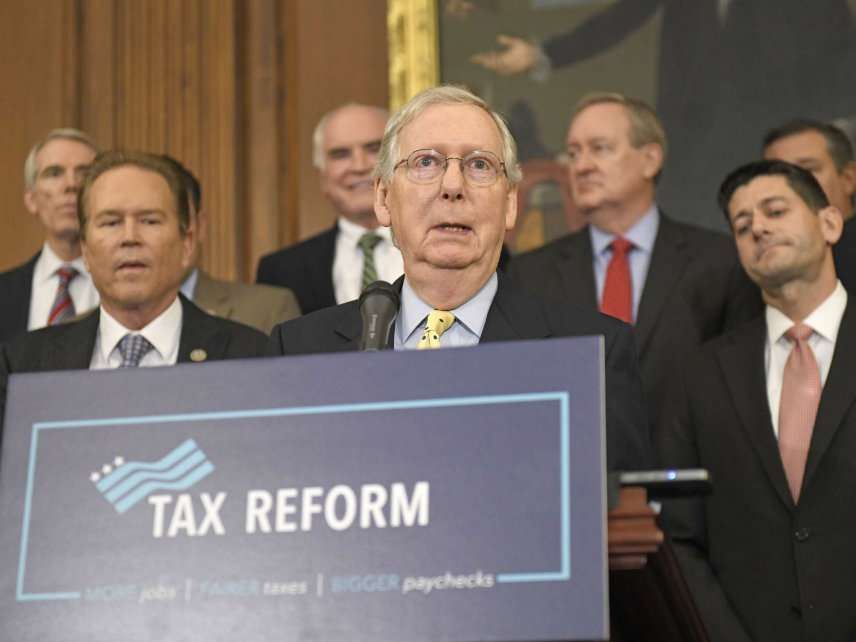

Senate Republicans Just Took a Big Step Toward Permanently Overhauling the Tax Code

The bill advances lowers corporate and individual tax rates while setting the stage for large increases in the deficit.

Senate Republicans just passed a major rewrite of the tax code on a party line vote, with only one GOP dissent. The vote puts Republicans significantly closer to permanently altering the shape of the U.S. tax code, which has long been a priority for party leadership.

If the legislation becomes law, it would be the first major rewrite of the tax code since the Reagan administration. The bill would substantially cut the corporate tax rate, which analysts say would help spur economic growth and make America more competitive internationally. At the same time, passage of the bill also represents a significant abdication of the GOP's promises to legislate transparently and not increase the deficit.

A separate version of the bill has already passed in the House last month. The two pieces of legislation are now expected to advance to a conference committee where House and Senate negotiators will attempt to work out the differences, after which the two chambers will have to vote again. Alternatively, the House could simply pass the Senate bill unchanged.

The bill was in flux until the last minute, with significant objections coming from a group of senators who said they were concerned about the bill's effect on the deficit. Under President Obama, Republicans frequently criticized Democrats for failing to read or provide sufficient time to debate major legislation.

But as of late Friday afternoon, after Republicans secured commitments to vote for the bill, final legislative text had not been published. When the final text of the legislation did appear late in the evening, it was covered in handwritten notes and alterations.

Two more pages of changes to the Republican tax bill—these ones in handwriting. pic.twitter.com/rYQoe9brUB

— Sahil Kapur (@sahilkapur) December 1, 2017

The Senate version is projected to increase the deficit by a little more than $1.4 trillion over the next decade. Republicans backing the bill have insisted that the plan will make up the revenue by spurring additional economic growth, but they have not produced official analysis reaching the same conclusion. Although Treasury Secretary Steve Mnuchin repeatedly promised that the administration would provide a dynamic analysis, no such report has been released.

Independent analyses have found that some of that decline in revenue would be made up by increased economic growth. A Joint Committee on Taxation Report released yesterday estimated that even with dynamic effects the bill would still increase the deficit by about $1 trillion; more favorable estimates have put the effect on the deficit closer to $400 billion.

Throughout the week, there were reports that the bill would address worries about the deficit with the inclusion of a "trigger" mechanism that would automatically raise taxes if yearly economic growth projections fell short. But that plan fell through last night after the Senate parliamentarian told GOP leadership that it wouldn't be allowed under the reconciliation process that Republicans relied on to pass the bill with a simple majority.

One of the senators who objected to the bill on fiscal responsibility grounds was Jeff Flake (R-Ariz.). But on Friday he announced his support for the bill after securing the elimination of an expensing provision and a promise from party leadership to enact permanent protections to recipients of the DACA immigration program that started under President Obama.

