Tax Reform Is on Track to Add $1 Trillion to the National Debt, Even After Accounting for Economic Growth

The GOP tax plan looks like it could pass, but should it?

It's not yet a fait accompli, but Thursday was a good day for supporters of the GOP tax proposal. The bill, however, still doesn't come close to paying for itself.

Sen. John McCain (R-Ariz.), considered a crucial swing vote on the measure, said he will support the bill. House leaders are reportedly preparing for a vote on Monday to go to a conference committee to iron out differences between their version of the tax bill (passed earlier this month) and the Senate bill. All that comes less than 24 hours after the first vote on the Senate tax bill—a motion to proceed to debate, a procedural step that's been anything but simple on other major GOP initiatives this year—including a drama-free "aye" from all 52 Republican senators.

The only thing that slowed the tax bill's momentum was a new analysis from the Joint Committee on Taxation (a number-crunching cousin of the better-known Congressional Budget Office) showing, once again, that the GOP proposal will add about $1 trillion to the federal debt. This, even after accounting for increased economic growth from cutting corporate income taxes.

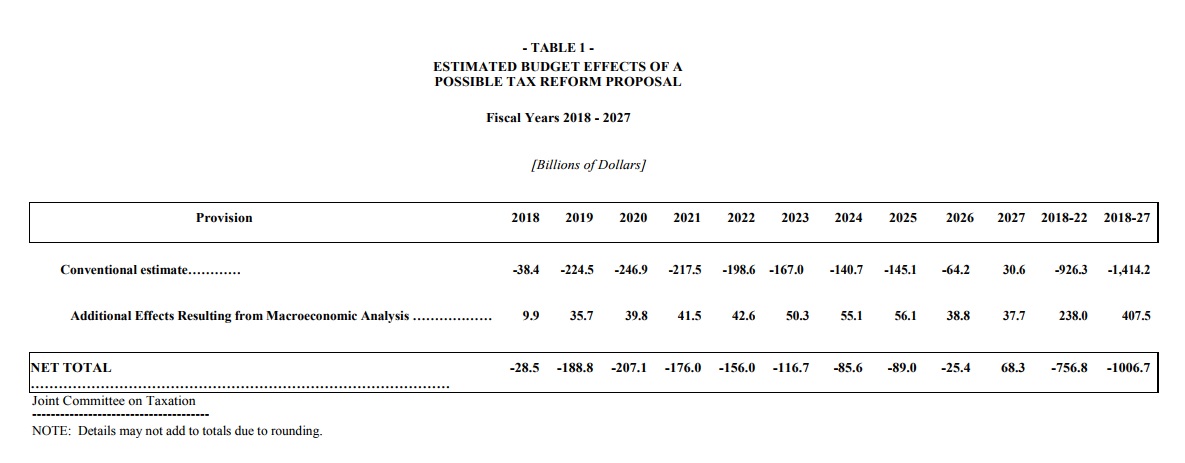

Here's how the JCT spelled it out:

All of those minuses show the one glaring flaw in the plan. Republicans mostly seem willing to ignore the defect, claiming increased economic growth will cancel out an estimated $1.4 trillion blow the plan will deal to the federal budget. The JCT report shows clearly that is not going to happen. Increased economic growth cancels out about $400 billion, leaving a $1 trillion shortfall.

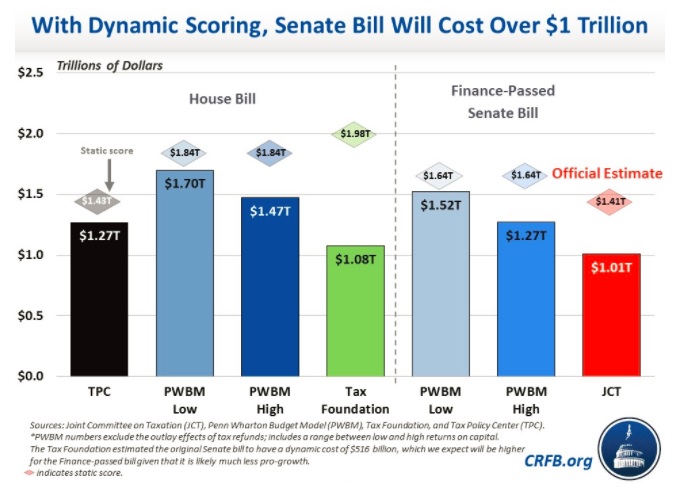

That's roughly in line with other estimates. When forecasted economic growth is factored in, the Republican proposal will cost about $500 billion, according to The Tax Foundation, a nonpartisan think tank. A separate analysis by the Wharton School at the University of Pennsylvania says the cost, including projected growth, will exceed $1.3 trillion.

Here's a neat summary of various estimates, compiled by the Committee for a Responsible Federal Budget, which opposes the current tax plan because of how it will add to the debt.

Projections are tricky things, with lots of moving parts. No one knows for sure what dynamic effects the tax changes will have on the economy, or what outside factors could drive growth—or trigger a recession—in the coming years. There are, however, no estimates, even from Republican sources, showing that tax bill cuts would fully pay for themselves.

Instead, Republicans have responded to the estimates much the way Sen. John Cornyn (R-Texas) did today after the JCT analysis was released.

.@JohnCornyn tells me re: JCT score "I think it's clearly wrong." Says growth projections are too conservative

— Seung Min Kim (@seungminkim) November 30, 2017

In other words, close your eyes and wish really hard for the Economic Growth Fairy to make everything okay. It's a vision that you're tempted to believe in because it means you get all the benefits with none of the costs—which, in this case, are the tough political decisions about cutting spending—but it's not one that tracks with the real world or the economic and political history of the last 30-plus years.

This isn't new. It's the same thinking that drove the passage of the Reagan tax cuts, properly understood as "tax deferrals," since the debt has to be paid back someday, as National Review's Kevin Williamson wrote in a memorable 2010 piece. The same thinking that drove the passage of the Bush tax cuts. Correcting this view, as Williamson wrote at the time, requires equating "spending" and "taxes" so that every dollar spent today means a dollar in taxes must be raised, either today or tomorrow.

Unfortunately, that's not where we are right now.

When the Bush tax cuts passed in 2001, the nation's debt-to-GDP ratio was 31 percent. Today, it's 77 percent. And Congress is about to add another $1 trillion to future Americans' tab.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Just tell us how much in taxes every American has to pay to eliminate the national debt?

If you have to ask you can't afford it.

Just live an unhealthy lifestyle so you croak before the shit hits the fan, then you come out ahead.

I'm splitting the difference with my libertarian ideals. I will only be eating gold, so that I croak preparing for the financial meltdown.

Eat silver. You die faster.

Personally I recommend Mercury, quicker than gold or silver and easier to swallow.

Start working at home with Google! It's by-far the best job I've had. Last Wednesday I got a brand new BMW since getting a check for $6474 this - 4 weeks past. I began this 8-months ago and immediately was bringing home at least $77 per hour. I work through this link,

go? to tech tab for work detail,,, http://www.onlinecareer10.com

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.onlinecareer10.com

Cutting taxes without cutting spending means paying for that spending with borrowed money rather than with current tax receipts. In this sense, we in the present are receiving an involuntary subsidy from the future, as they will be the ones forced to pay for our spending today (plus interest).

I like tax cuts, and I like being able to keep more of my own money. I like that less of my paycheck is stolen by the thieves in DC. But tax cuts without spending cuts doesn't mean that there is less theft overall, it just means that the victims of the theft are changed.

