This One Chart Will Fill You With Despair for Chicago

But it doesn't say what you think it says.

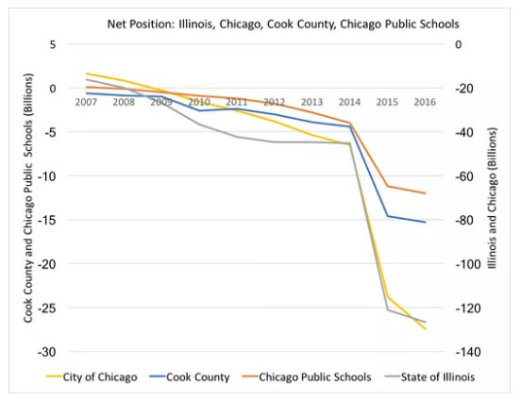

Residents of Chicago are technically on the hook for more than $250 billion in debt issued by four different government agencies (not including the federal debt, which is a whole 'nother ball of wax).

There's the city of Chicago, of course. But then there's also the Chicago Public Schools and Cook County, which includes Chicago and some surrounding suburbs. And, lastly, there is the state of Illinois. All four of these public entities are deep in debt, thanks largely to the pension promises made to public employees and decades of failing to meet those obligations.

Here's how it looks in one graphic from the latest Comprehensive Annual Financial Report, or CAFR, issued by the state, as highlighted by Mark Glennon at WirePoints Illinois, a state-based blog covering politics and economics.

If you're a resident of Illinois, and particularly if you are a resident of Chicago, avert your eyes:

The four colored lines on the chart represent the "net position" of those government agencies. That's a government accounting term for an annual snapshot of everything on a government's balance sheet.

It might be hard to believe, but there is actually a little bit of a good news here.

For starters, the chart doesn't say what it appears to be saying. Looking at this, you'd probably assume that something cataclysmic happened in the year 2015, sending those government balance sheets diving into the abyss. But there was no recession in 2015 or 2016.

Then, you might have glanced to the left-hand side of the chart, in an attempt to compare the precipitous drop-off over the last two years with the relatively modest decline experienced during the actual recession of 2008 and 2009. If the worst economic collapse of the past several decades barely made a dent in these balance sheets, then how could the comparatively good years of the mid-2010s cause such a crisis?

Contrary to what this chart shows, there was no inflection point in 2015. Illinois' and Chicago's budgets didn't get suddenly worse that year, they have been quite bad for a long, long time. What changed is how governments have to report their debt.

Prior to 2015, state and local governments commonly hid the long-term cost of their pension debt by keeping those details off their official balance sheets. Since pension costs are amortized (another fancy government accounting term that means "slowly paid over a long period of time") over decades, putting their value on a balance sheet requires making a number of assumptions about how quickly those debts will be realized. It's not impossible to do that, but there's a fair bit of disagreement about how to best make those assumptions.

Beyond that, there's a strong political incentive to keep those debts off-the-books so things appear better than they actually are. That happens in other ways too, like when Chicago Mayor Rahm Emanuel announced that the city was facing only a $114 million deficit next year, a figure that the Chicago Tribune says his office reached by ignoring several big ticket spending items like $70 million for hiring and training new police officers.

Starting in 2015, however, changes implemented by the Government Accounting Standards Board required states and localities to include pension debt on their balance sheets. That's why Illinois' and Chicago's finances suddenly look so much worse.

It's not that they got worse overnight. It's just that they are no longer allowed to hide those costs and pretend they don't exist.

That's the good news, such as it is. Governments are now forced to grapple with the reality of problems that have been growing in the darkness for a long time. As with many things, admitting you have a problem is the first step toward a solution.

Other costs are still off-the-books, though. As Bill Bergman of Truth In Accounting comments at Wire Points, governments "have yet to recognize retiree health care and other retirement benefits on the balance sheet, for example. We have a lot of ditch-digging ahead of us."