I will support #TaxReform bill after securing language to eliminate an $85 billion budget gimmick as well as commitment from the administration & #Senate leadership to advance growth-oriented legislative solution to enact fair & permanent protections for #DACA recipients pic.twitter.com/MGbWX7JrPq

— Jeff Flake (@JeffFlake) December 1, 2017

The Senate bill makes major changes to both individual and corporate taxation. It permanently slashes the corporate tax rate from 35 percent down to 20 percent, alters the way that businesses can expense new equipment, and reduces taxes on income earned by pass-through businesses, a tax structure in which corporate profits are taxed as individual income. Those changes could create an incentive for many businesses to restructure as pass-throughs as a form of tax arbitrage, which is what happened when the state of Kansas attempted a similar change. An analysis by the Tax Foundation found that the Kansas provision encourage tax avoidance but not economic growth.

The bill also cuts individual tax rates, nearly doubles the standard deduction, gets rid of the personal exemption, expands the child tax credit, and eliminates or caps several major tax code deductions, including the state and local tax deduction. It modifies, but unlike the House plan does not repeal, the alternative minimum tax, which disallows some deductions by high earners. Over the next decade, filers at all income levels would see a tax cut.

However, unlike the corporate tax reduction, which is permanent, the individual rate reductions are phased out by 2026, creating a major policy cliff, and nearly guaranteeing high-stakes legislative showdowns. The sunset was designed largely to ensure that the bill conformed with Senate budget rules, which require that legislation passed via the reconciliation process not increase the deficit after a decade. Republican leaders have argued that Congress is not likely to let those tax cuts expire. That, in turn, would result in a significant long-term deficit increase.

Among the biggest changes in the Senate bill is the elimination of the tax penalty associated with Obamacare's individual mandate, which could have significant effects on the stability of the exchanges, which have already seen high premiums and insurer drop outs, and thus on the number of people in the country with health insurance. The House bill did not eliminate the mandate, but repeal is likely to remain a part of whatever the two chambers negotiate in conference.

Eliminating the mandate lowers the deficit by about $340 billion, according to the Congressional Budget Office, as a result of about 13 million fewer people signing up for Medicaid and subsidized coverage in the exchanges. The savings help offset the budgetary effects of the bill's tax reductions. Some Republicans, however, have argued that the CBO's estimate attributes too much coverage to the mandate, which would mean that the deficit reduction is also too high as well.

Under the Obama administration, Republicans frequently criticized the president for high deficits and allowing the national debt to increase. Throughout the year, GOP leadership promised that the bill's budgetary effects would be fully offset by eliminating loopholes and deductions. That didn't happen.

The bill could still change in conference, but between the effects of repealing the mandate and the expiration of the individual tax cuts, it is probable that the final legislation will end up increasing the deficit far more than most estimates suggest.

So while it represents a significant legislative victory for the GOP, and the advancement of several longtime policy goals, it is also one that confirms that for the Republican party, fiscal responsibility was never more than a politically convenient pretense.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Flake won't run for reelection and he knows Trump hates him. But he saw an opportunity to pass tax cuts and help the DACA kids at the same time. Trump was surprisingly soft on the DACA kids (to the dismay of his supporters), but he was hopping mad at the Steinle verdict. Flake probably saw a chance to formally secure the president's support before he changed his mind and took it.

The growing deficits suck, but tax cuts can be good and the DACA kids and their family are one step closer to resolving their uncertain situation. I'll take it.

The growing deficits suck

But what else is new? Yes, cut spending, but that never happens, so I'll take a tax break over a deficit reduction any day.

Trouble is unless you make a $500K plus your taxes aren't really going down much at all. 1% ain't much.

Yes that is the place to address deficit concerns.

I agree. When it all collapses at least I will have my earnings and not the govt.

You can get therapy for delusions as severe as that.

If only it was a tax cut for everyone. It's a tax increase for me. Republicans decided that I should have less money in my pocket.

"At the same time, passage of the bill also represents a significant abdication of the GOP's promises to legislate transparently and not increase the deficit."

It's funny how the GOP gets the blame from some libertarians--for what libertarians do.

There was a Senate bill that would have cut $1.022 trillion in spending with the support of Rand Paul and some of his deep red state cohorts in the Senate, but they voted against that bill, and, someone correct me if I'm wrong, but I think Suderman cheered on Rand Paul's opposition, as well, and even opposed that Senate bill himself.

Here's a link to the bill:

https://www.cbo.gov/publication/52849

According to that CBO report, the bil cut $772 billion from Medicaid and cut another $408 billion in subsidies.

How's that for transparency?

There was some lost revenue in that bill, too, most of it associated with eliminating the penaltax along with the individual mandate--but the CBO still scored it as a net reduction in the deficit of $321 billion.

Like I said, Rand Paul voted against that bill, and as I recall, Suderman was against it, too.

It doesn't seem fair to blame the GOP for a lack of transparency and an abdication of their promise not to increase the deficit--not after Rand Paul and some of my fellow libertarians led the charge against the biggest deficit reduction bill we're likely to see in our lifetimes. If we libertarians aren't serious about cutting the deficit, why should the GOP stick their necks out?

