This One Chart Will Fill You With Despair for Chicago

But it doesn't say what you think it says.

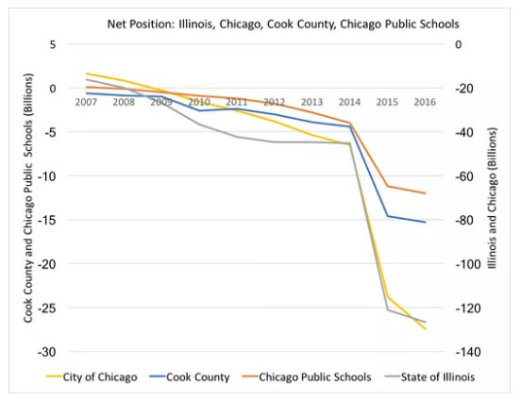

Residents of Chicago are technically on the hook for more than $250 billion in debt issued by four different government agencies (not including the federal debt, which is a whole 'nother ball of wax).

There's the city of Chicago, of course. But then there's also the Chicago Public Schools and Cook County, which includes Chicago and some surrounding suburbs. And, lastly, there is the state of Illinois. All four of these public entities are deep in debt, thanks largely to the pension promises made to public employees and decades of failing to meet those obligations.

Here's how it looks in one graphic from the latest Comprehensive Annual Financial Report, or CAFR, issued by the state, as highlighted by Mark Glennon at WirePoints Illinois, a state-based blog covering politics and economics.

If you're a resident of Illinois, and particularly if you are a resident of Chicago, avert your eyes:

The four colored lines on the chart represent the "net position" of those government agencies. That's a government accounting term for an annual snapshot of everything on a government's balance sheet.

It might be hard to believe, but there is actually a little bit of a good news here.

For starters, the chart doesn't say what it appears to be saying. Looking at this, you'd probably assume that something cataclysmic happened in the year 2015, sending those government balance sheets diving into the abyss. But there was no recession in 2015 or 2016.

Then, you might have glanced to the left-hand side of the chart, in an attempt to compare the precipitous drop-off over the last two years with the relatively modest decline experienced during the actual recession of 2008 and 2009. If the worst economic collapse of the past several decades barely made a dent in these balance sheets, then how could the comparatively good years of the mid-2010s cause such a crisis?

Contrary to what this chart shows, there was no inflection point in 2015. Illinois' and Chicago's budgets didn't get suddenly worse that year, they have been quite bad for a long, long time. What changed is how governments have to report their debt.

Prior to 2015, state and local governments commonly hid the long-term cost of their pension debt by keeping those details off their official balance sheets. Since pension costs are amortized (another fancy government accounting term that means "slowly paid over a long period of time") over decades, putting their value on a balance sheet requires making a number of assumptions about how quickly those debts will be realized. It's not impossible to do that, but there's a fair bit of disagreement about how to best make those assumptions.

Beyond that, there's a strong political incentive to keep those debts off-the-books so things appear better than they actually are. That happens in other ways too, like when Chicago Mayor Rahm Emanuel announced that the city was facing only a $114 million deficit next year, a figure that the Chicago Tribune says his office reached by ignoring several big ticket spending items like $70 million for hiring and training new police officers.

Starting in 2015, however, changes implemented by the Government Accounting Standards Board required states and localities to include pension debt on their balance sheets. That's why Illinois' and Chicago's finances suddenly look so much worse.

It's not that they got worse overnight. It's just that they are no longer allowed to hide those costs and pretend they don't exist.

That's the good news, such as it is. Governments are now forced to grapple with the reality of problems that have been growing in the darkness for a long time. As with many things, admitting you have a problem is the first step toward a solution.

Other costs are still off-the-books, though. As Bill Bergman of Truth In Accounting comments at Wire Points, governments "have yet to recognize retiree health care and other retirement benefits on the balance sheet, for example. We have a lot of ditch-digging ahead of us."

Those proverbial ditches will be filled in with taxpayer cash. Chicago passed a new tax on water and sewer service last year that will generate $240 million for pensions by 2020. Property tax hikes approved the previous year will generate an estimated $543 million in 2019 once they are fully phased-in, the Tribune reports. Meanwhile, Cook County passed a soda tax and Illinois lawmakers approved a 32 percent tax hike last month.

Pension costs cannot be hidden any longer. The bills are coming due. That's bad news for anyone living or working in Illinois, sure, but it's better than continuing to pretend that everything is just fine.