So I guess I'm a little torn. I suppose something could materialize between now and when this debt actually has to be paid off so that future taxpayers aren't stuck with such a huge bill, but I don't know what that would be.

I'm continually disappointed by it, and the sad truth is that Americans don't see to particularly care. If you straight ask them some dumb survey question like "Debt? Good?" people say no. But no one has anything they are willing to cut. And I can't see anything forthcoming on that forum.

So I am also torn. Part of me just says, cut taxes, fuck it, baby we're going down anyway.

Plenty of people are willing to cut spending as long as it's someone else who gets hit.

I am willing to cut all of the Department of Education, HHS, DHS, HUD, Commerce, Transportation, Energy, and Labor. Keep the bad deals of social security and medicare for those who are already stuck paying into them, but cut off enrollment.

If that isn't enough, cut the congressional staffs by 50%, and eliminate congressional retirement payments for all the newbies. Maybe better do this one first.

I like it.

Let's also reduce the salary of Congresscritters. They should make no more than the national median income, and only be paid for actual days worked. ie. 60k a year, 30 wks worked= (30/52)*60k. Sure, it's a drop in the bucket, but it's the principle. The point of service as a Congresscritter isn't to get rich.

Well, if you live in any state that the majority of the population lives in, you're going to pay more if SALT are no longer deductible. Higher taxes and higher deficits for the win! Only the Republicans are that politically stupid. Hello President Franken 2020!

They call it "printing more money."

They call it "printing more money."

Yeah that's what I'm afraid of.

It's okay. Like the Knight's Watch, Breton Woods will continue to protect us like it always has.

Ha! If only.

What could go wrong?

Well they're doubling the standard deduction as I understand it so itemizing won't be worth the effort for most of the middle class. Really gonna be an increase for high end incomes. Tax The Rich! But either way they'll be printing more money.

I can't really blame politicians so much as I blame voters who are too stupid and selfish to care about the debt they are leaving future generations.

Speaking for number three (Florida), there is no state income tax.

We depend on you tourists to pay hotel and entertainment and gas taxes to float our excesses.

Thanks, and come back soon!

And regardless of taxes, the government is still spending, that is, bidding scarce resources away from private use. I'm not going full MMT here, because tax cuts can generate growth, but I think govt spending is still the bigger problem.

(sure, overregulation might be a bigger problem than both)

^ This.

Without spending cuts, "tax reform" is just changing around who's taking on what portion of the tab.

Agreed. My whinging is that these two have been incredibly divorced, spending and taxation. People argue that the government is not a household, fine, maybe. But I still think income and expenditure should not be quite so divorced from one another as they seem to be at the federal level.

Here's how you balance the budget:

Block-grant all federal money that goes to the states, including funding for federal operations (federal courts, military bases, etc) in those states, then you say each state cannot receive more federal funds than it pays in federal income taxes.

States that currently get more money from the federal government than they pay in federal income taxes would have to decide what they would spend that money on and what they would cut.

States that currently pay more to the federal government than they receive in federal funds would not get more from the federal government. That surplus would be used to pay down the debt until it gets to a manageable level.

If people complain that federal courts and military bases in their states shut down, tell them to suck it up and grow their economies so they can afford those nice things.

We need a constitutional amendment to require some kind of balanced budget that includes an enforcement mechanism. Some new entity that can act as a "check and balance" against spending. It can't just be some naive declaration that the budget will be balanced. Without it, Congress will just keep playing accounting games to get around it.

States are no better than the feds at spending money. Balance the fucking budget, that's all it takes. It's a numbers game and they're ignoring the numbers. Bandages like you are proposing don't fix anything.

The robots that take our jobs will be paying for it with their taxes. Silly gullible robots!!!

Of course the tax cuts will increase the deficit! There is no talk about spending cuts along with the tax cuts. Tax cuts DO NOT add to the deficit. Spending does. Obviously if you are going to decrease revenue and keep spending the same amount of money then the deficit will increase. ( and that decreased revenue is not absolute) The BIG problem is that politicians do not want to cut spending any more than a junkie on dope wants to voluntarily cut back on his high. If you want to get back to Clinton era surpluses you must get back to Clinton era spending levels. IT IS THAT SIMPLE!

Tax cuts add to the deficit.

Cut the spending **first** before cutting taxes, especially when we're already deficit spending.

You call it "simple," but the fact is we haven't done that since Reagan. What happened under Clinton wasn't fiscal responsibility, it was spite enabling double-bubble economies to out-pace the growth in Federal spending.

And Clinton still added $1.5 Trillion to the deficit. Even with the surpluses.

It didn't happen under Reagan either. Not even close. What fake historical sources have you been reading?

Re: "Tax cuts add to the deficit."

Technically (mathematically), you are correct.

HOWEVER, the left loves to use this phrase rhetorically to argue against tax cuts. Their base assumption is that spending will never decrease, not if they can help it.

We have to be careful about the rhetorical use of this phrase, because it reframes the discussion in a way that gives the left an advantage towards raising taxes without cutting spending.

I too would like spending cuts, but I still see the outlines I have read on these tax proposals as overall net positives. Reduce the number of deductions, reduce marginal rates, simplify structure, reduce corporate tax rate to something more globally competitive. If I had a magic wand they'd cut the whole budget until there was a reasonable surplus that starts paying down the deficit. And we'd stop arresting people for ingesting substances others find icky. And stop bombing third world countries because "vital interest". And create national concealed carry reciprocity and strike down the ridiculous webs of gun prohibition CA, NY, NJ, and other tinpot shitholes have erected.

Policy ain't perfect though. If we can simplify the tax code significantly and reduce the mortgage interest deduction and state and local tax deduction, I'll take it.

I agree that the mortgage interest deduction is bonkers. Why should the government incentivize going deeply into debt? I am glad that is going away, if it does.

You haven't been paying attention, the mortgage interest deduction isn't going anywhere. Critters are going to give up their jobs for that.

Why? How does making other people pay more in taxes benefit you? Do you believe you're going to a get a commensurate reduction?

And how does favoring their spending help me?

No offense, but I care about me more than I do you.

If I can't deduct SALT, then I'm paying taxes on money I'm not actually getting. I could conceivably wind up in a situation in which CA takes half of my income, and the US takes the other half.

If not taking my money is somehow "favoring" my state's spending, then why not tax me on the total amount my employer has to pay me? Why shouldn't payroll taxes be counted as part of my federally taxable income? Why not count sales taxes businesses have to pay on merchandise they sell as federally taxable income? Gas taxes collected by gas stations?

Hell, why not take my whole income, since not doing so would be you "favoring" my personal spending?

You speak as if the Federal Government not taking my money is somehow a subsidy..

This is a case of the thief making us argue over whom he should rob more from, when we should be ganging up on the thief.

Why stop at 50% each? Go ahead and have both tax everyone 60% on gross income. Once we get there, why stop, give your city another 60% of gross income.

Brilliant!

No offense, but if your entire argument is about what benefits you versus a level playing field, then you've hardly got the high ground in criticizing. You are getting the benefits of that SALT spending. I don't really care if you don't think it's worth it because that is between you and your state government. The same applies to the mortgage deduction. Why should you get to deduct your interest on an expensive house while a renter can't? Why, you could end up in a situation where your mortgage takes half your income and the US takes the other half...

You speak as if the federal tax code should allow you to spend whatever you want locally and then only tax you on what's left over. How convenient. Hey, if housing values are bid up in your area it's not YOUR fault, so you should get a pass paying in to the feds. It's only fair.

