Why the Senate Tax Reform Bill Is a Big Deal for Gig Economy Workers

The newly released bill would clarify Uber drivers' and Airbnb hosts' status as independent contractors but would require tax withholding.

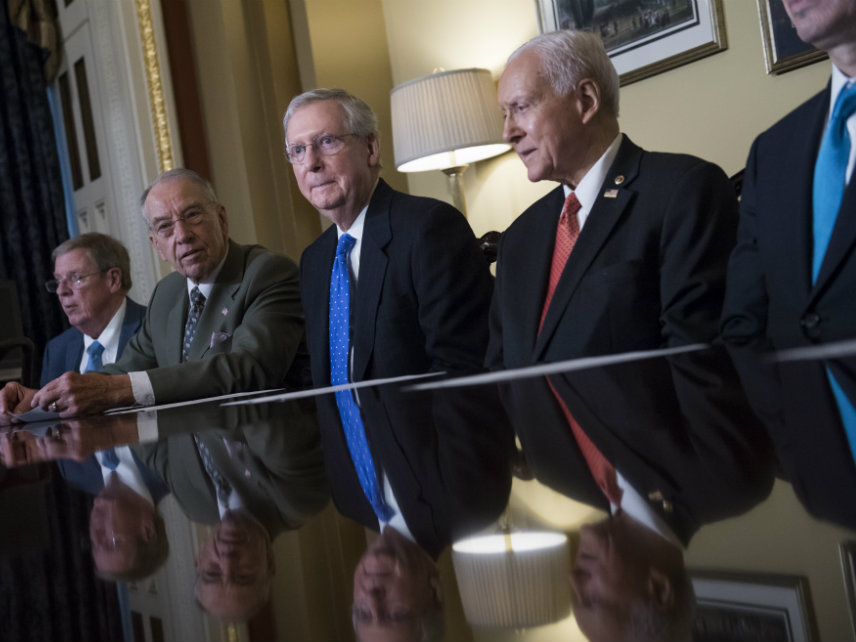

A key provision in the tax bill that Senate Republicans unveiled yesterday clarifies the role of workers in the so-called "gig economy." It also sets up a showdown over whether platforms like Uber and Airbnb will be required to withhold taxes on behalf of their users.

As I detailed in a Reason feature back in September, the current federal tax code—last updated in 1986, long before Uber, Airbnb, and the rest of the gig economy came along—fails to adequately account for the estimated 2.5 million Americans who earn income through on-demand platforms every month, according to an estimate from JP Morgan Chase. There have always been independent contractors, of course, but their numbers have shot upwards over the past decade as online platforms made it easier than ever to offer rides, lodging, or other services at the tap of an app. Many workers who sign up to drive for Lyft or sell homemade goods on Etsy are unaware that they are also signing up for a far more complex tax status by earning a few hundred dollars in a side gig.

The tax debate offers a rare opportunity to fix some of these problems. The Senate version of the tax reform bill makes a solid attempt at doing that by including portions of the South Dakota Republican John Thune's New Economy Works to Guarantee Independence and Growth Act—the NEW GIG Act.

Thune's legislation clarifies that gig economy workers are independent contractors, and that neither service recipients nor third party apps are employers. At the same time, the bill would require gig economy businesses to withhold income tax from their contractors—a provision that would ease the confusion facing Uber drivers who might expect income tax to be taken out of their pay in the same way it is for W-2 employees. Thune says his bill "would provide clear rules so these freelance-style workers can work as independent contractors with the peace of mind that their tax status will be respected by the IRS."

Researchers at Boston College and American University have found that gig economy workers confused by their status as independent contractors, or by other elements of the tax code, often do not pay taxes at all or have to hire expensive tax help to figure out what they owe on a relatively small income.

Thune's proposal would also set a new reporting threshold for all miscellaneous income earned by independent contractors. Workers who earn less than $1,000 would not have to report their income at all, while those who earn more would. Under current law, this threshold is a bit fuzzy. Some income is subject to reporting after $600 is earned, but credit card payments that total less than $200,000 do not—unless the income was earned via 200 or more separate credit card transactions.

A similar bill has been introduced in the House by Rep. Tom Rice (R-S.C.) and could be incorporated in the House version of the tax bill, the Tax Cuts and Jobs Act. (The House and Senate bills both use the same name, despite some differences in substance.)

The potential sticking point has to do with the idea of requiring sharing economy platforms to withhold income taxes from their users. As written, the Thune amendment would require income tax withholding as part of a three-pronged test that grants independent contractor status to gig economy workers. The platforms themselves want this clarification included in the law as a way to short-circuit lawsuits, like one already launched by Uber drivers in California, aimed at forcing them to treat workers as employees.

