You Won't Be Able to Pay Taxes on a Postcard, and That's Exactly How H&R Block Likes It

The Republican tax bill means most Americans will keep more of the money they earn. But the process will still be frustrating and terrible.

When House Republican leaders unveiled a tax reform bill on November 2, they made a bold promise.

"This is a complete redesign of the code, so we can simplify it so much that nine out of 10 Americans can file using a postcard-style system," said Ways and Means Committee Chair Kevin Brady (R-Texas).

President Donald Trump noted what that could mean for businesses that make their living off helping Americans navigate the awful, complex federal tax code.

"The only people that aren't going to like this is H&R Block," Trump said later that same day. "They're not going to be very happy."

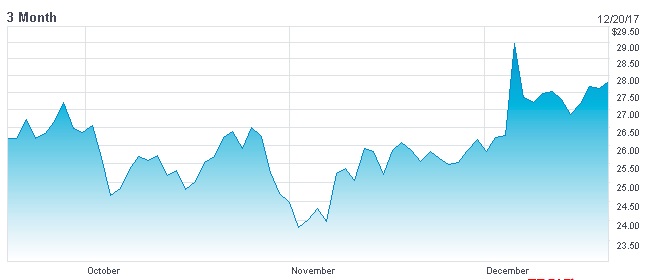

It was indeed bad news for H&R Block. Shares of the company's stock fell 2.7 percent that day.

But this afternoon, as the House cast the final vote on the Tax Cuts And Jobs Act, H&R Block's stock was trading at about $28 per share, up 13.8 percent from where it was on November 2. Intuit Inc., which owns the TurboTax brand, has seen its shares rise by about 5.5 percent over the same period.

I'm happy for the shareholders of H&R Block, who will be rewarded for their investment in the company. But the drop and subsequent rise of the company's stock tells you something about how the promises made for the Republican tax bill differ from the reality of the final text. Americans will not, in fact, be able to file their income taxes on the back of a postcard, and the bill does not do much to simplify the tax code (though the higher standard deduction does mean that fewer households will have to itemize deductions, a welcome change).

As Kevin Carmichael pointed out at FiveThirtyEight today, increasing the standard deduction doesn't do a whole lot for most people, because even families that take the standard deduction still often need help with their taxes. Simplifying the tax code in a meaningful way would have meant removing the various credits, deductions, and gimmicks littered throughout the code. Most of those remain.

Listen to the talking points Republicans are using this week. They aren't saying anything about paying your taxes on a postcard now. Nor is there much bragging about how many pages have been cut from the tax code. The code is still complicated, and so the tax prep companies win.

This isn't new territory for them. Intuit spent handsomely in 2013 to defeat a Democratic proposal that would have had the IRS pre-fill tax forms for taxpayers, as a 2013 Propublica investigation revealed. Since 1998, major tax preparers have spent almost $28 million lobbying Congress, according to the Center for Responsive Politics, a pro-transparency think tank.

They had help, of course. A multitude of special interests deploy legions of lobbyists—like this asshole—to preserve or create exemptions, breaks, and credits. That's why the idea of a postcard-sized tax form has always been a pipe dream.

The new tax bill means most Americans will get to keep more of the money they earn. And that's great, because they'll need that money to pay their accountants.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

And for the visually impaired, instructions will come on a single side of a compact cassette tape!

Just like the federal government to use obsolete technology.

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.onlinecareer10.com

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.onlinecareer10.com

(He converts single sided cassettes to vinyl LPs)

Good one.

Start earning $90/hourly for working online from your home for few hours each day... Get regular payment on a weekly basis... All you need is a computer, internet connection and a litte free time...

Read more here,..... http://www.startonlinejob.com

Jobs created!

Jobs in America!

Another nail in the Obama Legacy coffin!

Determining your tax consists of filling out a form with easy questions. Your only choice is whether to take a standard or itemized deduction.

95% of the effort that goes into business tax is keeping expense and income records. Filling out the form with this information is simple to do.

This "postage stamp" promise is an ignorant promise that only ignorant people would believe.

Meh. I do the online thing for free. It's pretty easy, just a bit time consuming.

Then when it says "You want to use this info to file your state taxes too? Only $12." I just go ahead and do it. Worth every penny.

There are computer aids that will help you get through questions like: name, marital status, number of children ............

Except when they hack your return. Paper for me buddy.

What are these 'postcards' people keep talking about? Is that like an e-mail?

/sarc

I hear the progs/socialists believe in one postcard form too: "How much did you make? Send it In. P.S. You will be informed later how much your benevolent legislators will return to you."

They want a nice personal postcard from their betters in DC like mom and dad want one from their college student kid on spring break.

"Dear mom and dad, Thanks for paying for my trip to Cancun. Don't worry I'm not drinking too much. But the, uh, parking meters are super expensive. Could you send me more money? Love, Tiffany"

What they really want is for everyone to work for the government and for the government to decide democratically how much to pay everyone. Except when a democratic decision disadvantages some protected group, then the career bureaucrats will decide.

This is only the least of the promises broken by this tax bill. It's almost obscenely tailored to Donald Trump personally (at least if he's the type of successful businessman he's portrayed himself as), when he told his mouth-breathing followers that he'd take a hit from it, month after month.

Libertarians think it's the bestest thing ever, to no one's surprise.

Cry more!

Try Flonase.

AT&T, Comcast giving $1,000 bonuses to hundreds of thousands of workers after tax bill

And totally not trying to influence a Trump Administration decision on any pending antitrust case involving AT&T, no sir.

Wells Fargo, Fifth Third Bancorp unveil minimum wage hikes after tax bill passage

Wells Fargo will also open a new account for you to honor the tax bill passage. Whether you want it or not.

Pretty horrible what evil KKKorporashuns are doing in response to this tax bill, eh Tony?

Not behaving like rational market actors so much as 5 year-olds who just got a scooter from Santa?

Tony!!

Come join other feminists to the March on Washington Against The Traitor Trump (MoWATT).

#MoWATT-2017-2018!!!

Join us this New Years Eve 2017-2018 as we bring in a New Year for a New Deal !

We will be walking behind Rosie ODonnell, Lady Gaga and her mom Madonna, and Ashley Judd as she re-performs her "Nasty Woman" Speech!

Extra Special - Witch Amanda Yates Garcia holding a communal Cast Out Trump Spell.

Be There for Herstory !

http://insider.foxnews.com/201.....er-carlson

Pussy hats?

It as obvious from the calculators presented to projected taxes under the new rules that the determination of Adjusted Gross Income was beyond any simplified methodology. So we were lied to by the Trumpians yet again.

Postcards greatly. Taxes easy. Wow

Seems like H&R Block stock should still be falling. Far fewer people are going to need to itemize. If you can't figure out how to fill out a 2 page form with the standard deduction and no AMT, you probably can't afford to pay someone to do your taxes. And if they're really complicated, you'll want a higher powered preparer than H&R.

Haven't paid anyone to do my taxes, ever.

A couple hours reading the instructions, fill in the blanks, nothing more powerful than an 8 digit 10 key calculator needed. As close as it ever gets to complicated is knowing what records to keep; the simple answer is "all of them".

(Well, I did use quickbooks to do the expenses and payrolls for my corporation, and it kind of did the taxes by default)

But never personal taxes.

It ain't that hard folks.