Those proverbial ditches will be filled in with taxpayer cash. Chicago passed a new tax on water and sewer service last year that will generate $240 million for pensions by 2020. Property tax hikes approved the previous year will generate an estimated $543 million in 2019 once they are fully phased-in, the Tribune reports. Meanwhile, Cook County passed a soda tax and Illinois lawmakers approved a 32 percent tax hike last month.

Pension costs cannot be hidden any longer. The bills are coming due. That's bad news for anyone living or working in Illinois, sure, but it's better than continuing to pretend that everything is just fine.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

whole 'nother ball of wax

Who say 'whole another ball of wax'? Who makes it even worse by shortening 'another' to ''nother'?

It sounds like you're a bit out of it, old man. All of us cool kids are saying "whole 'nother ball of wax." Kids love colloquial speech and candles.

"Whole other ball of wax" was good enough in my day. Now get off my lawn!

Repeat after me --- Pensions are a ridiculous concept and need to die. Pensions are a ridiculous concept and need to die. Pensions are a ridiculous concept and need to die.

They deserve to and should go bankrupt.

Public pensions are a ridiculous concept and need to die. If a private company wants to pay for pensions for its retirees, that's up to its leadership.

that sucks even for private employees. You get locked into their system, and they can pay you less. I know a nurse who hates her company, but hey only 7 more years til retirement and a pension!

You pays your money and you takes your choice.

I mean, sure I would take a 401k over a private pension if given the choice.

I happen to get both, and I'm happy as a clam about it. (Although I'm not retiring for 30+ years so I operate under the assumption that eventually they'll call it an outdated system and cash me out well before I use it).

Let's hope the company does not go bankrupt which could mean the nurse can get pennies on the dollar if PBGC kicks in.

Lack of portability, risk of bankruptcy make pensions a bad deal. Defined-contribution plans are a better deal for employees be it gobermint or private.

What are public employees supposed to do after they have aged out of the work force, just starve?

Not defending obvious abuse of the system such as not funding the retirement system and just kicking the can down the road.

Unless you plan to drop dead at age 65, you will need have a way to live.

They can put their money into a 401(k) or 403(b) like the rest of us.

If we want to protect stupid people, we can mandate that people need to put 10% of their salary, up to $20k, into some low-risk investments. That's roughly how many European pension plans work.

and that's worked out soooo well.

Yes, all those approaches to retirement work really well.

What makes you think otherwise?

Jesus Christ what a stupid question. They're supposed to save money.

You mean save dollars that are being inflated to oblivion?

The protection of pubsec unions is also enshrined in the state constitution of Illinois, so they are totally f*cked.

I tell two of my family members who within the last few years started working for Illinois Gov

The Illinois Constitution may say the pensions are guaranteed, but math will win in the end.

Australia's prime minister respectfully disagrees with you.

It's much easier to flee Chicago/Illinois than Australia. When the soul crushing debts begin to come due and taxes and fees go up so high to offset them that no one can afford to live there people will just move out of Chicago/Illinois and the whole place will crumble. Like Detroit, but worse.

But they will move to responsible locations and vote for the same policies and politicians that wrecked Chicago.

This a thousand times. I see that in Tennessee. People are moving to Nashville from those blue states and telling people how much smarter they are then those who live in rural areas because they, the newcomers, are more progressive. The Nashville mayor is from California and is a Democrat.

Progressives remind me of the Aliens from Independence day in that they drain all the resources from a place, strip-mining society, in the form of welfare and union payouts, then when there is nothing left they move on to a new city leaving a shriveled husk of a once great place behind (Detroit).

The main difference being the Aliens were honest about their intentions, the progs will smile and tell you it's for the collective well being and they're just trying to help.

The protection of pubsec unions is also enshrined in the state constitution of Illinois, so they are totally f*cked.

