Americans Keep Setting New Records for Renouncing Citizenship, and Tax Reform Threatens to Make it Worse

The House bill fails to put an end to global income taxation and the Foreign Account Tax Compliance Act, though the Treasury Dept. may provide some regulatory relief on the latter

One of the biggest arguments in favor of tax reform is that it's an opportunity to get rid of bad laws and human-harming regulations that virtually no non-self-interested observer can defend with a straight face. A welcome fix in the House's current tax-reform package, for example, is the removal of bonds for the construction of professional sporting stadia from the tax-exempt status granted to municipal bond-finance of actual infrastructure.

So why on earth does the Republican Party's opening bid for tax-code overhaul not include the end of worldwide income taxation on U.S. citizens (even if they live and earn their money abroad), nor repeal of the odious Foreign Account Tax Compliance Act? After all, both promises are right there in the 2016 Republican Party Platform:

The Foreign Account Tax Compliance Act (FATCA) and the Foreign Bank and Asset Reporting Requirements result in government's warrantless seizure of personal financial information without reasonable suspicion or probable cause. Americans overseas should enjoy the same rights as Americans residing in the United States, whose private financial information is not subject to disclosure to the government except as to interest earned. The requirement for all banks around the world to provide detailed information to the IRS about American account holders outside the United States has resulted in banks refusing service to them. Thus, FATCA not only allows "unreasonable search and seizures" but also threatens the ability of overseas Americans to lead normal lives. We call for its repeal and for a change to residency-based taxation for U.S. citizens overseas.

The United States is the only country besides Eritrea to tax the income of its non-resident citizens. If you were born to an American parent (or in the U.S. proper) but have lived and worked the bulk of your life elsewhere, the Internal Revenue Service still has a claim on your salary, even though you consume zero government services. That's just wrong, and should be stopped.

Meanwhile, FATCA-repeal bills were introduced in both chambers of Congress back in April by Freedom Caucus Chair Rep. Mark Meadows (R-N.C.) and Sen. Rand Paul (R-Ky.), but both have yet to move beyond committee. The Republican Party has controlled Congress since January 2015, yet can't screw up the courage to deliver a simple repeal of a lousy law.

