You Won't Be Able to Pay Taxes on a Postcard, and That's Exactly How H&R Block Likes It

The Republican tax bill means most Americans will keep more of the money they earn. But the process will still be frustrating and terrible.

When House Republican leaders unveiled a tax reform bill on November 2, they made a bold promise.

"This is a complete redesign of the code, so we can simplify it so much that nine out of 10 Americans can file using a postcard-style system," said Ways and Means Committee Chair Kevin Brady (R-Texas).

President Donald Trump noted what that could mean for businesses that make their living off helping Americans navigate the awful, complex federal tax code.

"The only people that aren't going to like this is H&R Block," Trump said later that same day. "They're not going to be very happy."

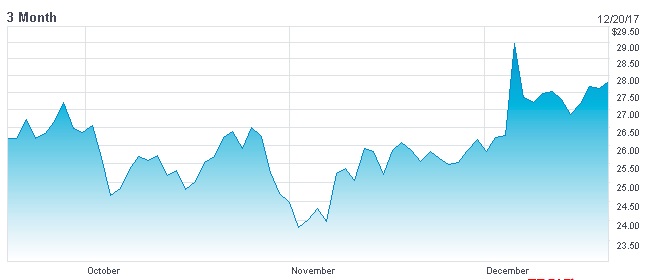

It was indeed bad news for H&R Block. Shares of the company's stock fell 2.7 percent that day.

But this afternoon, as the House cast the final vote on the Tax Cuts And Jobs Act, H&R Block's stock was trading at about $28 per share, up 13.8 percent from where it was on November 2. Intuit Inc., which owns the TurboTax brand, has seen its shares rise by about 5.5 percent over the same period.

I'm happy for the shareholders of H&R Block, who will be rewarded for their investment in the company. But the drop and subsequent rise of the company's stock tells you something about how the promises made for the Republican tax bill differ from the reality of the final text. Americans will not, in fact, be able to file their income taxes on the back of a postcard, and the bill does not do much to simplify the tax code (though the higher standard deduction does mean that fewer households will have to itemize deductions, a welcome change).

As Kevin Carmichael pointed out at FiveThirtyEight today, increasing the standard deduction doesn't do a whole lot for most people, because even families that take the standard deduction still often need help with their taxes. Simplifying the tax code in a meaningful way would have meant removing the various credits, deductions, and gimmicks littered throughout the code. Most of those remain.

Listen to the talking points Republicans are using this week. They aren't saying anything about paying your taxes on a postcard now. Nor is there much bragging about how many pages have been cut from the tax code. The code is still complicated, and so the tax prep companies win.

This isn't new territory for them. Intuit spent handsomely in 2013 to defeat a Democratic proposal that would have had the IRS pre-fill tax forms for taxpayers, as a 2013 Propublica investigation revealed. Since 1998, major tax preparers have spent almost $28 million lobbying Congress, according to the Center for Responsive Politics, a pro-transparency think tank.

They had help, of course. A multitude of special interests deploy legions of lobbyists—like this asshole—to preserve or create exemptions, breaks, and credits. That's why the idea of a postcard-sized tax form has always been a pipe dream.

The new tax bill means most Americans will get to keep more of the money they earn. And that's great, because they'll need that money to pay their accountants.