Don't let the good be the enemy of the perfect. For all that they've promised, the GOP figures if they've delivered on some small part of that, well, fuck it, good enough for government work. You'll never hear another goddamn word about repealing Obamacare or cutting spending outside of campaign rhetoric.

But why blame the Republicans for failing to live by their promise to not increase the deficit when the senators who voted against the bill were led by Rand Paul and cheered on by likes of libertarians around here?

Here's a list of six Republicans who voted against the bill to cut $1.022 trillion in spending from entitlement programs and a net $321 billion from the deficit:

Bob Corker Tenn.

Tom Cotton Ark.

Lindsey Graham S.C.

Mike Lee Utah

Jerry Moran Kan.

Rand Paul Ky.

----New York Times

https://tinyurl.com/y9wt74ht

These are not moderate Republicans from swing states. The only two who might be are Corker and Rand Paul--the two who should be most ashamed of themselves for failing to cut the budget.

All six of these senators voted for straight out repeal but against cutting $772 billion from Medicaid.

All six of these were supposedly senators we should be able to count on to vote to cut spending and entitlement programs. Bob Corker is such a hypocrite, he actually voted against cutting taxes because of the deficit!!!

If those six had voted to cut spending instead of against it, the replace ObamaCare bill would have had 49 votes for it--putting tremendous pressure on Collins, Mukowski, or Heller to come on board, just like it did with the tax overhaul.

The reason ObamaCare wasn't replaced and the reason we didn't cut $1.022 trillion in spending is not because "the Republicans" abdicated on their promise not to increase the deficit. That promise was abdicated by six senators comprised of fiscal conservatives, tea party types, and was led by a libertarian, Rand Paul.

Anyone who cheered them on has no business faulting the establishment Republicans for failing at fiscal conservatism. The establishment Republicans bravely voted to cut $772 billion from Medicaid, and Rand Paul voted with Bernie Sanders and Liz Warren against that.

And don't let the good be the enemy of the barely tolerable.

Cutting $1.022 trillion in spending, $772 billion of it from Medicaid, and eliminating both the individual mandate and the employer mandate wasn't "barely tolerable". It wasn't just good either. It was the most libertarian bill I've ever seen in my life. We were poised to cut an entitlement program!!!

Cutting regulation, cutting spending, and cutting taxes is what making the government smaller is all about--and that replace bill Rand Paul voted against even cut spending more than taxes.

The alternative was ObamaCare, so Rand Paul effectively voted for ObamaCare. No one's corrected me for being wrong on Suderman, but I think Suderman cheered Rand Paul on for doing so. I'm not sure ObamaCare is "barely tolerable" either--because it's unsustainable in its present form.

Some people opposed that replace bill for what it didn't do, but I didn't see anything in that bill not to like from a libertarian perspective. I think Suderman at one point was criticizing the bill for not doing things sooner? Well, now those changes are delayed indefinitely. We still have ObanaCare.

Killing the mandate effectively guts Obamacare. It will fail on its own.

I'd like to believe that except ObamaCare was centered around an expansion of Medicaid.

If ObamaCare "fails", there's no reason to think that will necessarily translate into cutting $772 billion in Medicaid spending. The bill Rand Paul voted against cut Medicaid spending directly by $772 billion.

Medicaid is a socialist program that is strangling our healthcare system and crowding out market solutions. It is not a coincidence that our healthcare problems got worse with the expansion of Medicaid.

In fact, the whole purpose of the individual mandate was to help cushion the blow to insurers of expanding Medicaid by forcing young healthy people to buy health insurance they wouldn't use. I'd love to think that repealing the individual mandate will lead to the repeal of the ObamaCare Medicaid eligibility expansion, but it could just as likely lead to expanding Medicaid even further.

And that's what we're talking about when we're talking about single payer. Single payer is when everyone is eligible for Medicaid because the private insurance companies imploded or for legislative reasons. That's why expanding Medicaid is the road to single payer and nationalizing the healthcare system. The bill Rand Paul voted against cut Medicaid spending, and, hence, I'd call moving people from Medicaid to private insurance "privatization". Watching the private health insurance system crash may just as well lead to more Medicaid eligibility.

I can guarantee that if the Congress were to repeal all tariffs that Reason would not say a peep about the increase in deficits that would result. The US raises about 30BB in tariffs every year so over 10 years that's 300BB. That seems to be the threshold for peter to wet himself.

Socially liberal. Fiscally convenient.

I hardly recognize the place anymore.

They're making arguments that they used to tear down, brick by brick.

Online editor writes for the daily beast. Petey writes for vox. They're gushing over pieces in NYT. Is it really much of a surprise?

Forgetting about economic growth resulting from the removal of tariffs there, Skip.

Pete seems pretty skeptical about dynamic scoring there, mj.

Nice hypothetical scenario you pulled out of your ass.

It's also hilarious to accuse other of being fiscally convenient when you're defending increasing the deficit by cutting taxes while not cutting spending. That's the absolute definition of fiscally convenient. Any other path involves tough choices. But not when you can promise tax cuts to people now without having to worry about paying for all the spending you're not cutting.