Payroll taxes ARE counted. Do you think you get an exemption for FICA/OASDI? Sorry, but that's not a deduction on your AGI. Employer contribution? Well the feds already took that so it would be double dipping.

I'm not defending the mortgage interest deduction, even though I use that one, too, because, as you already know, that's different (which is why you used it as your example). That's money I'm spending to purchase something for myself on loan. That's not tax money that is being extracted from me prior to my ever seeing it.

When it's my local government doing the spending it's my spending and not money being taken from me and spent by someone else like it is when the Federal Government does it to you?

On your logic, why should anyone be allowed to deduct anything? Why shouldn't the Feds just take everything, since it's all "our" spending, anyway?

Hey, if housing values are shit in whatever area you live in it's not your fault, so you should pay a quarter what I do and get the same return. That's fair, right?

Again, this is a case of the thief making us argue over whom he should rob more from, when we should be ganging up on the thief.

But while I think you're wrong on this, I am greatly enjoying watching you bat Buttplug around, below.

*tips hat*

No, you shouldn't get to deduct anything, that's kinda the whole damn point of broad base and low rates. Realistically with all of the other stupidity in the code and the welfare state we probably have to keep a deduction for retirement savings. And do you think the only reason the feds don't take everything you make is because of deductions? Shit, I hope you pay someone to do your taxes for you if that't the case.

Seriously, you are arguing for housing price equality? Explain what that has to do with federal tax rates again... Oh, right, it's expensive where you live so you should get a break on paying for NATIONAL services. Sounds fair.

No, this isn't about whom they should rob more from, this is about the same basic rules applied to everyone that doesn't allow localities to subsidize their services at the expense of paying the national tab. It's not that hard. Really, it isn't.

So what do I think is fair? National sales tax. But you'll whine about that too because your local cost of living is higher and NOT FAIR!

Sounds like a problem California could solve by deducting federal income tax from your state AGI.

Home ownership benefits the community, city, state and nation. There are billions with lesser benefits that could be cut elsewhere.

Please note that you can vote for state politicians that lower your SALT.

Everyone in the same circumstances pays the same federal income tax. That is called fairness.

If you will have to pay more than you do now because others no longer pay a part of your federal taxes, move to a different state, or elect different state politicians.

If we tax individuals on gross income, then we should also tax corporations on gross income. Or we could go the other directions. If we tax corporations on net income, we should tax individuals on net income. Regardless of which direction anyone prefers, the main point is that corporations are legally people, therefore they should be taxed the same way as individuals.

On a side note, the fact that unprofitable corporations don't have to pay federal income taxes is absurd. Both profitable and unprofitable corporations benefit from military protection, infrastructure and other government services, but we only profitable corporations have to pay for those services? That looks like punishing success and rewarding failure to me.

Take your side note and apply it to individuals. Nearly half the individuals pay no federal income tax.

How is that different from unprofitable corporations not paying federal income tax? After all, there is no income to tax.

"Thursday was a good day for supporters of the GOP tax proposal. The bill, however, still doesn't come close to paying for itself."

Did Tony hack the Reason server or something?

If the government can't cut taxes without decreasing its tax revenue, that is no reason not to cut taxes. 'Oh noes, what if there's no substitute for cutting spending', I hope this isn't what we've descended to?

And hanging in the air above that discussion is a flashing neon light that says, "Less tax revenue for the government means more for the taxpayers".

If I have to "suffer" keeping more of my own money--even if that means the government has less--then I'm willing to "pay" that "price".

P.S. The idea that the government will ever become so flush with tax revenue that it decides to cut spending is dumber than creationism.

"If I have to "suffer" keeping more of my own money--even if that means the government has less--then I'm willing to "pay" that "price"."

The future taxpayers are paying the price for our decision not to pay for our own level of spending though.

We aren't decreasing the amount of theft. We are actually increasing it, and shifting it to someone else.

No, taxing Americans up the ying yang is not saving people from theft.

What, are you angling for an interview to become President Lieawatha's press secretary?

I'm not in favor of taxing anyone up the ying yang.

I do however recognize certain economic realities. Tax cuts without spending cuts means that the future pays for our spending, as opposed to us in the present. TANSTAAFL and all.

And if Republicans don't get their act together, in 2020 we are going to have President Lieawatha in a 50-state landslide. And I will offer nothing more than a hearty laugh.

Lower taxes deprives the government of money to spend. That's all it does.

If Prop 13 were repealed, California wouldn't have cut spending and paid off their debt with the increased revenue. They would have spent all that property tax money--in addition to what they already spent.

It isn't lower taxes that makes the future pay for our spending. It's our spending. If you don't want future generations to pay for our spending, then stop the spending.

I agree with you. The spending is what creates the debt liability for future generations, not the taxation or lack thereof.

But WE are receiving most of the benefits (or lack thereof) of said spending. And the future does not get a vote in whether or not they get to choose to subsidize said spending. By reducing taxes but not reducing spending, we are choosing to shift the tax bill to them. It is good for us, but crappy for them. Is that really the correct choice to make?

I hear you Jeff. I understand what Ken is saying too. The truth is no one gives a shit about debt. It's a triffle, and it will continue to be until their is a less abstract consequence to it than a theoretical lowered growth in the economy.

Yeah I think you are right, sadly. None of us would ever (I'm presuming) eat a fancy meal at a restaurant and then offer to "split" the tab with the people sitting at the next table over. But that is what we are doing with our current spending. Making our portion of the split lower is good for us, but crappy for them. But as long as the other party doesn't actually vote, then we get to continue spending away.

I really wish there was some way to force the government to stick to a budget.

I've sometimes wondered how they would fuck up a balanced budget amendment. But even though I'm sure they'd find a way to fuck it I think that might be a great thing to have. They can still raise taxes to cover things, but there is a lot of public backlash against raising taxes and so I think those battles would be much harder.

As for now, people (the public, not just politicians) truly seem to have a attitude that there is almost nothing that can be cut. They admit to the wastefulness of it all while simultaneously saying that any reduction is impossible. I don't know what will happen, it will be interesting.

There would be an exemption for times of emergency or war. And we are always at war.

I've been thinking of a fourth branch of government to act as a kind of SCOTUS for government financial matters, mainly taxation and spending. It would have the power to judge whether Congress really did meet the requirements of a balance budget or however it's set up. This might be a 2/3 majority needed to increase spending, but you'd need to interpret what "increasing spending" would actually mean and how to recognize it.

Speak for yourself.

No, much of the future does get a vote. Those 18-25 will be around for "the future" yet they don't seem too concerned as they oppose spending cuts as much, or more, than the older voters do.

20TT this.

So tell me how leaving less $ in the private economy now helps future generations pay off gov't debt.

Ken, that operates under the assumption that the (federal) government will react to lowering taxes by cutting spending, rather than run higher deficits or raise taxes eventually. When has the former scenario ever happened, at least at the federal level? With the federal government's ability to endlessly borrow and print money it's a fantasy to think that they will actually respond to this by reducing spending. Or that if they were eventually forced to address the deficit, that they would do so by cutting spending instead of raising taxes.

I agree that spending levels are the source of the problem. So why not address it? Why continue to kick the can down the road while deluding yourself into thinking that cutting taxes won't increase the deficit because spending is totally going to be cut in the future as a result? As long as spending stays the same or increases, tax rates are ultimately window dressing. They decide how much of the tax burden gets paid by today's taxpayers or the future's taxpayers, not how much will be paid in taxes. That's the reality. Spending cuts should thus be at the forefront of any fiscal reform, but as we see yet again Congress relies on the cynical fantasy that it will be addressed at some point in the future.

