Americans Keep Setting New Records for Renouncing Citizenship, and Tax Reform Threatens to Make it Worse

The House bill fails to put an end to global income taxation and the Foreign Account Tax Compliance Act, though the Treasury Dept. may provide some regulatory relief on the latter

One of the biggest arguments in favor of tax reform is that it's an opportunity to get rid of bad laws and human-harming regulations that virtually no non-self-interested observer can defend with a straight face. A welcome fix in the House's current tax-reform package, for example, is the removal of bonds for the construction of professional sporting stadia from the tax-exempt status granted to municipal bond-finance of actual infrastructure.

So why on earth does the Republican Party's opening bid for tax-code overhaul not include the end of worldwide income taxation on U.S. citizens (even if they live and earn their money abroad), nor repeal of the odious Foreign Account Tax Compliance Act? After all, both promises are right there in the 2016 Republican Party Platform:

The Foreign Account Tax Compliance Act (FATCA) and the Foreign Bank and Asset Reporting Requirements result in government's warrantless seizure of personal financial information without reasonable suspicion or probable cause. Americans overseas should enjoy the same rights as Americans residing in the United States, whose private financial information is not subject to disclosure to the government except as to interest earned. The requirement for all banks around the world to provide detailed information to the IRS about American account holders outside the United States has resulted in banks refusing service to them. Thus, FATCA not only allows "unreasonable search and seizures" but also threatens the ability of overseas Americans to lead normal lives. We call for its repeal and for a change to residency-based taxation for U.S. citizens overseas.

The United States is the only country besides Eritrea to tax the income of its non-resident citizens. If you were born to an American parent (or in the U.S. proper) but have lived and worked the bulk of your life elsewhere, the Internal Revenue Service still has a claim on your salary, even though you consume zero government services. That's just wrong, and should be stopped.

Meanwhile, FATCA-repeal bills were introduced in both chambers of Congress back in April by Freedom Caucus Chair Rep. Mark Meadows (R-N.C.) and Sen. Rand Paul (R-Ky.), but both have yet to move beyond committee. The Republican Party has controlled Congress since January 2015, yet can't screw up the courage to deliver a simple repeal of a lousy law.

