The Hidden $700 Billion Debt Owed to Public Workers

The state pension mess is even worse than you think.

States collectively owe more than $1 trillion in pension benefits to current public workers and retirees, but that oft-cited figure does not include the cost of other retirement benefits for government workers and public school employees.

That's largely because states don't bother accounting for their so-called "Other Post-Employment Benefits," or OPEB, costs in the same way that they do for pensions. Instead of putting money away year-after-year to pay for those liabilities, most states fund OPEB costs on what accountants call a pay-as-you-go basis, meaning that revenue is appropirated from the state budget each year to meet those needs. The majority of OPEB is in the form of health care benefits, including retiree health insurance and other expenses like dental, vision, life, and disability insurance.

States paid more than $20 billion towards OPEB costs during 2015, according to a new analysis from the Pew Charitable Trusts. That sounds like a lot of money, but it's really just a drop in the bucket compared to the estimated $692 billion owed to public workers over the next few decades.

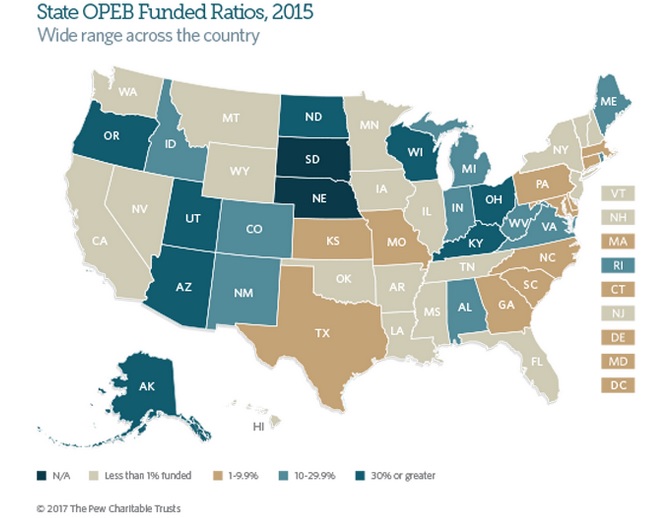

Some states have done better than others when it comes to keeping up with OPEB costs, but only six states (Alaska, Arizona, North Dakota, Ohio, Oregon, and Utah) have set aside more than half of the the assets necessary to meet thier long-term OPEB obligations, according to Pew's analysis. By comparison, 30 states have less than 10 percent of the necessary savings.

Think about it like this. Much like pension costs, OPEB costs are a long-term thing. When a state government hires a new worker, or a school district brings in a new teacher, the employer (the government) has a number of years to save-up for the eventual retirement of that employee. How much those retirement benefits—pensions and OPEB—will cost varies from employee to employee, but actuaries do a pretty good job of predicting costs in the aggregate. Based on those projections, actuaries come up with an "annual required contribution," which is exactly what it sounds like, except governments often ignore the "required" part.

The ARC is the equilavelnt of a miniumum payment on a credit card bill. Pay this much every year and you'll meet the obligations that you owe. A large part of the reason why so many states are underwater in pension payments today (though not the only reason) is that they ignored those ARC payments for years. Just like what happens if you fail to make your minimum credit card payments, the result is that the bills got bigger and more expensive.

When it comes to OPEB, most states don't even pretend to care about the ARC payments. That's why things are getting worse, not better. Compared with the same survey in 2014, Pew found that 31 states saw their OPEB liabilities grow during 2015. Even though states paid about 6 percent more towards those costs in 2015, the overall liability grew by better than 5 percent.

That's a worrying tragectory. Many states are already struggling to fund their pension promises, which are eating away at parts of state budgets meant to fund schools, roads, social services, and more. Because most states fund OPEB costs directly from state budgets, the lack of long-term savings threatens to cause more budgetary pain.

Like in Connecticut, for example. Last year's state budget (the current state budget is still being hammered out) projected $731 million to cover health care costs for retired state employees in 2017, compared to just $698 million for the health care costs of current employees.

Because Connecticut failed to save-up for the long-term costs of their retirees, state taxpayers are now paying more money to cover the costs of people who aren't providing any government services—because they are retired—than for people who actually are.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

public employees, the gift that keeps on sucking...

