American Companies' Bad Tax Deal

The United States' corporate income tax needs a makeover.

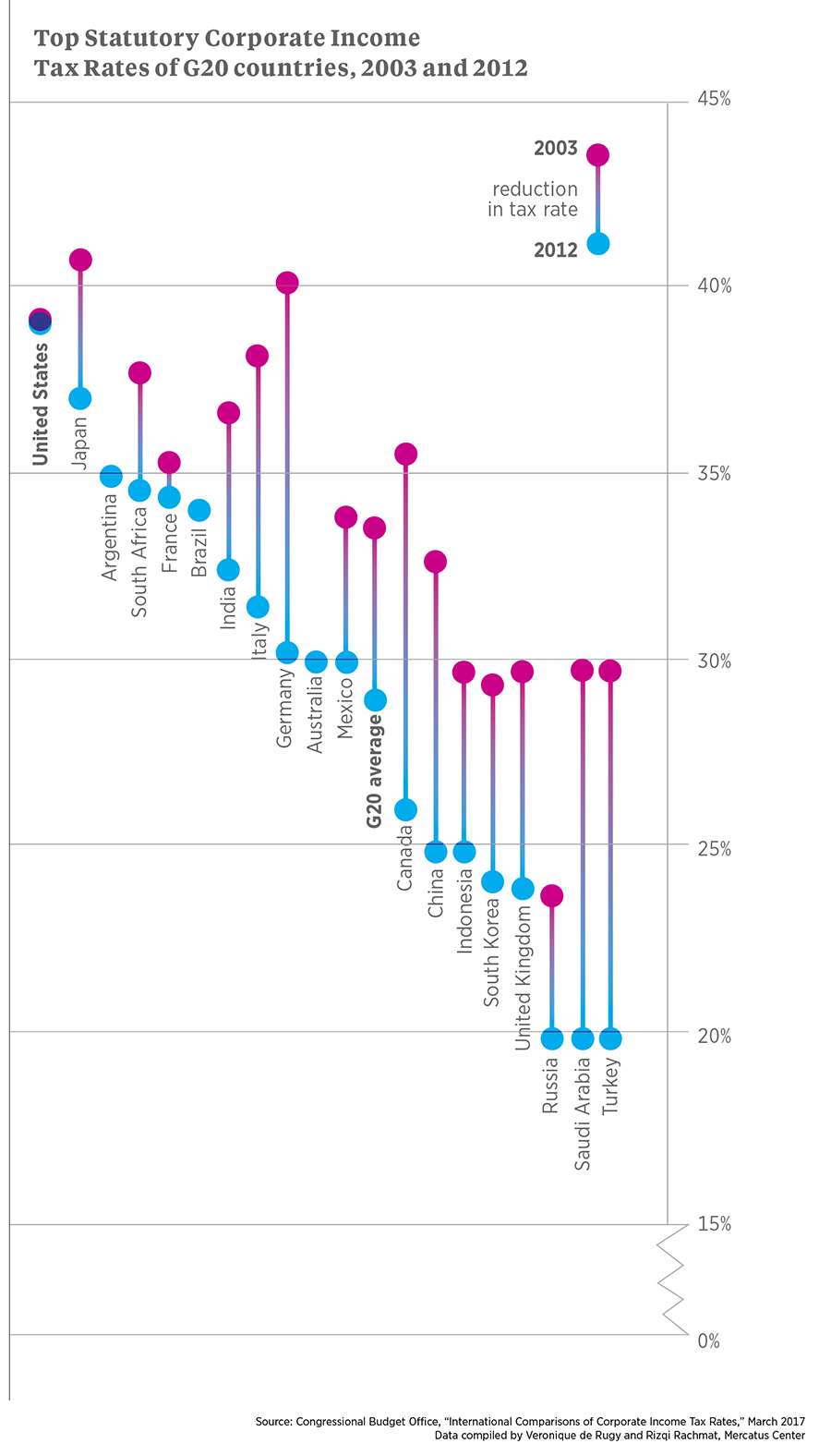

It's not just that Uncle Sam tries to take a piece of all corporate income, including money earned (and therefore taxed) in other nations. It's not just that America's top statutory rate is higher than in all other countries in the Organization for Economic Cooperation and Development (OECD). (According to the Congressional Budget Office, it currently stands at 39.2 percent including state levies; Trump has proposed a significant reduction in the federal rate, but prospects look weak.) It's that over the years, American companies have seen other governments reform their tax systems while the U.S. has done almost nothing to fix ours.

This chart shows the evolution of top statutory corporate tax rates (combining taxes at all levels of government) from 2003 through 2012 in the so-called Group of 20—some 19 developed countries plus the government of the European Union. At the start of that period, a few places had higher rates than the United States. Not anymore.

The consequence is that U.S. companies must compete against foreign entities that enjoy a lower cost of doing business. Those earning income elsewhere can avoid being double-taxed by keeping that income overseas. But this reduces their freedom to make business decisions on the merits, forces them to spend money on tax avoidance techniques rather than investing it, and keeps those dollars out of the pockets of American consumers.

This article originally appeared in print under the headline "American Companies' Bad Tax Deal."

Show Comments (1)