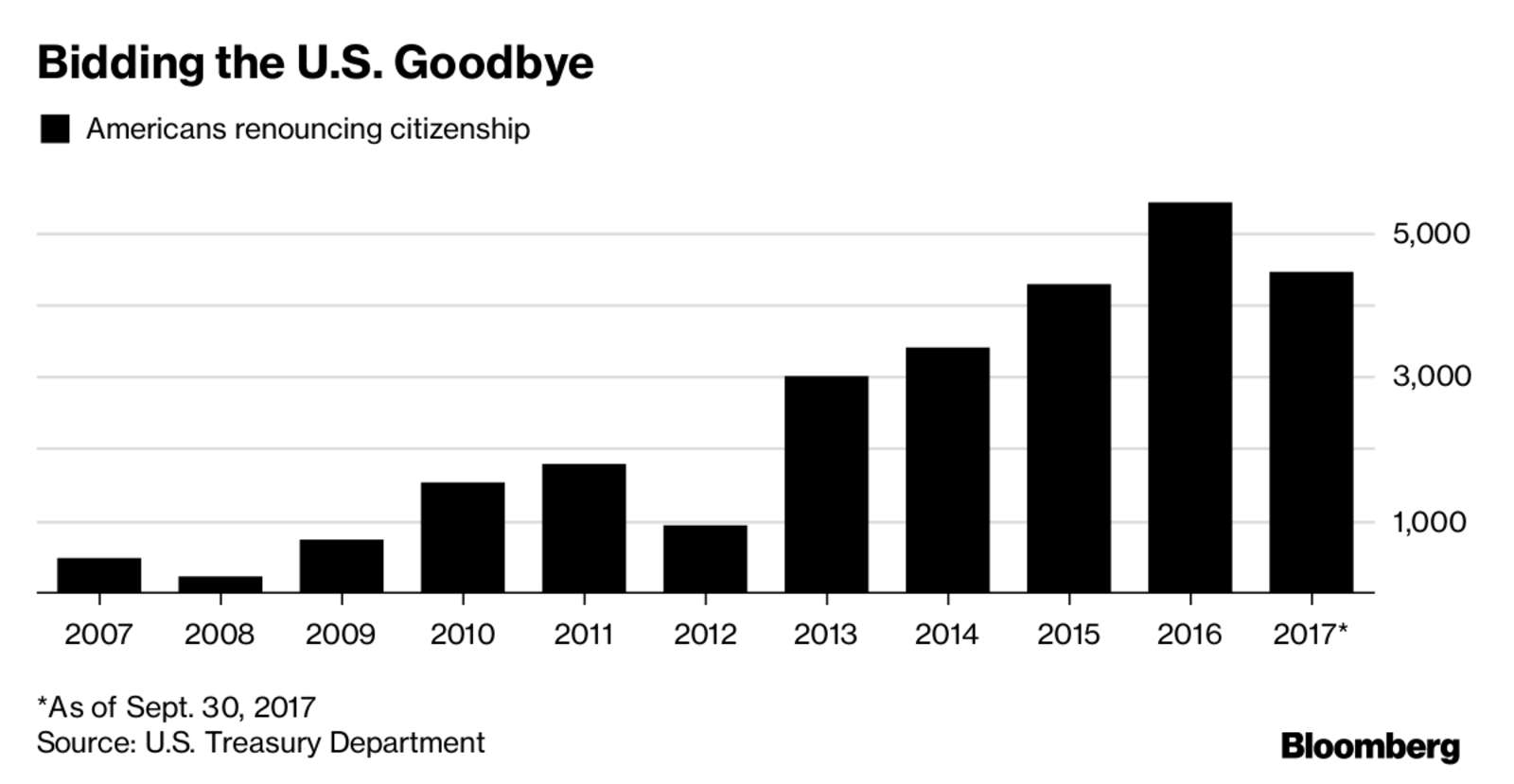

With each passing day of inaction, the number of Americans renouncing their own citizenship rather than deal with the ridiculously onerous and punitive tax-filing requirements continues to set new records. Last week, the Treasury Department came out with its quarterly name-and-shame list, putting the 2017 tally of passport-burners at 4,448. At that pace we should break last year's record of 5,411 by just after Thanksgiving. Congratulations, America!

Not only does the tax reform proposal thus far fail to provide any relief to the estimated 8.7 million Americans living abroad (who are routinely shut out of financial institutions, since foreign banks don't exactly enjoy playing errand-boy to the I.R.S.), it may rub salt in the wound. Max Reed, a cross-border tax lawyer in Vancouver, Canada, who writes frequently and well about such issues, says "it will make matters worse for some US citizens in Canada and keep it the same for others."

Some of Reed's preliminary findings:

* New punitive rules that apply to US citizens who own a business. Currently, most US citizens who own a Canadian corporation that is an active business don't pay tax on the company's profits until they take the money out. The House plan changes this. It imposes a new, very complicated, set of rules on US citizens that own the majority of a foreign corporation. The proposal would tax the US citizen owner personally on 50% of the entire income of the Canadian corporation that is above the amount set by an extremely complex formula. At best, this will make the compliance requirements for US citizens that own a business extremely complicated and expensive. At worst, this will cause double tax exposure for US citizens who own a Canadian business on 50% of the profits of that business.

* Imposition of a 12% one-time tax on deferred profits. Under the new rules, the US corporate tax system is transitioning to a territorial model. As part of this transition, the new rules impose a one-time 12% tax on income that was deferred in a foreign corporation. Although perhaps unintentional, since US citizens will not benefit from a territorial model, the new rules impose a 12% tax on any cash that has been deferred since 1986. Take a simple example to illustrate the enormity of the problem. A US citizen doctor moved to Canada in 1987. She has been deferring income from personal tax in her medical corporation and investing it. Now, 12% of the total deferred income since 1986 would be subject to a one-time tax in the US. That may be a significant US tax bill.

It is unclear what, if anything, will be enacted. However, US citizens in Canada – particularly those that own a business – should pay close attention as their tax situation could get significantly worse. Renouncing US citizenship may become an increasingly attractive option.