Your complaint is that they're too favorable toward free trade?

Ya know, Ken, the situation would be different if Republicans hadn't made grandiose, signature promises for YEARS and YEARS, on repealing ObamaCare, and then when finally called upon to live up to their promise, delivered the steaming piles of excrements that we saw earlier this year. Rand Paul didn't vote against these ObamaCare "repeals" because he sided with Bernie Sanders. He voted against them because they weren't actually repeals, and were an abdication of his tribe's own commitment to repealing ObamaCare. So I think a little perspective is in order here. The Republicans created expectations that - let's be honest - they had no intention of actually meeting, and they deserved to be punished for their perfidy.

The Republicans generally are clueless when it comes to health care. They have no guiding vision or principle about what health care in this country ought to be like. They clearly AREN'T free market dogmatists on the subject. They want government-run health care for old people and vets, but not for the poor? What is the guiding principle that justifies this type of position, other than a simple "we want government run health care for voting blocs that vote for us"? Their ineptness is what is going to give us complete single-payer health care in the end, because they aren't offering a forceful vision of an alternative. Sure we libertarians have ideas, but no one listens to us.

You mean like gayjay promising to reform spending by cutting a whoppong 1% from SS in his budget, or by increasing the definition of marriage for the purposes of calculating fovernment bennies?

Yeah, libertarians have so much fiscal cred.

No, more like this

http://www.cato.org/research/health-care

Incidentally, Cato wasn't a fan of Republicans' ObamaCare "repeal" proposals either. Maybe Cato is now in the pockets of Bernie Sanders too?

Pretty sweet cherries you're picking there. Cato isn't a fan of global warming scares either so you're going to be pointing that out the next time bailey wrings his hands, right?

I'm not talking about global warming. I'm talking about health care.

The point is, libertarians have many things to say about health care, beyond what vapid politicians like Gary Johnson have to say on the matter.

Claiming Gary Johnson is a spokesman for all of libertarian thought is like claiming Donald Trump is a spokesman for all of conservative thought.

If I disagree with Cato on the subject of global warming then I'll criticize them for that. But on the subject of health care, I can't find much to fault them on.

Right, so aside from the fact that gayjay was thr LIBERTARIAN nominee and endorsed by reason, he's irrelevant (inconvenient). Them's good thinkin there.

And ken is talking about deficits. If you get to change the subject then so do I.

Look, if you want to discuss libertarian (small-l) approaches to health care, then we can have that discussion.

If you just want to bash Gary Johnson, then frankly I'm not interested. He wasn't a great candidate and he shot himself in the foot many times. I ended up not voting for him because of his terrible freedom-of-association positions, actually. But that is the past.

If you want to dishonestly claim that Gary Johnson represented the entirety of libertarian (little-l) thought on every subject that every libertarian cares about, then I'm not interested either.

Sounds like all you want is a pissing match. Go play elsewhere.

You're the one who wants to pick and choose the definition of libertarian while simultaneously playing the appeal to authority fallacy with cato. Pick your meme.

And since you think that a gop failure to repeal will result in single payer and assignment of blame to them, then you get the fun task of explaining how single payer isn't the fault of libertarians who failed to get elected to prevent it.

This should be fun.

Take your games elsewhere. I'm not interested in performing as some sort of trained monkey for you.

Neither an individual person's views, nor the views of a political party, are the same as an entire ideology. Does Trump represent all of conservatism? Does the GOP represent all of conservative thought?

Pretty rich considering the broad brush you are applying.

But this is fun. If the GOP failure to repeal Obamacare means they are at fault for single payer, then... San Francisco is responsible for the death of Kate Steinle, right?

You are SO easily brainwashed! Always!!!

Do you like Medicare vouchers? Increasing competition in THE WRONG MARKET!!! Insurance is not healthcare, except to you and your liberal buddies.

You also flunk accounting and junior high math. Medicare vouchers LOOK LIKE privatization to the goobers. But they would insert a costly (and useless) middle-man between the Trust Fund and seniors!

Medicare has ALWAYS had competition in the CORRECT market ... providers. Seniors can select almost everything (except specialists who need referrals), but ... wait for it ... they have no skin in the game!!!

So your free-market idols

a) are in the wrong market, and

b) SOMEHOW forgot 50+ years of arguing for skin in the game.

The two Michaels, Tanner and Cannon, are about as stupid as Ron/Rand Paul. But their puppets are easily convinced by mere slogans and soundbites, devoid of common sense..

Anti-gummint babbling for the unwashed.

"Ya know, Ken, the situation would be different if Republicans hadn't made grandiose, signature promises for YEARS and YEARS, on repealing ObamaCare, and then when finally called upon to live up to their promise, delivered the steaming piles of excrements that we saw earlier this year."