"Lower taxes deprives the government of money to spend.

The debt markets charge higher yields for new debt to governments with less revenue.

Again, the impact of Prop 13 was to give the California government less money to spend than it would have had otherwise.

In fact, cutting taxes is the only policy that has effectively held back California's spending. The rest of it was driven by cyclical market fluctuations beyond the scope of fiscal policy. A recession, for instance, means less tax revenue because there is less taxable activity--even so, less tax revenue means less spending than there would have been otherwise. If California will finance a bullet train despite a recession, or even because of one, that is spending that might not have happened if the government had less access to more tax revenue.

The government will spend every penny they get their hands on plus whatever the debt markets will finance at reasonable rates. One way to limit spending in that equation is to limit how much money they can get their hands on. Certainly, the idea that they will ever become so flush with tax revenue that they refuse to spend it is profoundly stupid. Even the Keynesians think so--ever heard their explanation for why government spending is the solution to the liquidity trap?

Regardless, because the government can borrow doesn't mean cutting taxes doesn't lead to less spending than there would have been otherwise. The less the government's revenue stream, the harder and more expensive it becomes for the government to finance nee debt and deficit spending, and besides, if they'll spend 100% of tax revenue plus what they can finance based on the size of that tax revenue stream, then cutting their tax revenue off is an effective way to reduce out of control spending.

California is not a good comparison to the federal government because California cannot print money to cover its debts. There is an identifiable limit to how much California can borrow and remain financially solvent. If/when California reaches or exceeds that limit, there will be consequences, but those consequences do not include the devaluation of our currency. There is no similar identifiable limit to how much the money the federal government can borrow because it can print money.

California is not a good comparison to the federal government because California cannot print money to cover its debts. There is an identifiable limit to how much California can borrow and remain financially solvent. If/when California reaches or exceeds that limit, there will be consequences, but those consequences do not include the devaluation of our currency. There is no similar identifiable limit to how much the money the federal government can borrow because it can print money.

Well a hearty laugh and your vote.

I would never vote for Elizabeth Warren, not in a million years.

Not when Sanders is available, anyway.

For the record, I did not vote for anyone for president last year. Not Hillary, not Trump, not Johnson. I have never voted for a Democrat for president, ever. Not Obama, not Clinton. Their economics are just ruin for the most part. You either have "tax everyone up the ying yang" (to borrow a phrase), or you have "tax everyone up the ying yang AND close the border to free trade". Neither one is particularly appealing.

If only we had a fiscally conservative option. But no, we most certainly do not.

No who else was taxed up the ying yang?

YOU may recognize 'economic realities'.

Does that mean they do?

See, it doesn't matter. Tax cuts, tax increases, tax stagnation--whatever happens there is one and only one constant--the government will do it's utmost to insure that they spend much more than they take in.

No matter what.

I think this is one problem with democracy (and yes I know we have a "republic", not a democracy). People will vote to gain benefits now and are willing to push the burdens off onto future generations if they can get away with it. This might still be preferable to the usual end dictatorships seem to lead to and there's nothing to say non-democracies won't do the same thing regardless of how they are organized.

Dude's friggin untethered.

Did Tony hack the Reason server or something?

The consensus among H&R's leading sockpuppetologists is that Nick was the original Tony

I would deny it except that I owned a similar leather jacket back when they still weren't fashionable anymore.

What tax cut are you talking about? This tax bill will raise my federal tax bill by several thousand dollars a year. This tax bill is not a "tax cut", it's a redistribution out of my pocket into the pockets of other Americans.

I would totally be on board with the FYCS (Fuck You Cut Spending) party.

So you supported the ObamaCare replacement bill that Rand Paul voted against?

I linked it below.

"CBO and JCT estimate that, over the 2017-2026 period, enacting this legislation would reduce direct spending by $1,022 billion and reduce revenues by $701 billion, for a net reduction of $321 billion in the deficit over that period (see Table 1, at the end of this document):"

https://www.cbo.gov/publication/52849

This is how St. Stephen must have felt when he was standing in front of the Sanhedrin. Your job was to look for the messiah, and when he came, you found him--and you had him crucified!!!

They dragged him outside and stoned him for saying that.

"Fuck you, cut spending", they say.

And when the House passes the bill to do that, and the President promises to sign it, and the rest of the Republican Senate is ready to go? All the "FUCS" people applaud Rand Paul for voting against it.

Dumber than creationism!

Ken, none of the Republican bills actually repealed ObamaCare. Even you have to acknowledge that. Their only purpose was to allow Republicans to check off a box on "keeping a campaign promise".

So a bill that cuts spending isn't a bill that cuts spending because, um, squirrels or something.

It was a transparent attempt for Republicans to avoid having to deal with ObamaCare directly. They did not want to have to face the full wrath of the voters either way - by either not fulfilling their promise to repeal ObamaCare, or by making the situation even worse for them by actually repealing ObamaCare as they promised.

So in any other context I would have welcomed cutting spending as they proposed. But I'd be damned if I would let them off the hook for trying to weasel out of their campaign promises. They didn't deserve it.

And yes I do feel spite about what they did. They can all lose re-election as far as I'm concerned.

So now you admit that you don't care about the spending at all and it's just the posturing. Remind me why I'm supposed to take you seriously when you moan about the debt again?

On *the particular issue of ObamaCare*, then yeah I am going to be a spiteful bastard. Especially since Republicans staked so much and promised so much on their willingness to repeal it. They deserve what befalls them.

So again, it has nothing to do with debt and it's all about the feelz. Got it.

With ObamaCare and the Republicans' feckless attempts to non-repeal it this year? Yeah.

With spending in general? No.

You'll just feel your way through it.

"So now you admit that you don't care about the spending at all and it's just the posturing."

+1

"So a bill that cuts spending isn't a bill that cuts spending because, um, squirrels or something."

+1

Cutting taxes and spending is what I mean when I'm talking about smaller government.

They were actually going to cut an entitlement program!!!

$770 billion off of Medicaid.

If they had passed the replacement plan I still think they would have caved on Medicaid in the future, but at least in the original bill plus the Senate bill's removal of the mandate, well that covers the majority of the spending increase from Barrycare. To then say "not good enough" just reinforces my opinion of what passes for modern libertarianism today: socially liberal and fiscally convenient.

"Tax Reform Is on Track to Add $1 Trillion to the National Debt, Even After Accounting for Economic Growth"

Oh, and by the way, some Reason staff all but led the charge against the ObamaCare replacement bill that Rand Paul and company so foolishly voted against. That bill would have cut $1.02 trillion in spending, $772 billion of it from Medicaid, an entitlement program.

Here's the link:

https://www.cbo.gov/publication/52849

Listening to any libertarian who opposed that bill--because of what it didn't do--complain about the establishment Republicans for not cutting spending makes me want to puke. If that's what we have to say, then Donald Trump and the Republicans should ignore us.

Remember when Suderman wrote about how irrelevant it was to cut Medicaid spending because it was as big as SS and Medicare? Good times. Good times.

was=wasn't

It's unfathomable.

At one point, they were arguing that we shouldn't cut entitlement spending because some future congress might raise spending again.

If we wait until no future congress can ever add more spending again before we cut spending, then we'll never cut spending.

Given that federal governent operates on the principle that a future Congress can not be bound by the current Congress that is a requirement that can never be.