I'm making over $7k a month working part time. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life.

This is what I do... http://www.startonlinejob.com

Those Obamacare death panels don't look like such a net negative anymore, now do they?

I can't tell, whomever generated that infographic must be exceedingly close to collecting on their publicly funded pension(s).

I have the solution. Let the government throw a bunch of money at it. Unborn children 100 years from now can deal with it right?

i have a better solution; as soon as people can no longer perform gainfully as employees, let's throw them out in the cold and let them rot, so as not to squander any money that could have been better spent on wars and corporate pork

Your state declares war and you want us to pay for it?

Let's throw them out in the deserts of the Middle East. They can form a new union and rot our enemies from the inside.

The pilgrims formed a socialistic society, Plymouth Colony, based on "from each according to his ability, to each according to his need". There was no war or business subsidy. Therefore when it failed and all were on the brink of starvation, the socialists couldn't blame capitalism, becasue it didn't exist.

Goveror Bradley threw out the charter (the economic plan) and told all to work for themselves, save themselves from starvation, like a bunch of selfish, greedy bastards. They couldn't rob each other, all were broke. No wealth existed, only abject poverty, thanks to the previous socialism (sort of like the USSR after 74 years). So they worked their plots for themselves, not the community, and got to keep the fruits of their labor, without taxation or regulation. It was economic anarchy. No rules existed. This desperate, last ditch attempt to trust individuals with their own lives was (from a govt. view) chaos.

Within a few years, so much produce existed, the colony threw a big party and invited all the natives. It was later dubbed "Thanksgiving". And economists called the govt. approach of "hands off workers" capitalism.

Should have talked about income compared to the private sector. In CN, for example, the state would save 1.5 to 2.5 billion dollars a year if they simply paid salaries and benefits comparable to the private sector.

http://www.yankeeinstitute.org.....equal-pay/

What happened to the idea that public service paid less but was a more stable, less demanding job with good benefits? Now they get more money, more stability, better benefits, with a less demanding job.

Democrats happened.

Seriously, you have to wonder when the American people are going to wake up and realize that a meltdown is coming. In a few years when every state is bankrupt and there's nothing left to pay all those useless bureaucrats, who will take them in and feed them?

Are you sure about that? Some of the states with the highest percentage of government workers are red states.

http://www.businessinsider.com.....nebraska-1

Top four public employee jobs, plus #6, are teachers and their assistants.

It's for the children.

And that's true for a few places (NY, CA, NJ, CT, WI), but in the rest of the country teacher pay and compensation is significantly below private sector pay for college graduates. A starting teacher in NV with a family of four qualifies for food stamps.

Hmm, it sounds like MediSomething-For-All would cure this problem.

How?

Must be fun giving away other people's money.

"...other people's money."? Yes, a little. But most of the money is the government's, the money of TPTB, the ruling elite. They didn't earn it or deserve it, but they got it becasue most people forfeited their sovereignty to rulers, self-enslaved. When they did so their lives and the wealth they create became the property of their rulers.

I didn't forfeit my sovereignty but I am dragged down, exploited, robbed (taxed) as well. So the state is spending my money along with their own, thanks to the majority, and will ruin all. It's what has happened for millenia. And it will continue until enough wake up and stop supporting coercion.

Only a voluntary society is moral/practical. Then we will achieve security, peace, and prosperity.

What's the big deal? The Feds can just pick up the tab for these deadbeat states. So the debt will go from $20T to about $22T overnight. To a prog, that's just Monopoly money. I even saw a commenter here recently arguing that government debt is completely meaningless.

This is the ultimate truth of all of this obvious hell that is looming.

The US gov't in collusion wit the FED will engineer more QE and money printing and devaluation of the debt until one day it all collapses in a spectacular market crash and asset deflation that takes a decade to stabilize. Depression will be certain.

The only question left is whether the FED/ US Gov't debt charade can last for 20 more years because China, The ECB, and BOE are all playing the exact same game or, will there be a trigger event like another housing collapse that starts it soon. It might take a government stalemate in DC, it could be a volcanic eruption in some far off place that halts commerce for some time. .

