The Hidden $700 Billion Debt Owed to Public Workers

The state pension mess is even worse than you think.

States collectively owe more than $1 trillion in pension benefits to current public workers and retirees, but that oft-cited figure does not include the cost of other retirement benefits for government workers and public school employees.

That's largely because states don't bother accounting for their so-called "Other Post-Employment Benefits," or OPEB, costs in the same way that they do for pensions. Instead of putting money away year-after-year to pay for those liabilities, most states fund OPEB costs on what accountants call a pay-as-you-go basis, meaning that revenue is appropirated from the state budget each year to meet those needs. The majority of OPEB is in the form of health care benefits, including retiree health insurance and other expenses like dental, vision, life, and disability insurance.

States paid more than $20 billion towards OPEB costs during 2015, according to a new analysis from the Pew Charitable Trusts. That sounds like a lot of money, but it's really just a drop in the bucket compared to the estimated $692 billion owed to public workers over the next few decades.

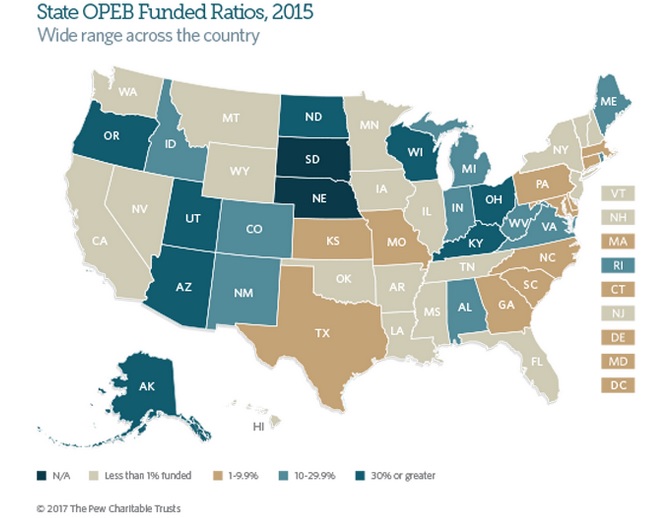

Some states have done better than others when it comes to keeping up with OPEB costs, but only six states (Alaska, Arizona, North Dakota, Ohio, Oregon, and Utah) have set aside more than half of the the assets necessary to meet thier long-term OPEB obligations, according to Pew's analysis. By comparison, 30 states have less than 10 percent of the necessary savings.

Think about it like this. Much like pension costs, OPEB costs are a long-term thing. When a state government hires a new worker, or a school district brings in a new teacher, the employer (the government) has a number of years to save-up for the eventual retirement of that employee. How much those retirement benefits—pensions and OPEB—will cost varies from employee to employee, but actuaries do a pretty good job of predicting costs in the aggregate. Based on those projections, actuaries come up with an "annual required contribution," which is exactly what it sounds like, except governments often ignore the "required" part.

The ARC is the equilavelnt of a miniumum payment on a credit card bill. Pay this much every year and you'll meet the obligations that you owe. A large part of the reason why so many states are underwater in pension payments today (though not the only reason) is that they ignored those ARC payments for years. Just like what happens if you fail to make your minimum credit card payments, the result is that the bills got bigger and more expensive.

When it comes to OPEB, most states don't even pretend to care about the ARC payments. That's why things are getting worse, not better. Compared with the same survey in 2014, Pew found that 31 states saw their OPEB liabilities grow during 2015. Even though states paid about 6 percent more towards those costs in 2015, the overall liability grew by better than 5 percent.

That's a worrying tragectory. Many states are already struggling to fund their pension promises, which are eating away at parts of state budgets meant to fund schools, roads, social services, and more. Because most states fund OPEB costs directly from state budgets, the lack of long-term savings threatens to cause more budgetary pain.

Like in Connecticut, for example. Last year's state budget (the current state budget is still being hammered out) projected $731 million to cover health care costs for retired state employees in 2017, compared to just $698 million for the health care costs of current employees.

Because Connecticut failed to save-up for the long-term costs of their retirees, state taxpayers are now paying more money to cover the costs of people who aren't providing any government services—because they are retired—than for people who actually are.

Show Comments (45)