I linked the bill above. Here it is again:

https://www.cbo.gov/publication/52849

It isn't a steaming pile of anything. It cuts spending by $1.022 trillion on entitlements, eliminates the individual mandate, and it eliminates the employer mandate. It cuts $751 billion in various taxes, including the elimination of the penaltax associated with the individual mandate.

One of the things you don't seem to be getting is that we're supposed to be able to depend on libertarians like Rand Paul to vote to cut entitlement spending. The GOP doesn't disappoint me because I have little faith in them. Rand Paul is supposed to be different.

I'm supposed to be able to depend on Rand Paul to vote to cut socialist entitlement programs. He betrayed my trust. When 44 other Republican senators voted to cut entitlement spending, Rand Paul voted with socialists like Bernie Sanders and Liz Warren against them. Why should I blame 44 other senators for what Rand Paul did?

"It isn't a steaming pile of anything."

Really? Tell it to these guys.

http://www.cato.org/blog/house.....e-or-worse

(Yes yes, it's about the House bill, not the Senate bill, but it's the same basic idea.)

It wasn't an ObamaCare repeal, Ken. It never was.

And why are you dishonestly claiming that he said it was? You're the one who's getting all emotional over "repeal." Ken's point is about deficits and entitlement reform. Here, let me help you:

Take your bait elsewhere, Skippy. This fish ain't biting.

Retreat is the wisest option.

BTW, here's Cannon writing five months later on a NON-REPEAL compromise:

"ObamaCare expanded Medicaid to able-bodied adults below 138 percent of the federal poverty level. The federal government covers a much larger share of the cost of covering Medicaid-expansion enrollees than enrollees in the "old" Medicaid program?currently 95 percent, bottoming out at 90 percent in 2020. So far, 31 states have chosen to implement the Medicaid expansion; 19 have declined.

The House leadership's bill would not even start to repeal ObamaCare's Medicaid expansion until 2020, more than two and a half years from now

----Cato

We're supposed to oppose a bill that cuts $772 billion from Medicaid because the savings don't kick in until two years from now--when the alternative is ObamaCare?

Why are we comparing the bill in question to something other than the reality of the ObamaCare we have now? With what we have now, spending cuts on Medicaid don't kick in until Jesus comes back.

The alternative to the replace bill was not repeal. The alternative to the replace bill was ObamaCare, and that's what we have.

We could have cut $1.022 trillion from entitlement spending, but Rand Paul and company voted against it. If they had voted for it--and then kept fighting to repeal the rest of the ObamaCare Medicaid expansion, I wouldn't complain.

If you wouldn't oppose cutting Medicaid because it doesn't also cut Medicare and Social Security, does that make sense? No, of course not, not if the goal is to cut as much entitlement spending as possible.

P.S.

What the Republicans have promised to do in the past pales in significance to Rand Paul's refusal to support cuts in entitlement spending today. Do you not see how ridiculous your position is? You're faulting the Republicans for being unwilling to cut entitlement spending even further--but Rand Paul wasn't even willing to cut entitlement spending as far as they did! They voted to cut $1.022 trillion in entitlement related spending. Rand Paul voted against that. And you want to fault the Republicans for being unwilling to cut spending?

You're going principals over principles.

I'm susceptible to hoping that I'm wrong about politicians not being the solution to our problems, and that if we only got the right people with the right ideology into the right office, then they could solve our problems. And maybe you want Rand Paul to be that guy. I sure did!

But when your hope leads you to blame other people for not cutting spending--after they voted to cut it--and leads you to exonerate Rand Paul for voting against cutting entitlement spending, then your righteous hopes and dreams are leading you astray. My support for Rand Paul only extends as far as his support for the libertarian things I believe. Principals over principles always ends in tears with politicians. That's one of the reasons they should be replaced with markets whenever possible.

His links prove you wrong.

(lol) Name one!

$1.5 Trillion in 10 years? Hah, Obama could do that in a month!

"""""permanently""""

Or until the next Congress writes up new tax law

National debt is currently at $20T. So this bill adds only $1.5T in 10 years? Sounds good to me......

It adds that to current deficits.

Dajjal doesn't seem to understand that it's in addition to current projections of the deficit. We can't all be economically literate.

The Senate version is projected to increase the deficit by a little more than $1.4 trillion over the next decade.

In a vacuum, yes. However, coupled with the spending cuts which the congressional GOP will tackle next-

You know, I've typed a lot of satire in my day, but some you just can't make it all the way through. And I guess doing away with the capital gains tax would seem too villainous for the Republicans' PR.

A libertarian I know said he'd be happy with zero corp. tax rate, with dividends and cap gains taxed as ordinary income to the recipients OR leave corp. tax rate at 35% and zero tax rate on dividends and cap gains. No double taxation just because you invest in the economy.

And I guess doing away with the capital gains tax would seem too villainous for the Republicans' PR.A tax cut for the rich ... because 90% of the middle-class is already exempt. Did you know that?

GOP spending cuts, that's the funniest thing I've heard all day.