I WOULD ARGUE THAT THE WORLD HAS NOT BEEN THIS DANGEROUS SINCE ABOUT 1933-38.

C'mon, Tony is just misunderstood....

If only we could get Tony to be our president. Then he would do socialism correctly.

Not to nitpick too much, but governments don't "save" money, they just steal more than they spend.

Carry on.

They spend more than they steal. They steal a ton on top of that. That's how f*cking stupid these bureaucrats are.

At least the mafia can run a balance book.

Tough luck public employees. Ignorance is bliss until you get f*cked by the government too.

I wish I could feel sorry for these people but I can't. When you repeatedly support statists and Marxists, you get what you deserve.

The coming riots are going to make Greece look like the 92 LA Riots. Tame in comparison to what these union animals and moronic public sector zombies will do.

We are going to see hostages taken, wanton murder in the streets, looting of entire upscale neighborhoods, and assault/rape of untold horror.

The police will sit back. Mix disgruntled union scum with welfare scum and savage thugs in the street. This is going to make Baltimore look like a hockey fight.

John Mauldin wrote another fascinating article on this Monday. This is but one more huge yoke around the neck of the American economy.

There is no fixing this mess. I just hope to not be collateral damage.

If you are not armed for increased crime, you should be.

Hopefully the robotic revolution will be able to produce enough wealth to afford drugs to keep all of the savages high all the time. that includes most government workers.

States should have it in their constitutions that all remuneration to public employees has to be defined contribution from that year's budget. No more getting elected by writing checks that future generations have to cash.

This has terrible implications for understanding how much of GDP government controls.

Borrowing is merely deferred taxation. Every cent of government debt must be recognized as a current expense.

And each annual increase in the various deficits must be added to total GDP arrogated.

The commonly repeated shares 25% federal / 15% state & local are thus understated.

None of this begins to address the further costs of unfunded mandates, regulation, compliance, and distortions of health care. Nor the value of information lost from distortion of market pricing mechanisms. Yes we can quantify that thanks to Claude Shannon.

"No, Robert, tell us how you REALLY feel..."

Pay employees their full pay and let them choose to who and how much of their pay goes to their medical insurance, workers' compensation insurance, unemployment insurance, pension fund and long-term care fund.

Stop letting companies, unions, cities, states and federal government mismanage and underfund promised benefits.

Liberate the paychecks of hard-working Americans from the convoluted tax code and dictates of politicians on how to save for retirement.

Abolish the income tax, tax code and IRS.

Since the whole retirement scam is forced by unions I think you kind of answered your own question. I recently had the misfortune of seeing a local teachers union be proud of getting the workers a tiny raise, but in doing so they also allowed an increase in retirement deductions that zeroed out the raise. Most union workers only touted how wonderful the unions were for getting that raise.

You're missing the much bigger part of the story. The estimates of liabilities are based on VERY unreasonable expectations of returns (usually 7-8% annually). A more realistic estimate of returns gets the liabilities up to 2-4 trillion

http://www.mauldineconomics.co.....rm-warning

Thank you for being the only one to mention the real problem, historically low interest rates since the beginning of the great recession. Had interest rates returned to historical averages we'd have a much smaller hole. We'd still have a hole because, for some reason, TPTB decided copying the monetary policies of Japan's lost decade after the tech bubble burst.

I would like to note that from 1971 until 2001, 7-8% returns were reasonable. Nearly two decades of poor fiscal and monetary policy got us in this mess. To make matters worse, it doesn't seem like there is anyone left in Washington that knows how to fix the mess and is willingly to go against popular belief.

The "real problem", the fundamental problem, is a system of institutionalized violence called govt. While you debate and argue over details of the results, society and the economy collapses. Study history. All this has happened in hundreds of so-called civilizations for millenia. But the faith in force remains. Civilations fall and the problem is not concieved. Therefore the solution, a voluntary system, is not tried.

"When will they ever learn?"

Why so many speling eorrrs?

So, states act like the federal government and people are mad about it? We allow the fed to run at a huge deficit and people just argue that we need to go even further into debt. Why do we as a nation force states to run on a budget and be responsible to the citizens, yet we allow the federal government to waste money left and right and still let them create more and more debt?