Ken would lambaste Paul if he voted against a bill that cut entitlement spending but also meant that half of the U.S. population would be summarily executed via lottery draw of SSNs. Butting spending is just that important to him, you see.

Cutting spending, that is...

Good thing that's not the case here.

True. What really is the case is that Ken wanted Paul to sign onto a bill that cut entitlement spending, but screwed up the health insurance market even more than Obamacare did, as the partial repeal would have done. Then, see, the Republicans would have been the ones to blame for the oh-so-predictably disastrous results, which would have helped the Democrats storm back into power, back to the filibuster-proof majority they once had, whereupon they would repeal this bill altogether and institute their dream of single payer at last.

That is apparently what Ken wants to happen.

^ This.

And then there's reality.

You're the one denying reality if you think the partial repeal wouldn't have left the health insurance market in an even bigger shambles. The Democrats put in the individual mandate because they knew they'd have to force young and healthy people to buy insurance to subsidize sick and elderly consumers, or they wouldn't have put it in the bill to begin with. Repealing that but leaving the mandates that insurance providers have to cover everyone with pre-existing conditions would have resulted in even more healthy people dropping out of the markets, which would have increased the pace of premium price increases.

Ken wants President Bernie Sanders, Vice President Kamala Harris, and Majority Leaders Schumer and Pelosi to pass single payer into law, or he wouldn't be continually harping over the failure to pass the wreck of a bill that Rand Paul intelligently did NOT sign.

Which is exactly the same trajectory we are on anyway. Then again you're conflating the individual market which covers a small fraction of the population with the country as a whole. The vast majority of those on Barrycare are on Medicaid which isn't impacted by the individual mandate.

And then there's reality.

"Ken would lambaste Paul if he voted against a bill that cut entitlement spending but also meant that half of the U.S. population would be summarily executed via lottery draw of SSNs."

Some things are too stupid to merit a response. Other things are so stupid they absolutely require one.

I linked to the bill Paul voted against. Here it is again:

https://www.cbo.gov/publication/52849

It didn't execute anybody. In fact, I can't find ANYTHING anti-libertarian in that bill.

People were faulting it for what it didn't do, not for what it did.

Some of the highlights:

It cut Medicaid (for the first time ever) by $772 billion and had a total of $1.02 trillion in spending cuts.

The "costs" they're talking about are tax cuts. Because the bill repealed both the employer mandate and the individual mandate, that meant there would be hundreds of billions less in "penaltaxes" and other ObamaCare taxes coming into the treasury. In the CBO's universe, tax cuts are a cost. So the the bill cut $1.02 trillion in spending, but there was only $320 billion in deficit reduction--because of the $751 billion in tax cuts.

Cutting spending on entitlement programs + tax cuts = smaller government.

There was no good, libertarian reason to oppose that. It was the most libertarian bill I've ever seen in congress.

No executions by lottery. Just smaller government.

You responded to hyperbole. I'm curious as to your response to this instead.

President Bernie Sanders. Vice President Kamala Harris. Majority Leaders Schumer and Pelosi. All the thousands of state and local seats won by Republicans over the last ten years replaced by Democrats. 35 Democrat governors instead of 35 GOP governors. And all the onerous legislation that assortment of government representatives would gleefully pass. Is that what you want in exchange for the spending cuts in that bill?

You'd need to show what there was in that bill that would have screwed up the health insurance market.

I'm not going to link it again. I've already done so twice, but here are a couple of quotes:

"CBO and JCT estimate that, in 2018, 15 million more people would be uninsured under this legislation than under current law?primarily because the penalty for not having insurance would be eliminated . . . . By 2026, among people under age 65, enrollment in Medicaid would fall by about 16 percent.

Medicaid is a socialist program that screws up the market. The ObamaCare Medicaid expansion screwed up the market. This bill was a rare solution that actually fixed that problem.

Under the Senate bill, average premiums for benchmark plans for single individuals would be about 20 percent higher in 2018 than under current law, mainly because the penalty for not having insurance would be eliminated . . . . In 2020, average premiums for benchmark plans for single individuals would be about 30 percent lower than under current law.

The "negative" impacts of the bill would have mostly resulted from the bill repealing the individual mandate.

The positive benefits come from deregulation (ending ObamaCare practices like forcing insurers to include prenatal and ob/gyn coverage to older policyholders and single men), fewer people on Medicaid, and other pro-market reforms.

There is no way to "fix" the health insurance market because health insurance should not be a thing. It should not even exist. We should all pay for all medical expenses out of pocket. That's the only way we can get proper price signals in the healthcare market, which is the only chance we have of actually reining in the cost of healthcare.

In short, I wasn't just responding to the hyperbole. You might notice where I stated that I can't find anything anti-libertarian in that bill. The fact is that the bill did not and would not have screwed up the insurance market. Being such a libertarian and pro-market bill, it would have made the insurance market much better--even according to the CBO.

P.S.

"Medicaid is a socialist program that screws up the market. The ObamaCare Medicaid expansion screwed up the market. This bill was a rare solution that actually fixed that problem."

I didn't mean to suggest that the bill fixed the problem of Medicaid completely. Doing that would require us to repeal Medicaid completely. I meant to say that that the bill was a rare bill that actually addressed the cause of the problem by shrinking the size of a socialist program that screws up the insurance markets. The bill was a rare solution that actually worked to fix the cause of the problem.

If the insurance premiums were projected to drop 30% below where they are now because of deregulation and less government participation in the market, that is not indicative of a bill that screws up the insurance markets.

Funny thing happened after those Bush tax cuts, publicly held debt-to-gdp didn't actually move very much. It increased from 31% to 35%.

Debt didn't really start to balloon until the recession and the double whammy of decreased GDP and increased welfare spending. Wait, did I just write increased spending? Yes, yes I did. And what happened after Barry increased taxes in 2010? Gosh, we went from 56% to 75%. It's almost like it's a SPENDING problem and not a taxing problem.

Yet the deficit went down from $1.2 trillion (Bush's last year) to about $500 billion (Obama's last year) during this period that you imagine went to increases in welfare.

By Jeanne Sahadi, CNNMoney.com senior writer

Last Updated: January 7, 2009: 5:00 PM ET

NEW YORK (CNNMoney.com) -- The U.S. budget deficit in 2009 is projected to spike to a record $1.2 trillion, or 8.3% of gross domestic product, the Congressional Budget Office said Wednesday.

The dramatic jump to the highest-ever deficit in dollar terms compares to a $455 billion deficit in fiscal year 2008 and $161 billion in 2007. The estimate does not account for the massive spending and tax cuts proposed in President-elect Barack Obama's economic rescue plan.

And debt increased faster than after Bush's tax cuts. I even gave you the FRED link. But chart reading is hard for you.

Debt did increase more with trillion deficits. The Bushpigs left the economy in a smoldering crater in 2009 with negative GDP and 750,000 job losses a month.

A smouldering crater because he didn't tax and spend enough? Nobody racked up the debt better than Barry. And the best part is that he had absolutely shit growth to show for it. 1.6%. Awesome.

No, the BUSHPIGS left the economy in a smoldering crater 2009. Can you not read?

And the first month in office Obama CUT taxes for a mild stimulative effect (because we were in a lethal downturn from the GOP years.

Is that what your Mark Zandi models tell you? His brilliant plan was so effective that he couldn't even achieve a single year of 3% GDP growth coming out of a severe recession. Not a single year.