"Other key Republicans have hinted that after the tax bill passes they'll take on welfare and entitlement programs. House Speaker Paul Ryan (R-Wisc.) said that he wants Republicans to reduce spending on government programs in 2018, and last month President Donald Trump said that welfare reform will, "take place right after taxes, very soon, very shortly after taxes."

On to possible cuts to entitlements

And this is why newsweek was overvalued at $1. SS alone is larger than the defense budget. It can't be "second."

You oligarchs have stolen our democracy and turned it into a plutocracy. The federal budget isn't your own personal piggy bank, rich people! Deficits are only good when they're spending deficits, not tax deficits! God my diarrhea is strong and burning right now!

More like deficits are good when the economy is bad. Now, when the economy is fairly strong, the deficit should be addressed. Instead, Republicans are emptying the economic tool box, setting up a potential recession with no means to respond. All because it was absolutely IMPERATIVE that rich people have more money.

Keep peddling the lie that corporate taxes are mainly paid by rich people. No matter how many times it's refuted, by all means keep claiming that.

Read the analysis, basically anyone's analysis, of this bill. Taken as written, the cuts in this bill are overwhelming loaded towards the already-wealthy. I don't have to make any claims, it speaks for itself.

MarkLastname is just one of the Republicans who got duped into thinking this was a middle class taxcut. It's some scraps for the middle class and t-bone for the $500K+ crowd

Yeah, repealing the individual mandate is bad. The government forcing you to buy something is the most libertarian-y thing ever.

Tax cuts without spending cuts represent forced subsidies from the future.

Is the bigger problem that we are taxed too much, or that our debt is too high?

Neither. The bigger problem is that we spend too much.

So the problem is too much debt then.

I want to be taxed less. But I do not want the future to be taxed more because I am being taxed less.

Reading isn't your strong suit, is it. The problem is too much spending. A balanced budget wouldn't reduce the debt at all but it would solve the problem over time. Yes, that means that future generations will pay financing costs just like I am paying financing costs on debt created before I was born.

Where/when are we getting a balanced budget in this fantasy world of yours?

Come on, it';s one thing if we want to admit we need less taxation. But give me a break if you insult my intelligence that reducing the coirporate tax rate woulkd increase investment in workers. Guess what, a decrease in tax rate gives more incentive to reduce corporate costs which includes employee salaries since that is more money they get to keep.

This is a bullshit bill that is just a giveaway to only certain segments. At least simplify the tax code if you are going to reform the system.

That is true with respect to US expenses but not true with respect to shifting profits overseas.

"Guess what, a decrease in tax rate gives more incentive to reduce corporate costs which includes employee salaries since that is more money they get to keep."

There is ALWAYS an incentive to pay the least you can for any workers. What are you babbling about?

CEO: "Woohoo, the government is taking less money from my bottom line! That means more for me! This was just the opportunity I was waiting for to reduce the pay of my employees and keep more of that money too!"

Do you really think that's how company owners and CEO's think?

And this is why we need a third party that is not beholden to either extreme. The democrats fucked themselves by cateting to niche interests way too much and pandering with 15 dollar minimum wages regardless of the city. So when Repbulicans pass a crap bill like this , a lot of people will choose this as reducing taxes even if most of the tax savings go to people who really do not need it.

"even if most of the tax savings go to people who really do not need it."

I'm not enthusiastic about the bill, but what does "need" have to do with keeping more of your money?

For a viable third party, we need one of two things:

(a) one of the major parties to collapse, leaving a power-void to be filled

(b) dramatic changes to how we elect our representatives that allows minority representation such as proportional voting and at-large districts.

Point (a) is wrong.

A MAJOR step, much easier to achieve is to elimeinate the partisan primaries, which speak for only a minority of voters, so both parties govern like fucking idiots ... to please their base which now consists of wackos, zealots and fanatics.

And we donl't need a libertarian party.

We need two of them.

But our establishment is as fuxcked up as the other two.

I have trouble believing that a $900 penalty materially influences a $20k decision to buy insurance.

That's pretty much always been a problem with the penalty. It never had enough teeth to be effective, but the legislators never had the guts to give it real teeth.

ALMOST as stoopid as repealing the mandate but keeping guaranteed issue.

Thjis is GUARANTEED to INCREASE the death spiral of premiums.

But they'll blame Obama for that, and the goiobers will swallow it,

How do I structure my investments to insulate me from inflation?

Invest in companies with pricing power? Buy real estate? Or will real estate tank when people can't afford mortgages at 15%?

So for nothing then?

I'm kind of slowly learning about the two bills. I see a lot to be encouraged about, and find most of the arguments against to be lazy, but I'm not sure it's worth voting for.

I'll keep looking, but what I've seen doesn't suggest it does enough to simplify the tax code itself, which is more important to me than lowering rates, even though I'm all for that as well. I'm also not for for temporary measure, which makes planning harder and creates unnecessary political drama.