In return for clarifying that gig economy workers are contractors, Congress appears to be saying, those platforms will have to collect income taxes from those same workers. By doing that, Congress guarentees that more taxes will be paid—rather than the current system, which relies on individual contractors to correctly calculate and pay their own taxes, something that likely shortchanges the IRS to the tune of several billion per year, according to Caroline Bruckner, managing director of American University's Kogod Tax Policy Center.

Congress cares about capturing those unpaid tax dollars because it has to find a way to "pay for" the GOP bill's $1.5 trillion in tax cuts. Republicans plan to pass the tax reform bill through the Senate with a simple majority using the reconcilliation process, which can only be used on bills that adhere to the Byrd Rule and do not increase the deficit outside of a 10-year window.

"They'll likely be looking for money, and platforms like Airbnb which process transactions for sharing economy hosts and guests will look like attractive targets," says Romina Boccia of the Heritage Foundation, a conservative think tank in Washington, D.C.

But mandatory withholding could stifle innovation and competition in the gig economy, because it would add to the start-up and overhead costs of new online platforms.

Instead, Boccia suggests, lawmakers should allow workers on gig economy platforms to opt in to tax withholding. That would be a win for everyone. Platforms would get clarity about the employment status of their workers; workers would get the option to simplify their tax prep by having taxes withheld; and Congress would not impose mandatory costs on future gig economy platforms.

In all cases, flexibility is the key. Gig economy platforms say they expect to see participation in the "on-demand economy" rise from 4.4 million workers today to approximately 7.6 million in 2020. Lawmakers in 1986 could not have expected this surge in independent contracting, and lawmakers today should be prepared for the economy to keep changing in unexpected ways.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Guess who said this: "Kim Jong Un is the saviour of the world trading system at the moment."

Shaggy 2 Dope?

Of course ICP would use the British spelling of Savior. They're damned cads, they are.

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.netcash10.com

Is there more appropriate Veterans' Day music?

Wrong! Violent J is the correct answer.

Well, you're the expert.

There have always been independent contractors, of course - - -

Exactly. So no new money grabbing legislation is required. An independent contractor damn well knows he is running a business, and that there are tax responsibilities. We always have, and always will. That is why I always did the necessary analysis to determine if I should take a contract as an individual, or incorporate.

As to the "often do not pay taxes at all or have to hire expensive tax help to figure out what they owe on a relatively small income" item, I used very reasonably priced (and deductible) software, and spent about 15 minutes a week entering income and expense data. The program told me when to file the required quarterly returns of payroll taxes, workers comp insurance, and income tax payments, and printed out the checks. I signed and mailed, and all was well.

It ain't (or at least wasn't) that hard, folks.

Unless, of course, you are a Republican majority in both houses and incapable of actually forcing through real legislation, and hide behind reconciliation. Grow a pair, guys, and do what you were elected to do. Or start printing up "Welcome back Nancy" banners.

Well they're not really hiding behind reconciliation unless you want to eliminate the filibuster entirely.

But if we're dreaming then we could scrap the income tax entirely and go to a national sales tax which would render all of this unnecessary wrangling truly unnecessary.

Literally no filing whatsoever, and gets the IRS out of everyone's butt. IRS then becomes like a staff of 20 people just adding numbers up, and all the tax vultures like H&R Block go the way of the horse-drawn carriage.

Also pretty hard to cheat on a sales tax - - - -

They'd just start complaining about person to person sales.

CLOSE THE CRAIGSLIST LOOPHOLE!

Exchanging money for goods and services with no government involvement? That's crazy talk.

The solution is an equal tax per person - say $1000 per year per adult. $3000 per adult gets us the same revenue we get today but it's a bit excessive for most people. Cut the government by two thirds, collect $1000 per adult and everything is simple and fair.

They could just invoke the 'two speeches in a legislative day' rule, let the dems babble on twice each, and then vote. But that would require party discipline, a good proposed law, and other things that do not live in the swamp.

"Better keep moving and don't stand still; if the skeeters don't get you then the gators will"

Surely you don't think it's reasonable to force senators to actually carry out a filibuster. What a monster you are.

Too true, blue.

Reasonable, and funny as hell to watch.

New Economy Works to Guarantee Independence and Growth Act?the NEW GIG Act.

Jesus Christ.

Too true. Maybe a constitutional to prohibit any law with a cute acronym?

(especially ones that have 'independence' in the title; no politician wants independent voters.

Maybe not a prohibition per se, but i'd be down with the sponsors of said bill each losing a finger.

Eric could have given us a wordcount on the proposed law. The Declaration took 1400 words, the Constitution takes fewer than 7600 words, but these kleptocracy looters think nothing of shoveling out laws containing over 57,000 words. How about a cap on the number of words a law can contain? It would be a limitation on the Political State's power to defraud and coerce, and could only inure to the benefit of individual rights.

You'll have to pry my frog gig pole from my cold dead hands.