2008-09 was not just a recession. It was an economic collapse where only 1929-1933 is comparable. 2.5% GDP is about 10 basis points higher than the negative 8% Obama inherited (the lowest in modern history).

Oh bullshit. (click on "Max" since you're probably too stupid to figure that out for yourself). See that dip before 1960? See the dips in the 70s and 80s?

What's that huge dip in approximately 56?

Probably the day that the BEA realized buttplug was alive.

https://fred.stlouisfed.org/series/TNWBSHNO

Net wealth has seen one serious downturn since 1950.

So much for talking about GDP, I guess.

GDP is a means. Wealth is the goal.

Burning off inventory drags GDP down.

Wealth is the final yardstick.

Well at least until it doesn't tell the story that you want. Of course you still haven't accounted for the increase in federal debt and the massive degradation of the national fisc not to mention that we still haven't burped out that massive inflationary bubble caused by the Fed, but you'll still get your welfare checks regardless.

Makes me wonder about the percentage of net worth is one's house over time. Has that stayed steady or not?

Start here.

Digging through government data that my taxes paid for is, of course, cumbersome and inefficient. Be my guest.

Slow going, the charts change year to year.

So far, apparently ~70% of a home owners net value is their house in 2013. That's all I got so far. Will look further.

Here is an attempt I made to get a graph of it:

https://fred.stlouisfed.org/graph/?g=g1Gw

Top line is the total wealth of households and non-profits. Bottom line is the Homeowners Equity in their house. Perhaps this gives some idea, but the bottom one obviously doesn't include non-profits or non-homeowners so that makes it harder to really pull much from it.

Yeah, their websites are shit. It is physically painful to mine data from them. And FRED is actually about 1000x better than BLS/BEA. Sad!

Didn't Democrats have the power in 2007 and 2008 to keep the Bushpigs from leaving a smoking crater?

The great recession was a bi-partisan disaster was it not?

The Great Recession was a Western world event - at least where real estate prices went to a tulip like bubble.

Western world event? So then not caused by Bushpigs? Or caused by Bushpigs, unrestrained by Democrat Congress, that infected the whole Western world? I don't recall Senator Obama introducing bill after bill to change the Bush economic policies before the punch bowl was pulled away.

I have idiot conservatives tell me Jimmy Carter caused the 2008-09 British mortgage collapse.

And dumbass socialists tell me that Barry saved the economy.

The smartest capitalists supported Obama then. Warren Buffett is smarter than any Bible beating GOP lunatic.

Like Bruce Bartlett, I used to respect conservatives. No more. Conservatism is idiocy just like Creationism is.

What does your Krugman plushie whisper to you at night?

I note that you didn't address any of my points about Buffet. But he is a crony so just your kind of capitalist.

I'd be careful with that. Clinton started the path toward the mortgage collapse and W foolishly embraced it. That's a bi-partisan failure.

And Buffett is a brilliant investor, but (like Trump) he knows dick about economics.

Bush's tax cuts would have increased the deficit more/sooner, but he benefited from the real estate bubble providing fake economic growth. I'm not saying Bush was responsible for the bubble, only that the numbers used to judge his administration were affected by the bubble, and the gains from that bubble had to be "paid back" (there is no such thing as a free lunch). It was paid back during Obama's presidency. And I'm not saying Obama is absolved of responsibility for what he did because of a bubble he had no part in creating, either. My point is that all of this is a lot more complicated than the simple narrative you are attempting to convey.

This is where I ask myself if democrats are stupid or evil. I suppose these aren't mutually exclusive. They baseline "Bush's last year" as 2009 because that is how things normally work, but the deficit was voted in as an emergency budget amendment after Obama took office.

Bush is responsible for the $787B (IIRC) TARP bailout but much to my surprise that money was actually paid back.

To Obama's credit, much of the federal deficit was "structural" in that it was based on unemployment payments and the like. The specific amounts weren't authorized, just the method of calculation. But we know that Obama spent trillions on "shovel ready infrastructure" that was just hand outs to government employees, i.e. democrats.

And you are just wrong.

The deficit was $1.2 trillion before Obama was sworn in.

By Jeanne Sahadi, CNNMoney.com senior writer

Last Updated: January 7, 2009: 5:00 PM ET

NEW YORK (CNNMoney.com) -- The U.S. budget deficit in 2009 is projected to spike to a record $1.2 trillion, or 8.3% of gross domestic product, the Congressional Budget Office said Wednesday.

The dramatic jump to the highest-ever deficit in dollar terms compares to a $455 billion deficit in fiscal year 2008 and $161 billion in 2007. The estimate does not account for the massive spending and tax cuts proposed in President-elect Barack Obama's economic rescue plan.

And the majority of the 2009 budget was passed after Barry was sworn in.

Ever get tired of being wrong?

That's too simplistic. 2009 expenditures were about $500 billion greater than 2008 expenditures, and we already had a $450 billion deficit in 2008. But that only adds up to $950 billion. There is clearly more to the story. An important part you are ignoring or dismissing is that 2009 tax revenue was $400 billion lower than 2008. It wasn't until 2013 that federal government tax revenue surpassed 2008 revenue. If you want to blame Obama for the slow recovery, I disagree (the president is not an economic magician), but that's fine. If you want to be intellectually honest, you at least have to acknowledge that reduced tax revenue contributed to the deficits and national debt and not focus entirely on the budget/expenditures.

I also don't know where you're getting your debt-to-GDP figures. When Bush took office, the national debt was at 54.6% of GDP. At the end of 2008, the national debt was 67.7% of GDP. At the end of 2016, the national debt was 105.2% of GDP.

Clearly the national debt increased more during Obama's presidency than it did during Bush's. Some of that was due to spending by Congress and the Obama administration. Some of the was due to reduced federal tax revenue. I believe that Bush benefited from the real estate bubble (extra revenue) and Obama paid the price for that bubble (reduced revenue). If we corrected for that, Bush's presidency would still looks better than Obama's, but the numbers would be a little closer.

"Dynamic scoring" is like Creationism. Both are pure bullshit conservatives think are somehow credible.

Not nearly as flat earth as your belief in stimulus.

So you admit a tax cut is no stimulus?

No, I admit that you're ignorant of the literature. Should we see what the Romers say?

Christina Romer & David Romer, The macroeconomic effects of tax changes: estimates based on a new measure of fiscal shocks, 100 American Economic Review 763-801 (2010).

Pretty sure Romers aren't conservative considering they've served on councils for Team Blue presidents.

tax increase of 1 percent of GDP lowers real GDP by about 3 percent after about two years

Bill Clinton's 1993 tax increase led to robust GDP growth throughout the late 90s.

Arguing about a point or two in tax increases is meaningless to GDP. Warren Buffett (the greatest investor in history) said he doesn't give a fuck what the tax rate is when he can make money.

You mean after Team Blue lost congress and cut taxes later in the decade coupled with the dot.bomb bubble, the smouldering wreckage of which Clinton left Bush II? That growth?

Warren Buffet also doesn't understand double taxation of capital gains (he does, but he lies about it) and is the king of avoiding paying taxes. If he's so sure that the government needs to tax him more he can either donate to the Treasury (funny, he scoffs at that), or, even easier, he can NOT TAKE THE CHARITABLE DEDUCTION. The latter would be less work for him. Odd, he won't do that.

Wealth still increased annually from 2000-2007. In 2008-09 net wealth in the US fell $15 trillion.

Suddenly you don't want to talk about government debt anymore. Funny.