Perhaps a smaller, more targeted package would have been better.

Oh Good, another Hihn-fected thread.

Hey Hihn, fuck off, bully!

I thought it might be interesting to see what the thread was yeilding until it turns out that fucking retard Hihn has shown up.

Hey, Mike! Did the Kochs laugh at you when you showed them your treasured screen shots? Or were they polite and laughed at you later, you tire piece of shit?

Fuck off, Mike; your act is long past the 'sell by' date.

Drat those republicans! Making reason contributors qualify their barbed comments instead of getting to go full jeremiad on their flabby white asses!

Drat those republicans! Making reason contributors qualify their barbed comments instead of getting to go full jeremiad on their flabby white asses!

Show of hands. How many people here think there's going to be an anti-debt groundswell that will carry deficit hawk candidates (back) into the majority at some point after 2018 elections?

Sure, but that has nothing to do with this or any other bill, and just that when Democrats take the presidency again (or possibly just the senate/house) Republicans will suddenly remember that deficits are bad.

To put it simply: Republican/conservative distress over deficits has always been a political tool to attack Democrats. It has never been sincere.

Which isn't to say that a given individual Republican or conservative politician might not genuinely care, but as a group, they don't care.

Which would be today, if we were voting!

DO YOU NEED A LOAN?

We are Currently offering a floating loan scheme at interest rate of 2% with proper valid identity card for verification.

You can send your loan request for any amount of loan you need.

We offer loans ranging from $5,000.00 USD Min. $50,000,000.00 USD Max.

We long-term credit from five (5) to fifty (50) years maximum.

We give the following type of loan: Project loan, Refinance loan, business investment loans, car or vehicle Loans, Student loan, debt consolidation, housing Loans, Personal loans, travel and vacation loan, Christmas and new year loan.

Our company also need a person that can be our company representative in your country.

Contact our STEPHEN WILLIAMS FINANCIAL LOAN FIRM office via email: stephenswillsloan@gmail.com

DO YOU NEED A LOAN?

We are Currently offering a floating loan scheme at interest rate of 2% with proper valid identity card for verification.

You can send your loan request for any amount of loan you need.

We offer loans ranging from $5,000.00 USD Min. $50,000,000.00 USD Max.

We long-term credit from five (5) to fifty (50) years maximum.

We give the following type of loan: Project loan, Refinance loan, business investment loans, car or vehicle Loans, Student loan, debt consolidation, housing Loans, Personal loans, travel and vacation loan, Christmas and new year loan.

Our company also need a person that can be our company representative in your country.

Contact our STEPHEN WILLIAMS FINANCIAL LOAN FIRM office via email: stephenswillsloan@gmail.com

"Permanently"

Hahahahahaha.

Start earning $90/hourly for working online from your home for few hours each day... Get regular payment on a weekly basis... All you need is a computer, internet connection and a litte free time...

Read more here,..... http://www.startonlinejob.com

"This is NOT rocker science"

I'm not sure what you would know about rocker science, since you are clearly off yours. 🙂

One problem I've factored into several "S corp LLC or C corp" equations is that the S corp or LLC profit will be passed on to shareholder but there may not be sufficient cash flow to actually dividend any cash out to pay the tax.

For example, two doctors upgrading their office and medical equipment may need all their cash flow in 2017 to avoid taking out a loan, but still have to raise the cash to pay taxes on, say, $200,000 profit passed on to each of them.

It's a joke on your misspelling of "rocket".

And few recall that it wa

And few recall that it was Lyin' Rand who promoted "repeal and replace" -- giving Trump an excuse for failing to repeal Obamacare on his first day in office.

And considetring that wer had universa

When you can't post, you look retarded, aggressor!

Don't make me bitch slap you in self-defense, you bootlicking idiot!

More like "Quit stealing from me. And everyone else."

If you regard the feds as mafiosas with better PR, you'd get my indifference about their problem financing their coercion.

Who gave you the right to confiscate and spend my money?

OK - what is the difference between taking someone's money without their consent, and threatening violence if they resist, when the wording is "theft" versus when the wording is "taxation"?

OK, cut my taxes including SS and Medicare and I'll gladly waive all benefits. Same for my children. Same goes for Obamacare. I don't want to pay for it nor do I want the service from the government.

If you know the difference between correlation and causation it is, yes.

Michael Hihn|12.2.17 @ 4:39PM|#

"(yawn)"

Fuck off, mike,

(giggle)

Flunking math is not as bad as flunking sanity, which you have clearly done Mike

what the hell is wrong with you dude lol

you're like a living parody

Right, the idea that corporate taxes are passed on to the consumer in higher prices. Higher taxes will lead to raised prices, but I won't be holding my breath for prices to come down in this case. Things like this go in one direction: up.

My real problem with the corporate tax cuts is that there's absolutely no reason to believe corporations are being strangled by high taxes. They are flush with cash, and the benefit of lowering their tax burden should be greater than the damage it'll do to the deficit. There's absolutely no reason to believe that will be the case.