"...yet we allow the federal govt...."? How about "yet we allow govt.", any govt., on any level, to run our lives? Isn't that the fundamental problem? And worse, "we" (the majority) force "our" decision on the minority, denying the right of all to decide their fate, live their own lives without interference from anyone. That is immoral. That makes an immoral society. That is NOT a society that believes in rights.

I see govt. as self-enslavement. But that's the right of each person to forfeit sovereignty. It's a decision to embrace the myth, the superstition, the faith in force. But it's no one's right to force me to join them in their irrationality. I decline. I resist. And I am branded as anti-social, anarchist, an enemy of the state. I am not anti-social. I am anti-conformist. I do not believe in joining in the worldwide mutual suicide by superstition. I don't demand others join me. I don't threaten them if they don't. But they threaten me. They demand I join them. So I resist. I insist on my sovereignty. I am a voluntaryist.

I am not a whiz bang economist but seriously doubt our future monetarily stability. What I see is huge numbers of politicians doing whatever to get votes.

I didn't know about OPEB. You learn something new every day.

To place blame on Malloy, the governor of Connecticut, isn't entirely fair. It seems that his predecessors have some blame too. They probably knew we couldn't afford to pay for these pensions and benefits. Unfortunately they didn't do anything about it and now we are in this predicament. But Malloy has to know that we as a state cannot afford to pay for these pensions and benefits as they are right now. He's got to look at the numbers. He's got to look at the number of people leaving Connecticut. Same goes for other states in similar situations. These OPEBs and pensions are unsustainable in the long run.

It was Ella Grasso who started the downward spiral in CT. I lived there when she balanced the budget by lowering the pension contribution. She did it by changing the average number of years to retirement for state workers. That is the other factor in calculating pension funding. It doesn't get as much attention as interest rates but it can be even more telling. How many states do an actual calculation of average years to retirement or just guess at it like Ella didn't?

We should embrace a living pension system where our obligations to retired public employees garner the same respect that Ginsburg, Kagan, and Sotomayor have for the Constitution.

Indeed. Look at other uses of the word retired that may serve.

Moved to a warm climate and spending the remainder of their days leisurely soaking up the sun. Like the "retired airplanes in the Arizona desert. Don't forget the fence.

The fun part starts when we rationalize the retired units should be "caniblalized" for parts.

My wife quit her job working as manager at a small family owned grocery in 1983. She wanted "security" so she went to work for the state of CA. I told her she was crazy and couldn't trust govt., on any level. She ignored me. We married that year and she retired in 2009.

I predicted her pension would be worthless in 5 years. I was wrong, but it is losing value steadily every year. It is probably worth about 60%. However, more importantly, I was wrong about gold. It went up quadruple to $2K/oz. but how could I sell? Dollars don't hold value. Plus who would have predicted gold would plumet to about $1K/oz?

Bottom line: No monetary strategy will work as long as the $ is controlled by the govt. becasue everything is valued in dollars. What good is $Ten Thousand per oz. if the dollar is still the only accepted money and it is losing value faster than gold is rising? Currently, that is my situation. Gold is NOT going up commenserate with the dollar going down.

That will change you say? That's was the theory in 1970. I'm still waiting. But I now am too old to wait any longer.

As for the coming pension fund failures? Isn't that justice? Join the govt., trust it, and ignore the harm it does as long as you profit? How is that moral? How is it smart to trust a system that initiates violence? I have no sympathy for govt. employees. They made a decision to join the "dark side", work for the US Empire, not the rebel alliance.

Being from CA, it has been apparent for years that this "house of cards" was on track to collapse; and that only the idiots running things can't see it - or suffer from willful blindness.

Which is why I'm "from" CA, and residing elsewhere.

Why is Nevada listed as under 3% funding of OPEB when we don't have any OPBEs? As a teacher in NV, when I retire I get my pension and that's it.

These benefits, just like Social Security and Medicare, have always, and will continue to be, Ponzi schemes. None of them were ever going to work. They were only sustainable as long as there was a high rate of population growth.