You can't blame Clinton or Obama for creating debt. As bad as Obamacare can be it reduced the deficit and debt.

HAHAHAHAHA. Exactly which part of overshooting per capita Medicaid expenditures by 50% and doubling of premiums in 4 years do you not understand? The only reason it didn't show up as a net loss is because enrollment was only about 60% of their target and almost 40% of states didn't increase the medicaid rolls.

Seriously, doesn't your ass get tired of all of this spanking?

You're too stupid to get off the TEAM RED! short bus.

Such a powerful intellect. Dazzle me with more of your scatological analysis. Tell me, what did Barry have for dinner tonight?

"You can't blame Clinton or Obama for creating debt."

LOL, that is the dumbest thing I have ever read. Hands down.

Oh that's not true. People really do respond to incentives. When taxes are lower, they really will generate more economic growth.

The problem is that modeling that behavior correctly is next to impossible. It's probably easier to construct reliable climate models than to construct reliable tax models.

The only sure thing is that tax money is inherently wasted because it is spent by people with little incentive to spend it wisely.

This GOP plan is pure bullshit because it does not address spending as others have noted.

There has been exactly ONE serious attempt at fiscal reform (cutting tax rates, deductions, and spending) and Obama led that with even Tom Coburn supporting it (Simpson Bowles). One real attempt.

I know the TEAM RED! cheerleaders will deny it came from the Kenyan Marxist ni88er they hate so much for his skin color but that is the truth.

Again you lie about that. Barry ran screaming from Simpson Bowles as fast as he possibly could. He didn't want a damn thing to do with it.

Bullshit. You are the liar. Typical for a TEAM RED! jackass.

Really?

I live in the real universe. I can do this all night. Probably best to just run away with your tail between your legs like you always do.

This "theory" you cite is girded by some truth - McConnell had vowed to oppose everything Obama supported - even righting the economic/fiscal ship. Republicans are all about TEAM! (mainly for racist aborto-freak reasons)

Just because abortionists kill so many black babies doesn't make them racists, you should be nicer to your party's backers than that.

Our resident Aborto-Freak pipes in.

Our resident Aborto-Freak pipes in.

Look, let the woman decide. You don't have a vote.

If only the male justices who voted for Roe v. Wade hadn't had a vote.

Tell you what, why not have *all* men withdraw from the abortion debate and let the women vote on it. They're about as divided on the issue as the men, of course, so that wouldn't really help you.

But it would be worth it to see prochoice men like Bill Clinton, Al Franken, et. al., and you, withdraw from the discussion.

Abortion is one of those issues that are very difficult. Even from a strict libertarian view point you can come to very different answers. I know you have no urge to concede that because you're just a noise-maker, but all it does is make you look even more ignorant.

Even from a strict libertarian view point you can come to very different answers.

No you can't. Every single Aborto-Freak wants to build a police state to oversee a woman's reproductive choices, These statist fucks even want to police the morning after pill. There is no liberty in a 24/7 police state to enforce their version of morality.

They might as well be goddamn Islamists - the most oppressive shit-kickers in the world.

I don't believe that nearly any libertarian would allow for murder. That's the NAP at its core.

Is it murder? I don't believe this is an answer one can derive solely from a political viewpoint. And it is also not something has a true objective answer.

Or we could simply not fund it.

I easily agree with that. I waffle back and forth on the abortion issue, but it is morally repugnant to make those who believe it to be murder to pay for it.

Barry could have submitted SImpson-Bowles as his budget. Surely you can provide a citation for that. What, you can't? You're full of shit as usual? This is my shocked face.

Here you go, idiot.

President Obama's Latest Proposal Largely Mirrors the Bipartisan Simpson-Bowles Plan

In his most recent proposal to resolve the fiscal showdown and reduce the budget deficit, President Barack Obama offers approximately 90 percent of the overall amount of spending cuts proposed in the bipartisan deficit reduction plan authored in 2010 by former Sen. Alan Simpson (R-WY) and former White House Chief of Staff Erskine Bowles?the co-chairs of the president's 2010 fiscal commission. The proposed revenue increases in the president's offer are about 60 percent of those proposed by Simpson-Bowles.

With this proposal, President Obama is clearly trying to find a reasonable middle ground that both Republicans and Democrats can agree on. Given how often conservatives cite the Simpson-Bowles plan as a model of bipartisan compromise, only the most ideologically blinded lawmakers could reject a plan that has 90 percent of Simpson-Bowles spending cuts and 60 percent of the plan's revenue for having too much revenue.

Obama SUPPORTED just the spending cuts.

https://goo.gl/w481dW

What, you can't?

You are owned, you GOP gasbag.

Skippy has skipped out of town.

TEAM RED! idiocy does that.

He probably left at some point in the hour and 5 minutes it took you to respond.

He probably left at some point in the hour and 5 minutes it took you to respond.

Okay, then I will bookmark this page.

The next time that dumbass leaves Bratfart.com for here I will remind him of what a fool he is.

Please do.

NotAnotherSkippy|11.30.17 @ 9:50PM|#

Yeah, their websites are shit. It is physically painful to mine data from them. And FRED is actually about 1000x better than BLS/BEA. Sad!

Skippy is still here as of 9:50pm.

Poor sap is no doubt avoiding this ass-kicking he deserves though.

I just put my 3 year old to sleep. While you both need the same level of parental guidance, he wins.

What, no response? Shall we go to Politico?

Ooo, big cutter.

You mean the proposal he reneged on? That's rich. So what does Politifact say (you like Politifact):

Where's your answer, buttplug?

Hurry up, you should have your talking points on your Obamaphone by now.

This is what you said, dickhead:

Barry ran screaming from Simpson Bowles as fast as he possibly could. He didn't want a damn thing to do with it.

As I have proven you are dead wrong again.

Did he reform entitlements along the line of Simpson Bowles? Nope. Go ahead, call Politifact liars. That would make you a TEAM RED! shill, wouldn't it?

And what else did you claim?

Well if Barry gets credit for proposing something you think is equivalent to S-B, then so does Boehner. But logical consistency isn't a strength for the welfare class, so I don't expect much from you.

Did he reform entitlements along the line of Simpson Bowles? Nope.

Obama wanted to. Simpson Bowles was sabotaged in committee by zealots on both sides.

The idiotic "freedom caucus" as well as stupid progressives.

Bullshit. The first thing Barry pulled when Boehner negotiated was entitlement reform.

Bullshit. The first thing Barry pulled when Boehner negotiated was entitlement reform.

And you are wrong yet again. doofus. Obama's position on chained CPI pissed off the left for its fiscal restraint.

Do you ever get tired of your dumbass views?

Dems reject Obama's chained CPI formula for Social Security

Obama used his 2014 budget plan to call for imposing a so-called chained CPI formula. That formula would reduce Social Security cost of living adjustments by taking into account alternative purchases people can make in order to avoid goods and services whose costs are rising quickly.

Politico

You are just fucking ignorant.

Not stupid. I think you could learn.

Let's compare 2014 budget proposals, shall we?

Is there any meat left on your ass, or are we down to bone yet?

He yanked that so fast it exceeded the speed of light in your head (which is actually emptier than a vacuum).

Clearly a good thing for you personally.

Obama was talking about $400 billion in health-care cuts

WTF is wrong with that?

And Chained CPI cuts are for Social Security, not Medicare!

You should just bow down to the Buttplug right now and say you're sorry for being a GOP shill and Obama had REAL SPENDING REFORM that the tRump asshole does not.

Bow down now, bitch!