And then there's the various pieces, like the scholarship tax and ending medical care deductions, that hurt the middle class badly, while pass through entities get laughably corrupt preferential treatment. In practice, this entire bill is geared towards helping people who are already rich, and the people who aren't get hosed.

Cost is at least a lower bound to price, so there is that.

If you're not concerned about higher corporate taxes raising prices, than what are you objecting to?

Could you not be so condescending, please?

Your arguments don't make a lot of sense to me, frankly. You're listing ideological reasons to cut taxes, or situations where it could be helpful to cut taxes, but don't apply to the current economy. Business is doing perfectly fine under the current tax regime: the stock market is soaring, unemployment is low, credit is loose, and companies are flush with cash. Cutting corporate taxes is low priority. But Republicans are doing it anyway, at great cost to the average person and to future America. That's why I say this tax bill is crap. I'm not opposed to cutting corporate taxes, like at all. But it should makes sense to do so.

Start working at home with Google! It's by-far the best job I've had. Last Wednesday I got a brand new BMW since getting a check for $6474 this - 4 weeks past. I began this 8-months ago and immediately was bringing home at least $77 per hour. I work through this link,

go? to tech tab for work detail,,, http://www.onlinecareer10.com

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.onlinecareer10.com

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.onlinecareer10.com

Michael Hihn|12.3.17 @ 11:17AM|#

"My stalker goes off the rails again! MOAR AGGRESSiON!"

Oh for fuck's sake, you pathetic piece of shit. Get lost!

Ignorant asshole decides bold caps make him look like he has a point, and fails.

For fuck's sake, you stinking asshole, go get help.

Fuck off.

Fuck off, shitbag.

Michael Hihn|12.3.17 @ 3:39PM|#

"AGAIN called out .... and AGAIN fails!"

AGAIN, you miserable fuck face, get lost.

You are seeing hostility where there is none. Good day.

(snort)

Good luck electing a Congress and/or amending the Constitution, to REWARD your entitlement mentality. It's called consent of the governed, individual liberty, and all the other things you reject.

Or, you can simply stop sucking off the wealth and liberty provided by others ... and exercise your freedom to emigrate to any other country that might accept you,.

P.S. This is a libertarian website. PLEASE post your fascist rambling to Infowars, Bretbart, WND and/or Fox.

And have a good life, wherever else you choose to live.

The Constitution.

Consent of the Governed, which evolves from Freedom of Association.

Or ... you're free to leave the country.

(Are you really Alex Jones in an alias?)

Consent of the governed except where the majority inflicts first aggression on the individual (there's that liberty bullshit, again).

Seriously, do words mean anything to you, "John" (/snark)?

So I'm free, "John", to tell you, 'fuck off, slaver', and I'm free to give you a tourism pamphlet to anywhere outside the U.S. Love it!

Quote the part that says they can spend my taxes on education, retirement, food, job training etc etc etc etc etc

Entitlement mentality is now ALSO authoritarian!!!!

Enjoys the LIBERTY created and provided by others ... in a VOLUNTARY (consensual) association ? but claims HE has "speshul" rights.

A teat-sucker .,. AND self-righteous!

I'll TRY to dumb it down.

1) Consent means voluntary..

2) A "just" government is a "consensual" association of individuals. Like Kiwanis.

(his brain just EXPLODED!)

3) Kiwanis has the right to demand dues ... or expulsion. YOUR FREE CHOICE.

4) You DENY the right of free individuals to form ANY voluntary association.

(Not ALL anarchos are bat-shit crazy)

THIS group -- the one you suck off ? has GRACIOUSLY chosen to NOT expel you.

(lol) I KNOW WHAT "CONSENSUAL" MEANS!

Your liberty is to LEAVE.

(am I going too fast?)

"Love it or leave it" .... NO ? Merely accept the rules. You have NO special rights, NO power to govern 350 million people, Napolean.

Just like Kiwanis.

His cult is WORSE than the Moonies, Davidians, Peoples Temple et all ... HIS cult REFUSES to form its own community ...so ONLY his cult is morally and intellectually bankrupt on this. And authoritarian.

(vomit)

I jammed it up his ass here.

http://reason.com/blog/2017/12.....nt_7051140

NOW I GET TO TWIST IT.

Of course

Yes.

Bend over,. It will go up your ass easier.

Are you saying your can be the only one who refuses to pay dues to a CONSENSUAL association .... like Kiwanis ... then saand all the dues-paying memebers have

Are you saying you can be the only one who refuses to pay dues to a CONSENSUAL association .... like Kiwanis ... which means ONLY all the dues-payers lose their membership?

1) ARE YOU THAT CRAZY?

2) Do you STILL "love it"

Already answered.

Surely you're not like Mitsima, denying people the right to form voluntary associations.

Just scroll back to all the times you see "Kiwanis."

Anything else?