereka sendiri, daripada menghisap tes orang lain.

bocoran hongkong

We're under no obligations to provide solutions.

If I see your car has a flat tire and let you know, do you reject my heads-up because I didn't bring a spare tire, jack, and wrench?

The solution is simple: move from states that are going bankrupt to states that aren't, preferably before the big exodus starts.

Left + right = 0.

FIFY

And leave your pension behind?

Michael Hihn...

Because the Electorate for the past many score of years, let them kick that can down the road rather than be realistic (meaning, pay their own way, rather than suck someone else's teat.)

Normal human stupidity, unfortunately.

Y'all are SO funny... last year someone pointed out that one of my tires was going flat. I hadn't noticed.

I immediately drove, literally, across the street, put air in the tire and took the car in for service the next day.

In all such situations, the heads-up versus the-why-didn't-you-bring-a-jack thing is... "It Depends."