Did I say that they were? Medicare and Medicaid are the bulk of the unfunded liability. I realize that those are big words for you, so let me simplify: Medicare/Medicaid biggest problem and need fixey thing muchly. 400BB not fixey thing that need it muchly.

You're the gum stuck under my shoe. I'd have to scrape you off before I could even contemplate bowing.

Obama wanted "only" $400 billion in cuts and now the GOP wants NOTHING? And the GOP has full control of the federal government today?

Are you that stupidly partisan?

And just how many cuts did TEAM BLUE! push through when they had a supermajority for over a year? Right.

All they had to do in 2014 was agree to the House budget and we'd be on a path to balance. Why didn't choco Jesus do that? Because it would have killed grandma no doubt.

What was that you were saying about being a partisan hack?

I agree that Simpson Bowles was as serious at an attempt that Congress typically gets when it comes to reducing spending. But no one really wanted it, not Obama, not Republicans.

Not true. Obama wanted it as part of his Grand Compromise. The committee vote was close. Purists in both parties killed it.

See above, Jeff. Obama was fully supportive of Simpson Bowles debt reduction.

Palin's Buttplug|11.30.17 @ 9:12PM|#

"See above, Jeff. Obama was fully supportive of Simpson Bowles debt reduction."

Bullshit. See above; turd gets caught lying one more time.

Fuck off, turd. Your act is long past the 'sell-by' date.

If it even threatens to strangle government, in any way, I'm against it.

Exactly! What would we do if we didn't have others (smarter, better looking) to tell us what to do?

Considering we added $10 Trillion to our debt under the last clown who was in office, adding another $1 Trillion over 10 years to it isn't going to bother me a bit.

Yes, I realize the $1 trillion is in addition to the annual deficit that will certainly occur with Trump.

The Dudes Behind 'Epic Rap Battles of History' Eye an Uncertain Future

On a much-needed break, the guys behind YouTube's popular series take five.

Guess who's to blame?

"Then, on top of the stress, the 2016 U.S. presidential election in which Donald Trump won on a nationalistic platform shook the young, progressive talents at their core.

""We have a lot of different ethnicities and races and sexualities [behind the scenes], and we were scared," Shukoff says. "People were confused. We didn't know what it meant."...

"...At the end of the video, which has more than than 54 million views, Lincoln slaps Trump twice. Honest Abe does not hit Hillary.

""To me, that was not up for debate," says Shukoff. "Abraham Lincoln is not going to smack Hillary Clinton. Abraham Lincoln was not going to respect Donald Trump. That was an obvious, honest character choice. We saw in the comments anger towards that, and that's when I got scared."

""We were isolated in our Los Angeles world and weren't aware of the anger in the country," says Shukoff. "It caught us off guard and it depressed the hell out of me.""

""To me, that was not up for debate," says Shukoff. "Abraham Lincoln is not going to smack Hillary Clinton. Abraham Lincoln was not going to respect Donald Trump. That was an obvious, honest character choice. We saw in the comments anger towards that, and that's when I got scared."

I don't know if he'd really smack either, but I don't know if he'd respect either. Shit, my guess is any politician from 150 years ago is going to have views that differ greatly from almost any mainstream politician these days.

""We were isolated in our Los Angeles world and weren't aware of the anger in the country," says Shukoff. "It caught us off guard and it depressed the hell out of me.""

New media, exactly like Old Media.

""We have a lot of different ethnicities and races and sexualities [behind the scenes], and we were scared," Shukoff says. "People were confused. We didn't know what it meant."..."

So when in doubt, assume anyone not (D) is a poopyhead.

Yep, sounds like the LA 'music scene'.

Wonder why John McCain is backing it considering many congresspuppets are on record saying that the only reason they're doing this is because the donors have promised to turn off the spigot if they don't. Why should he give a fuck I wonder.

They know the people will hate this. But the sugar daddies want a ROI, and in the end they matter more than the people.

Well, if nothing else, he can try to hang in there until the estate tax is kaput.

The people will like it because they don't understand that spending must be cut dramatically.

Not must. Only must in the sense that a Scientologist must get an e-reading. We are America, richest country on earth. We can do whatever we want.

It's not yet a fait accompli, but Thursday was a good day for supporters of the GOP tax proposal.

BTW, do you know for whom else, today was a good day?

Ice Cube?

People who know correctly how to use the word 'whom'?

This is the best I could come up with from Wikipedia:

"November 30, 1938 (Wednesday)...

"Nazi leaders were instructed to have flowers held by onlookers confiscated by security wherever Hitler's motorcade was about to pass through. The Nazis had been trying unsuccessfully for years to discourage the practice of throwing flowers at Hitler because it was feared that an assassin could throw a bouquet containing a bomb."

nb, with all due respect, I don't think you strictly observed the rules of the you-know-who-else game. You're supposed to make a Hitler allusion which everyone will recognize, eg, "you know who else invaded France" - but the significance of Thursday or Nov. 30 to Hitler eludes me, not that I'm an expert, but the rules don't presuppose we're all experts.

If we were talking about Hitler and November in general, then his denunciation of the "November criminals" (armistice negotiators, Nov. 1918) would fit, but you mentioned a good day for Hitler - help me out here...

May I suggest "you know who else believed in big budgets?"

Every bride-to-be in human history?

Rule of thumb, if you see "nazi" anywhere the post, stop reading and realize the poster has no originality.

Matt Lauer's lawyer?

If republicans really cared about reducing the size/scope of government they would pass the tax cuts ignoring the deficit projections and then get serious in the budget bill. Cutting spending, eliminating agencies, but it won't happen.

Republicans don't give a fuck about deficit spending, that's just pillow talk before they fuck you in the ass and fuck up the deficit even worse than it already is so their cronies can get some more tax deductions

Not that their estimates are likely to be worth a whole lot to begin with but, I wonder if they are factoring in the potential growth due to slowing down the growth of and/or cutting of regulations.

1- Pass the huge tax cut without cutting spending

2- Make sure the press widely disseminates that government workers will never receive their benefits because of the deficit

3- After several years of no one being willing to work for the government, cut spending. It will pass with no one to defend it.

4- Make me sober up before I type step 1

This isn't a huge tax cut. It's income redistribution.

For me, it's a huge tax increase. My 2018 federal income tax bill will go up by nearly 20%, from around $35k to $40k. Clearly the Republican party has decided that other people need and deserve the money I earn more than me. Fucking Marxists.

And the truth shall set you free.

Now, let's hear which federal departments you'd like to slash. I'm almost positive you'll get a lot backing here, regardless of the department.

I wish people would stop saying that future generations will have to pay back the debt. That's both untrue, and also not a very effective argument against the debt, as most people don't really much about future generations.

It's more accurate to say the debt leads to inflation, and at some point other countries, and investors, may completely lose faith in our currency, at which point we're in a whole lot of trouble. The whole thing about our grandkids will have to pay this back is a loser of an argument.

most people don't really much about future generations

I assume you mean "don't really much care ...". So, you agree that most people are selfish dicks when it comes to the debt.

we're in a whole lot of trouble

And by "we", you mean future generations for the most part.

I have yet to hear someone from the future object to our leaving them a debt to pay off, so why not?

The tax bill is a big middle finger to the middle/lower class. A couple years of chicken feed to make it through the 2018 midterms.

Start earning $90/hourly for working online from your home for few hours each day... Get regular payment on a weekly basis... All you need is a computer, internet connection and a litte free time...

Read more here,..... http://www.startonlinejob.com