Even renouncing citizenship can be an expensive hassle, as tax lawyer Robert W. Wood recently wrote in Forbes:

Ironically, leaving America can be costly. America charges $2,350 to hand in your passport, a fee that is more than twenty times the average of other high-income countries. The U.S. hiked the fee to renounce by 422%, as previously there was a $450 fee to renounce, and no fee to relinquish. Now, there is a $2,350 fee either way. The State Department said raising the fee was about demand and paperwork, but the number of American expatriations kept increasing. Moreover, to exit, one generally must prove 5 years of IRS tax compliance. And getting into IRS compliance can be expensive and worrisome.

The news on FATCA is not 100 percent horrible, though. Even as Congress fails to deliver on its basic promises, the Treasury Dept. of all places is contemplating potential relief. In a little-noticed report last month in response to President Donald Trump's request for rolling back tax regulatory burdens, Treasury Secretary Steven Mnuchin included FATCA in a list of potential targets for reform:

Treasury is committed to reducing complexity and lessening the burden of tax regulations. In response to Executive Order 13789, Treasury's Office of Tax Policy completed a comprehensive review of all tax regulations issued in 2016 and January 2017. The June 22 Report identified eight proposed, temporary, or final regulations for withdrawal, revocation, or modification. Treasury continues to analyze all recently issued significant regulations and is considering possible reforms of several recent regulations not identified in the June 22 Report. These include regulations under Section 871(m), relating to payments treated as U.S. source dividends, and the Foreign Account Tax Compliance Act.

If Mnuchin moves on FATCA, it would almost certainly come in the form of mild regulatory tweaking, since the executive branch can't just go around undoing laws. But it would certainly fit a pattern: If you want to see real moves on regulatory reform, look to the White House, not Congress.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

The GOP tax reform bill seems to be appalling. It doesn't seem to cut taxes for anyone. Sure it cuts corporate taxes but corporations don't pay taxes. They collect them. Meanwhile, it seems to completely fuck anyone who has a job or owns anything in the name of "fairness" and simplification. The GOP's idea of simplifying the tax system seems to be "fuck you pay me".

What an utter fail. They should just give it up and report that they are too incompetent and poorly led to pass any meaningful legislation.

Matt seems to forget that there are Tax Agreements between civilized countries. Citizens paying tax in foreign countries can mitigate their US taxes. This also applies to non-US citizens resident in the US as I know as a (ex) Brit living in the US. Thanks to the Guardian expose of off-shore 'savings' by US folks that resulted in the outcry for declarations.

Per the comments on this 'site' regarding the alleged impact of US folks avoiding the tax regime; those who believe they are winning must be in countries that do not have a Dual Taxation Treaty, or they have an advisor who is 'a rogue'.

In either case ....

Civilized countries don't impose taxes.

Start earning $90/hourly for working online from your home for few hours each day... Get regular payment on a weekly basis... All you need is a computer, internet connection and a litte free time...

Read more here,,,,, http://www.onlinecareer10.com

Large businesses ? defined as those with more than 50 employees ? must comply by 2021. Mid-sized businesses, with 11 to 50 employees, must pay the wage by 2023. Small businesses ? those with 10 or fewer employees ? have until 2024.

"WHEN DO WE WANT IT?!"

Reply to Juice, below.

*** gets coffee ***

You spent the first comment of the thread well, Johnowan.

Congratulations John, at least you understand that product pricing reflects cost of the business. So you will appreciate that reduction of those cost elements will at least defer price increases.

Cut-and-runners have no place in this country. You want to get out? Fine, but you're not taking our American dollars with you. If you don't like it, you can GET OUT.

I don't have to sit here and take this verbal abuse, I'M OUTTA HERE.

Cut-and-runners have no place in this country. You want to get out? Fine, but you're not taking our American dollars with you. If you don't like it, you can GET OUT.

And don't even think about bringing any of that American music back with you

FATCA has nothing to do with American income. It taxes Canadian income legitimately made in Canada and on which US citizens abroad pay Canadian taxes. You move to Canada, you make income IN Canada , you pay taxes TO Canada. ONLY in the US do they claim that you also owe taxes to the motherland. Double taxation and without representation, since US citizens abroad do not have anyone in Congress representing them as regards US imposition of claims on them. And US citizens living abroad have NO claim on US services.

If you don't like it, you can GET OUT.