Knowing this and reading;

Made it seem like admitting you have a sucking chest wound is the first step toward the solution and/or that the sucking chest wound isn't the final step toward solving a 'You' problem.

Lots of people on the government payroll and legacy costs of retiring after 30 with pension and benefits. Is this not what so many are clamoring for? There must be some rich guys and companies around that can pick up the tab and pay their "fair share," right?

Just stop being so greedy! (Never realizes its them who are greedy)

Greed and envy are 2 different sins.

For the price of one

Who was it that said these jurisdictions are effectively pension providers with a little side business of providing civic services?

That chart gives me the blues, brother.

Simple solution: the pensions are null and void as the taxpayers on the hook were minors when the contacts were negotiated.

"Contracts" and "negotiated"... interesting choice of words.

Nothing can make me feel more despair for Chicago.

Actually, I did not need that chart to feel despair for Chicago.

Just knowing which political party has been charge for all these years is enough.

"...What changed is how governments have to report their debt...."

Moonbeam claimed to have balanced the CA budget several years back by digging through the sofas in the capital for spare change to pay the minimum on the charge cards.

Lying POS...

I am creating $100 to $130 systematically by carrying down facebook. i used to be unemployed a pair of years earlier , but currently I actually have a very extraordinary occupation with that i build my very own specific pay .I am very appreciative to God and my director .If you wish to induce a good quantity of wage per month like ME , you'll check my details by clicking the link below..HERE

???? http://www.netnews80.com

It's a reverse hockey stick... SCIENCE!

Watching with glee as another Dem stronghold implodes...

They were counting on Hillary to bail them out with your money.

Do these CAFRs realistically report gov't assets? I bet they dwarf the debts but are treated as untouchable.

Who would buy them? Especially when they come on the market all at once? What's a used baseball stadium worth? Or two of them? And throw in a hockey stadium, a basketball stadium and a football stadium.

What about parks and other public lands as well?

Put it to a vote... we can continue to fund all of this stuff if you give up your parks and sports teams Chicago. I wonder how that will turn out?

I hear St. Louis is in the market for an NFL team.

As a former CAFR reviewer for the GFOA, I have no fucking idea. They're all bullshit and political.

Those assets were/are being embezzled.

"Those proverbial ditches will be filled in with taxpayer cash"

Maybe. But you can collect cash only from taxpayers who still live there. Chicago, Cook County, and Illinois are already losing population.

not according to the voter records...

But, dead people are not leaving! They do continue to vote, in Cook County!...(;-P

"Nothing that (it's never enough when we try it) more stimulus can't fix" - Paul Krugman

I am creating $100 to $130 systematically by carrying down facebook. i used to be unemployed a pair of years earlier , but currently I actually have a very extraordinary occupation with that i build my very own specific pay .I am very appreciative to God and my director .If you wish to induce a good quantity of wage per month like ME , you'll check my details by clicking the link below..HERE

???? http://www.netnews80.com

I am creating $100 to $130 systematically by carrying down facebook. i used to be unemployed a pair of years earlier , but currently I actually have a very extraordinary occupation with that i build my very own specific pay .I am very appreciative to God and my director .If you wish to induce a good quantity of wage per month like ME , you'll check my details by clicking the link below..HERE

???? http://www.netnews80.com

I found a great site that focuses on stay at home mom's complete guide to gaining a serious amount of money in very little time. While being able to earn an passive income staying home with your kids. If you are someone who needs more money and has some spare time, this site is perfect for you. Take a look at...

?..????????????

Trump"s New Opprunuties See Here

I get paid ?82 every hour from online joobs. I never thought I'd be able to do it but my friend AB is earning ?9k monthly by doing this job and she showed me how. Try it out on following website..

????????? http://www.Prowage20.Com ?????????

very nice post. I like it. Thanks for sharing this information.

Tinder is the best online chatting application. Try it.

http://www.tinder-pc-download.com/ tinder for pc

http://www.tinder-pc-download.com/ tinder download