When Chipper says "my frog gig pole" he means exactly what you're hoping he doesn't mean.

fuck off slavers

extortion-protection racketeers want their cut

How bout everyone pays x% (17?) of their income? No deductions, no exceptions, no tax on business. No other federal taxes.

Oh, wait...that would make it impossible to buy votes...

What was I thinking?

Define income.

Everything that doesn't drizzle down your mom's inner thigh.

ZING!

I.. well... but... dag, yo.

Most of that's vaginal fluid anyway. She is very much a squirter.

the bill would require gig economy businesses to withhold income tax from their contractors

FUCK THAT.

-jcr

I'll gig your work.

I'm sorry I have a hard time giving a shit knowing that the Republican tax bill is a tax increase for virtually the entire middle class. Oh, so gig economy workers have changes too? Big fucking deal.

Sorry, I can't be bothered to give a shit about Uber drivers when everyone else is getting shafted.

Republicans that can't cut from the budget are useless. Full stop.

Bullshit.

Obviously spending cuts should be what is happening, but from everything I've read the middle class isn't getting a hike, it's just not getting as big a cut. Which ultimately makes sense because even the middle of the middle class doesn't REALLY pay a ton of income tax anyway. The upper middle class and outright rich pay almost all taxes sooo...

The truth is I think the poor probably need to have their taxes raised so they actually have skin in the game, and the lower middle class doesn't need to be made non payers. We need them to keep paying and bitching so spending might actually get cut someday! I think business and upper middle class cuts are the most "useful" if we accept government choosing winners at all.

Once again, I will ask when ignoring the plain meaning of the word "independent" became a core libertarian tenet.

The idea that a ride-share driver is "independent" when the company controls literally every aspect of the engagement except the hours worked is both laughable and Orwellian.

But again, millenials and entry-level Reason reporters think Uber is neat-o (which it irrelevantly is), so priniciple and dictionary go straight out the window.

P.S. Interesting that only withholding for income traxes is mentioned, but not the far more important withholding for payroll taxes. ISWYDT, Senator Thune...

Sup, Glen. I didn't know Jesus had yet another brother.

There is a fine line between at-will employment and independent contracting, and the difference between the is often an administrative one moreso than anything else. But hey, you know who should define where that line exists? The employer and the employee/contractor together, not some dude at the state department of labor with no knowledge of the mindset of either party. That voluntarism is the very heart of the philosophy, remember.

Uber and Lyft provide a platform for people to use to make money. Is someone who sells shit on Ebay an employee of Ebay?

Are you allowed to select you driver on uber? Does the driver set rates? No, it's not ebay.

"Thune's legislation clarifies that gig economy workers are independent contractors, and that neither service recipients nor third party apps are employers. At the same time, the bill would require gig economy businesses to withhold income tax from their contractors?a provision that would ease the confusion facing Uber drivers who might expect income tax to be taken out of their pay in the same way it is for W-2 employees."

Filing income taxes as an individual or tax forms as a sole proprietor without a W-2 or a federal tax ID is more than just a pain in the ass--it's fraught with danger of tax fraud. That problem needs to be solved for these people.

Opposing that solution is a bit like opposing the legalization of marijuana--if that means sales will be subject to taxation and zoning laws. Normalizing something means making it like everything else that's legal, and if legalizing marijuana means that sellers get treated just like liquor stores, well, that's not a good enough reason by itself to oppose legalization.

If the government is making criminal tax cheats out of honest business activity, then that needs to change. And I bet the majority of Uber drivers are screwing up their returns big time through no fault of their own.

Yeah, because all Uber drivers are morons that need their mommies aka the government to hold their hands. Are you fucking serious? Stop projecting your damage onto other people. Sloppy as hell.

If we want the IRS to stop requiring W-2s, do that for everybody. Why should Uber drivers suffer the brunt of our "principles"?

My libertarian principles are not centered on, "the beatings will continue until morale improves".

Throwing kids in prison for marijuana possession until the government finally relents on zoning laws for cannabis shops, liquor stores, and everything else is not a viable solution, and leaving Uber drivers to twist in the wind at the mercy of the IRS isn't the solution to IRS withholding requirements either.

and American University

This sounds like a made up college in Egypt.

OMG CLOSE THE TAGS YOU DINGLEBERRY!

"The university was chartered by an Act of Congress on February 24, 1893, as "The American University", when the bill was approved by President Benjamin Harrison.[5]

The university has seven schools and colleges: the School of International Service, College of Arts and Sciences, School of Business, School of Communication, School of Professional & Extended Studies, School of Public Affairs and the Washington College of Law.