After paying the $2,350 fee, of course.

That's right. If you don't like armed robbery with excessive force, we don't want you here.

And make sure you convert your toilet paper, er, American dollars to something of actual value before you take it with you.

Where is the Rand Paul coverage? I want to say something about his lawn maintenance compared to his hair maintenance. Thanks.

Yes Tony, you love leftist violence. You don't have to remind us.

Oh I just knew you nutbags would make this a thing.

Paul was almost murdered by one leftist and now has been attacked by another. You think it is a joke because you are a leftist and murder and violence is your move.

Might as well throw all leftists into camps, just to be safe.

That is where you rightwing fucknuggets are going with all this horseshit I read every single day amid calls for black genocide etc., right?

It's okay, I don't expect rightwing fascists to be original. That's not the point of it.

That is where you rightwing fucknuggets are going with all this horseshit

That's uncharacteristically generous of you.

Tony reads calls for black genocide every day. That says a lot more about Tony than it does about anybody here.

We're trying to deport you lefties and make the constitution so strong you cannot possibly win with socialists, so you leave.

Get all your friends to pack up and leave.

Well, since fascism is a left wing ideology, then the genocide is on you. Just like before.

Yes, the most important characteristic of those two nutjobs is that they are leftists. Not that they are nutjobs. Just like the most important characteristic of Damon Root and the Charlottesville car rammer are that they were righties, and not that they were violent assholes.

So a guy goes to Washington for the purpose of murdering the GOP majority in Congress and shoots 8 people in the process of trying to do that and it is just one of those things? It has nothing to do with politics?

I guess people who did the lynchings in the South were just nutjobs and it had nothing to do with race. Do you think that?

Jesus fucking Christ you are stupid. I mean seriously, you are epically stupid and dishonest.

Oh John, you will never understand naive set theory.

Damon Root killed somebody?

But anyway, if John wants to know about naive set theory, he will read your mind and tell you what to think about naive set theory.

Whatever that church shooter's name was. You know who I meant, obviously not the Reason contributor, who is, though, by the way, probably and unfortunately, related to Wayne Alan Root.

Ugh, I tried to make a set joke, but latex didn't work. I know you can't give us an edit button, but you Reason fuckers KNOW that we can barely live without a latex compiler.

REASON

Good thing that gated community put up that gate to keep the immigrants out.

Someone needs to extremely vet the doctors wanting to move into the neighborhood.

I'm sure we all can't wait to see what bitchy, unclever turn of phrase you've dredged up from the tepid roadside ditch of your mind.

All of Tony's anger comes from being rejected for a writing job at Mad Magazine 30 years ago.

I'm not angry, it's just that most other comments boards won't let me say fuck, so I have to get it out here.

Other boards?

It's not the swearing that makes you seem like a bitter and angry individual.

No, you really don't.

The fuck you do.

Mad? No, Tony's more of a Cracked guy. The original, desperately unfunny dead-tree Mad ripoff - not the pretty good pop culture website or the crappy performative wokeness clearinghouse it became.

You mean to tell me the GOP campaigns on a small-government platform and governs on the same greedy-pig platform as the Democrats? God help me, I hope they've got a program for subsidizing fainting couches and clutching pearls because I'm gonna need a shitload of both.

Montgomery County Council unanimously approves $15 minimum-wage

The people that make up the council (if I'm not mistaken) have altogether zero business experience among them. I don't think they realize that this will certainly drive at least a few marginal businesses into insolvency and eventual closing. It will almost certainly result in reduced hours and a few layoffs here and there. But, they do what will get them re-elected, and folks around here will definitely take this as a positive thing they've done.

Fuck. This is definitely going to negatively impact my restaurant excursions into the People's Republic of Maryland (which is one of the few reasons to go there).

Think of the money you will save by avoiding the speed cameras. Fuck Montgomery County. Maryland should have given it to DC (along with PG) when it was founded.

When the restaurant scene in Montgomery County goes to shit, and it will, that will just be bad luck. God these people are fucking morons.

It's an affluent county, John. The homies will take care of their own.

I just love all the people who applaud these people because they think they are protesting Trump, when in reality it's mostly wealthy people who don't want to pay their taxes.