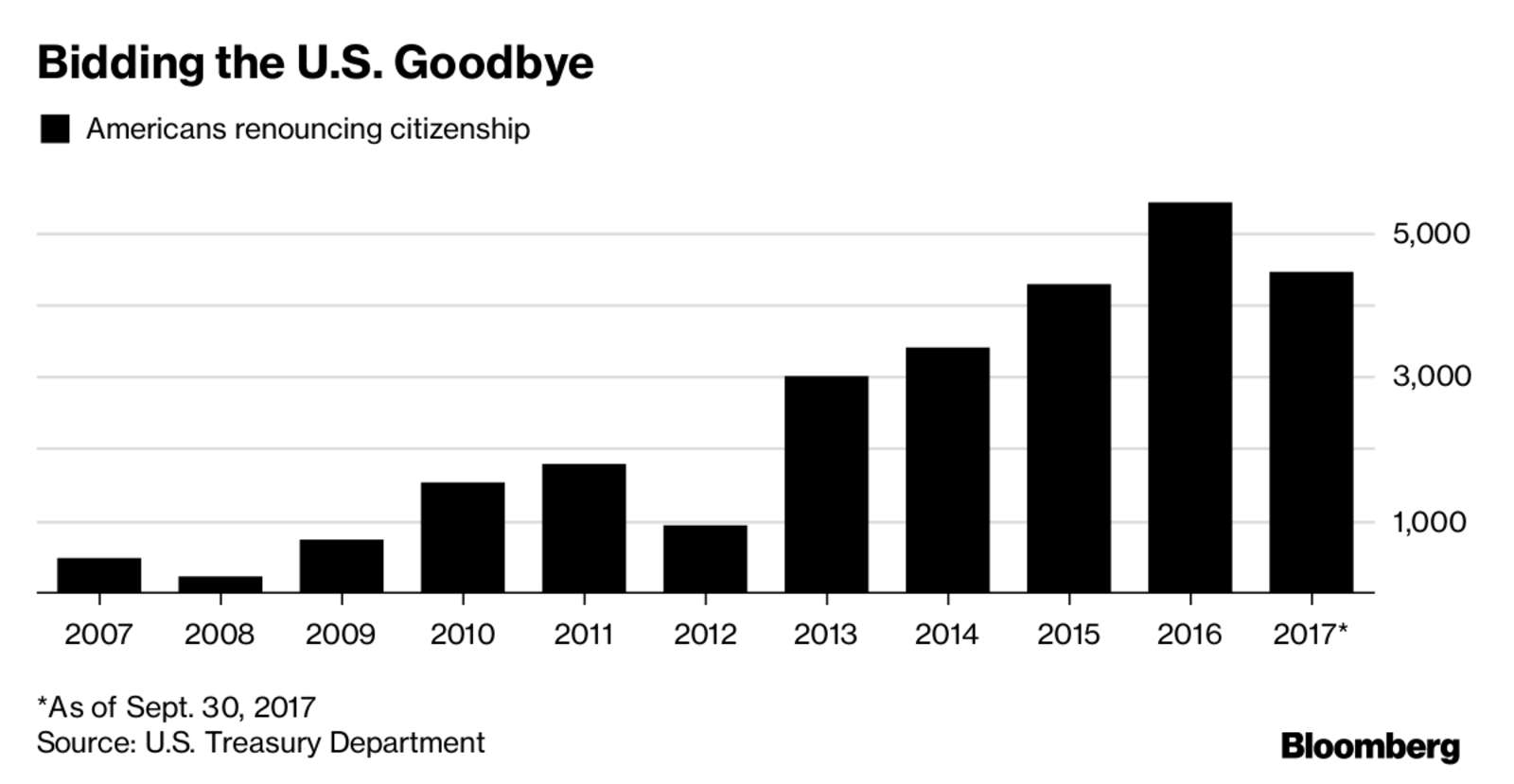

With each passing day of inaction, the number of Americans renouncing their own citizenship rather than deal with the ridiculously onerous and punitive tax-filing requirements continues to set new records. Last week, the Treasury Department came out with its quarterly name-and-shame list, putting the 2017 tally of passport-burners at 4,448. At that pace we should break last year's record of 5,411 by just after Thanksgiving. Congratulations, America!

Not only does the tax reform proposal thus far fail to provide any relief to the estimated 8.7 million Americans living abroad (who are routinely shut out of financial institutions, since foreign banks don't exactly enjoy playing errand-boy to the I.R.S.), it may rub salt in the wound. Max Reed, a cross-border tax lawyer in Vancouver, Canada, who writes frequently and well about such issues, says "it will make matters worse for some US citizens in Canada and keep it the same for others."

Some of Reed's preliminary findings:

* New punitive rules that apply to US citizens who own a business. Currently, most US citizens who own a Canadian corporation that is an active business don't pay tax on the company's profits until they take the money out. The House plan changes this. It imposes a new, very complicated, set of rules on US citizens that own the majority of a foreign corporation. The proposal would tax the US citizen owner personally on 50% of the entire income of the Canadian corporation that is above the amount set by an extremely complex formula. At best, this will make the compliance requirements for US citizens that own a business extremely complicated and expensive. At worst, this will cause double tax exposure for US citizens who own a Canadian business on 50% of the profits of that business.

* Imposition of a 12% one-time tax on deferred profits. Under the new rules, the US corporate tax system is transitioning to a territorial model. As part of this transition, the new rules impose a one-time 12% tax on income that was deferred in a foreign corporation. Although perhaps unintentional, since US citizens will not benefit from a territorial model, the new rules impose a 12% tax on any cash that has been deferred since 1986. Take a simple example to illustrate the enormity of the problem. A US citizen doctor moved to Canada in 1987. She has been deferring income from personal tax in her medical corporation and investing it. Now, 12% of the total deferred income since 1986 would be subject to a one-time tax in the US. That may be a significant US tax bill.

It is unclear what, if anything, will be enacted. However, US citizens in Canada – particularly those that own a business – should pay close attention as their tax situation could get significantly worse. Renouncing US citizenship may become an increasingly attractive option.

Even renouncing citizenship can be an expensive hassle, as tax lawyer Robert W. Wood recently wrote in Forbes:

Ironically, leaving America can be costly. America charges $2,350 to hand in your passport, a fee that is more than twenty times the average of other high-income countries. The U.S. hiked the fee to renounce by 422%, as previously there was a $450 fee to renounce, and no fee to relinquish. Now, there is a $2,350 fee either way. The State Department said raising the fee was about demand and paperwork, but the number of American expatriations kept increasing. Moreover, to exit, one generally must prove 5 years of IRS tax compliance. And getting into IRS compliance can be expensive and worrisome.

The news on FATCA is not 100 percent horrible, though. Even as Congress fails to deliver on its basic promises, the Treasury Dept. of all places is contemplating potential relief. In a little-noticed report last month in response to President Donald Trump's request for rolling back tax regulatory burdens, Treasury Secretary Steven Mnuchin included FATCA in a list of potential targets for reform:

Treasury is committed to reducing complexity and lessening the burden of tax regulations. In response to Executive Order 13789, Treasury's Office of Tax Policy completed a comprehensive review of all tax regulations issued in 2016 and January 2017. The June 22 Report identified eight proposed, temporary, or final regulations for withdrawal, revocation, or modification. Treasury continues to analyze all recently issued significant regulations and is considering possible reforms of several recent regulations not identified in the June 22 Report. These include regulations under Section 871(m), relating to payments treated as U.S. source dividends, and the Foreign Account Tax Compliance Act.

If Mnuchin moves on FATCA, it would almost certainly come in the form of mild regulatory tweaking, since the executive branch can't just go around undoing laws. But it would certainly fit a pattern: If you want to see real moves on regulatory reform, look to the White House, not Congress.

Show Comments (70)