AU's schools are consistently ranked highly in national college rankings; the School of International Service is ranked 8th for graduate programs and 9th for undergraduate programs in the world according to Foreign Policy.[6] The School of Public Affairs is ranked 19th in the nation, tied with Columbia University and the University of California, Los Angeles according to US News & World Report.[7]

https://en.wikipedia.org/wiki/American_University

I grew up in DC, so . . . it's where you go to join the diplomatic corps.

They should legalize prostitution and then they could also tax the giggety economy.

How they gonna figure out how much to withhold?

One amount for drivers that incorporated (oh, wait, then they cannot be employees. oops), one amount for drivers that are operating as sole proprietorship (schedule C), one amount for sole proprietorship (business pass through).

How can they determine the level of deductions each driver will have at the end of the year so they don't over or under withhold?

Or should they just rename this to the IRS clerk full employment act of 2018?

Oh wait. Federal government, never mind.

Senate LOOT reform bill.

We got us some wars goin on. Them thar Uberites need to pull thar weight.

Any Uber driver with an IQ above room temperature (in Celsius) runs a mileage tracking app, takes the standard mileage deduction, and doesn't owe any taxes anyhow. The only practical effect here is the government gets another interest-free loan until your "refund".

Bingo.

How can an independant contrator be subject to witholding taxes? They are not employees. Its not real confusing to claim side income on your taxes, especially using TurboTax or similar software. Sounds like an excuse for government to start shaking down more workers....

Not that I have any objection to clarifying the status of gig economy workers, but "expensive tax help"? You can buy a copy of TurboTax Home and Business for $100, or the H&R Block equivalent for less than $80. It would be nice not to have to pay anything, but let's face it -- can even somebody who spends all their working time as a W-2 employee do their taxes without help these days?

From what I've read, the GOP tax bill _isn't_ simplifying the tax code, it's making it MORE complicated.

So much for tax "reform".

In my own blog I've been suggesting a much simpler option -- although I'm afraid it has no chance of passing: a combination of two simple taxes:

1. The so-called FAIR tax -- but set at 20% of the pre-tax price, not at nearly 30% as currently set up. (THey call it 23%, but it's 23% of the AFTER tax price.)

2. A Henry George-style tax on the ground "rent"(*). That's a tax on JUST the land, not on any improvements. And only on the extra value you get from being in a community, not on what your land would be worth if it were out in the wilderness with no neighbors, no fire & police protection unless you buy it separately, no utilities, no people around to buy your products and sell you theirs.

The advantages:

a) They're simple. No brackets, just x% of the retail price of what you sell (for use, not for resale) and y% (maybe 1%?) of the ground "rent" of land you own.

b) they're very hard to evade. If you sell stuff at retail, you have to pay the tax. You can sell to somebody who plans to resell it, but then _they_ are responsible for eventually paying the tax. Or we could make it a true VAT, but that requires more people to keep records and pay taxes.

c) The land tax does not distort the economy at all -- the only way to pay it is not to own or rent or otherwise use land. (If you're a renter, it's included in your rent because the owner has to pay it.) And the sales tax is nowhere near as distorting as our income tax. And the simpler, the less distorting.

. . . earning a few hundred dollars in a side gig.

Since the traditional 40 hour a week job is disappearing, there is no such thing as a side gig. There is only earning income.

Leave the tax system alone and free people will figure out how to deal with it.

The idea of "simplifying filing" for independent contractors, which is to require companies to withhold taxes which may be owed by contractors, is an attack on the independence of the self-employed and will add cumbersome accounting and extra costs to the relationship.

Thank you!

I hope my brothers at the Freelancers Union are on this. Their home turf is New York, but they accept members from all over, field no goons, and mainly do things like write apps to help freelancers put together bids and agreements instead of just signing whatever is shoved in front of them.

Rideshare drivers are self-employed and know they don't get taxes taken out of their earnings. Whoever wrote this article is a moron. Drivers use their business deductions to minimize taxes owed. This is asinine.

The whole thing is just so they get to park on the money all year before refunds go out, and also to catch people who probably dodge now, but are too low dollar to go after.

A lot of drivers are pretty dense, imagine in burger flippers had to figure all this stuff out... But even if they withheld the money you STILL have to do the full accounting at the end of the year! You just won't owe anything over and above what already got taken throughout the year. It DOES take a lot of ICs by surprise the first time they do it, the FICA stuff really gets a lot of people. I've been self employed most of my life, so I'm keenly aware of how much the IRS sucks and how painful it is to cut large checks to those assholes.

Republican Tax Rape, I mean Reform. The fact that these apes have accepted the Democrat line that you have to pay for tax cuts is all you need to know. No real cuts in spending whatsoever. The Uber drivers are already getting screwed via rates and most don't even speak English, but money is money. Take what you can get.

They should all just be independent contractors or Corps if they decide to incorporate. Anything else is just more useless laws. Make them use 1099 and fuggetaboutit. Gig economy is just a stupid buzz phrase, they are just independent contractors like we've had for decades.