-1 Tina Turner

The fact that your brain coughed up Tina Turner before Willie Nelson speaks volumes about you.

Willie's not a tax exile. Tina's been a Swiss citizen since 2013.

Willie Nelson renounced his citizenship?

What is Wesley Snipes, chopped liver?

Well since the discussion's about rich people who relinquished their US citizenship to avoid paying taxes, it makes sense that he's more likely to think about Tina Turner than Willie Nelson or anyone else who didn't do that.

Huh:

Wonder how that works, 'cause his fans handing his possessions back to him is income.

No, it's not. The "income" is whatever they paid for the items which is what he'd have to pay taxes on. Keeping the possessions he already owned isn't income but it might affect how much of the bid amount is taxable. Example: if I pay $100 for an item and auction it for $200, then I pay taxes on the $100 difference between the cost to me for the item and what I earned in the auction. But if the person who buys it pays me the $200 and lets me keep the item, then my cost for the item (as far as the auction was concerned) is zero so I have to pay taxes on the full $200 that was paid for it.

After all, both promises are right there in the 2016 Republican Party Platform

Matt, Matt -- what year is this?

It is not tax reform it is a tax increase, but watch liberals that are for higher taxes argue against it anyway 'because Trump' and watch Republicans be for it 'because Trump'.

They have gone full retard. Don't mistake that for peak retard though, because there is no such animal outside of death.

Trump's whole appeal is based on keeping as many people as possible out of America, so why would he change the laws that actually help to accomplish that goal?

Zing

So the alt-right should have voted for Hillary, because she would have made the country even less desirable for immigrants.

Yeah, but they were hypnotized by Pepe.

So why on earth does the Republican Party's opening bid for tax-code overhaul not include the end of worldwide income taxation on U.S. citizens (even if they live and earn their money abroad), nor repeal of the odious Foreign Account Tax Compliance Act?

Because they need Democrats on board to pass it?

If you were born to an American parent (or in the U.S. proper) but have lived and worked the bulk of your life elsewhere, the Internal Revenue Service still has a claim on your salary, even though you consume zero government services.

You call having correspondence from the IRS delivered to you overseas "zero government services"?

More socialism=more brain drain. Ayn Rand yelling "I told you so" from the grave.

I'm confused! The most Libertarian bill in decades which basically says "Here are your tax rates and government isn't going tell/influence you how to live your life" is getting destroyed by what is supposed to be a Libertarian news outlet??? What am I missing here?

Taxes are going up for a lot of people.

No, they're really not. I have 3 letters for you: AMT.

It isn't favorable for beltway, NY, and CA property values. Such a shame.

If you were born to an American parent (or in the U.S. proper) but have lived and worked the bulk of your life elsewhere, the Internal Revenue Service still has a claim on your salary, even though you consume zero government services. That's just wrong, and should be stopped.

FTFY

The real fun part is when I come back to the states and tell people about this, no one believes me. This is a non issue outside of libertarian circles. And Canada just shrugged about the violation of charter rights.

Not that I'm going to become a Canadian citizen. I'd have to swear to some (german) british lady and while I mean her no harm, I'd really rather not.

Anyway, I'm so damned glad reason writes about this nonsense. It makes me feel a little less forgotten.

Jacqueline Bugnion provides a succinct explanation for the soaring renunciation numbers-

Americans abroad are renouncing because their local banks (foreign banks for the US) refuse to deal with them due to FATCA, because FBAR reporting requirements on accounts over which they have just signature authority block them from career opportunities, because the cost of compliance is a multiple of that for US residents due to the complicated international filing, because the tax code leads to double taxation and taxation on phantom capital gains, - in sum because the law is unjust and discriminatory against Americans abroad.

Comment from Norman Diamond:

"I guarantee that America's founders would have renounced or rebelled a long time ago if they were expats today."

America's founders got to be America's founders because they sure did renounce and rebel.

Could you wake us up again when the number renouncing is actually meaningful? Like maybe 1.5% instead of 0.0015%?

Help me out here; if someone wants to denounce their citizenship, and does so, how is there an issue for either the federal government or the citizens who remain?

I thought Libertarianism allowed for individual choices?

very nice information you share with us. thanks

How to create PPC campaign for tech support